by GaryG

I love independent watchmaking and independent watchmakers; one of my great joys as a collector has been the opportunity to own the works of several of these great creators, and I love having the feeling that, in a small way, I am supporting their efforts.

Philippe Dufour Simplicity

My high regard for these great creators makes it all the more difficult to accept that for many of them, business survival is a struggle and that very few of them will ever achieve prosperity by pursuing their chosen paths.

Why is this so, and what, if anything, can they do about it?

Why they struggle

Independents face four major categories of challenges: consumer market dynamics, production economics, industry structure, and management capabilities.

Consumer market dynamics: The first issue that high-end independents face is that the number of well-heeled enthusiast collectors oriented toward the indies is quite small. For instance, while I’m quite confident that I don’t know them all, I can say that I very likely personally know more than half of the 50 buyers for a timepiece such as the new Grönefeld 1941 Remontoire and know several more by reputation.

Grönefeld 1941 Remontoire on the author’s wrist at Baselworld 2016

Happily for the independents, creating fundamental awareness is not as much of a problem as one might suspect; among potential buyers for these pieces, various online media and social outlets distribute the latest news from the independent front to an eager audience. Some newer independents such as AkriviA have intensively targeted potential buyers using online media like Instagram.

AkriviA Tourbillon Regulateur

At the same time, however, market transparency can be a double-edged sword as the socially connected collector community is quick to judge which new pieces are “must haves” and which are not. Groups of friendly collectors and consumers from around the globe increasingly come together to propose group purchases in exchange for sometimes-substantial price discounts.

Production economics: In the 1960s, consultants from the Boston Consulting Group quantified a phenomenon known as the experience curve. Put simply, in most manufacturing businesses (and many services), the cost of making a given item decreases on the order of 10 to 30 percent every time the cumulative production doubles.

So, if the initial run of items (in our case, watches) is, say, 10 pieces, we’d expect the direct cost of producing the twentieth piece to be around 80 percent of the initial cost, the fortieth piece to be around 64 percent, and the eightieth piece to be just over half of the cost of each of those first ten watches if the watchmaking business exhibited a 20 percent experience curve.

Hard to make the numbers: limited production Marin 1 movement by Peter Speake-Marin

There are a couple of pieces of bad news, though.

First, many independents never produce as many as 80, or in some cases even 20, of a given design. Second, the costs of some of the most costly components (for example, precious metal cases) are driven largely by underlying commodity costs and are therefore not subject to the experience effect.

And at the same time, the big brands are cranking out individual watch lines, or complementary lines of watches that utilize the same underlying manufacturing processes and components, in the thousands or tens of thousands, driving their costs lower and lower as their cumulative production grows.

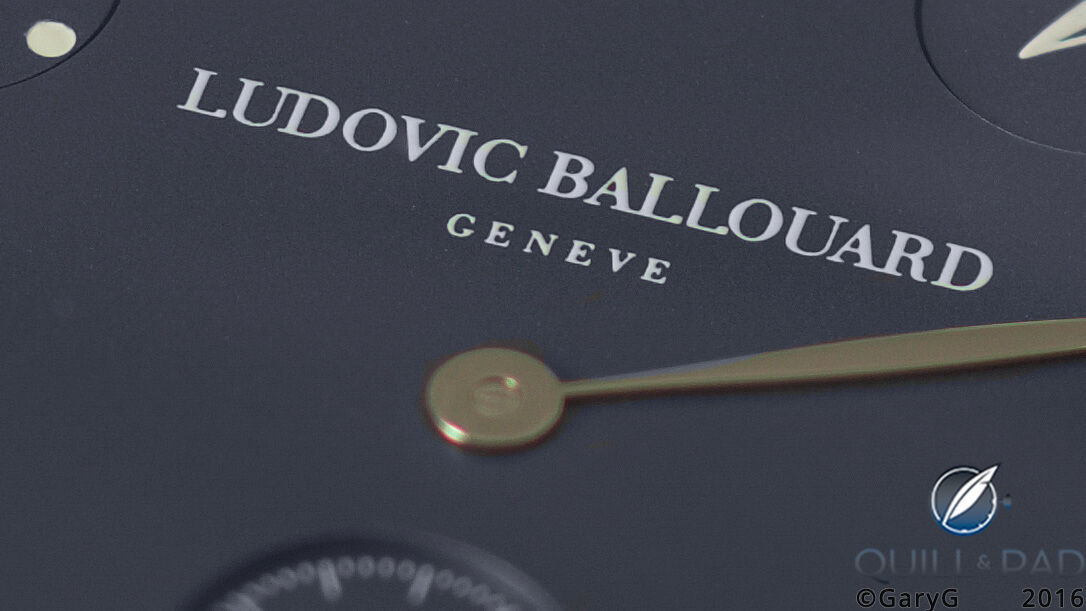

Rare and beautiful, but costly: dial detail of the radical Upside Down from Ludovic Ballouard

For the independents, the economic conundrum is that if they were able to afford to produce in sufficient quantities to come down the cost curve, they could afford to lower prices to a level that would attract additional buyers. And if they could attract sufficient numbers of buyers, they could afford to produce in quantities that would enable them to ride the experience curve to further profits.

The tragedy is that many independents get stuck on the wrong side of this cost-volume-price equation and can neither justify prices low enough to attract buyers nor drive volume high enough to cut costs.

Industry structure: When you read the term “industry structure,” chances are that the words “influence” and “power” are not too far away.

In an industry in which there are big players who either make critical components used by other manufacturers in-house or order massive quantities from suppliers who depend on their patronage, the mom-and-pop operations are almost always going to be at an influence disadvantage.

My friends and I learned first-hand, for instance, how long it can take for an independent to get delivery of ten customized watch dials (see Commissioning A Watch: My Journey With The Kari Voutilainen Masterpiece Chronograph II).

Small volume: dial detail, Voutilainen Caliber 27

And even when an independent can get delivery, the unit cost is almost always higher than the volume pricing extended to large-volume buyers, creating further production cost disadvantages for the little guys.

On the sell side, there are more bills to be paid in the form of discounts to distributors and retailers. And while there are passionate proponents of independent watchmaking within the world of timepiece distribution, it’s often tough for independents to get their products to retail and then all too common for their pieces to languish in display cases as poorly-equipped retail salespeople fail to bring the independents’ stories to life for potential buyers.

Management capabilities: As I’ve developed this article, I’ve considered a number of times whether it’s actually that relevant to apply a business lens to what is fundamentally an act of self-expression on the part of the watchmakers.

Business or art? Antiqua from Vianney Halter

If it’s been hard for me, I can only imagine the challenges for these independent creators as they attempt to bridge a love for watches and the necessity of being in the watch business.

To succeed, independents must complement their watchmaking chops with solid people management skills and business and financial acumen. It shouldn’t surprise us that as in most lines of human pursuit, the likelihood that artistic, leadership, analytic, and fiscal capabilities are embodied within a single watchmaker is quite low.

Why it could get worse

To a considerable extent, the robustness of consumer markets depends on confidence, and for collectors part of confidence consists of the belief that we are unlikely to “get hurt” on the value of pieces once we purchase them.

In the current market environment, what we’re seeing is a tendency on the part of some collectors to become more conservative with the mixes of their collections, and at the margin to place available budget into vintage watches or important pieces from major brands.

For other watch buyers, tough economic times for independents may further feed the traditional concerns about the availability over the long-term of servicing for low-production pieces.

The appeal of rare beauty: McGonigle Tuscar One of Ten

In competition with the more affordable end of the independent market we are also seeing disruptive business models come into play as waves of “microbrands” emerge.

To get around the capital and sourcing constraints that independents face, these startups use funding mechanisms such as Kickstarter and Indiegogo to raise funds before they ever go into production, and as a rule focusing their development and production models on cosmetic packaging of off-the-shelf movements rather than development of novel mechanical offerings (see Calling On The Village: Czapek & Cie. And The Quai Des Bergues Collection).

How independents can survive – and potentially prosper

It’s not time to abandon hope, however! We are already seeing examples of many practices that independents can adopt as they battle the odds.

Diversifying revenue streams: This is actually a time-proven model for independents as many of them perform work including design, manufacturing, and assembly for other brands including major manufacturers.

Andreas Strehler Papillon d’Or

Kari Voutilainen’s work with Urban Jürgensen, Maîtres du Temps, and MB&F is well documented.

Personally, I’ve seen trays of complicated major-brand movements under assembly at more than one independent workshop, and Andreas Strehler even bills himself as the “engineer for the brands and watchmaker for the few.”

And at the margin independents such as Romain Gauthier have even given up a bit of their financial independence by striking co-investment deals with luxury goods manufacturers (see Surprising Ties That Bind: Chanel And Romain Gauthier).

Integrate vertically and develop scale to leverage the experience curve: Voutilainen finally got tired enough of the challenges of dial supply that he bought his own dial manufacturing operation and guilloche rose engine. He now supplies dials to others and leverages his in-house capability to provide his own customers with a broad array of colorfully decorated dial design options (see Fiona Krüger’s Unusual Petit Skull Watches Have Made Me A Fan).

MB&F Legacy Machine Perpetual Calendar

Broaden the addressable market: Maximilian Büsser and his MB&F are the masters here; after the brand concluded that selling to hardcore horological collectors alone would be insufficient to secure its future, it moved aggressively to establish itself as a lifestyle brand, launching the M.A.D.Gallery (see MB&F M.A.D.Gallery: An Artful Meeting Place In Dubai) as an adjunct business and opening new communication channels aimed at young, wealthy consumers around the world who see watches as fashion items.

Stay the course and change things up: Yes, there’s a tension there! For me, Tim and Bart Grönefeld have done a great job of keeping things interesting by introducing new variants of existing watches such as their One Hertz while also refining and updating their art with pieces like the remarkable new 1941 Remontoire, all while maintaining a clear and consistent brand personality.

Voutilainen scores again here by adding small complications to the Vingt-8 base movement and adorning it with a seemingly endless variety of dial designs rather than trying to invent something fundamentally new every season.

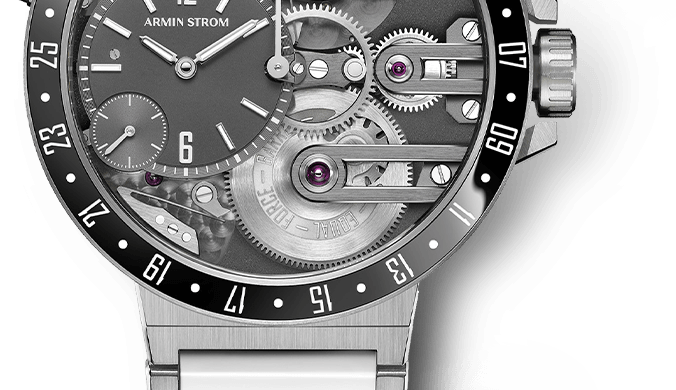

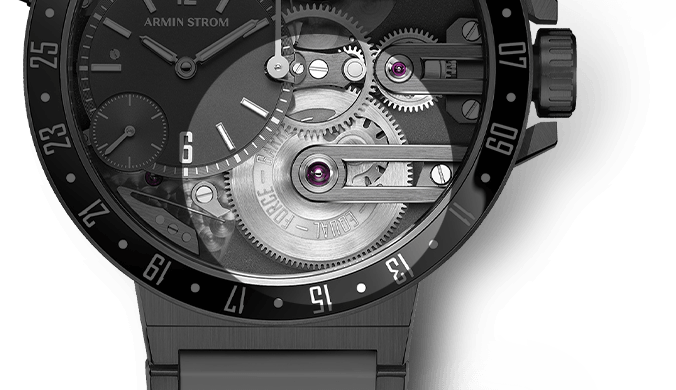

Kari Voutilainen GMR with Vingt-8 base movement

I’ve owned several Habring2 watches, and the Austrian duo can always be counted on for honest timekeeping, interesting takes on complications such as dead seconds, and crisp-looking dials, hands, and markers, all at attractive price points (Habring2 Gets Happy (And Serious) With Felix, Featuring First Austrian Movement).

Habring2 Jump Seconds

Tell their stories – in person: As I’m fond of saying, “Meet the maker, want the watch!”

There’s still no substitute for meeting one of these great people at dinner, a major show, or at their atelier; and if the watches themselves are based on great stories such as Vianney Halter’s dream that led to the Deep Space Tourbillon (see Why I Bought It: Vianney Halter Deep Space Tourbillon) or the remontoire mechanism of the Oldenzaal town clock that inspired the Grönefeld 1941 (see Grönefeld 1941 Remontoire In The Horological House Of Orange), all the better.

Cultivating the collector community directly is hard work, and for some major brands this seems to have fallen out of style. But for the indies, it will continue to be mandatory.

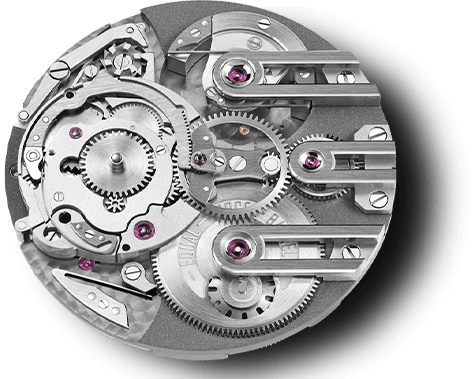

Watch with a story: Grönefeld 1941 Remontoire movement

One potential leverage point: watch-related communities such as Redbar are on the rise globally, providing new focal points for independent access to potential buyers.

Apply alternative business models: Many of these models aren’t new: the “subscription” model being utilized by the flood of watch microbrands goes all the way back to Abraham-Louis Breguet and was applied with great success by F.P. Journe to start his eponymous line.

F.P. Journe “Souscription” watch number 9/20

Microbrands also eliminate the middleman by selling directly to consumers; and while many independents take some orders directly from collectors, none that I know of have moved exclusively to direct sales.

In a world of instant awareness for new offerings and given the marked shortcomings of traditional retailers in selling independent offerings effectively, it may be time for many independents to consider going fully direct.

Band together: The A.H.C.I. provides invaluable services to its members and recently has begun to build a formal network of friends who receive updates on independents’ activities and increased access to the makers themselves.

That’s great, but might it be time for more formal collaboration among independent watchmakers on both the “buy” and “sell” sides of the business model?

While I recognize that the very concept of independence makes this a long shot, long-term survival may depend on learning what worked well and not-so-well with attempts such as the Time Aeon collaboration among Philippe Dufour, Kari Voutilainen, Vianney Halter, Robert Greubel, and Stephen Forsey and applying these lessons to new, more robust cooperative ventures for the future.

Make it great: Logical One from Romain Gauthier

Make great products: One of my mentors, legendary marketing channels strategist Professor Louis Stern, once told me his three secrets for successful channel strategies: “Product, product, and product!”

Not all independents have earned the stature and market appeal of Dufour; but the quality and inventiveness that many of them display, at a broad range of price points, gives me hope that we will be treated to their work for a long time to come.

* This article was first published on August 26, 2016 at The Independent Watchmakers’ Struggle: Why It’s So Hard And What They Can Do.

You may also enjoy:

Why We Are In A Golden Age For Appreciating Superlative Hand-Finishing In Wristwatches

Independent Watchmaking: A New Trend Or Just A Trendy Term?

Does Hand Finishing Matter? A Collector’s View Of Movement Decoration

Is Independent Creative Horology Dead?

‘Time Piece’: If You Only Watch One Film On Independent Watchmaking, Watch This One

Leave a Reply

Want to join the discussion?Feel free to contribute!

Dear Gary,

Nice read. Thank you. I should have expected you made reference to Mr Vincent CALABRESE, who are really KEY in the AHCI development. Thanks to write a post dedicated to this Great Watchmaker.

Best,

Patrick

Hello Patrick,

Thanks for taking time to comment! I have great respect for Mr. Calabrese and I think it’s a great idea to feature him in a future post.

Best, Gary