by GaryG

A couple of years ago, I wrote here about the struggles that independent watchmakers face simply to survive (see The Independent Watchmakers’ Struggle: Why It’s So Hard And What They Can Do To Better Survive). Expressing oneself through horological art may well be a noble calling, but it’s definitely one of the tougher ways to make a living.

Art that requires a management balancing act: Voutilainen Masterpiece Chronograph II

At the time, I suggested several factors contributing to independents’ difficulties.

- The relatively small market for high-end independent watches, even given the increased reach that the Internet and watch enthusiast groups have provided to independent makers in recent years.

- An inability to achieve scale in production, which in turn keeps the independents from enjoying the cost reductions that come from increased experience.

- Difficulty in gaining the attention of component suppliers, leading both to higher costs paid and often substantial delays while waiting for critical items such as dials.

- Limited ability to attract retailers, and difficulty in educating retail sales representatives sufficiently to in turn engage and educate potential consumers.

- Deficits in management capability, both in terms of business operations and team development.

- Consumer concerns about long-term availability of servicing and repairs from the independents.

- More recently, the emergence of threats from below in the form of Kickstarter-funded microbrands.

Enter the investors

Third-party investment in independent houses is not an entirely new phenomenon; for instance, Greubel Forsey sold a 20 percent stake in the company to Richemont more than a decade ago.

Other independents such as Peter Speake-Marin looked to outside investors to finance growth. And as long ago as 1994 and 1996 respectively, Daniel Roth and Gérald Genta sold 51 percent interests of their brands to The Hour Glass, which in 2000 resold those shares to Bulgari.

Early adopter of big-firm partnership: Greubel Forsey

In more recent times, Chanel has led the way with its purchase of a “friendly” stake in independent Romain Gauthier (see Surprising Ties That Bind: Chanel And Romain Gauthier) that occurred in 2011 but was only revealed in 2016 at the launch of Chanel’s Monsieur de Chanel jumping hour retrograde minute watch – and with the blockbuster news in September 2018 that Chanel had acquired 20 percent of F.P. Journe.

I had to confess that the Journe transaction made me sit up and pay attention: if the famously independent François-Paul Journe was willing to sell part of the enterprise he built through 30 years of toil, might this be a tipping point for independent watchmaking overall?

Thirty years an independent: F.P. Journe’s Anniversary Tourbillon T30

Last week in Switzerland, I asked a still fully independent watchmaker about the Journe and Gauthier equity sales and their merits, and he put forward several arguments as to why this phenomenon might be the right path for independents to follow.

First and foremost, there’s the prospect of organizational longevity. Journe spoke specifically about his desire to “guarantee the future” of his business through the Chanel linkup, and my watchmaker friend said that he often thinks about the future of his business should his children elect not to follow in his footsteps.

From my perspective, this is one of those “maybe, but not for sure” reasons. It’s much more likely to work in those instances in which the watchmaker in question has built up a strong supporting team with skills across the full range of conception, construction, and production who are capable of continuing the flow of compelling products after the founder’s retirement.

I know of a few indies who likely meet this test, but there are many others whose brand stories are likely to end when the original visionary is no longer on the scene.

One other area in which more assured longevity may pay off is in allaying the fears of some potential buyers that independent pieces might not be serviceable in the future. While I’m not concerned about this and have full confidence both that independent watches are designed for future serviceability and that qualified watchmakers will be around in the future, I can understand that some other folks might not be quite as confident.

Assuring longevity for makers and buyers: who will service the Ludovic Ballouard Upside Down?

Another argument for big-firm partnership is the availability of management capability. As a rule, watchmakers – even those who have started companies – like making watches! The ability to rely on a larger corporate ally to provide management expertise can certainly be a benefit, not only from a succession perspective but very much in the here and now.

Next there are leverage and access. This takes at least two forms, the first being access to production resources for components in a timely fashion, and at a more reasonable cost, than would be available to the independent standing alone.

The second is access to corporate marketing resources and a broader network of retailers.

These benefits directly address two of the major challenges I noted in The Independent Watchmakers’ Struggle: Why It’s So Hard And What They Can Do To Better Survive, and given the universal frustration I’ve heard from independents about the difficulty of getting to the front of the queue with suppliers and sellers, I can easily imagine that these factors would be compelling to independent makers.

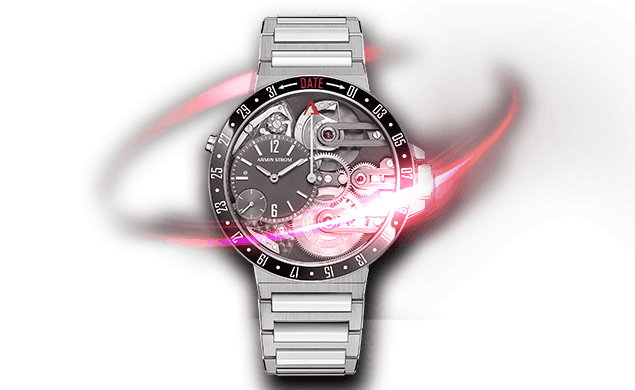

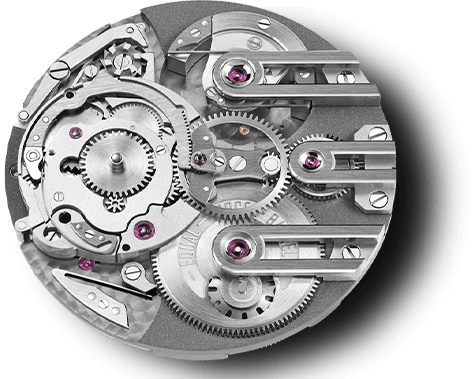

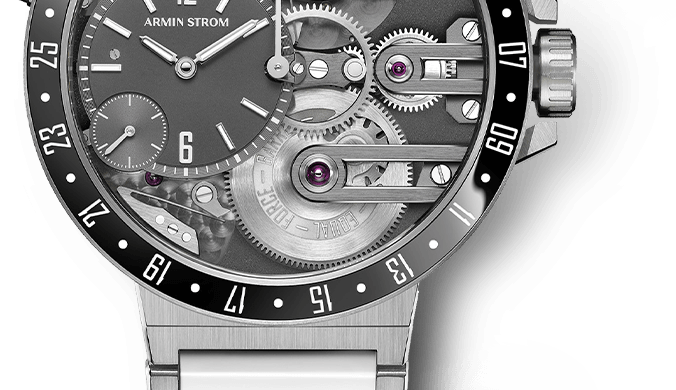

Not too surprisingly, capacity utilization and the prospect of achieving scale in production also make the list. While Stephen Forsey is 100 percent circumspect when it comes to talking about his firm’s Complitime operation – which develops and executes complicated movements for third-party watches – I can easily imagine that over the years they have undertaken a number of commissions on behalf of Richemont brands, helping to fill the design and manufacturing books and helping to scale a facility that otherwise would be making fewer than 100 watches annually under the Greubel Forsey brand.

Similarly, it is clear to this observer that Romain Gauthier has made notable contributions to recent Chanel watches. While the official statement at the time of the Monsieur de Chanel launch was that Gauthier’s involvement was in the form of the production of a number of the watch’s components, anyone with an eye for Gauthier’s sense of design and house style will surely suspect that the collaboration was substantially deeper than that.

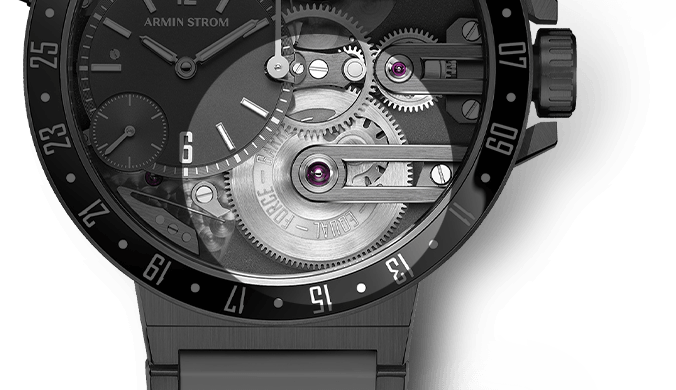

Distinctive style: Logical One from Romain Gauthier

And then there’s the money! It’s possible to kill a business both by growing too slowly (and incurring costs in advance of revenue) and too quickly (by being unable to meet demand due to a lack of working capital or extending terms to retailers).

In my own small business, I am constantly amazed at the desire of multibillion-dollar corporations to use our company as a “bank” by stretching their payables to us to 60 or 90 days and even beyond, while suppliers of course are prone to demanding cash on the barrelhead.

For independent brands, a jolt of capital from a big partner can alleviate these concerns and remove the need, for instance, to utilize a subscription campaign to finance a new watch such as the one that Vianney Halter used with his Deep Space Tourbillon.

Subscription item: Vianney Halter’s Deep Space Tourbillon

Deep pockets from a corporate investor can also be tapped for new capital equipment and the hiring of new talent in advance of paying business to fund it; if spent wisely, product quality and the frequency of product launches can increase, launching a virtuous cycle of growth.

Buying into an independent watchmaker, what’s in it for the big groups?

There are a number of pretty clear incentives for the big groups to make direct investments in prestige independents, including:

- Cachet: while a brand like Chanel clearly has one of the world’s great positions in the pantheon of luxury brands, at the same time being able to boast of its work with gifted creators such as Journe and Gauthier gives it the ability to extend that brand into the world of fans of fine mechanical horology as well.

- Expertise: at Chanel we are already seeing the effects of Romain Gauthier’s touch, and I can’t wait to see what emerges from the Journe collaboration. Of course, there are also the behind-the-scenes contributions to solving complex technical problems that each can bring; these may be less obvious to the consumer but nonetheless highly valuable to the bigger partner.

- Specialist production: Complitime is a great example here, as is the wonderful ground-floor parts manufacturing facility at Romain Gauthier’s workshop.

- Consumer insights: almost as a matter of necessity, most independents hit the road and interact directly with enthusiasts on a regular basis. While “meet the maker, want the watch” is both a powerful success driver and a potential limitation on the ability to scale for independents, the resulting insights into consumer preferences and unarticulated desires can be a big source of value for the major brands if they are willing to pay heed.

Lots of cachet, but likely not a corporate candidate: Philippe Dufour

What could possibly go wrong?

While some of the “friendly” investments by sympathetic (and often family-led) companies in independents seem to be working well (and allowing the smaller firms to retain their autonomy to a large extent), there are of course some perils involved.

If and when an outside investor achieves effective control of the firm’s equity, things can change very rapidly. And even in cases in which an acquirer is a benevolent one (such as The Hour Glass with its Roth and Genta investments) it does happen that those interests can be resold to yet another party (in those cases, Bulgari), who have different goals in mind.

Daniel Roth and Martin Braun sold the rights to their own names and upon exiting the acquiring companies have had to set up shop under different brand labels.

A cascading set of cash infusions by an investor over time in Peter Speake-Marin’s brand eventually led to his exit from the business, the loss of his eponymous brand, and the forfeiture of his (and other small investors’) stakes in the company.

On the outside looking in: Peter Speake-Marin

Hopefully, the type of minority investments we are seeing more recently will yield happier results, and lessons from some of the cautionary tales from the past will help the independents who go the route of big-firm partnership to survive, grow, and perpetuate their enterprises.

At the same time, I hope that the larger firms will recognize that “independence” is a big part of what defines an “independent” and will treat their new partners accordingly while reaping the potential benefits of collaboration with these creative powerhouses.

You may also enjoy:

Surprising Ties That Bind: Chanel And Romain Gauthier

The Independent Watchmakers’ Struggle: Why It’s So Hard And What They Can Do To Better Survive

Leave a Reply

Want to join the discussion?Feel free to contribute!

A very insightful analysis!

My only issue is economic: how much are the Big Brands paying and for what ROI? Without numbers it is difficult to evaluate what makes sense on either side and what doesn’t.

Thanks, Michael! I’d love to have a clearer view of the economics as well — of course the parties involved are quite closed-mouthed about those sorts of matters, but I’ll do a little gentle nosing around and if you can gain any sense of the likely economics from your sources I’d love to discuss when we next meet.

Best, Gary