On January 22, 2018, Richemont announced its intent to purchase the remaining shares it doesn’t already own of online luxury retailer YOOX Net-A-Porter Group (YNAP). The price is to be at a 26 percent premium to that day’s closing price.

Richemont’s share price dipped $.12, about 1 percent; not much in a $9.30 stock. On that same day, the share price of YNAP spiked up $8.12, a 22-percent jump (closing Friday, February 1, 2018 at $37.74). This confounded short-sellers of YNAP’s stock, who saw an opportunistic abyss due to the difficulty in replicating Amazon’s appeal to buyers of more down-market items in the expensive luxury space.

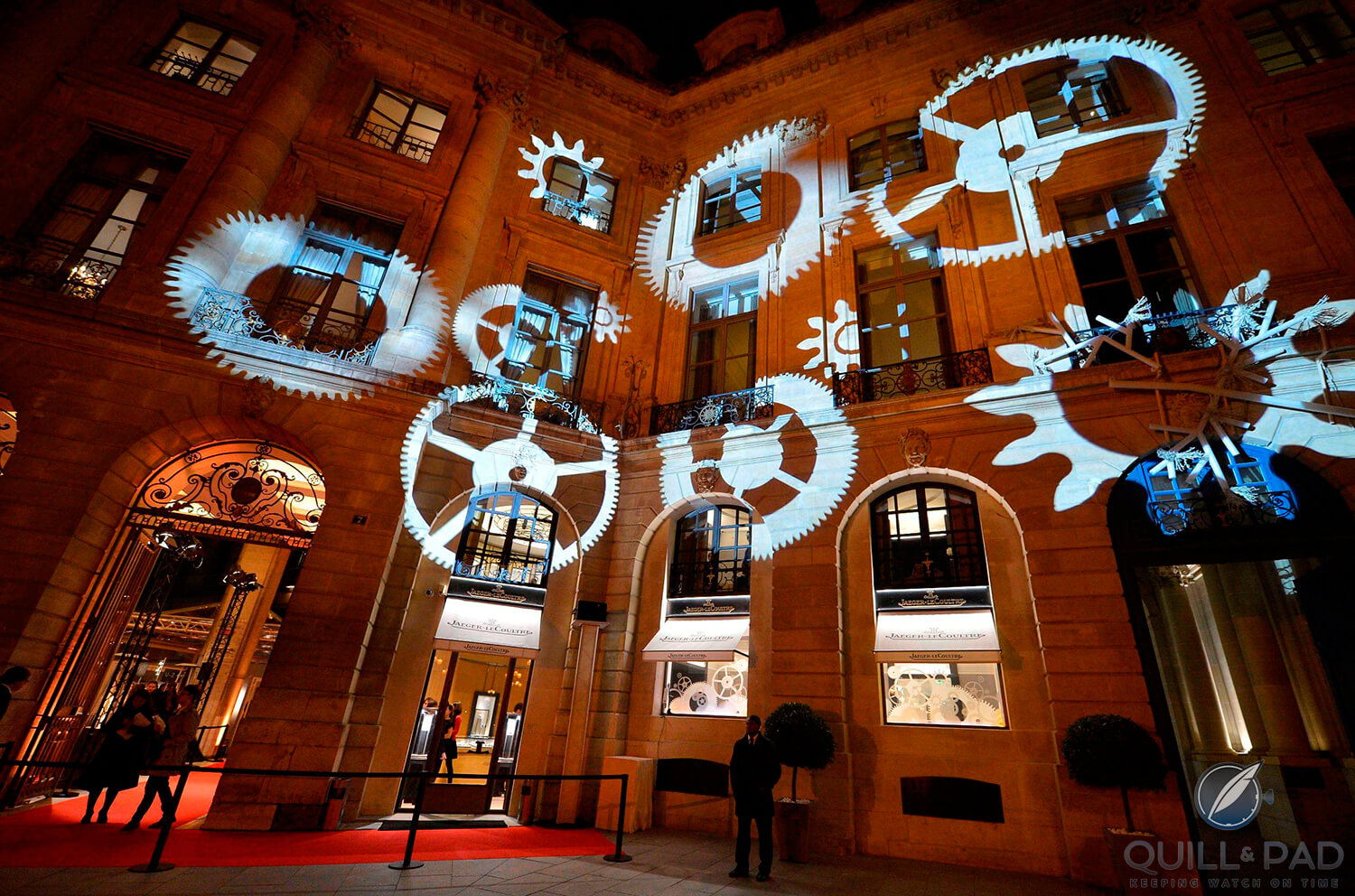

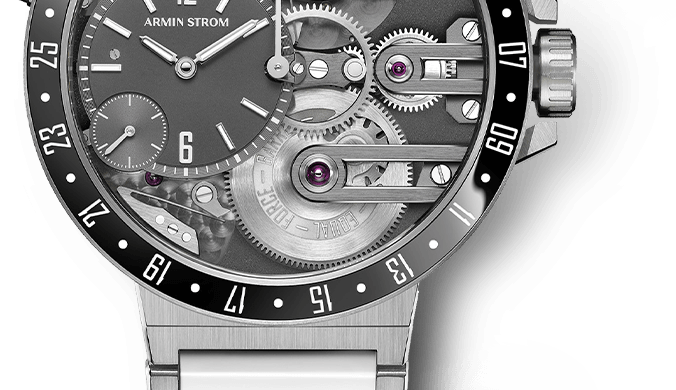

Jaeger-LeCoultre boutique on Place Vendôme in Paris

This is the second time Richemont has been involved in a buy/sell transaction with YNAP.

But there’s much more to this story than just a corporate acquisition. This is as much about Amazon and how fine timepieces will be sold in the future as it is about the online sales of luxury goods between two industry giants.

It’s not every day that Amazon shows areas of weakness, but consumer luxury ecommerce is one of them. Richemont is doubling down on its already strong market position; Richemont chairman Johann Rupert saw an opportunity and he took it.

Why this acquisition of YNAP by Richemont?

Back in 2015 when YOOX purchased Net-a-Porter from its creators, Richemont, LVMH and Kering, founder Natalie Massenet called it, “ . . . a store that never closes, a store without geographic borders, a store that connects with, inspires, serves, and offers millions of style-conscious global consumers access to the finest designer labels in fashion.”

In other words, it’s a consumer luxury goods ecommerce site. Fine. There are others.

Still the question remains why Richemont’s Rupert wanted complete control over YNAP.

Richemont may have acquired the remaining 75 percent of YNAP shares it doesn’t currently own for several reasons.

The first, and most likely, is strategic. As the world’s largest luxury online presence, YNAP would provide a robust ecommerce platform for most of Richemont’s product lines and brands. With YNAP’s reputation for speedy delivery, guaranteed authenticity, and a forgiving return policy, the group’s highest luxury good watch brands such as Vacheron Constantin and A. Lange & Söhne – two of the only brands in the group not yet e-tailing on their own platforms – are a natural fit.

Integration strategy

Rupert said that the company intends to strengthen YNAP’s leading position in luxury ecommerce, growing the business in existing and new geographies and increasing product availability and range. He intends on sprucing up his new acquisition, making it more valuable.

I also take this to mean he intends pushing many of Richemont’s products through the YNAP ecommerce pipeline. Of course, this includes some, if not all, of its luxe timepieces now customarily sold through company-owned boutiques and authorized dealers.

There’s another strategic reason for Richemont to add a trusted ecommerce channel for its luxury products: its brick-and-mortar stores.

With a growing percentage of sales moving through YNAP sites like Net-a-Porter and Mr Porter, there just may be an opportunity to reduce Richemont’s real estate footprint.

Take Cartier, for example. Its boutique network is one of its prime assets – and one of its costliest: there are 278 Cartier boutiques.

Yes, they each offer a warm welcome, comfort, luxury beyond compare, and presentation appeal. There are Cartier stores in Seoul (Cheongdam Road), New York City (the 5th Avenue Mansion), and a Tokyo Ginza flagship store, to name just three.

All are beautiful examples of luxury retail.

Yet the same pieces, at the same prices, and with the same guarantee of authenticity, can soon be had on the YNAP site from the comfort of the buyer’s home or office, albeit without the nicely dressed sales staff gushing and fawning over potential customers.

More and more, buyers have become used to purchasing everything online. So why not an A. Lange & Söhne Zeitwerk Minute Repeater for $495,000?

When such high-end timepieces are new and the seller is known and trusted, they become commodities with smaller and smaller profit margins if left to open competition. The only variables left in the purchase equation are price and availability. YNAP has standardized both.

Richemont’s A. Lange & Söhne brand has 17 boutiques worldwide. IWC has literally dozens of company-owned boutiques in the United States alone and many more worldwide. The list of Richemont real estate goes on.

As YNAP grows and gets its watch-selling business model together, my guess is that it will cannibalize a significant amount of sales that would otherwise have gone to Richemont’s boutiques.

At some point these boutiques will fall below the sales and profit hurdle rates that justify their existence. Then we’ll see a decline in Richemont watch shops, but an increase in corporate profits as online sites replace brick-and-mortar boutiques, beautiful as the latter are. Sad for those of us who like visiting our favorite watch boutiques, but I suspect an inevitable sign of times to come.

A less obvious reason

This may be the thriller novelist in me speculating, but I think Rupert may have actually had a financial acquisition in mind when he made his offer. YNAP manages online flagship stores for brands such as Kering, Ferrari, Armani, and Chloe (which Richemont also owns).

Scaling luxury online is inherently tricky, but YNAP has done it. The element of perceived prestige, expense, and scarcity figures prominently in these goods. YNAP is the master.

Amazon, on the other hand, focuses on precision logistics, low price, and availability. Its strategy is the opposite of the factors that attract luxury buyers.

As Richemont deploys its substantial resources ($4.45 billion in cash on hand as of its latest fiscal year ending March 31, 2017), its presence in the ecommerce luxe space through YNAP can only grow.

Global management consultant Bain & Co. estimates online sales of personal luxury goods will grow from its present 9 percent to 25 percent by 2020. That’s a moon shot.

Currently, watches – in the luxury category that Richemont manufactures, distributes, and sells along with premium jewelry, leather goods, writing instruments, firearms, clothing, and accessories – are not a major category in online sales. With Richemont’s acquisition, they soon will be.

Amazon is not myopic. Rather than compete against Richemont/YNAP for luxury online sales, it may decide to just buy them. Amazon currently has $19 billion in cash along with an investment-grade credit rating by Moody’s and S&P.

This would instantly open another sales channel for its trading partners and be accretive to earnings in the year of acquisition. Further, it would allow Amazon to strengthen its presence in both Europe and in the Asia-Pacific region. Both are geographies in which Amazon is now comparatively weak.

Should Rupert spin off YNAP as a separate entity, then sell it to Amazon, Richemont investors would come out enormous financial winners.

Further, Richemont would still have the luxury ecommerce channel that it originally created along with LVMH and Kering available for its use. There would just be a new owner – one with even greater resources to further expand its reach.

The makings for this are already in place: Richemont has stated that it will not dismantle YNAP’s management team. Nor will it close YNAP’s corporate offices in Milan. So it remains, for all intents and purposes, a standalone entity – easily spun off, then sold separately.

About the participants: Richemont and YNAP

Richemont owns several of the world’s leading manufacturers of luxury goods. To readers of Quill & Pad, it’s likely best known for its presence in luxury watches with brands including Cartier, Piaget, Vacheron Constantin, Jaeger-LeCoultre, IWC, Panerai, A. Lange & Söhne, Van Cleef & Arpels, and Montblanc.

Richemont’s fine watches though account for just 27 percent of Richemont’s sales. Jewelry comprises the lion’s share of sales with 56 percent.

Writing instruments (Montblanc, for example) and other business areas account for the remaining 17 percent.

Richemont profits have been up and down for the last several years. This acquisition of the remaining 75 percent of YNAP stock should stabilize and expand its sales pipelines. As the digital channel becomes increasingly critical to engage with customers in the luxury industry, Richemont intends to further strengthen its commitment to ecommerce.

YNAP is the only logical choice since Richemont is already its largest single shareholder and knows the business as well as the company and its management team.

Richemont is well positioned to defend its investment in this luxury online sales pipeline against Amazon. Richemont brings to bear its substantial financial and management resources, sophisticated and globally dispersed clientele, and a broad array of some of the world’s greatest luxury brands in jewelry, fine timepieces, and writing instruments.

Richemont can expand YNAP’s presence in existing and new geographies, increasing product availability and range, and develop unique services and content for its consumer luxury goods clientele.

With cash on hand of $4.5 billion, Richemont could easily include a substantial cash component in its offer for the remainder of YNAP stock and finance the rest with stock or issue bonds.

YOOX Net-A-Porter Group is the world’s leading online luxury retailer. Some have described it as the Amazon of the luxury goods sector.

Some years ago Net-A-Porter was cobbled together by Richemont among other investors. YNAP acquired Net-A-Porter in 2015, with Richemont retaining a 25-percent interest.

Today YNAP provides many varied luxury brands with the online technology and fulfillment logistics needed to sell consumer luxury products online. Among brands represented are Dolce & Gabbana and Stella McCartney.

The takeaway is that Richemont is well versed not only in online luxury goods sales but also specifically in YNAP, its corporate culture, and its management team.

Richemont had a market capitalization as of January 19, 2018 of approximately $51 billion. This is compared to YNAP’s market cap of $6 billion. This is a case of the whale swallowing the minnow. Whole.

How does this affect YNAP?

YNAP will continue largely as before.

Its management team is said to remain, as will its Milan-based corporate headquarters. YNAP will enjoy a significant bump in the financial, technological, management, and product resources available to it. It will be able to execute expansion plans more quickly and with greater use of available technology than before.

YNAP comes out of this transaction a winner.

What can watch buyers expect?

The near term won’t affect buyers of Richemont brands’ products. It’ll take some time for YNAP’s luxury timepiece pipeline to ramp up.

It will also take time for prospective buyers to get used to the idea of making such a large purchase online. This has to do with watch buyers’ trust in the purveyor. Worry about fakes is rampant in the online watch sales industry.

Trust is where YNAP excels: authenticity is guaranteed as is customer satisfaction.

If you decide that IWC Da Vinci Automatic 36 you bought is just not for you (though I can’t understand why), return it for a full refund of the $5,400 price.

YNAP’s return policy spans 28 days after purchase for any reason or no reason, and YNAP even pays the return shipping. Customers can choose a refund in their original payment method or store credit.

Such an easy return policy goes a long way to instill consumer confidence and lessen perceived purchase risk.

Currently, the selection of fine timepieces available on YNAP within the Richemont product lines is spartan. After all, the acquisition of YNAP was just announced last month and by press time it hasn’t even closed. Give it time.

I anticipate that the YNAP pipeline for Richemont watches will be fully populated with each brand’s collection within 2018. This acquisition cost Richemont $3.3 billion not including attorney’s and accountant’s fees. It won’t be allowed to sit around gathering dust. Integration of the two companies’ systems, finances, and management will be a priority.

When that happens, buyers of Richemont’s fine timepieces can not only view the manufacturer’s complete collections (all of them, every piece) but also be able to execute purchase if they wish on the spot.

They’ll know the piece is brand new, totally authentic (they’re dealing with the manufacturer, after all), and that they’re getting the best price possible.

Additionally, delivery will likely be super fast. If it’s on the site, it’s in inventory and ready to ship that day.

Impacts

Creating such a robust pipeline for new timepieces gives Richemont a degree of control it doesn’t currently have with its hundreds of company-owned boutiques and authorized dealers. That control manifests itself not only in supply and availability, but also in price.

As the YNAP ecommerce sales channel gains a significant foothold in the number of Richemont timepieces sold, the company can adjust pricing and supply to meet its profit and cash-flow targets.

Just as many manufacturers withhold supply to justify higher prices and create an impression of scarcity and prestige, so can Richemont if it wishes. Except in this case it can exert this control instantly with just a few keystrokes on several website portals.

There’s nothing sinister or evil in this: luxury watch sales is a business with several significant variables figuring into profit. Just three among them are supply, demand, and price. The more control over each the manufacturer has, the more profit it will make.

That’s the reason such businesses exist. The only reason.

The Amazon effect

Amazon is the 800-pound gorilla in whatever space it chooses – especially in online sales. Just not in the online sale of luxury goods. Not now.

You can bet that Amazon is watching the growth of this segment. It is enormous in terms of sales revenue and with fewer transactions to gum up the works.

Should Amazon decide it wants into this space, it has two choices: one is to grow a new luxury goods business pipeline organically from scratch using its existing infrastructure. This will cost considerable investment that has an unknown cap. And it will take an unknown amount of time.

Further, some luxury goods manufacturers have in the past refused to deal with Amazon – something about the fairness of its trade practices. That’s one of the reasons Richemont, LVMH, and Kering created Net-A-Porter in the first place.

Should Amazon decide to grow its own luxury ecommerce pipeline, watch out, Richemont. Fear of being Amazoned has struck so many industries: the shipping and pharmaceutical industries are just two.

Currently healthcare is in the crosshairs of Amazon CEO Jeff Bezos. The news of Amazon’s interest devastated healthcare stocks: the iShares U.S. Healthcare ETF fell almost 2.1 percent, UnitedHealth Group was down 14 percent, CVS Health dropped 4 percent, Express Scripts retreated 3 percent, and Aetna also fell 3 percent.

The mere mention that Amazon is considering moving into an industry sends the stock price of its participants plummeting. Should Amazon decide to grow its own organic ecommerce pipeline, Richemont can expect the same treatment.

Suddenly, its investment in YNAP would not seem such a good idea.

Amazon’s second choice would be to acquire YNAP, perhaps even Richemont while it’s at it. Though that seems a stretch since fine jewelry and timepieces are outside its core competencies.

Still, that doesn’t seem like a stumbling block for Bezos in light of his Blue Origin spaceflight services company.

Also consider that Richemont has sold its ecommerce company, Net-A-Porter, before – in 2015 to YOOX. The second time around should be even easier.

With YNAP as an Amazon company the cost is fixed and the timing is immediate. In my humble opinion, that’s what could one day happen.

And that’s what I think Rupert may have had in mind all along when he tendered an offer for the rest of YNAP’s shares he does not already own: add tremendous value to the company, cement Richemont’s product lines into YNAP, and then flip it to Amazon.

For more articles by Chris Malburg, please consider:

Happy Wife, Happy Life: What Women Want (In A Watch)

Why People Buy Watches

What Will The Future Wristwatch Offer Millennials, Generation X, And Baby Boomers That Other Devices Cannot? A Generational Migration Of Timekeeping Examined

Leave a Reply

Want to join the discussion?Feel free to contribute!

Hi Chris, good read and together with the Q&P article on the grey market i have this question:

1) how does Richemont/YNAP plan to make me (consumer) pay full MSRP instead of less through grey market (with free 14 day return rights by law and full refund ) also for limted models, or with much nicer in person service through an AD and possibly a better price or free straps etc?

2) is this another `synergy on paper` merger that will never work as most other mergers?

3) All i can think of that YNAP is good for is the to be developped womens watch market, as in new handbag new matching colour watch.

Good reading and probably better journlism than on other watch sites!

Hi Ron,

Good comments all and thank you for continuing the dialog. I think you’re right about the competitive effects of gray market pieces. How indeed does any OEM manufacturer selling any kind of product compete with gray market, black market, or fake market purveyors? But that’s not necessarily the specific market here. What commoditizes OEM fine timepieces is first trust in the seller that it is without a doubt the real thing and that you will absolutely get the exact item you paid for. Lastly that you are getting the best possible OEM brand new price. Gray market or other markets don’t have these assurances. In my mind, that’s what takes the commodity pricing out of the gray market. Each piece is unique in some way, be it authenticity, price, availability or whatever.

Thanks for the comments, Ron.

Best,

Chris

Thanks Chris, valid point on trust but with rating systems on ebay and chrono24 i believe that is secure enough ? No dealer sells fakes on these open markets anymore, they would be banned. IMO an under 10K watch is no longer special enough for VIP/Boutique full MSRP, but still more than a commodity. Even Omega Trilogy `limited` edition is freely available online, while some who have ordered through brand channels last year are STILL waiting for delivery. I would feel %##@%%^^ !!!

If brands themselves are the main supplier for grey markets ( surplus or cash flow reasons) i can be sure it is the real thing and i would be my own thief paying MSRP. I do enjoy a visit ( 1 hour drive) and need the feel and fit when trying and seeing new watches. But now i have the EU law guarantee of return within 14 days with full refund, i can try and fit at home. No risk either. IF YNAP doesnt have the same benefits as AD they can not charge AD prices. It is after all `just` a website. Just my thougts !

Oh that is unfortunately a very naive view on the open markets of Ebay and Chrono24. I cannot count the amount of fake watches sold and offered on these platforms. I have many times reported them, with most of the time no reaction and no removal of the pieces in question. Only when I exercise a lot of pressure, at least Chrono24 then removes the watch. Ebay truly doesn’t care at all. That is my experience and I am in the watchtrade for 20 years now.

hi Chris, thanks for sharing your valuable input. Being a bit familiar with Richemont, I think it’s a great move: besides a new digital channels to push sales, I also think it will create a lot of synergies within the group to develop a better expertise in fashion, a territory where Richemont has not yet succeeded (access to customer data, to trends, to pool of talents available at Net A Porter, sharing practices with Richemont fashion brands…). Another expertise that Richemont teams will further gain from an integration of YNAP is probably in their digital communication to millennials. I believe Richemont management will fantastically exploit this acquisition in many aspects in the future. It opens a lot of opportunities…

Hi Ren,

Your assessment of Richemont’s expanded reach to the millenials is spot on. YNAP is a professional online marketing and logistics firm. Richemont isn’t but needs such an expert. Now they have one–at least until they sell to Amazon!

Best,

Chris