Rolex Case Study: How Many Watches and How Much Money Does Rolex Make?

by Raman Kalra

Rolex is one of the largest, most prominent brands in the world. This is not just confined to the watch world, but Rolex has similar brand recognition to names such as Coca-Cola and Apple. Unlike many other brands of this size, Rolex is a private company and so it is somewhat opaque when it comes to hard facts about what goes on behind closed doors.

Some numbers can be found online, and below those will be used to try and answer a few further questions: How many watches does Rolex make a year? Within this, how many of each model are produced? From here, how much revenue is made per model?

Rolexes

Before getting into any details or takeaways, this is NOT exact. No one outside of the company knows the figures and I have absolutely no extra information that isn’t available online. However, what I’ve attempted here is to use publicly available information to try and model answers to the aforementioned questions.

This post will be extensive as I will touch upon methodology, results, and limitations. I hope the methods are somewhat clear, but the results and graphs are just below and be hopefully easier to digest. There are also sub-headings to help guide you through.

Rolex headquarters and manufacture in Geneva

—————————————————————————————————–

For this study, we are considering FY21 data as there is more information on total revenue and rough watch production numbers available compared to 2022. In 2021, Rolex is estimated to have produced 1.05m watches and generated revenues of $8.807bn. This is an incredible amount on both fronts.

The next luxury brand down in terms of revenue for watches is Cartier which generates $2.615bn (revenue: Statista, production: NYT). When it comes to production, each Rolex is made fully in-house.

This does not just mean the movement; Rolex goes the extra mile in every respect. They push the whole industry forward technologically e.g., Parachrom hairsprings, the materials they use are produced internally e.g., Oystersteel, and they ensure that everything, not just the movement, is flawless.

With that in mind, producing 1.05m watches is extraordinary. It does make you wonder about the true extent of demand given it is a genuine challenge buying one from an Authorised Dealer when they produce that many.

Rolex watchmaking

Rolex has noted this and they are currently producing a new site costing USD $ 1 billion that is due for completion by 2029. We don’t yet know what this will end up being used for but hopefully, along with the grey market decline, this will lead to more watches available for genuine collectors and consumers.

So we have two numbers as starting points – $8.807bn revenue and 1.05m watches produced a year. We now need to break this down for different models. If you have read my article on watch market trends, you would have seen the use of Chrono24 data., which will be used again here. By filtering and sorting all Rolex watches produced in 2021, we can find the proportions that each model contributes to the overall Rolex numbers. Once this has been done, I will look at the retail prices of Rolex’s main models.

Finding 2021 RRP figures was not as simple as I hoped, but for clarity, I have used figures from Monochrome Watches, which posted the change in prices across all models from 2021 to 2022. This value was converted to USD at the 2021 average USD-EUR rate as we know the total revenues in USD.

One extra comment on retail prices is that there is an extensive list of references on offer all at differing levels. To account for this, the Chrono24 figures were used to form a weighted average e.g., the GMT Master RRP used is the average of stainless steel, two-tone and gold references.

Furthermore, Rolex is not selling watches at RRP to dealers. Watches are produced and sold to the retail network at wholesale prices. Found on Luxury Launches, they mention that revenue figures from 2021 are ~$8 billion wholesale, equating to roughly $13 billion at retail prices. This ration enables us to estimate the wholesale value across all models.

Finally, the focus will be on revenues as the costs that go into each watch is extremely opaque, just bear in mind revenues do not equal profits.

—————————————————————————————————–

—————————————————————————————————–

With all of this information, what can we learn?

Below you will find two different approaches to answering the questions at hand. This does rely on the revenue produced being solely from the sales of watches. When looking through the figures, if we assume that the production value of 1.05 million watches is correct, the retail prices converted to USD are a close enough estimation and the wholesale ratio is correct, then the revenue numbers found on Statista is inconsistent with what is found here.

Likewise, assuming that the revenue numbers found online and retail and wholesale prices are correct, then the production number may be understated.

For clarity, both methods will be worked through and then you can decide which you think would be more accurate – let me know in the comments below.

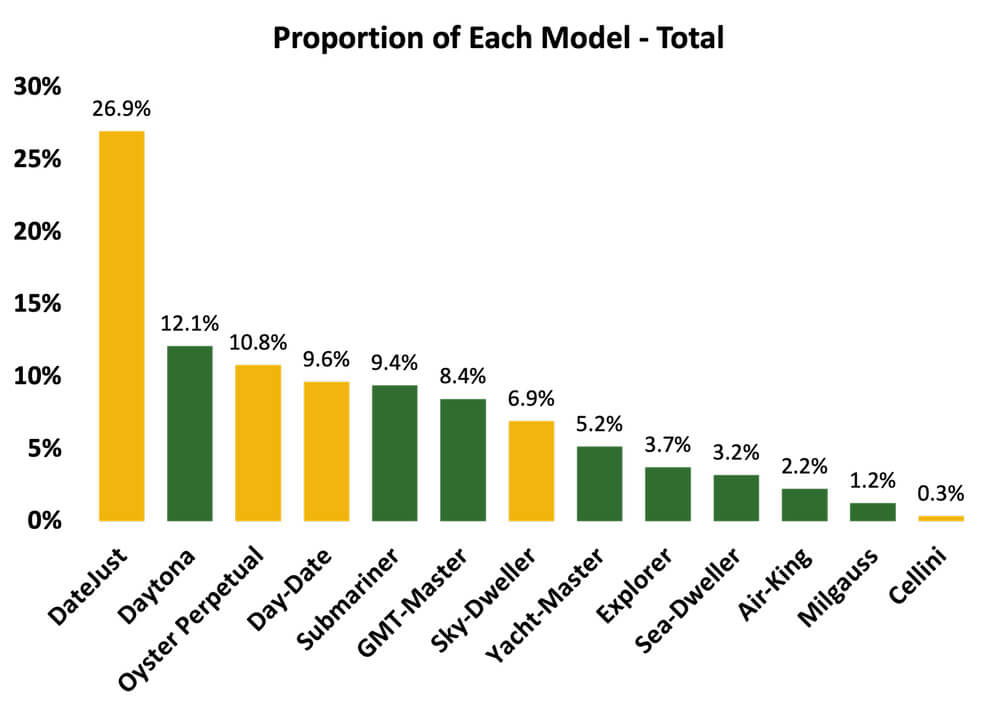

The Proportions of each Rolex Model to the Total Production

Before getting into any hard revenue or production numbers, we can consider the proportion of each model to total production in 2021. As a reminder, this has been generated through Chrono24, a global watch marketplace open to dealers and personal listings.

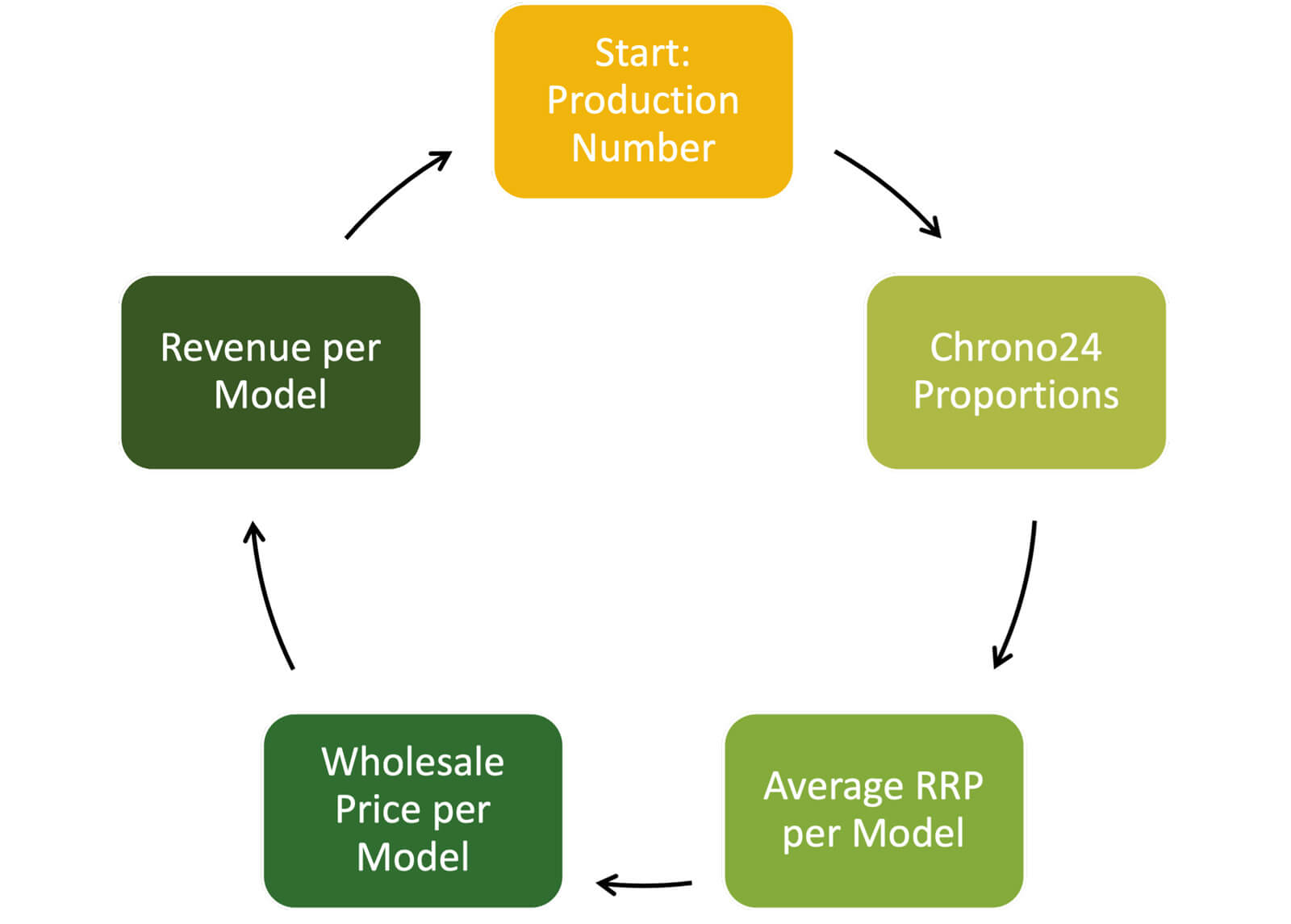

The methodology used to estimate Rolex production numbers and revenues of each model

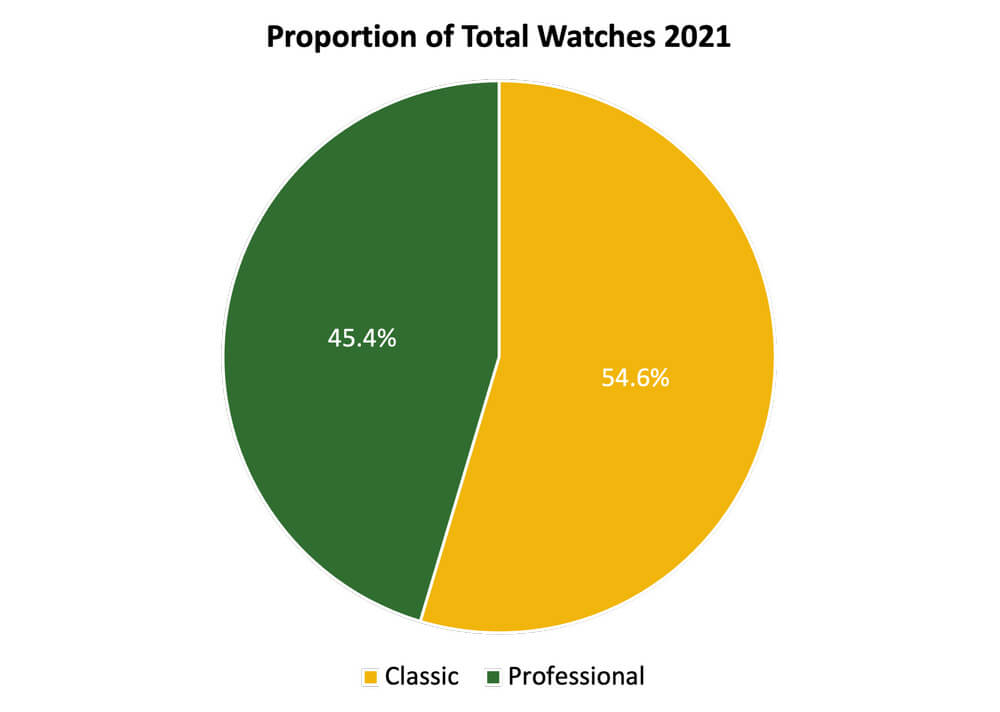

When considering the two collections within the Rolex catalog – Classic and Professional – we can see here that there are more watches produced in the Classic collection. The Classic collection accounts for 54.6% of all Rolex watches in 2021; therefore, the Professional collection is 45.4%. This may come across as surprising given how much we see of the Professional models online – both in the general media and over social media, and how these models are, in general, the most coveted. However, the split does make sense.

Percentages of Rolex Classic versus Professional models

There may be fewer ranges in the Classic collection (five compared to eight in the Professional series), but within those ranges, there are more references. Consider the Datejust as an example. There are varying sizes from 28mm to 41mm, a wide range of dial options, smooth or fluted bezels, oyster or jubilee bracelets, as well as those options that include diamonds.

When you consider these factors along with the various Day-Date and Oyster Perpetual models, it becomes clear that the Classic collection accounting for a larger portion is not a surprise.

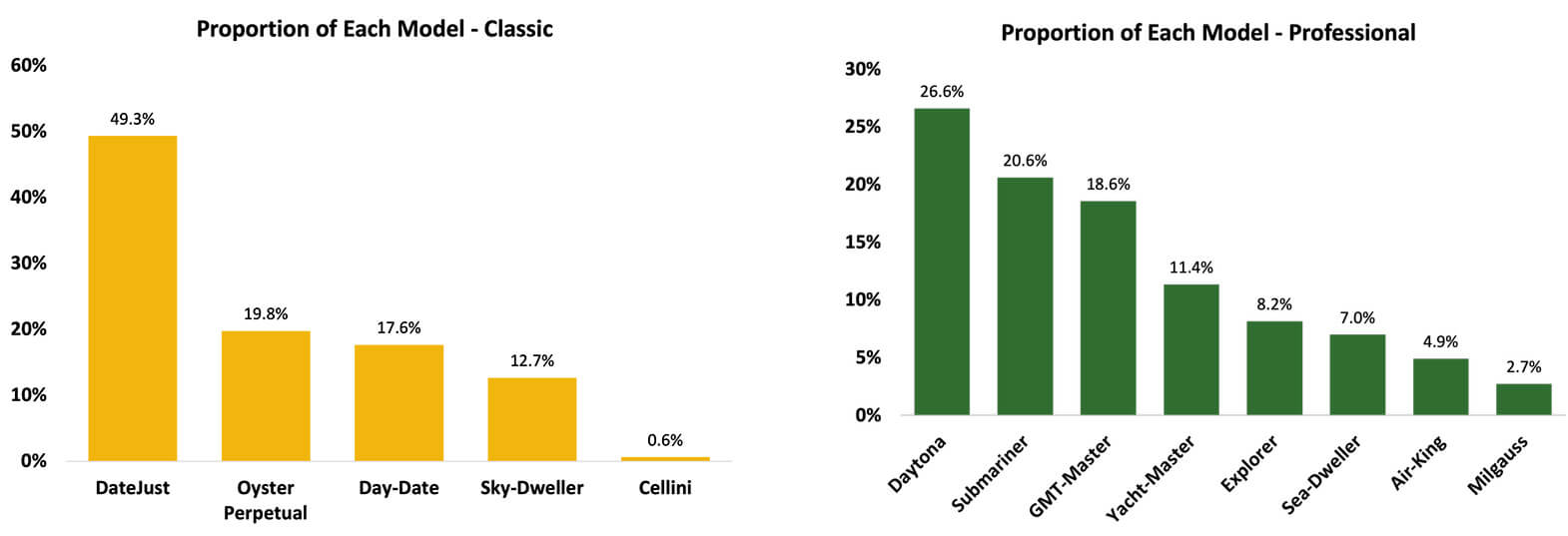

If we now break down both collections into their respective models, we can visualize the watches that make up the production numbers. It is easy to see that within the Professional series, there is a smoother slope downward across models. This is a result of broader-based demand across the Professional watches and retail prices being in a tighter range.

—————————————————————————————————–

—————————————————————————————————–

Of course, there are some high-end models such as the Rainbow Daytona or gold variants, but the prices of the stainless steel versions are close together. Whereas in the Classic collection, the Datejust far exceeds every other model. This comes down to the breadth of references on offer. This also reflects the fact that the Datejust has the widest consumer base as they are available across all price ranges. The Day-Date, as an example, is only available to those who are looking for a gold or platinum piece.

Percentages of Rolex Classic versus Professional models

The next point to note is that within the Professional collection, the watch with the highest proportion is the Daytona – this surprised me initially, I would have thought Submariner. However, on deeper reflection, the Daytona is similar to the Datejust as it is offered in a broad range of references, covering not just case material but also dial, bracelet and gem-set options. Following the Daytona is the Submariner.

The Submariner and GMT-Master are close in terms of proportions, and this should be expected to some degree given the universal love of both. We are considering 2021, but in 2022 Rolex launched the GMT-Master Destro (“Sprite”), so I would expect the GMT-Master proportions to move upwards with the new reference. On the other side of the scale are the Air-King and Milgauss.

This is probably not shocking – they are divisive models and come in only one and two references respectively. I have thoughts on why the Milgauss should be taken more seriously, and potentially, 2023 will bring a long-awaited updated Milgauss.

Finally, it is worth just touching on just how few Cellini’s are produced. Rolex is not known for its dress watches and that is reflected here. However, if your sole aim is to own a ‘rare’ Rolex, the Cellini may be something to consider!

Estimated production percentages of each Rolex model

Combining the two collections together to compare the proportions overall to total production, the Datejust is over double the next model for all the reasons mentioned previously. There are two surprises to me here that I want to highlight. Firstly, the Daytona is the model with the second highest proportions and secondly, the Day-Date is above the Submariner and GMT-Master.

Again, both can be explained by the broad range of references on offer. However, we will touch on the limitations of these assumptions below, but this does rely on secondary market data and it could be they are more popular models to ‘flip’.

Revenue and Production Numbers – Method 1

Now we have considered the proportion that each model contributes to Rolex as a whole, we can look at what that means for revenues and actual production numbers.

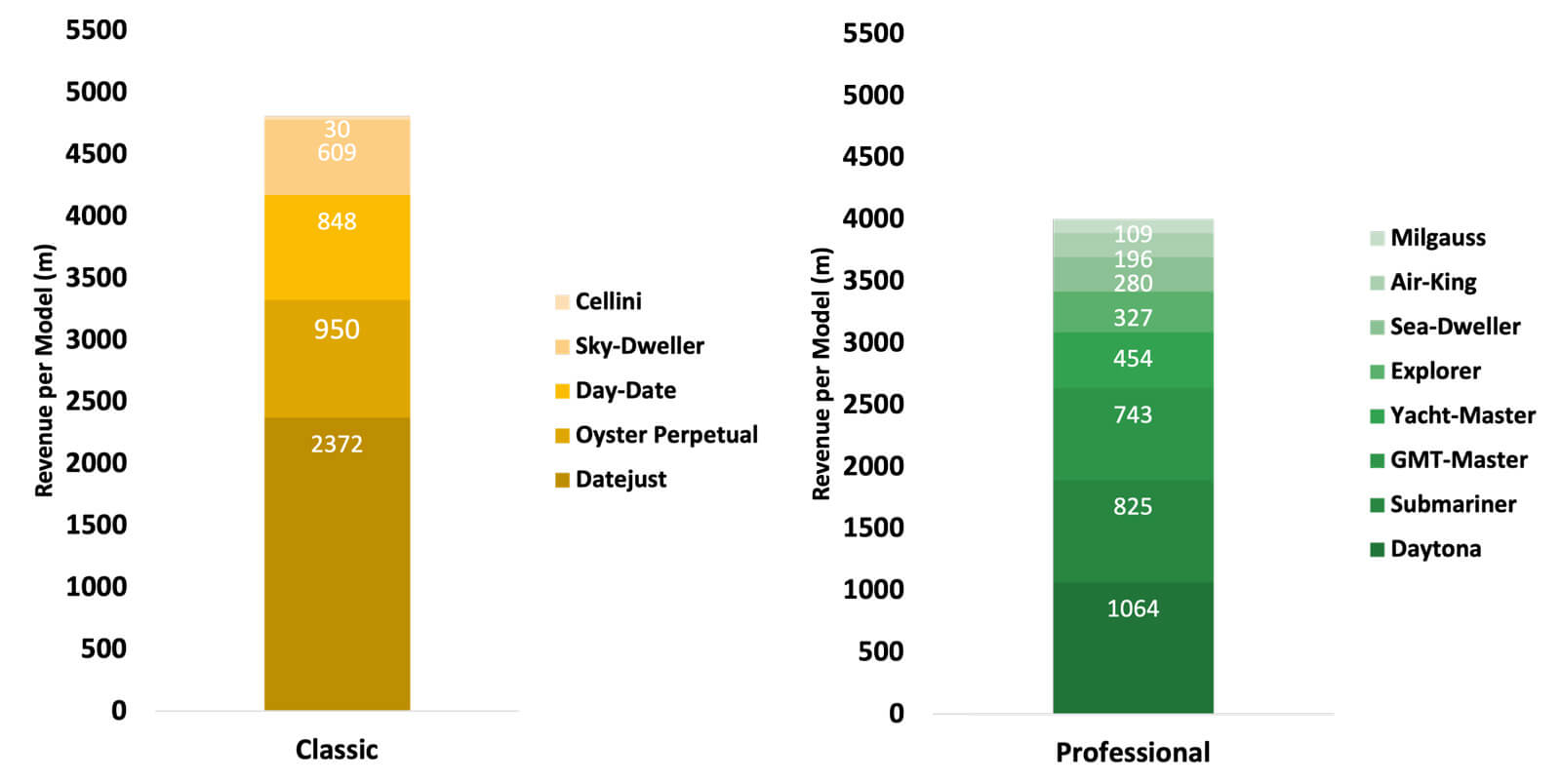

The first method assumes that the revenue number found on Statista is accurate – $8.807 billion. This means the respective proportions found above can be applied to the revenue number directly giving us the amount each model generates for the brand. You can find the charts below.

Estimated revenues of Rolex Classic and Professional models using Method 1

We have covered the proportional aspects, so here the focus will be more on the numbers. First and foremost, the Datejust could be a watch brand in itself. The Datejust makes the brand $2.372 billion in revenue. If this study ends up being anywhere near close, this results in the Datejust being not far below Cartier, which is second in terms of revenues in the whole industry.

It sounds like a similar situation to the success Apple has with AirPods. The Datejust is iconic, as are many models, but there is an element of the Datejust being an entry point to the brand.

When I say entry point, this does not mean it is the cheapest, rather this covers the broad price range the Datejust covers, the wide aesthetics variations, case materials and case sizes. It is the model where it is easiest to find something that appeals more specifically to you while remaining timeless.

Building on this, the high demand for the Professional models has now spilt over into other Rolex watches. I would caution though that this excessive demand has not always been the case, as a proportion of all Rolex watches the Datejust has not changed greatly in the last five years.

Moving on from the Datejust, another four models are making more than $800 million a year in revenue – the Daytona, Oyster Perpetual, Day-Date and Submariner. This puts each model greater than whole brands such as Tag Heuer ($746 million a year) and close to IWC ($877 million a year).

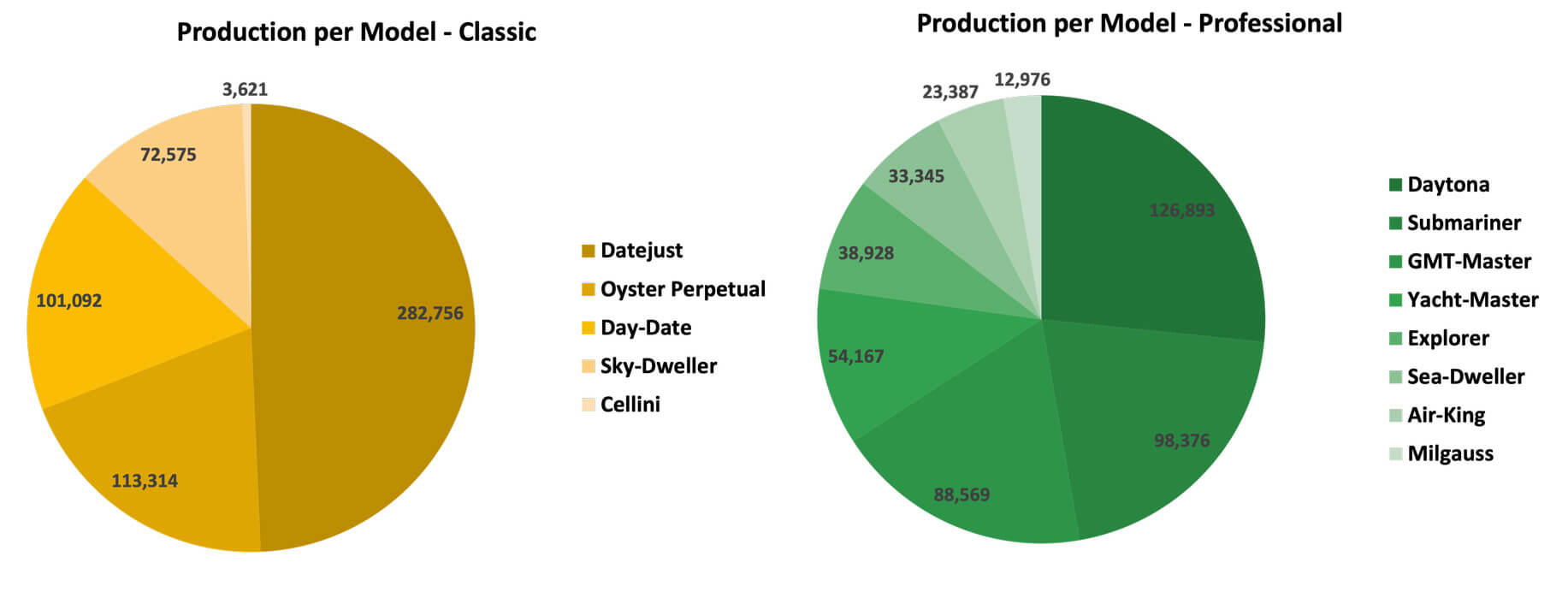

Moving on to production numbers, we are unable to just take the above proportions and apply that to the $1.05 million figure found online in Method 1. This is not the case because, after calculating rough wholesale prices for each model, the production figure should be higher to result in the $8.807 billion revenue value.

Therefore, we can get updated production values for each model by modelling and adjusting the production numbers for each model to match the revenue generated at wholesale prices. This will change the proportions each model accounts for in total production.

What does this mean? The total production number for 2021 is closer to 1.24 million watches. As this relies on wholesale values, it results in production changes varying from model to model when compared to the proportions found in the previous section. The most notable takeaway: there are nearly 35k fewer Professional models and over 200k more Classic models being produced.

Estimated production numbers of Rolex Classic and Professional models using Method 1

This is driven by far fewer Daytonas than initially suggested by the Chrono24 data, and more Datejust and Oyster Perpetuals. You will be able to see the outcome in the charts.

—————————————————————————————————–

—————————————————————————————————–

Revenue and Production Numbers – Method 2

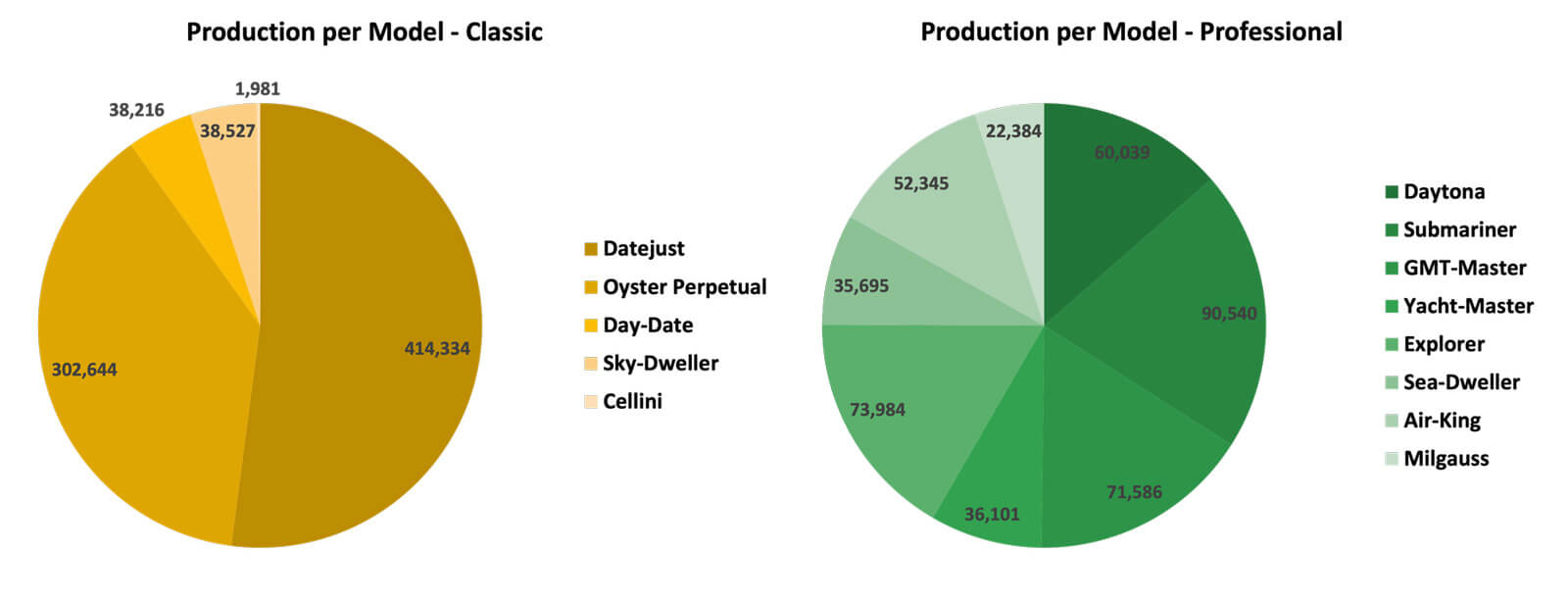

The second of the two methods assumes that the production number of 1.05 million watches per year is correct. With this being the case, we can apply the Chrono24 proportions discussed earlier and visualize how many of each model are produced.

Estimated production numbers of Rolex Classic and Professional models using Method 2

Looking at the figures here, the numbers are still large, even if less than Method 1. There are roughly 575k Classic models produced, of which, nearly half are the Datejust alone. To put this into context, it is estimated that Omega produces half a million watches a year (BQWatches). It is known Rolex is large, but now with this in mind, the extent of just how enormous Rolex becomes clear.

Looking at a few popular models in more depth, the Submariner accounts for just over 98k watches a year and within that just under 60k are stainless steel versions. The remainder is equally split between the two-tone and gold variants. The GMT-Master is somewhat similar. Overall, 88.5k are produced a year, with the stainless steel model accounting for around 54k.

For the balance, the GMT-Master sees a higher proportion of gold models when compared to the two-tone. The final example to consider is the Daytona. As we saw earlier, the Daytona accounts for a higher proportion than the Submariner and GMT-Master, but when breaking it down, the gold references make up the majority.

The coveted stainless steel Daytonas only account for around a third of the gold references. But keep in mind that there are only two stainless steel references.

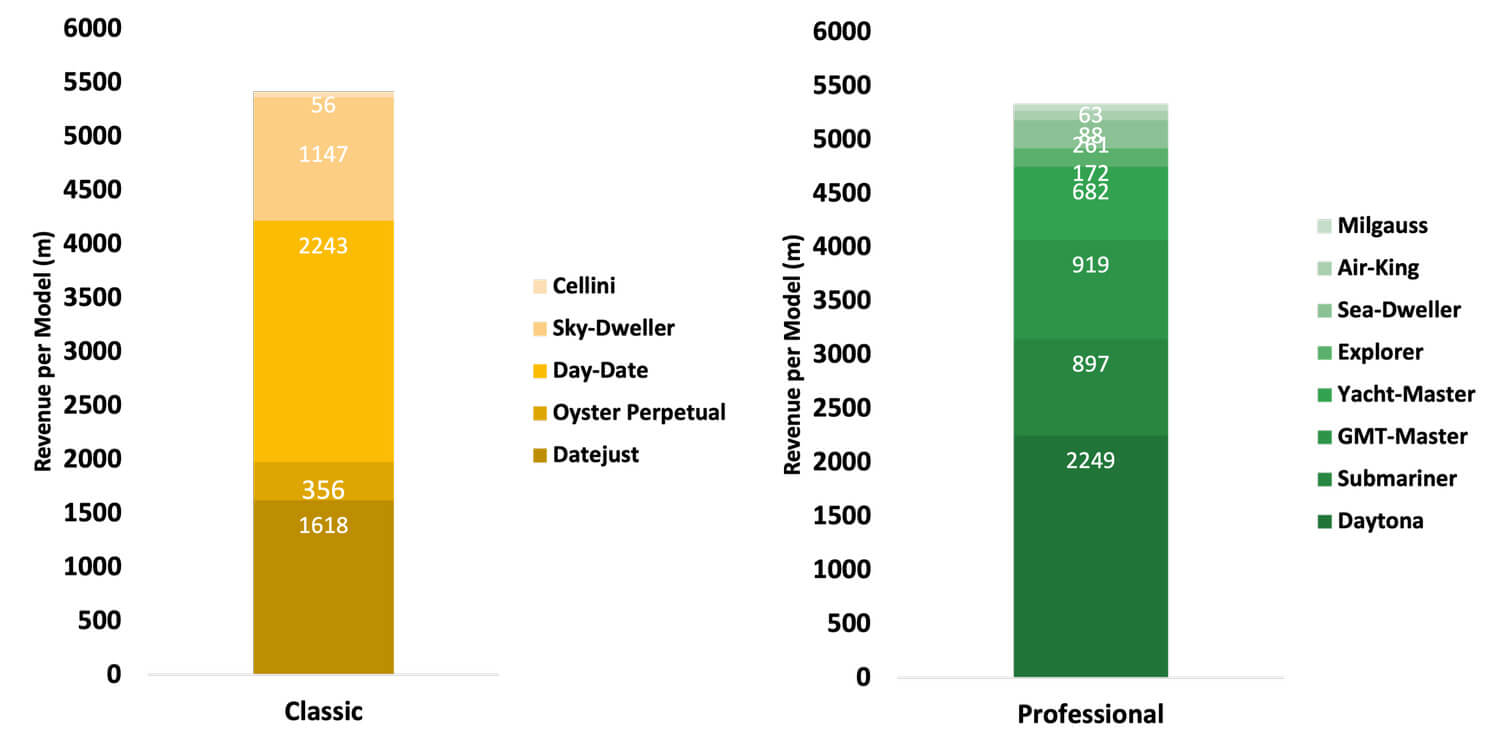

Assuming that the production number of 1.05 million watches a year and the amount per model is correct, what does this mean for revenue? Using the same weighted average retail price of each model and corresponding wholesale prices, we can find out.

Estimated revenues of Rolex Classic and Professional models using Method 2

The most significant outcome is the top-line revenue is $10.75 billion – this is $2 billion more than the figure from Statista. Moving to the next level, the revenue generated by the Professional and Classic collections is a lot closer. This is being driven by the Professional side, more specifically, the Daytona and Yacht-Master thanks to higher wholesale prices.

The Daytona accounts for $2.25 billion in this method. The GMT-Master is also affected and generates over $900 million. This results in the GMT-Master producing more revenue than the Submariner, contrasting with what was seen in the previous method.

On the other hand, the revenue from the Air-King, Explorer and Milgauss is significantly lower. Moving to the Classic watches, the Datejust accounts for $1.6 billion. Still an astronomical number, but lower than in Method 1, and offset by a large increase in revenue from the Day-Date.

These numbers, as touched upon with the Daytona and Yacht-Master, are all driven by wholesale price levels. Those watches with a higher retail price have a greater wholesale price and this is the number used in calculating revenues. This can be clearly seen when considering the Day-Date.

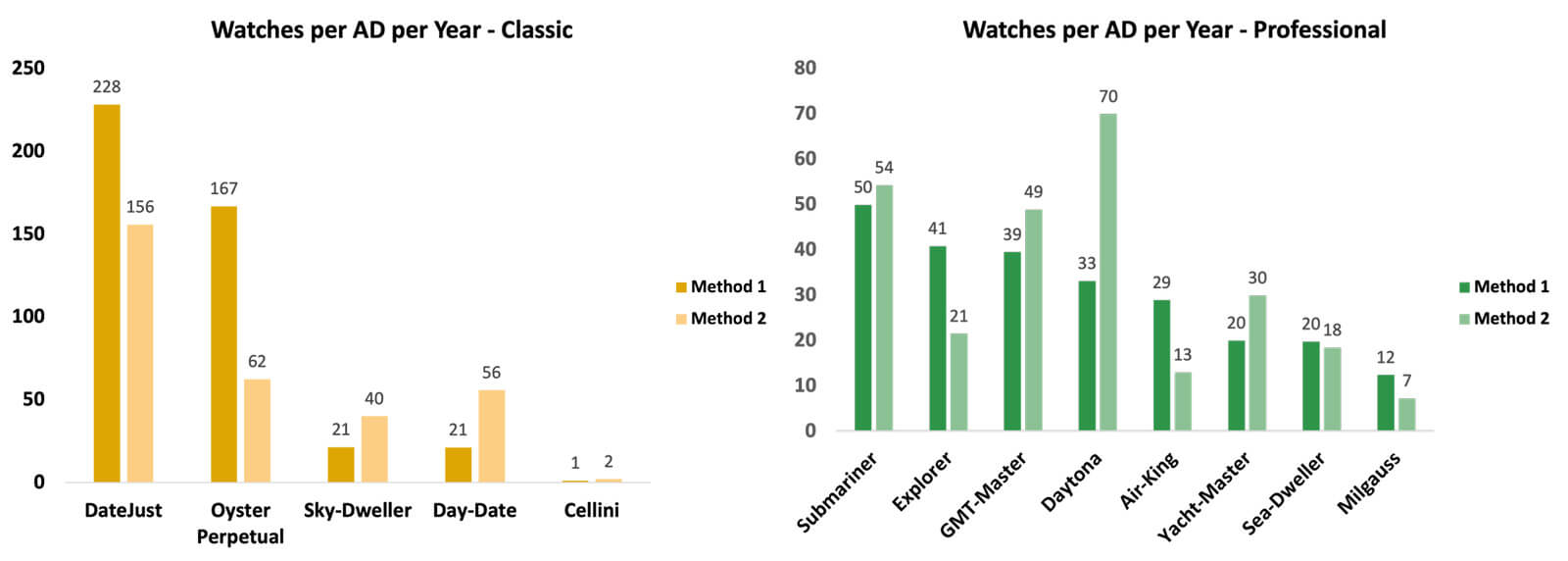

Number of Watches per Authorized Dealer

Finally, with these supply figures we can estimate one more metric – the number of watches each Authorized Dealer receives a year. In 2022, Millenary Watches calculates that there are 1816 ADs globally (2022 AD numbers vs. 2021 production so a small margin of error here).

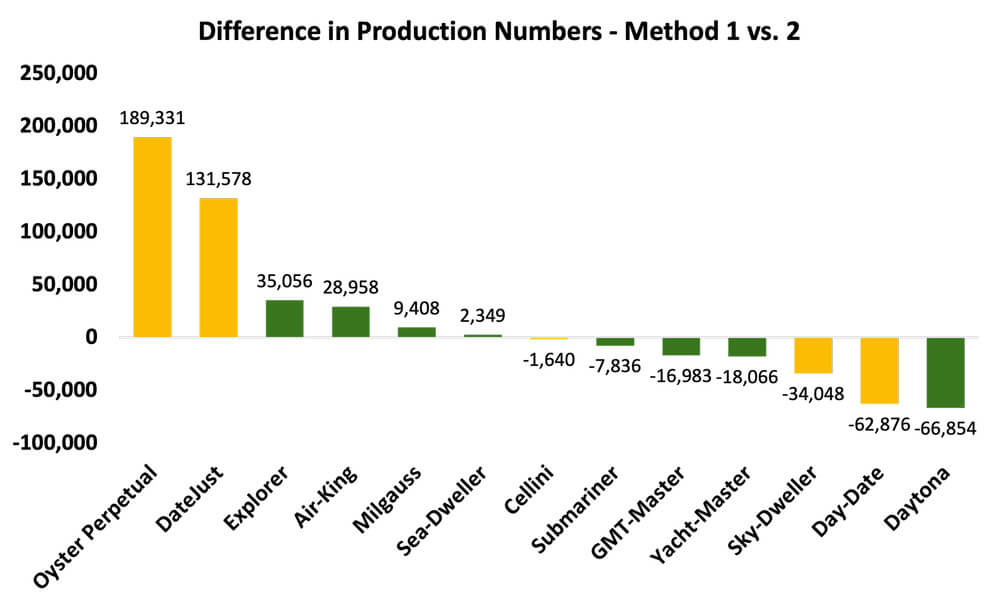

Difference in Rolex production estimates between Method 1 and Method 2

As we saw above, the two methods provide us with differing estimates of production numbers across models. Before getting to the watches per AD, you can see on the chart the difference in production values calculated between Method 1 and 2. The biggest driver here is those models that have a lower wholesale price need to be more supplied by Rolex to generate the corresponding revenue proportions. Below you can see this difference and it will become clear.

Now that we can easily see the variation between the two methods and understand why it is the case, we can find the corresponding number of watches per AD for both. Spoiler – this just reinforces how few each store receives a year!

Focusing on Method 1 to start (assuming the revenue value is correct). On average, each store will receive 244 Professional watches, nearly double that in Classic. Only 33 Daytonas reach each AD, and only half of the retailers globally will receive 1 platinum Daytona each year.

Despite the relatively few references, the Submariner is one of the more supplied models, even more so than the GMT-Master. Surprisingly, even the Explorer I & II is more supplied than the GMT-Master. This results from the lower wholesale value of the Explorer range meaning more watches need to be supplied as mentioned above.

Estimated numbers of Rolex models delivered to authorized dealers

Moving to the results for Method 2 (assuming the production value is correct). Each AD would receive 262 Professional models a year, only slightly more than Method 1, however, ADs only receive 316 Classic models. This is much lower than the number just above, driven by far fewer Datejust and Oyster Perpetuals offset by a small increase in Day-Date references.

In the Professional collection, this can also be seen, although the changes result in only a minor divergence in the total line. There are double the Daytonas making their way into ADs compared to Method 1 but nearly half the Explorers. This is because the wholesale value of models is not taken into account in calculating the production, but rather, solely the Chrono24 proportions.

I do want to acknowledge that these are just averages. Not every Rolex AD is equal. There may be regions or cities where specific models tend to be more supplied given consumer trends. Likewise, if you have a large Rolex AD such as the London Knightsbridge location, I imagine more watches make their way here compared to a small branch in a less populated town.

Again, I have no specific information on how this works, but it would be logical that not every branch received the same allocation.

—————————————————————————————————–

—————————————————————————————————–

Limitations

Getting to these figures required assumptions, mainly that either 1.05 million watches per year or $8.807 billion revenue is correct and all revenue is generated by watch sales alone. Nevertheless, there are limitations to this model as well. Firstly, the initial proportions were found using the 2021 models currently available on Chrono24. This relies on those who are listing pieces to correctly identify the watch information, e.g. listing a GMT-Master 126711 ‘Root Beer’ as two-tone and not solely gold.

Rolex GMT Master II ‘Root Beer’ in gold

Furthermore, there are models that are more favourable to ‘flip’, and this could be distorting numbers. The Daytona has a larger proportion than I would have initially expected, and despite being able to explain this by the many references on offer, it is no secret that it is a model with exceptionally high secondary market prices. This could lead to a higher number making their way onto Chrono24, compared to less popular models such as the Milgauss or Yacht-Master, and especially the Cellini.

Next, the retail prices that have been used were originally in € figures and converted to $ using the 2021 exchange rate average. This was followed by a weighted average across references, again relying on the proportions from Chrono24. In addition, wholesale prices were calculated using the ratio mentioned in the methodology, and this likely varies across different models.

Finally, the total number of Rolex ADs is likely to fluctuate and with this, the number of watches per AD per year may look ever so slightly different.

Conclusion

Rolex is one of the best-known companies in the world and is capturing the attention of even more people in recent years. However, despite the broad interest, it is all relatively opaque given it is privately owned. There are a few numbers that are in the public domain such as FY21 revenue and estimations of total annual production. Using these values and other public information, primarily from Chrono24, the production of each model and subsequent revenue has been modeled. Unfortunately, whether this is close to reality we will never know!

Rolex Oyster Perpetual Submariners

What are my impressions? On one hand, in Method 1, it would not surprise me if Rolex was producing more than 1.05m watches per year. Further, when considering the number of watches per AD, I find the numbers are more believable, especially when it comes to the higher figures of the Datejust and Oyster Perpetual. In contrast, Method 2 applies the wholesale value to the revenue result, which instinctively makes sense.

It would not surprise me if the revenue Rolex generated was slightly larger although this would impact the market share values referenced online by Morgan Stanley – this is a red flag in my eyes as they research the industry in great depth. Given this, and as the watches per AD seem too weighted towards the high-end, rarer models, I find myself believing the figures from Method 1 more so. Now you have seen the numbers, which method do you think reflects reality more closely?

If you enjoyed this more in-depth study please let me know in the comments! It can help me understand if more brands should be looked at and whether to update the figures for FY22 when possible.

You can read more articles by Raman Kalra at www.thewatchmuse.com.

* This article was first published 21 March 2023 at Rolex Case Study: How Many Watches and How Much Money Does Rolex Make?

You might also enjoy:

Why I Bought It: Vintage Rolex Day-Date Reference 1803

A Very Rolexy Rolex Discussion: 3 Reasons The Rolex Day-Date 40 Convinced Me

Mythbusting: 3 Persistent Patek Philippe And Rolex Myths Debunked

Hello, Newman: A Collector Looks Askance At The Cult Of The Paul Newman Rolex Daytona

Leave a Reply

Want to join the discussion?Feel free to contribute!

Absolutely great research and well written article with all the caveats. I applaud your work and love of watches. Thank you

I can only go by the availability of models at my AD. Submariners are easier than GMT-Masters are easier than Daytonas. The value on the secondary market is in reverse order, and therefore I would conclude that they are flipped more often (as a percent of production) in order of value.