After the markets closed on July 30, 2014, luxury group Kering (previously known as PPR and the Gucci Group) sent out the announcement that it had acquired 100 percent of Ulysse Nardin as part of its quarterly report. I reported on this on Forbes at Kering (Previously PPR, Gucci Group) Acquires Ulysse Nardin.

Naturally, it is hard to understand the background behind such a takeover without talking to someone from the company. Takeovers are a common occurrence in today’s watch world, a seemingly necessary way of doing big business. In my long experience there are times this can work out well, and times it doesn’t work out so well. This has a lot to do with how similar the visions of the two companies merging are.

Ulysse Nardin currently owns three manufacturing sites in Switzerland: two factory locations (the historic headquarters in Le Locle and additional manufacturing in La Chaux-de-Fonds) and dial maker Donzé Cadrans SA, which Ulysse Nardin acquired in 2011 as part of its long-term verticalization strategy.

All three sites comprise 360 employees, while Ulysse Nardin has another 100 scattered across the globe, making for 460 in total.

Ulysse Nardin has been an independently managed company for all of its existence thus far. Its structure has remained personal and flexible, and in my opinion this has been one of its big advantages: its directors have continued to listen to its customers and clients, which makes them feel like part of the extended Ulysse Nardin family.

Naturally, takeover by a large structure such as Kering is at once a scary and a freeing prospect: synergies and big background finances could indeed turn Ulysse Nardin into a very big player. At the same time, if Kering’s management is too restrictive or decides that it can do better than the watch company’s own employees, it could change the unique character of Ulysse Nardin forever.

At Girard-Perregaux, which was also taken over by Kering after the passing of previous owner Luigi Macaluso in 2010, I have personally perceived both of these elements coming into play. While I feel that Girard-Perregaux has upped its game in terms of product lines and their clarity – including notable timepieces introduced such as 2013’s incredible Constant Escapement and the 1966 Integrated Chronograph – I also feel the absence of the Macaluso family and its unique and personal contributions. Luigi’s two sons, Stefano and Massimiliano are officially still part of the company, though they do not seem to be part of the day-to-day business anymore.

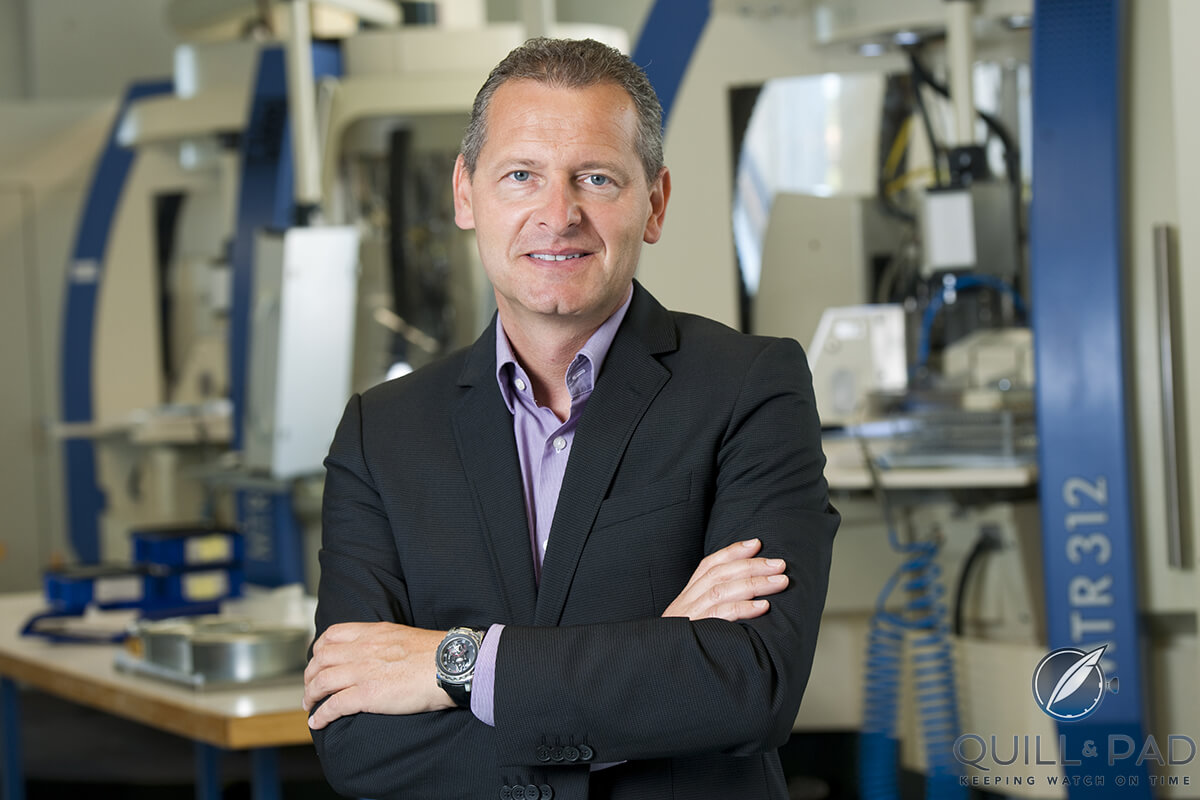

Patrik Hoffmann, CEO of Ulysse Nardin spoke to me regarding the takeover, exuding positivity and reassuring me that this acquisition step had not been ruled out by deceased owner Rolf Schnyder in the will he left behind that also named Hoffmann as CEO.

“It’s really important to say that it was always clear in Rolf’s will and wishes that he left both options [independence or merger] open,” Hoffmann confirms. “He was clear that Ulysse Nardin could remain independent, but he also left it open to [his wife and chairperson of the board] Chai or whoever made those decisions.”

Particularly in this era of takeovers and mergers it’s important to know that this step was taken for the right reasons as casual observers and even customers don’t necessarily always view such a thing positively; in fact, as one of the remaining few independent luxury watch manufacturers this takeover could be viewed rather negatively.

“You know I knew Rolf very well, and I think he would be very proud of what happened, what we’ve done over the last three years and how we found this new partner. I’m convinced he would be very happy.”

According to Hoffmann, the idea of selling developed over the course of the last three years and the terms of this specific sale were worked out over the course of months. “It was definitely not a fire sale,” Hoffmann quipped. “It was a really classic merger and acquisition procedure; the whole procedure of preparing and bidding was really classic.”

Certainly such a big change could also be a bit scary as well? “No, I don’t think so. The management here, including myself, is actually very happy with this solution. Of course, we were part of this merger and acquisition procedure,” Hoffmann replies with a trace of both enthusiasm and weariness in his voice.

“Over the last few weeks, we’ve met many times with the management of Kering. I myself met with Mr. Pinault personally in Paris as well. He owns a couple of Ulysse Nardin watches. He’s a watch collector, he’s very technical, and he loves new technologies. So this really fits into his philosophy and I think the chemistry immediately worked between us and definitely between [head of Kering’s luxury watch and jewelry division] Albert Bensoussan and the entire management. We are really looking forward to this new venture,” he continued before confirming that there are no expected cuts in staff, particularly of the experienced management team.

At this point it is not unimportant to note that the key members of the managing staff have been with this company for decades. Hoffmann was named CEO in 2011, but had joined the company in 1999 as the director of the U.S. operations, which is also in charge of Central America. A Swiss national, Hoffmann has worked in the watch industry since 1991.

Susanne Hurni is due to celebrate her 30th anniversary in the company as director of communications at the beginning of August 2014. She told me, “I am so excited to begin my next decade at the company with this new chapter for Ulysse Nardin.”

Clockwise from top left in 2009: Rolf Schnyder, Lucas Humair, Pierre Gygax, Patrik Hoffmann, Ludwig Oechslin

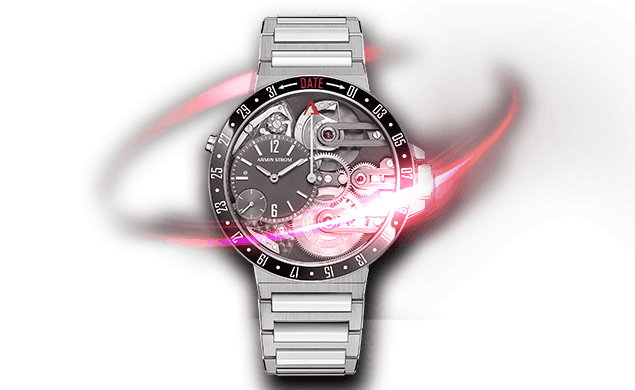

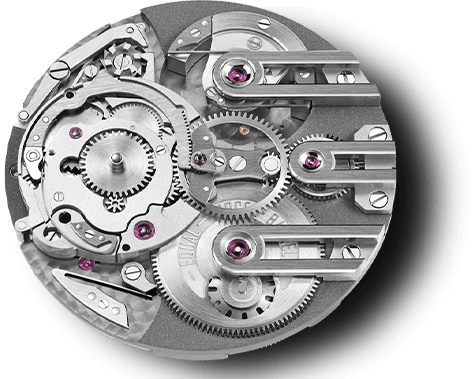

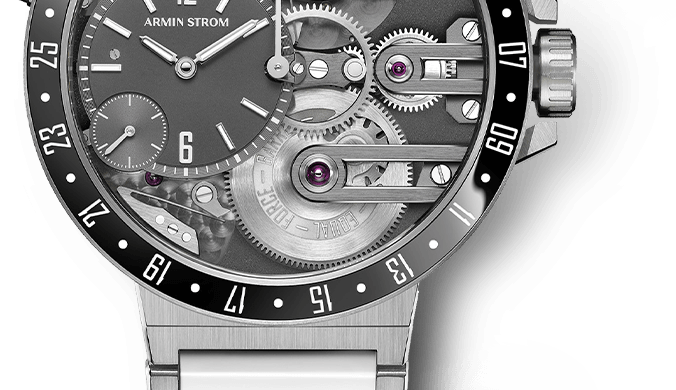

Executive vice-president Pierre Gygax, perhaps the most important link in Ulysse Nardin’s chain in terms of new technologies – and one of the most intelligent and level-headed people I have the pleasure to know, a recurring theme among employees of the company – joined Ulysse Nardin in 1997 as its industrial manager. His skills have been key to the company’s ever-increasing verticalization and, of course, in discovering the materials needed for the brand’s silicon-fueled escapements and other progressive and experimental technologies.

Movement designer Lucas Humair and CFO Patrice Carrel complete the longtime group of key managers. “All five of us will stay,” Hoffmann confirmed.

Now that Ulysse Nardin is a “sister company” to Girard-Perregaux, it might be natural to expect a few synergies. “I think the first synergies we can expect are in the area of media buying and certain synergies in distribution,” Hoffmann replies honestly. “But one thing that is very clear is that the DNA of the two companies will remain completely different: Girard-Perregaux with its more classic approach, and Ulysse Nardin with its clear approach of the marine theme and our own movements.”

He also explained that Ulysse Nardin’s movement technology will not be mixed. “Naturally, in the background there can be some know-how exchange, but we will not see a mix of DNA.”

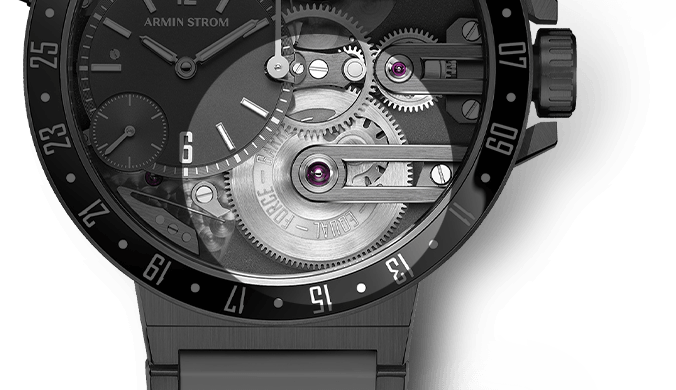

One of the burning questions, though, is what the takeover will mean in terms of changes for Ulysse Nardin. Hoffmann answers typically pragmatically. “You know, there are always changes. Very clear, as I said before, is that our DNA will not change. Neither will our product philosophy, the direction of our own movements, the vertical integration, or our whole silicon technology.

“There are always changes, but I couldn’t really tell you [anything will] happen because of this acquisition. I don’t see that. And I think the statement is clear: it’s a healthy company they’ve purchased, very profitable – you can take this from the press release – so there’s no need to turn anything around.”

Toward the end of our pleasant conversation I find out why there is a trace of weariness in his voice. “I have to tell you that we are really, really looking forward to being able to go back to daily business. We were so absorbed in this whole procedure that now we are relieved to go back to daily business.”

For more please visit www.ulysse-nardin.com and http://www.kering.com/.

Trackbacks & Pingbacks

-

[…] A recent chat with Ulysse Nardin CEO Patrik Hoffmann revealed an extreme sense of contentment at the state of affairs inside the company since the takeover by luxury group Kering was announced in July 2014. (For more on that see Ulysse Nardin’s CEO Patrik Hoffman Comments The Kering Takeover.) […]

-

[…] all its timepieces. That article appeared before the Kering takeover; however, according to this Quill & Pad article, UN CEO Patrik Hoffmann seems to suggest that the new Kering-based UN will stay true to its core […]

-

[…] If you read just one article about the acquisition of Ulysse Nardin make it this one. […]

Leave a Reply

Want to join the discussion?Feel free to contribute!

One can only hope they’ll let them operate independently as well as LVMH did for Hublot!

I am confident this will be the case. And even more importantly: Patrik seems confident. That’s all good!

Great interview, Beth, and good to read these reassuring words from Patrick.

Thanks, I totally agree, Frank!

Enjoyed the article and glad to see this is good for Patrik and his staff.

Thanks for reading, Clint! We’re all happy to see Ulysse Nardin prosper.

This was a very interesting read and reassuring to hear that hopefully nothing will change and hopefully they will keep their freedom similar to Hublot with LVMH.

Nice interview, valid points, good to get an insider’s viewpoint

Thanks

Nice and authentic interview/report. Thank you Elizabeth !

Thank you, Estelle!