Living Beyond Your Means As A Collector: How To Avoid Getting Hurt – Reprise

by GaryG

When collectors gather anywhere and talk about their collections, recent purchases, and executed or potential sales, there’s an expression that comes up more often than not: “getting hurt.”

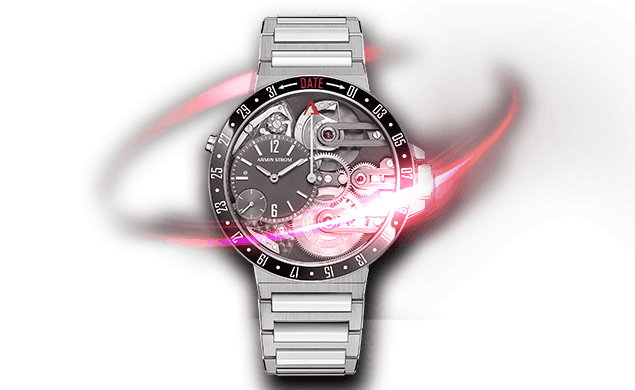

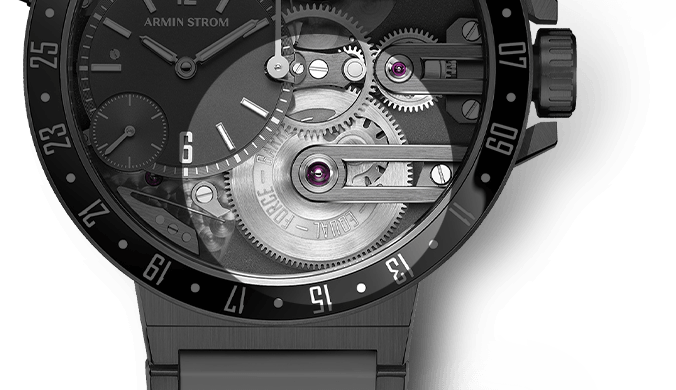

Unlikely to inflict pain: A. Lange & Söhne’s Datograph

That’s as in, “I heard that Gunther really got hurt when he sold that blinged-out limited edition watch,” or “If you get that watch at the upcoming auction anywhere in the estimated price range, you’re not going to get hurt.”

Or, most painfully, sitting alone at home realizing that a watch that you really had to stretch your resources to buy is worth much less than you would like.

And, yet, as collectors we are surrounded by glittering objects of desire, too many of which seem just out of the range of financial prudence to acquire.

What to do?

The first thing to know is that while I’m happy to share some lessons learned during my collecting career, the best way to avoid “getting hurt” on watches is not to buy any! I’m a watch guy not an investment advisor, so please treat my following observations accordingly.

Getting started without getting hurt

For the novice collector, there are really only a couple of rules.

Getting started without getting hurt: the author’s Jaeger-LeCoultre Master Ultra Thin in stainless steel

Only spend what you can afford to lose: When you’re starting out, you’re going to buy some watches that you love but that won’t hold value. Don’t stress about it! Buy what you love and can afford; if you’re fortunate you’ll end up with some longterm keepers and if not you’ll have learned a lot about the world of watches, met some great people, and enjoyed an affordable hobby.

Expect to be illiquid: If and when you do decide to sell, either to move up or because your tastes have evolved, understand that the market for pre-owned pieces can move much more slowly than you might have thought. If you think you might need that “watch money” for near-term financial requirements then it’s not watch money. And if you do sell, be prepared to wait out the market and deal with some tire-kickers before you ultimately transact.

Not for beginners: the author’s Kari Voutilainen Masterpiece Chronograph II with bespoke dial and case

Moving on up: pain avoidance for the intermediate collector

Perhaps the most important advice on collecting I have received came from my friend Terry, who years ago shared his portfolio view of watch collecting. In the “Terry taxonomy,” there are three classes of watches: “fun” pieces that one can enjoy without considering economic consequences, “investment” pieces that have established market values and can serve as the core of a well-curated collection, and “patronage” pieces, usually by independent watchmakers, that promote watchmaking’s creative arts.

Patronage in action: the author’s Ludovic Ballouard Upside Down

Manage your portfolio: Decide how much “fun” money you have and how much you are willing to devote to patronage and keep the rest aside for mainstream, classic pieces (more about those below). From time to time as you sell and buy, do a quick check of your portfolio balance to make sure that you aren’t biased too heavily toward fun or patronage for your comfort.

Sell to buy: Trust me, it’s sad to sell! At certain points, however, it makes no sense to pour more money into a single, illiquid class of assets like watches. Setting a firm “sell to buy” rule can help. It also helps to build curation skills: if you don’t like that new piece better than any of your existing ones, is it really worth having?

Had to sell to buy: the author’s Greubel Forsey Invention Piece 1

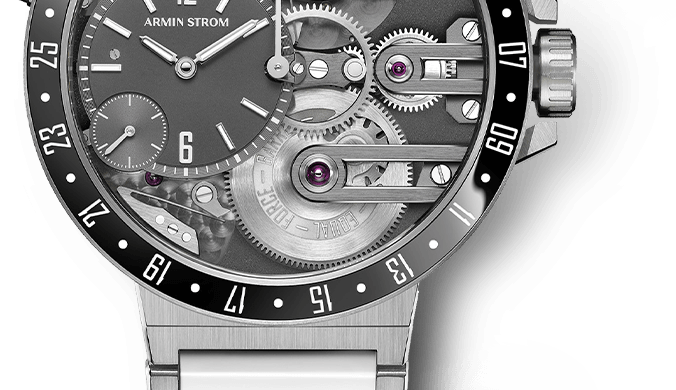

Understand breadth of appeal: Some of the greatest watches ever made have extremely thin markets. Years ago I bought a pre-owned Audemars Piguet Jules Audemars Equation of Time, a watch based on the legendary 2120 automatic movement with complications including a perpetual calendar, moon phase, equation of time display, and the times of sunrise and sunset in San Francisco.

It’s a good thing I love it: I paid a fraction of its original retail price, and it’s worth even less now! The same goes for skeletonized and engraved watches: I own both, but they aren’t everyone’s cup of tea.

Fabulous watch, thin market: the author’s Audemars Piguet Jules Audemars Equation of Time

While you’re at it, take a look at the pre-owned values of various brands: while every purchase need not be from the “big three” manufacturers or even from major brands like Jaeger-LeCoultre or Omega, all brands are not equal when it comes to value retention.

Take one at retail price and avoid pain: limited edition Patek Philippe 5131J

And shun the bling, at least at retail! At each major Hong Kong watch auction there’s a fantastic assortment of lovely jeweled watches selling for a fraction of their original prices; I’d hazard a guess that buying the watch you see on my wrist below would have exposed me to a world of hurt.

The bling’s not the thing: diamond-encrusted platinum Vacheron Constantin on the author’s wrist

Buy classics you love: Note that I didn’t just say, “Buy the classics!” It would be a boring world indeed if we all owned the same pieces, but one central criterion for the “investment” portion of one’s watch portfolio is that the pieces in it be desirable to many others and therefore somewhat liquid and predictable in value.

Affordable classic: Ulysse Nardin Monopusher Chronograph with F.P. Journe-designed movement on the author’s wrist

Within this category, find your passion at the same time you begin to consider longterm value. I owned an A. Lange & Söhne Datograph for several years before moving on to two “bigger” Lange chronographs: the Double Split and Datograph Perpetual.

When I finally bought a Rolex, it was the sought-after GMT-Master II “Batman” rather than a more obscure piece, and if I ever do buy an Audemars Piguet Royal Oak, it’s going to be that tasty 15202 “Jumbo” in stainless steel with the blue dial, not something like the Rodeo Drive Offshore or another cosmetic limited edition.

Mainstream value: the author’s Rolex GMT Master II BLNR “Batman”

Buy pre-owned: As my pal Larry says, “It’s going to be used when I sell it, so it might as well be used when I buy it.” As much as I love the feeling of owning a brand-new watch (and I do buy new pieces from both authorized retailers and independent watchmakers), my view is that I’m much less likely to get hurt if I’m buying watches with established resale price histories.

Bought pre-owned: the author’s Vianney Halter Antiqua

Bargain hard: Particularly in today’s environment, don’t be bashful! It stands to reason that the less you pay at the outset, the less likely you are to get hurt. And if you’re going to violate this rule by buying a boutique piece at full retail price, think hard about whether it’s truly an “investment” item or whether you should really be thinking about it as a more volatile “fun” expenditure.

It’s good to have friends: the author’s early F.P. Journe Tourbillon Souverain, bought from a friend

Build your network: I have great friends who are private dealers and auction house members, but there are a lot of wonderful watches out there that still trade privately within networks of friends at zero sales commission. I can count a good dozen pieces that I’ve bought or sold that way, and among other things it’s a bit of innocent fun to bust the prior owner’s chops about a particularly great watch that you sweet-talked him into selling.

Master class: a few final tips

Wait out the cycles: It’s not a universal phenomenon, but I’ve observed that a great many desirable watches follow a predictable price trajectory over time. At launch, there’s a lot of excitement and a wave of initial purchases. After a period of months to a year, some early owners get antsy and want to sell, often at somewhat depressed prices: this provides a good buying opportunity.

Wait them out: the author’s A. Lange und Söhne Datograph Perpetual

Over time, certain watches become sought-after in the pre-owned market, and values march upward as demand exceeds supply. But then there’s a subsequent downward trend before a semblance of equilibrium sets in.

Good examples of this pattern are provided by the F.P. Journe Vagabondage I, which had a pre-owned value of more than $90,000 in its heyday but has now softened considerably, and the A. Lange & Söhne Datograph Perpetual, which for a while couldn’t be found pre-owned for less than $100,000.

One that got away: A. Lange & Söhne Pour le Mérite Tourbillon

It is possible to wait too long and miss the boat as prices continue to rise, as I did with the original A. Lange & Söhne Pour le Mérite Tourbillon, but remember: the goal here is avoiding pain, not speculating for profit.

Buy quality: I recently had the opportunity to buy a somewhat dinged-up example of a complicated Patek Philippe reference I’ve lusted after for some time at a mouth-watering price, but ultimately passed to continue my search for a mint-condition piece.

We’ve seen that at the high end of the vintage watch market, a great example often sells at multiples of what a less correct piece will draw; my sense is that this will also apply to watches in the expensive-but-not-stratospheric range in the years ahead. Opting for quality with these pieces, in my opinion, will reduce the risk of getting hurt despite the higher acquisition price.

A few dollars more, but worth it: the author’s near-mint Jaeger-LeCoultre Futurematic

If you do buy at auction, by all means do your best to view the watches in person: one person’s “near mint” is another’s “chewed up,” and while miracles can be had through restoration, given the choice I’d opt for buying mint and wearing with care.

Finally, trust your tastes! If you’ve been collecting for decades and been through the wars, your sense of your own desires and the tastes of like-minded collectors should be pretty strong. Take advantage of that to buy emerging classics (for me watches like the Vianney Halter Antiqua and early F.P. Journe Tourbillon Souverain) or to extend your patronage portfolio a bit more toward deserving creators.

If you get hurt on this one call me: Philippe Dufour Simplicity

Getting hurt hurts! But with careful attention to your portfolio of watches you can enjoy more and worry less.

* This article was first published on October 8, 2016 at Living Beyond Your Means As A Collector: How To Avoid Getting Hurt.

You may also enjoy:

Mothers Of Invention: Behind The Lens With Invention Pieces 1 And 2 By Greubel Forsey

And always try to get the box and papers.

I’m looking at relatively recent vintage dress chronographs. What’s your view on Roger Dubuis’ Sympathie or Daniel Roth, and have you seen many on your travels?

Hi Gil — good point on the box and papers — it didn’t used to be that people placed such an emphasis on those (hence the relatively low survival rate of these for older watches), but they play a key role in ability to sell at a decent value these days.

I’ve seen many of the older Dubuis pieces as well as older Roths, and in both cases they seem really well done. Not too much experience with the chronograph versions of those watches (more the retrograde calendars with Dubuis and Roth tourbillons) but wouldn’t be surprised if those are quite tasty as well.

Thank you, Gary. The case shape designs are just so unusual and striking, I haven’t seen anything like them.

Excellent and helpful article, in part because our taste in watches is similarly varied yet sufficiently aligned. Among the watches I currently own or have on my list of potential future purchases are the GMT II “Batman”, the Ballouard Upside Down and the JLC Futurematic.

Now there’s an eclectic (and quite nice, of course) list of watches! You could do a lot worse than those three as a “three watch collection” that covers dress, sport, indie and major brand, vintage and modern.

Thanks for commenting!

Best, Gary

Helpful review. I would add try not to buy what is currently the “hot” watch. Don’t get caught up in the fads.

Great point, David — in addition to risking the bursting of a bubble, there’s the problem that pretty quickly your collection gets to look like “everyone else’s” and you aren’t really owning the pieces you love!

Best, Gary