WatchCharts June 2025 Market Update: Light at the End of the Tunnel?

by Hamza Masood

What happened in May 2025?

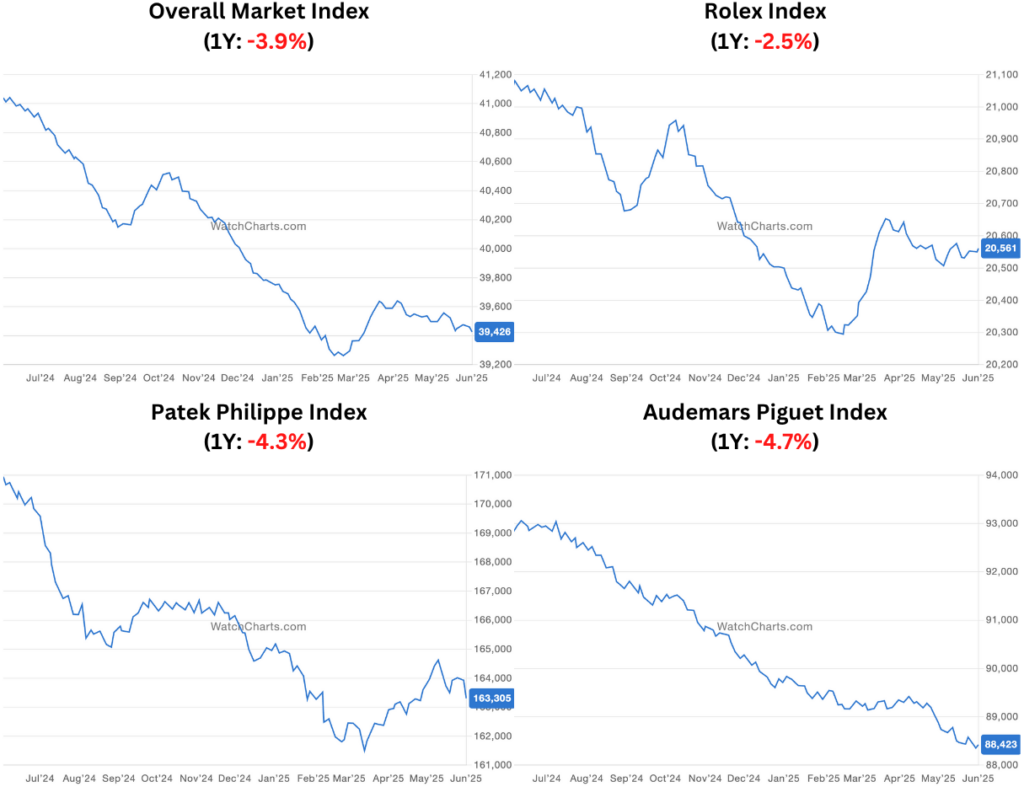

May once again saw a mixed picture of performance at the top: the WatchCharts Overall Market Index fell by 0.1% but prices for Rolex and Patek Philippe rose by 0.1%.

Both brand indexes have seen positive performance in three of the previous four months, indicating a more sustained stabilization in prices rather than a temporary improvement in performance. Prices for Audemars Piguet, however, declined by -0.6%, the largest monthly decline for the brand in 2025 and a new 4-year low.

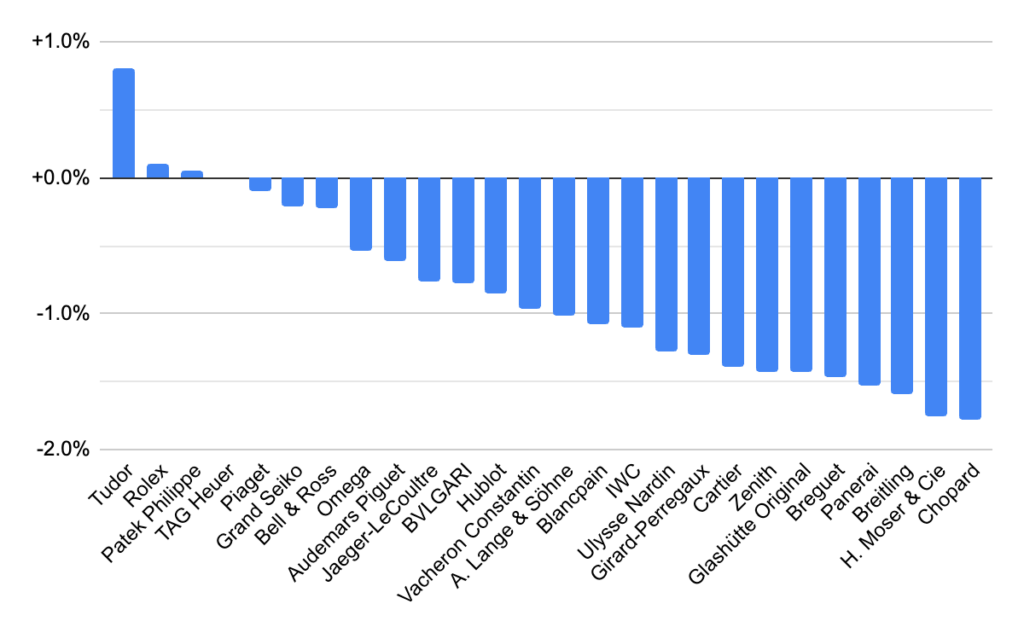

Performance by Brand in May 2025

While Rolex and Patek Philippe prices improved, the market as a whole is still generally in decline, with the vast majority of key brands still declining in May.

While Tudor is the best performing brand in the chart above, its performance is slightly inflated by new variants of several existing references entering the secondary market. Because these new variants – such as the opaline dial Black Bay Pro, the blue dial Black Bay Ceramic, and the pink dial Black Bay Chronograph – share the same base reference as older models, their entry into the market may result in an uptick in the average price of the base reference, and thus the broader index.

Despite this, Tudor prices were still up less than 1% in May, and around 1% over the past three months.

Some of the best and worst performing collections of May from major brands are listed below.

| Brand | Collection | Delta % |

| Rolex | Cellini | +2.1% |

| Rolex | Explorer | +1.7% |

| Patek Philippe | Aquanaut | +0.8% |

| Breguet | Tradition | -2.2% |

| Chopard | Alpine Eagle | -2.3% |

| Cartier | Ballon Bleu | -2.8% |

Has the watch market stabilized?

While our Overall Market Index is only down 0.1%, the state of decline by brand continues to be more grim. The Overall Market Index is weighted by transaction value, and is thus heavily biased towards the Big Three – Rolex, Patek Philippe, and Audemars Piguet – all of which have performed relatively well so far this year.

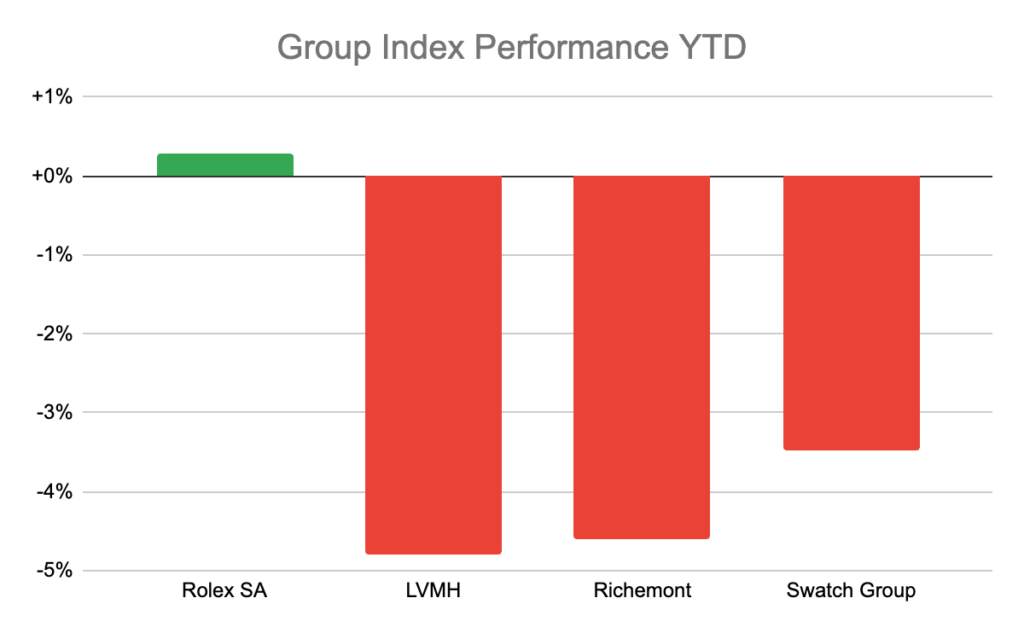

For a broader view of the market, we can look towards the WatchCharts Group Indexes, which track the performance of the major Swiss groups (both publicly traded and privately owned). In this view, Rolex SA (which owns Rolex and Tudor) is actually slightly up this year, while Swatch Group, LVMH, and Richemont have all struggled.

Have Rolex and Patek Philippe at least stabilized?

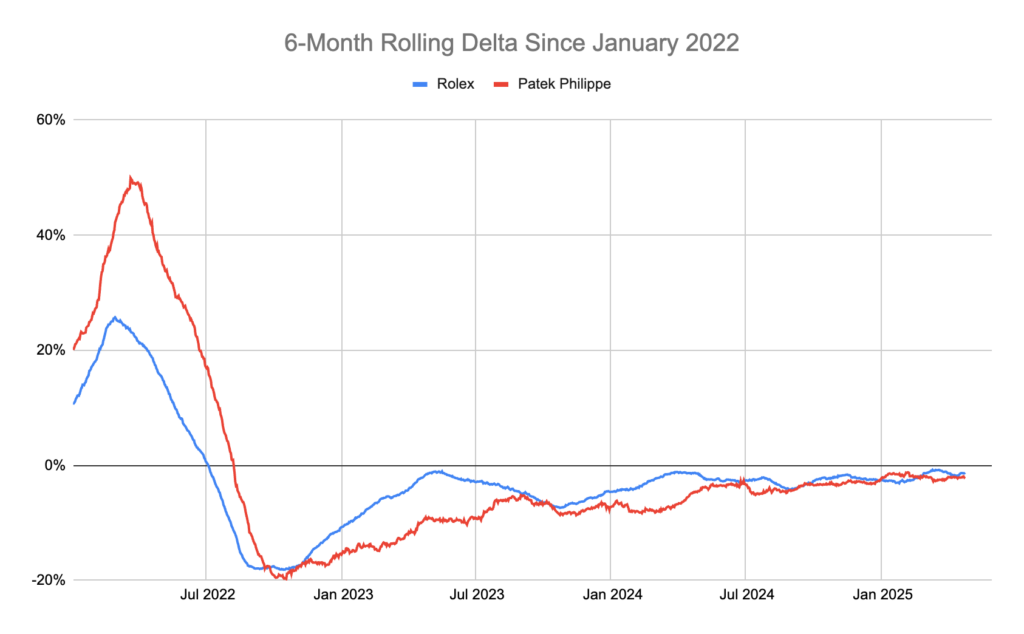

In a sentence, it is still too early to know if we are at another false dawn. The chart below tracks the rolling 3-month delta for the brand index since January 2022. Essentially, this shows that there has never been a period longer than about three months where the rate of price change was stable, and those periods were always followed by further decline.

Nevertheless, the price appreciation of the last three months for Rolex is the longest period of sustained gains for the brand within this period.

While the three month trend may look somewhat promising, looking at the rolling 6-month delta, we see that secondary prices for these brands has never improved over any given 6-month period since the market downturn began in the first quarter of 2022.

In theory, the secondary watch market should be facing three upward pressures: inflation (around +20% in the US over the past four years), retail price increases by brands (driving up the baseline which helps establish secondary values), and increased secondary market demand relative to retail demand (as a result of worsening value retention).

Despite these factors, secondary prices are barely stable over a 3-month period and still down over the past 6 months.

However, there may be two positive takeaways. From a buyer’s perspective, the value proposition of the pre-owned watch market is stronger today than at any point in the past five years.

Furthermore, the rate of secondary price decline has been gradually slowing over the past three years, suggesting that buyers today have likely missed the worst of the market downturn.

* Hamza Masood is the Business Development Manager at WatchCharts.com. You can check out previous Market Updates at https://watchcharts.com/articles/category/dispatch and there are more market insights and analysis on their YouTube channel at www.youtube.com/watchcharts

You might also enjoy:

WatchCharts May 2025 Market Update: The Big Three Still Performing Relatively Well

Leave a Reply

Want to join the discussion?Feel free to contribute!