Tell me with whom you associate, and I will tell you who you are. –Johann Wolfgang von Goethe

The luxury watch industry depends a great deal upon credibility. Arguably, belief in superior quality is the top reason people are willing to hand over four-, five-, or six-figure sums of money to buy a watch. If the watch-buying public starts to doubt a brand’s quality claims due to a loss of credibility, the brand’s future is in serious question.

For these reasons, I’ve watched with some trepidation as various watch brands have started to enter the cryptocurrency / blockchain / non-fungible token (NFT) world. This space is highly specialized in skills that are not typically associated with traditional watchmaking. A lathe isn’t much use when you’re trying to evaluate a particular public key encryption standard, for example (and vice versa). For this reason, horology’s entre to the crypto space almost always involves a partnership with another person or organization already active in that space.

And this is where the industry exposes itself to risk.

Bitcoin mining farm servers (photo courtesy Marko Ahtisaari/Wikipedia)

Trustworthiness of the cryptocurrency and NFT community

There is rampant fraud and scheming in the cryptocurrency and NFT community. In a recent interview with Bloomberg, a cryptocurrency entrepreneur with an estimated net worth of $24 billion explained an emerging cryptocurrency fad called “yield farming.” The interviewer concluded that this was nothing more than a Ponzi scheme.

We shouldn’t equate financial success with value creation. After all, convicted Ponzi schemer Bernie Madoff had an estimated net worth of $17 billion at some point (he also had a fairly decent watch collection that was sold off by U.S. Marshalls back in 2009).

Software engineer Molly White runs web3isgoinggreat.com, a web page that compiles all of the unseemly activity taking place in the cryptocurrency world. The page’s motto is, “web3 is going just great and is definitely not an enormous grift that’s pouring lighter fluid on our already-smoldering planet.” To clarify: web3 is a new buzzword for the cryptocurrency realm and its adjacent activity.

White’s motto also points out that web3 consumes massive volumes of energy, a byproduct that is likely worsening climate change. As a side note, any watch brand touting their environmental initiatives while simultaneously entering web3 territory is arguably hypocritical.

White’s web page includes a running counter of reported funds lost to fraudulent web3 activity. As of today, it stands at $9.5 billion. That is a lot of grift. In May of 2021, the U.S. Federal Trade Commission reported a tenfold increase of losses from cryptocurrency investment scams. The list goes on.

The risk for a watch brand is that it will lash up with a cryptocurrency “expert,” there will be a scandal involving fraud, the brand’s reputation will irrevocably tarnish, collectors will doubt the brand’s claims regarding the quality of the product, and that will be the end for that brand. While this may seem a remote possibility, there is already one episode that illustrates a good portion of this disaster in waiting.

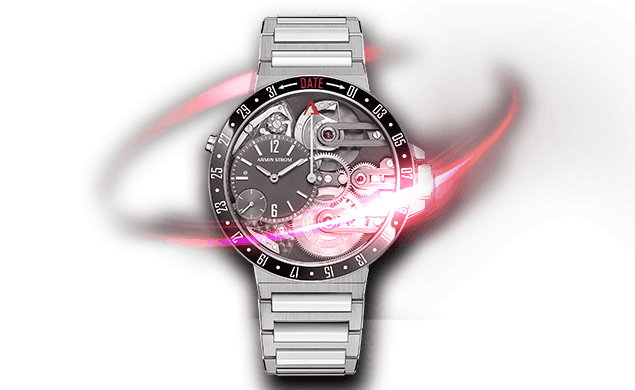

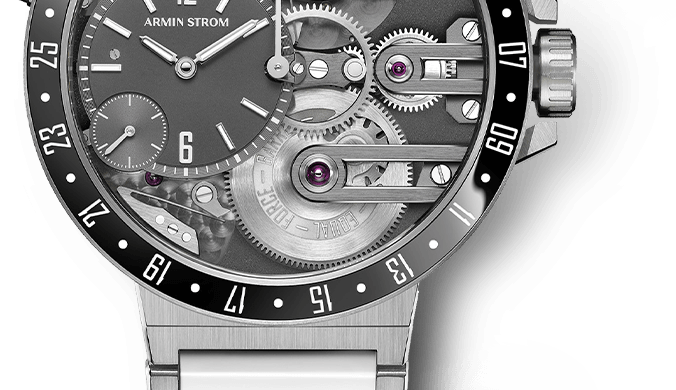

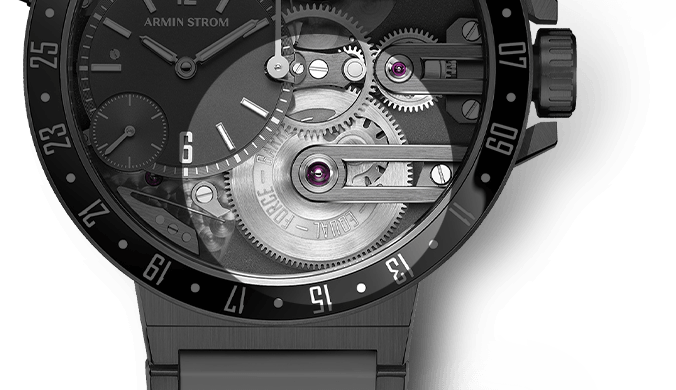

Jacob & Co. NFT SF24 Tourbillon

Approximately one year ago, Jacob & Co. announced that it would sell the world’s first NFT of a luxury watch: the SF24 Tourbillon “piece unique.” The plan involved auctioning the watch NFT on ArtGrails, a self-described “standalone Blue Chip NFT platform.” After the auction supposedly closed, the reported result was that the NFT sold for $100,000.

The problem is that the SF24 Tourbillon digital asset was never even minted on the blockchain, or at least I cannot find it. Back in November 2021, Twitter user @teeprofit described the many failures of ArtGrails, observing, “@Jacobandco X @argrails [sic] drop, which they did not manage to sell to anyone but themselves lol was not even minted no proof on blockchain.” I posted about these irregularities on my Instagram stories and asked if anyone could find the SF24 Tourbillon on the blockchain and to DM me its address.

I was met with silence. I invite readers to peruse ArtGrails’ 676 items that actually were minted on the blockchain to see if they can find the SF24 Tourbillon.

It is one thing to debate whether digital assets are really worth any money. If the digital asset itself doesn’t even exist on the blockchain, though, there is absolutely no reasonable basis to argue that it is worth anything, never mind $100,000.

Indeed, when ArtGrails founder Avery Andon was questioned about these events, he replied on Twitter, “These were done in the early days and never promised any utility outside of the art.” While the definition of an NFT is, in some ways, surrounded by mystery, there is common understanding that it typically involves minting a token on a blockchain. Unless, apparently, the seller is not promising any utility, whatever that means.

At the end of the day, watch brands must ask themselves if the risk accompanying the web3 space, along with environmental harm, is worth any possible reward. Watch collectors should also ask themselves if a watch brand’s decision to take part in web3 signals a level of risk-taking they can live with.

As complicated in-house movements see wider adoption, buying a watch implies that a collector relies upon the long-term viability of a manufacturer. If a risk-taking manufacturer disappears, it may be prohibitively expensive, or perhaps impossible, to service a particular timepiece. For now, it might be reasonable to conclude that the best brand is one that decides NFT stands for “not for this” manufacturer.

Brendan M. Cunningham, PhD is a professor of economics at Eastern Connecticut State University and founder of www.horolonomics.com. He has a forthcoming book on the history of Rolex; you can learn more by visiting www.sellingthecrown.com and sign up for email updates on the project.

You may also enjoy:

Real Or Illusory? A Watch Collector’s Foray Into The World Of Digital Collectibles And NFTs

What Happens After A Watch Is Stolen? Chris Marinello Of Art Recovery Can Help

Leave a Reply

Want to join the discussion?Feel free to contribute!

Fabulous stuff, Brendan, and several hours worth of links to follow up!

Thank you Colin! 🙂 🙂

A lot of ideas being packed into one little article. Yes, NFTs are scams. But usually the environmentalists attack the O.G., Bitcoin. Bitcoin is not a scam, and very very green. Cutting down trees to print paper money inside an antiquated banking system, and a bloated, corrupt bureaucracy with limitless middle men getting a cut of the transaction on the other hand…

US dollars are made from 25% linen and 75% cotton, and many foreign currencies use polymer notes, if not similar recipes to the fabric American currency uses.

And where you got the idea that Bitcoin is very, very green is beyond me, all the information is out there why crypto currencies are problematic and will only get worse compared to the current digital transfers of the most common state produced fiat currencies. Also, all crypto currencies only currently have value based in those state produced currencies because it is itself NOT a currency but a speculative product, no different than stocks and other financial products. Crypto is based still largely a confidence scheme because it is being propped up as an investment vehicle so that the early adopters and whales can have ways to cash out and make their profit.

I don’t think that Bitcoin is a scam Robert, but it’s certainly extremely inefficient and it’s definitely not green.

https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html

https://www.forbes.com/advisor/investing/cryptocurrency/bitcoins-energy-usage-explained/

Regards, Ian

We’ll have to agree to disagree Robert, which is fine 🙂

When you reference “corrupt middlemen” I don’t know which financial system you’re referencing. I think there are a lot of well-organized and regulated financial systems without corruption. My personal inclination is that if I couldn’t find trustworthy traditional financial services in my own locale I would move my funds to a place where I could. Cryptocurrency would probably be my last choice, if that.

Regrettably, Bitcoin and almost anything based upon blockchain consumes vast amounts of energy. They’re very inefficient systems and they’re making climate change worse ( https://news.climate.columbia.edu/2021/09/20/bitcoins-impacts-on-climate-and-the-environment/ ). In most economies, the money supply has already been digitized in a much more efficient manner (paper and metal monies are a small portion of the supply).

Bitcoin is only worth what someone will pay in State money for it ! You sound like the right type of demographic for bitcoin lunacy ! Buyer beware is on full blast with bitcoin and the other want a be gambling tools available to the gullible.

Enjoyed this article. Most of us realize that in-house movements pose a risk down the line, but it’s hard to imagine Jacob & Co. suffering a catastrophic hit to their reputation, considering their target client is not an old money goody two-shoes.

Jacob & Co got caught with their drawers down, but I have no issue with the watch brands issuing NFTs in conjunction with a physical product. It gives affluent clients an opportunity to stick a toe in the web3 pool. If things don’t work out, you still have the watch and a piece of digital nostalgia, not so different than the CD ROM programs that came with some watches in the early 2000s or the USB 2.0 drive manuals that came with some watches in the 2010s. For the watch brand, it is risky to separate the NFT from the physical asset, since most watch executives’ knowledge of the blockchain comes from reading about how the blockchain is the future, rather than living it.

Thanks for reading and commenting Jordan. I agree with a lot of the things you expressed. I’ll just note that I would be a whole lot more comfortable with NFTs as an “add-on” product if not for the implication for climate 🙂

Finally an excellent article addressing this complex topic. I really don’t understand why something so traditional, conservative and exclusive must be dragged in these modern nonsenses. Especially since none of these modern concepts is not really regulated.

Thank you for pointing out these things and calling out some hypocritical decisions…

Love this article …

Cheese,

Andrei

Thank you for reading and commenting Andrei, I’m glad the article was enjoyable

You ask a good question about why an industry rooted in centuries of manufacturing practice would be drawn to these digital endeavors. Web3 has certainly attracted some of the most persuasive hucksters that exist, unfortunately. The money seems very easy to make, I imagine (just email them a digital image file and in comes the money). The harder part is the impact on the environment an reputation, which I really urge brands to take very seriously. Some money isn’t worth it.

My take on this is that many brands and related services in the watch industry have noticed that their (relatively wealthy) clients have embraced it, which is why they feel the need. Nonetheless, I hope they begin changing their minds soon to realize it might not be worth “appearing hip” in this case.

A great piece of work, got more info about their role in the world.

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.儿童色情片