Horology is so rich in history, engineering, and design that it is sometimes hard to remember the wider context surrounding the watch industry in which comparatively gigantic “luxury groups” own collections of watch brands and are diligently operating in the background. For the watch industry, there are at least four groups worth knowing: LVMH, Swatch Group, Richemont, and Kering.

It can be amusing to consider the wide array of products assembled in each of these conglomerates. For example, earnings from children buying tickets to shoot arrows in the Paris suburb of Bois de Boulogne are pooled with sales from Bulgari’s Octo Finissimo watches. LVMH owns both Bulgari and an amusement park in France called Jardin d’Acclimatation. The fictional character Jack Donaghy from the TV series “30 Rock,” whose title was President of East Coast Television and Microwave Oven Programming, would likely feel comfortable at LVMH headquarters.

Patrick Pruniaux, CEO of Ulysse Nardin and Girard-Perregaux since 2017

On a more serious note, on January 24, 2022, it appears that two historical watch brands, Ulysse Nardin and Girard-Perregaux, respectively headquartered in Le Locle and La Chaux-de-Fonds, Switzerland, were reorganized in response to men’s fashion developments in Rome, Italy. In a vacuum, it is hard to see how one would lead to the other: their connection is the Kering group.

Girard-Perregaux Bridges Cosmos

Kering, Brioni, Ulysse Nardin, and Girard-Perregaux

Kering’s CEO is French billionaire François-Henri Pinault. Ten years ago, Pinault bought the Italian menswear brand Brioni. The brand seemed to thrive; in 2016 news circulated that then-presidential candidate Donald Trump favored its suits. Brioni also worked with Jude Law and Brad Pitt as brand ambassadors. The global pandemic closed many of the spaces in which men might consider wearing expensive, relatively formal clothing: offices, restaurants, and nightclubs just weren’t an option for a long stretch of time. Brioni’s sales faltered.

As a result, in October 2021 news broke that Brioni would be laying off up to 320 employees. The brand planned to change its “production matrix in order to return Brioni to levels of efficiency and profitability that are sustainable over the long term.” This pivot involved a new focus on high-end leisurewear.

Kering’s formal acknowledgement of these financial difficulties was published in the summer of 2021. In its financial report for the first half of 2021, Kering noted, “In first-half 2020, given the deterioration in the financial outlook for certain Houses in the context of the COVID-19 pandemic, the Group recognized asset impairment of €256.7 million, which chiefly concerned the Ulysse Nardin, Girard-Perregaux, and Brioni brands in an amount of €201.0 million. Impairment of other non-current assets included impairment of a right-of-use asset under a lease held by Brioni for €35.1 million.” An “asset impairment” means that Kering formally acknowledged a nine-figure drop in the joint market value of these three brands.

Within the context of Kering’s balance sheet, this was not a major blow; these are comparatively small pieces of a very large pie. The biggest slice, Gucci, has its own difficulties. The major motion picture House of Gucci paints a less-than-flattering picture of the brand’s founding family (it has been denounced accordingly). Gucci’s sales growth has been on a steady decline over the past four years, and it has struggled to recover from the pandemic.

In light of these developments, Kering understandably chose to cash in some of its luxury watchmaking chips, which watch industry insiders have been seeing coming for about a year. Finally on January 24, 2022, the company announced it was selling Ulysse Nardin and Girard-Perregaux to management.

Former Ulysse Nardin owner and CEO Rolf Schnyder, who passed away in 2011

For Kering, this will provide an injection of cash that will help the group in its efforts to turn around Gucci and Brioni. Moreover, management’s decision to take ownership of Ulysse Nardin and Girard-Perregaux represents an incredible vote of confidence in the future of these two watch brands (confidence that is shared with the financiers who backed management’s buyout).

Ulysse Nardin and Girard-Perregaux’s new-old management may not have all its financial eggs in one basket, but it now has more of their eggs in that basket than in the past. There is a lot of “skin in the game” when it comes to the UN and GP C-suites.

Kering’s stock price did close lower following the sale announcement, but the fall was less severe than that which simultaneously took place market-wide. In that sense, the market reaction to Kering’s move was positive.

There are a few more implications of this development. With this one change, the independent watchmaking community expanded its ranks to include two brands with very long and important legacies in watchmaking. Ulysse Nardin and Girard-Perregaux’s management likely feels greater freedom to push its brands in any preferred direction.

It is possible that Kering had a light touch when it came to overseeing these watchmakers, so this may be a distinction without a difference. However, in coming months, any advantage available to management will be important.

Take, for example, Ulysse Nardin. The top 10 countries in which people conduct Google searches for this brand are Armenia, Azerbaijan, China, Switzerland, Kazakhstan, Moldova, Russia, Uzbekistan, Hong Kong, and Ukraine. With tensions rising between Russia and Ukraine (as well as the likelihood of international sanctions), the brand may face a worrying demand slump in the near term.

And now luxury “archrivals” playing chess?

In retrospect, one particular Instagram post “hits different” in light of the Ulysse Nardin and Gerrard-Perregaux sale. Kering’s CEO Pinault and the CEO of LVMH, Bernard Arnault, have been referred to as “archrivals” in the market for luxury.

Two days before Kering announced its divestment from luxury Swiss watches, a picture of Arnault appeared on his son Frédéric’s Instagram page showing a chess board between father and son, the elder Arnault’s wristwear obvious as he makes a move. The younger Arnault captioned the image, “Unique 5740 playing for the win. Check mate!”

Bernard (left) and Frédéric Arnault playing chess (photo courtesy @frederic.arnault)

The 5740 in question (and visible in the photo gracing Bernard Arnault’s wrist) is a unique Tiffany-dialed Patek Philippe Nautilus Perpetual Calendar. Imagery of the timepiece almost immediately flooded watch accounts across Instagram. Like many others, I interpret this as a playful debut of the timepiece and nothing more.

However, this post may have been a clever flex by Arnault the elder: just days before his “archrival” Pinault sold Ulysse Nardin and Girard-Perregaux, thereby retreating from the proverbial battlefield of horology, Arnault very publicly celebrated his close and growing relationship with one of fine watchmaking’s “Holy Trinity” brands (friendly reminder: the Tiffany-dialed Patek Philippe Reference 5740 was preceded by the wildly successful Tiffany & Co. double-signed Patek Philippe Nautilus Reference 5711 at the close of 2021).

This timing could have been coincidental. Or the game of chess referenced in the caption may have been a metaphor for the high-stakes luxury market share battle that wages between Arnault and Pinault. It remains to be seen if this is truly a checkmate moment or whether we are in the middlegame with many additional moves to come.

Brendan M. Cunningham, PhD has a forthcoming book on the history of Rolex. You can learn more by visiting www.sellingthecrown.com and sign up for email updates on the project.

You may also enjoy:

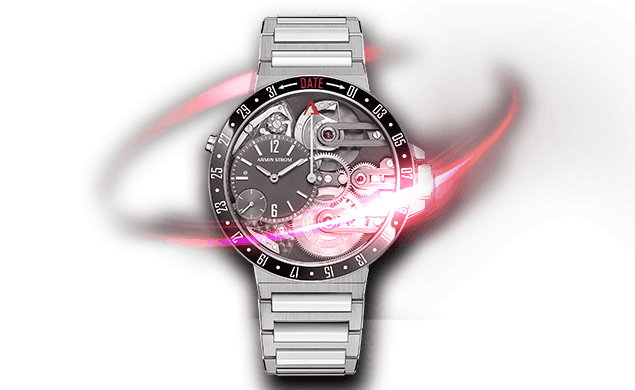

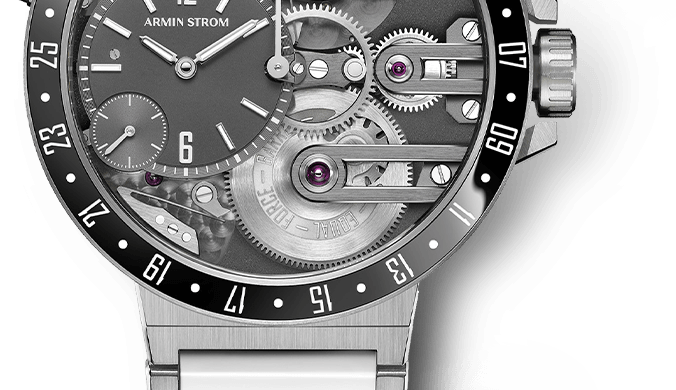

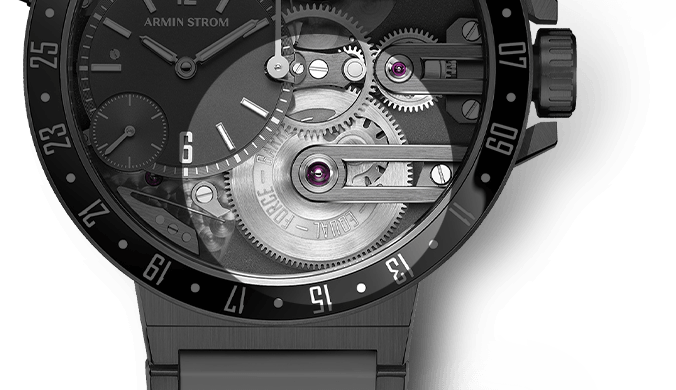

Ulysse Nardin Blast: Highly Volatile Explosive

Leave a Reply

Want to join the discussion?Feel free to contribute!

I love both UN and GP but even I have lost interest over the past few years, especially in UN after the departures of Schnyder, Oechslin and Hofmann are no longer there. It would be great if both GP and UN were led by commercially minded watch enthusiasts and people who are themselves passionate about these brands. Not sure managers they are best run by managers who are peddling iPhones, perfumes, beer no the like…

It would be the best of all possible worlds if watch brands could be run by people passionate about the products all the time. Alas, that it rarely our luck anymore. It’s why so many are turning to independent watchmakers.

What a waist of money, time and history… The question is really how much customers are interested at all in the “health” of the brand/company behind the product they just purchased. I personally think that most do not care a bit. If you don’t then stop reading and save yourself the time. If on the other hand, you are indeed concerned then the following needs to be said.

This move Kering just did is only a strategy to be place them as far away from failure as possible. Just pass it on to another and have the brand(s) go bust in 2-3 years when the money from loan is gone (if no other victim has been found to keep funding or buying into this nonsense). Corum, Eterna and countless other historic Swiss watch brands that have been swiped under the rug.

Ulysse Nardin cost Kering 800m Chf. (when it had annual sales of 200m Chf.) Only to end up tossing it like a burning bag-o-shit to those co-responsible on the board for 1 Chf (plus a loan). This is certainly cause for concern that to many media outlets just celebrate and play along with this move. I would love to have interviewers (the newcomer/noobs in the watch world) ask Pruniaux about that in Podcasts, Youtube channels and Instagram Live for a change instead of embarrassing “massage sessions” on how they are killing it in the market and how pretty that dial is. CEOs should be held responsible when they publicly omit the truth and so should the media that play along.

As much as “Timepiece Gentleman” would like you to believe that the Laureato by GP is the next Nauty/Oak and this move is great news, I give both brands 2-3 years before closing shop. That is unless they find another investor. But as they say “there is a sucker born every minute…”

You bring up great points. I can tell you that at least UN was healthy and robust at the time Kering took it over…what has happened here is quite symptomatic of what can happen when individualistic brands are swallowed by groups and managed by “managers” rather than people who have been in the watch industry for most of their lives. Very few have made that crossover well…I cite Bulgari as being one of the best examples of how well it can go if the right people are involved, even if there are “managers” involved.

I need to wear my glasses next time I post a comment… 🤦🏻♂️

Better?

Watch brands should be run,by watch lovers and not guys looking only at the numbers. Watches are mechanical art and not just part of a balance sheet