False Scarcity And Steel Sports Watches: A Collector’s View

by GaryG

“Ferrari will always deliver one car less than the market demand” – Enzo Ferrari

One of the pleasures – if one can call it that – of collecting is that you can’t have everything you want! For almost everyone, there’s the little problem of resources and affordability; I’ve written previously about that constraint and how throughout my collecting journey I have needed to “sell to buy.”

In other instances, though, the frustration comes from the limited number of pieces available of a given reference or from a particular brand. In the vintage world, some coveted pieces were made in very small quantities and aren’t being made anymore, making them nearly impossible to acquire – especially if you’re looking for an example in especially good condition.

Unobtanium, at least at retail price (and now discontinued): the author’s Rolex GMT-Master II

But the “unobtanium” phenomenon isn’t limited to watches from the past: in the broad and deep landscape of contemporary watch production, there are a variety of references for which supply seems to lag demand by much more than Enzo Ferrari’s legendary “one less.” Nowhere is this more apparent than in the current market for select steel sport watches, and that imbalance has resulted in some interesting dynamics – not to mention loud choruses of complaints from prospective buyers.

A brief, incomplete, and somewhat personal history of managed scarcity in luxury goods

For a broad overview of the phenomenon of scarcity in luxury goods, I’d recommend Lucy Alexander’s recent article on the Robb Report site: From A Rolex To A Birkin, Why Some Luxury Items Are So Hard To Get.

I won’t repeat her arguments (or outline a few quibbles I have with her reasoning) here, but I will dwell for a moment on the case of that classic exemplar of the art, Enzo Ferrari.

Ferrari was first and foremost a racer, and famously disliked producing road cars; as a result, he had little desire to expand road car production beyond the point needed to fund his racing operation. At the same time, he was a shrewd businessperson with a keen sense of revenue and profit maximization and knew that the shortest path to raising the needed cash was to sell fewer cars at higher prices.

By remaining true to this principle through periods of higher and lower demand, Ferrari was also able to sustain the residual value of cars already made and support his brand’s new-car pricing over the longer term – a topic I’ll return to shortly when I talk about the current watch world.

Of course, no policy is so perfect that it operates optimally under all conditions or can’t be perverted in some way. I came out on the good side of the imperfections in 1993 when, after several years of booming Ferrari market prices following Enzo’s death, customers figured out that perhaps Ferrari would be making good cars for a while yet and demand softened. When I bought my beloved 512TR, I received not only a discount but a fully paid trip to Italy for the Pilota Ferrari driving school as incentives.

Hard to get: the author drifting his Ferrari 599 GTB at Laguna Seca

The flip (literally) side caught me out in the 2000s, though, when booming demand for Ferraris led to the emergence of a class of Ferrari buyers who bought cars at the right moment, flipped them at above retail, and returned to the dealer to do it again – and again.

Somehow these folks became classified by Ferrari dealers as preferred customers, and I found that I couldn’t even get on a waiting list for a new car – until I succumbed to the unsavory practice of tying, in which I agreed to buy a less-desirable used four-seat model at its asking price in exchange for a spot in the new-car queue.

In a classic display of GaryG market timing (remember, folks, I’m an enthusiast collector, not an investment advisor), in March of 2008, just before the bottom fell out of the economy, my name magically rocketed to the top of the waiting list. I passed on my slot and bought a year-old, lightly driven car at a substantial discount, selling the four-seat car at a considerable loss as well.

While it’s somewhat cathartic to tell my story, the main reason I’ve set it out here is to illustrate a migration of the role of managed scarcity in luxury goods: from a method to sustain overall pricing for a brand to a tactic to force the purchase of less desirable items in exchange for access to more coveted ones. Whether it’s a Birkin bag or a Rolex GMT, the ability to buy “hot” items seems more and more to depend on other purchases made from the brand or retailer.

Turning to the world of watches

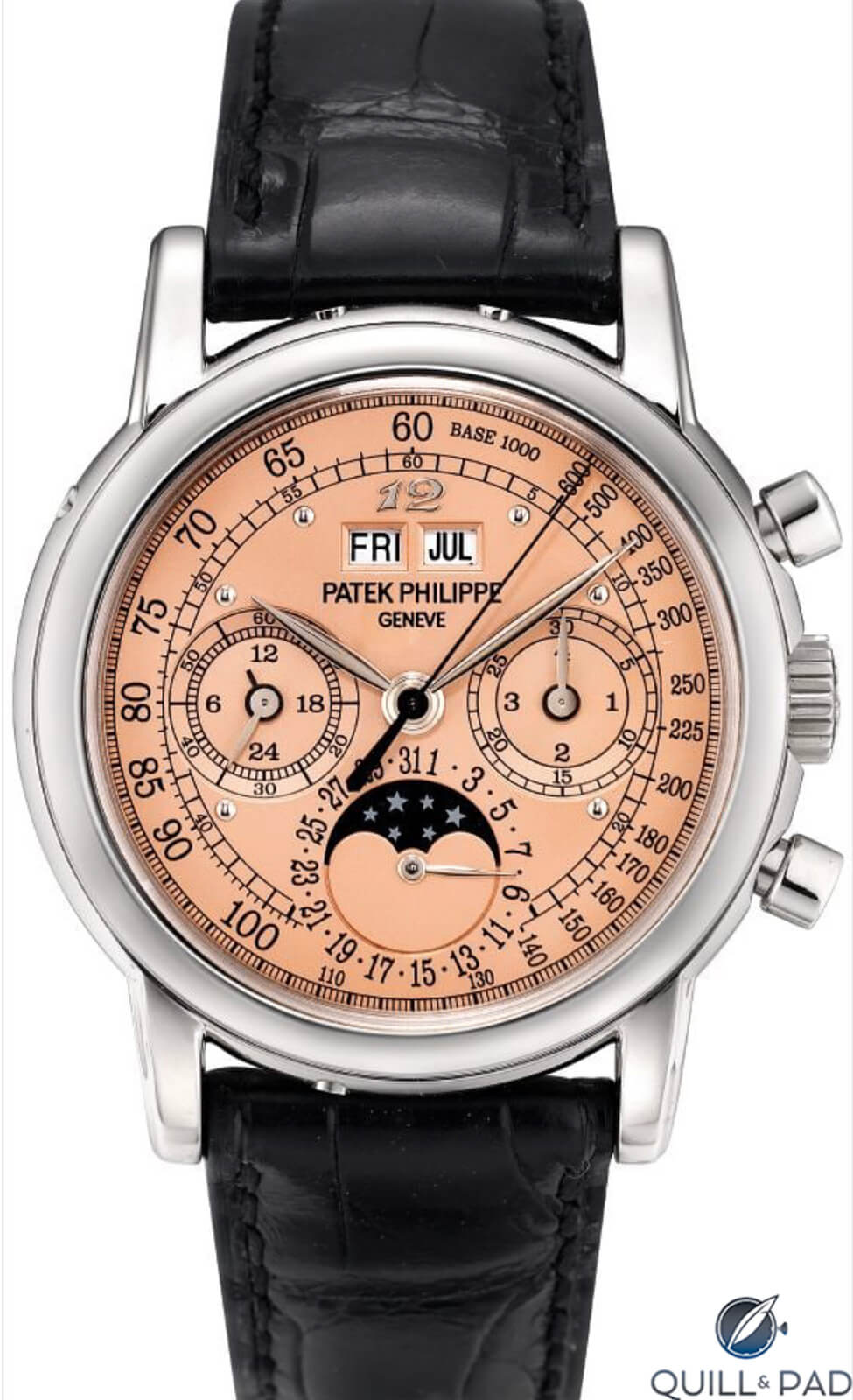

While all , or at least many, of the facts are to some extent shrouded in the mists of history, it was most likely Patek Philippe that first mastered the use of what I’ll call the “Ferrari” model in the world of high-end horology. Access to the brand’s highest complications was reserved for the loyal customers of the brand and by application only, and top customers (with Eric Clapton and Michael Ovitz as prominent examples) were sometimes granted the privilege of requesting unique pieces.

Patek Philippe Ref. 3970 commissioned by Sir Eric Clapton (image courtesy Phillips)

I recall well the experience of sitting several years ago with a collector friend at the Patek Philippe Geneva Salon, where he had not previously done business, as he asked about the availability of a certain perpetual calendar chronograph.

The sales advisor asked my pal to write down on a note pad a list of the Patek Philippe references he owned; when my friend flipped the sheet over to continue on the other side, he was informed that it might well be possible to find a piece for him. Notably, there was no hint of, “If you want x now, it would be very helpful if you took y off our hands.” Rather just a validation of past buying behavior.

While it was easy for me to resent that I wouldn’t have had the same access, by the same token I understood that when a manufacturer has a finite capacity to create its finest pieces, it might well want to ensure that the majority of them go to the most loyal buyers.

Finally got one, though: the author’s Patek Philippe Ref. 5370P

More recently, though, it’s not so much the ultra-complicated platinum and gold pieces that are objects of desire and in short supply: it’s the more prosaic sport models, especially those in steel.

Once upon a time (actually, not that long ago), it was possible to go into an authorized Rolex dealer and buy a GMT-Master II “Batman” off the shelf at its suggested retail price. I did just that in late 2015, just before Rolex steel sports watches became the subjects of a buying mania.

Somewhat more recently, a good friend purchased, at suggested retail, a white-dialed “piano key” Patek Philippe Reference 5711A Nautilus that was in stock at the brand’s Geneva Salon. And although it’s been a while, you could also once buy an Audemars Piguet Royal Oak Reference 15202 in steel with blue dial without standing on your head or coughing up exorbitant amounts of cash.

In theory, at least, manufacturers should have few problems shifting production to these simpler items; so, what’s behind the current scarcity and what should manufacturers, buyers, and retailers do?

Triumph of groupthink

With all of the great watches and diverse brands out there, is there any reason why all of us “must have” examples of only a few of them? In reality, no – even with a general shift in lifestyles leading to increased demand for more casual and sporty watches, there are many fine pieces out there that aren’t labeled Nautilus, Royal Oak, or Daytona.

And yet, with the constant reinforcement of a seemingly endless stream of daily Instagram posts, blog articles, and dealer messages, owning one of a small number of possible watches has become a badge of honor for many.

He has one, I don’t: a friend’s Patek Philippe Ref. 5711A

Brands have contributed to the mentality of scarcity over the years by introducing steady streams of limited edition pieces; and while brands such as Omega, Panerai, and Hublot receive their fair share of criticism for breathlessly hyping the latest substantially-sized “limited” runs of modestly tweaked pre-existing models, those watches do sell, at least well enough for their makers to continue repeating the practice.

It’s become a FOMO world out there; online retailer Hodinkee took things to another level with limited online batch offerings of customized watches that sold out within minutes, and even small brands like Hajime Asaoka’s Kurono have benefited from this practice, most recently with an offering of 136 examples of its Chronograph 1 selling out within ten minutes of opening the order book.

Kurono Chronograph 1 designed by Hajime Asaoka (image courtesy Kurono Tokyo)

More of us, it seems, want the same things, and those nasty manufacturers aren’t giving them to us – right?

Looking at it from the producers’ point of view

Imagine you’re the head of product policy at one of the big makers I’ve mentioned above, and you are more than well aware that demand for your steel sports line is substantially in excess of what you’re making. Why not simply make more or balance supply and demand by raising prices on the popular pieces?

Just make more? Royal Oak Ref. 15202 from Audemars Piguet

For better or worse, it’s not that simple. As a brand chief, you have to balance several considerations:

- Brand equity: ensuring that your offerings are seen as providing value for money and managing a steady value trajectory not just in response to today’s demands, but for the long term.

- Customer equity: maximizing the value of your customer relationships and balancing what you do to ensure that you have a healthy mix of new-customer acquisition and existing customer retention.

- Pricing structure: maintaining an appropriate relationship between the prices of different types of products in your overall line and signaling the inherent value of workmanship, technological complexity, and material costs in each part of your offering.

- Product policy: maintaining a diverse and healthy product portfolio that doesn’t become overly dependent on a single sub-line (witness Royal Oak at Audemars Piguet) or type of watch.

- Infrastructure costs: avoiding substantial investments in manufacturing equipment and capabilities that may fall idle when tastes shift again.

Flooding the market with today’s hot sports watches poses real risks from a longer-term perspective on most of these dimensions, and pumping up the price point would risk disrupting the brand’s full-line pricing policy in ways that would be very difficult to retract later.

Perhaps the toughest challenge is with customer equity: if your brand’s most-desired watches are among your most affordable and yet are reserved for existing customers, what will replace them as “entry-level” pieces to draw new buyers to your brand?

Tough ticket: Odysseus in steel from A. Lange & Söhne

And in some cases there are actual physical constraints: I’m sure that A. Lange & Söhne, for instance, would love to be making more steel Odysseus pieces right now than it is, but with a production capacity on the order of 5,000 or pieces per year in total and a pandemic going on, the ability to deliver even the *hundreds of steel Odysseus examples targeted for year one must be in jeopardy.

What to do?

There are no perfect solutions to the current situation, and I’m certainly not going to go on the record encouraging watch brands to invest in a bunch of tooling and parts production for products that may or may not remain at recent levels of demand.

In fact, I’m a qualified “yes” on managed scarcity – the establishment of certain luxury items and items within a brand’s line as aspirational purchases that represent the apex of a relationship with the brand over time (and that help to generate the profits needed to sustain the brand, as well as provide a halo effect to brand equity).

I’m much less a fan, however, of the way that false scarcity is used, particularly in retail channels, to coerce the purchase of less desirable items in order to obtain access to more desirable ones. To me, there’s a big difference between rewarding loyal customers and forcing a quid pro quo on buyers, whether established or new.

A few thoughts for the various participants in this dance:

For manufacturers:

- Strive for transparency. I think that Patek Philippe president Thierry Stern has done a pretty good job here, explaining that he does not plan to increase Nautilus production.

- Discourage flipping. That’s tougher, but if flippers understand that they will likely lose access to desirable items, more pieces will be left for those who will keep and treasure them.

- Discourage retail tying. I was troubled to hear that in at least one region, A. Lange & Söhne dealers are requiring the purchase of other Lange watches to get on the list for the Odysseus, and I sincerely hope that this practice, and similar practices by others, will be eliminated.

- Focus on customer acquisition. Again, not easy when your “entry” items become hot; these days, even the “entry Nautilus” Aquanauts seem impossible to find. But keep trying – without appealing and affordable entry pieces, brand longevity is at risk.

For retailers:

- Stop the obvious games. We know that in some cases you have those pieces in the back room, and in others you are holding onto your preciously small allocations to sell each as parts of multi-watch deals. Yes, you have to make a buck, but the cynicism you create is poison for the long term.

Going beyond the obvious suspects: the author’s Vacheron Constantin Overseas

For consumers, one of three things:

- Buy something else! The world is full of wonderful watches, and when I wear my Vacheron Constantin Overseas or A. Lange & Söhne Odysseus, or for that matter my Ming 17.06 or Hajime Asaoka Tsunami, I bet I feel just as good as the folks who love their Royal Oaks and Aquanauts.

- What goes up usually comes down, and we are already seeing a softening of the price bubble on some of the “must-have” steel sports pieces.

- If you absolutely, positively, can’t live without one of the popular sports models, pay the going price! Markets are made of willing buyers and sellers, and if you’re one of those on the buyer side you absolutely have my blessing. Only thing: once you buy, I don’t want to hear any bitching about what you had to pay.

I’m eager to hear your views in the comments section below – in the meantime, happy hunting and enjoyable wearing!

* Correction: in an earlier version of this article, the 2020 production of steel Odysseus watches by A. Lange & Söhne was incorrectly estimated at 1,500 examples. The author regrets the error, which has been corrected.

You may also enjoy:

Stainless Steel Patek Philippe Nautilus Market Madness: Thoughts On The Current Market Situation

Why I Bought It: A. Lange & Söhne Odysseus (A Photofest!)

All 7 Of The Latest Rolex Models Of 2019, Plus Some Cool Variations (Rolex Photofest!)

Great Rolex Experiment With The GMT-Master II Or How I Learned To Stop Worrying And Love The Crown

Leave a Reply

Want to join the discussion?Feel free to contribute!

I used to care about this sort of naughtiness, but having landed the Rolex and AP models I wanted thanks to my previous purchasing history (the rigmarole of the imposed limitations on choice in that history being a pleasantly fading memory), I’m OK with them keeping things as they are.

The working class can kiss my ass

I got the foreman’s job at last.

Ouch! Well, it’s good to be an insider, I suppose! Glad you have the pieces you want, and I’ll register one vote for the status quo…

All the best, Gary

Well, a low level insider – they still warn me I might be in my dotage before I can get certain models (code for: you’ll need to spend at least twice as much before these unlock m’laddo). As good as it’ll get for me I think. 😉

Mustn’t forget to mention a certain Tantalum-cased watch with blue dial. I’ve no buying history with the 2 retailers who sell that brand in the UK, but have chatted with them from time to time (not tyre-kicking, just coming very close to trigger pull) and for one of the stores the wait is 10 years, and the other 20 years (sincerely). Admittedly that’s not false scarcity, though.

I eventually did the math in my case: Cheaper to pay over retail for the few pieces I want instead of buying first many watches I don’t from multiple ADs. I realized this too late. If I had this attitude when I got started I would have fared extremely well. The brands are in a bad place. They are not getting what the market will pay for their pieces, and at the same time people resent the AD approach. Lose, lose.

Excellent article, as ever Gary. Thanks for sharing.

One question: where have ALS stated that they aim to produce 1500 Odysseus in year one? I remember a HODINKEE/ ALS interview where the CEO implied far fewer than this. Just curious a someone “on the list”!

Good question, Tim — I’m drawing on memory here and it may have been something that ALS folks told me at the time of the launch. I suspect that with the shutdown they won’t hit that number, but we shall see. If in the meantime you or others find any public pronouncements from them that cite a lower target I’m happy to be corrected.

Thanks, Gary

Cheers Gary! Will do 👍🏻

Hey Tim — looks as if I was significantly mistaken in my estimate! The Lange folks have been kind enough to let me know that the number is in the hundreds, not close to the 1500 I had in the article. Thanks for pointing this out, and good luck moving up the list!

Best, Gary

I just dont see this as that big of deal. I’ve decided to stay away from most of those brands. Everyone has to start somewhere and if those brands are not interested in starting with me that’s ok. I am in my mid 30s and I’ll build with brands that want to grow with me. I didn’t get on a wait list after I had my first born. I bought a brand that was available and now that brand is special to me. Like you said there are so many beautiful watches to mark life’s mile stones and collect.

I’m delighted to hear that you have found a brand that is special to you — and congratulations on your happy event!

Best, Gary

Touché, my thoughts exactly.

The Swiss manufacturers policy of holding back the stock of stainless steel products from the retail customer have created an explosion in the grey market of which they claim they were trying to stop, its had the reverse effect they desired.

You make a good point — but as I tried to set out in the article, it’s not that easy a call for the manufacturers to ramp up production on these pieces to meet current, and potentially unsustainable, demand.

One practice that has been established in the car business is for manufacturers to keep the same MSRP (clearly posted) but to allow dealers to add on a “dealer premium.” That way, the manufacturer doesn’t destroy long-term pricing, the economic incentive to the retailer to bundle is reduced, and it is quite clear to the consumer who is pumping up the price. Might be one model worth considering for watch producers, although the complexity of it is greater for brands who are selling through company-owned stores…

Best, Gary

Very well said.

This is why I’ve lost interest towards Rolex and Patek. They’re well made but seasoned collectors know the finishing level or production effort is not at a haute horological level yet. I humbly think these so called hot pieces appease less on very experienced collectors who’s seen enough watches to know there are other better deals out there.

To be better deals not just mean lower prices but the efforts that are invested towards the design or finishing level rather than merely just swapping dial colours and call it a good year.

I shamelessly confess I’ve converted from Rolex and Patek collectors to a Hublot loyalist. Yes they’re vulgar but I appreciate their creativity towards the movement and material choices. Dressier watches ain’t my cup of tea but for sport watches I wholeheartedly think there are other less obvious or less popular choices than the P or R.

Good on you! What a boring world it would be if we all liked, or bought, the same watches — and as for Hublot, while the pieces are not to my personal taste, I very much take your point on their creative approach.

Best, Gary

“They’re well made but seasoned collectors know the finishing level or production effort is not at a haute horological level yet. I humbly think these so called hot pieces appease less on very experienced collectors who’s seen enough watches to know there are other better deals out there.”

====> the rare WIS-wisdom that makes it to the printed webpage!

What perpetuates the less seasoned collectors’ fever pitch grasping at unattainable pieces (oops, unless u pay the premium) ? The many many many:

– copy & paste & publish press release ‘articles’ of ‘watch bloggers’

– seasoned, veteran watch bloggers who have a genuine ‘mostly liking’ kind word review of every damn reference that is being released in the last twenty years.

There are no scathing watch reviews when there should be.

There are no watch journalists anymore – only watch publicists.

Who are writing for, Gary? Enzo Ferrari was a shrewd businessman. Leave out the emasculation. It’s affected.

Hi Will — Not sure what your point is on emasculation, but for the record I’m against it! I’ll do my best to avoid affectation in future — I do realize that it’s easy to slip into the pretentious prose zone when writing on these topics.

And, also for the record I do say in the article that Mr. Ferrari was a shrewd businessman — but that doesn’t excuse some of the shadier behaviors of some of the brand’s retailers.

Best, Gary

I literally have no idea what the point of your comment is!

I believe Will was saying that using the ungendered term “businessperson” was somehow emasculating compared to the much preferred (by Will) masculine term “businessman”.

Aha! I think you may have it — and in my view there’s nothing at all wrong with terminology that is consistent with current usage. If that’s pretentious, I shudder to consider what Will would think of some of my actual affectations! 🙂

Thanks for the clarification!

Lol! Gary, I like you more all the time!

immoral practices by a company like rolex. In mass-produced products they create the illusion of uniqueness. The best creation of rolex is “the grey market” congratulations rolex

I acknowledge your point, but as I describe in the article the choice to ramp up production of these popular models isn’t that simple a matter, either. As I responded to an earlier comment, one potential solution is to allow the Authorized Dealers to charge a stated premium while maintaining the MSRP at sustainable levels — but significant thought would need to go into such a tactic before rolling it out.

Best, Gary

Excellent article on a rather tired, and tiresome, subject. I honestly wish I hadn’t read all the others before as your analysis is both sophisticated and exhaustive. (Too much interest in watches as investment pieces and/or tokens of status created among non-watch people with way too much money on their hands is what I lament. The silence of the safe queens…). Cheers Marc

The silence of the safe queens, indeed! Time will tell whether a market shakeout will leave the watches for the watch lovers in future, but for now the manufacturers are left to grapple with what may well be a market bubble, with all the inherent risks of either under-producing or over-producing today’s popular watches and messing up their pricing and product line structures.

Thanks for commenting!

Best, Gary

Noting what you’ve said re needing to purchase something else to get on the list to buy an ALS Ody…i was with my brother when he was told that as he has never purchased a Patek there’s no way PP would allow the dealer to sell him a gold aquanaut….GOLD!!! JFC

I’ll admit that I’ve peeked at the Ref. 5164R (Aquanaut travel time in RG) from time to time, and at least as of 18 months ago those were available in real time at dealers with no strings (I even had one dealer offer to free up a steel Daytona as an incentive to buy the PP) — but as you say, now even the gold models are falling into the game!

Best, Gary

Great points, Gary.

I honestly do not see any problems with what Patek, AP or Rolex is doing.

Just as you touched, they are trying to ensure the long term equity of their watches; thus clients and can spread this through all of their collections.

From another perspective the loss of profit from not producing enough to meet demand can be seen as a marketing tool – which has drastic advantages for the brand’s overall watch portfolio.

The problem indeed arises from retailers with bundling, or hiding watches or even worse, from the brand’s own boutiques itself.

The Ferrari model is one of the main legs of the milking stool and has to be there. One thing that Richemont did not understand or did not want to understand for shareholder value and other did due to their independence.

Regarding excellent point on – how to get new clients when your entry level pieces are the hottest ones; this is the tough part that requires complete transparency and asking for different approaches than currents.

Have a good Sunday my friend!

Thanks for your (as always) thoughtful comments, Alp! I agree that the entry-offering challenge is perhaps the toughest — and would love to hear any creative ideas on the topic!

All the best, Gary

c’mon langepedia wikipedia (oh whatever that gives u access to standard composed watch pics) tell us what you REALLY think. it’s worth that PR job!!

(but oops. u already know that…, i think….: )

There are a lot of beautiful watches out there…I’m not the guy that will go to the ends of the earth to find/purchase a “Beanie Baby” watch…while it is a brilliant marketing strategy (Mfg: you can’t have one, Buyer: therefore I must have one), I ask myself if the Nautilus/Aquanaut/Daytona ss models were readily available, would I purchase one? They are beautiful to be sure, but not at the top of my list…I don’t purchase watches for investment purposes, solely my own personal enjoyment…

Completely agree! When it comes to scarce pieces, like you I always try to be honest with myself about whether I would buy the watch given unlimited supply, and to pass if the answer is “no.” Sometimes that leads to sub-optimal outcomes (from some perspectives, anyway) — my big “miss” was turning down a Patek Ref. 5976 anniversary Nautilus because it was just way too big on my wrist, and seeing resale values soar to 3x or 4x original retail… Oh well — at least I have my integrity! 🙂

Best. Gary

I did exactly that, and regret it too, passing the anniversary Nautilus too. Well, they asked if I’d like to put my name not sure if they were ready to offer it. And it’s these weird market trends that sometime make it difficult to be disciplined, buying what you like, only. I started with PP buying a grand complication only, and have purchased north of $500k of watches, yet an aquanaut is unattainable. And it’s strange because when I saw a post you did I did walk into the Geneve boutique asking for a 5270P or a 5370P, they don’t seem excited to sell it, and keep asking you to go back and purchase from your AD. Not sure if it’s the ADs discretion or who, as PP puts some controls. On a different note, In defense of ALS, I got into ALS when I got a chance to buy a Richard Lange Jumping seconds, limited to 100 in platinum. It was then that I got into Lange 1, then a double split. Would PP ever do that, I’m not sure, and this was 2016 or 2017 not far. Also on another topic, Ferrari US, although 50% of the world wide market, is not what Ferrari practice worldwide, nor are market or resale values. Demand can dictate certain practices. Many dealers in other places are grateful if you buy a car, as long as it’s not the limited series. What I can’t understand Gary, if you had bought a 512TR, which was special as the price new was substantial back then, not more than roughly 2,500 units produced, you should be regarded as a special old client, and should not be subordinated because a flipper has bought 2 cars more recently. In the Patek example, or more specifically AP, as they keep very little record of their clients, I no longer buy watches from them because they can’t keep track of a client who has been buying watches from 1990 to 2012, but will offer a limited production black ceramic perpetual Calender RO to a client that has bought 3 watches in 2019. 2 of which were probably sold in the grey market. Sorry just some thoughts, throwing everything all at once : )

Ok I have to say one more thing, #nota5140P, 5370P, and. 512TR are very very best designed stuff. I’d like to say more but I’ll email you if I get a reply from you with your details

Thanks very much for the thorough and wide-ranging comments! Your note on #nota5140P brought a big smile to my face, and as you can imagine I agree with you on the designs of the 512TR and 5370P.

The point you make on the 512TR and Ferrari’s subsequent practices is exactly what annoyed me so much. That 512 wasn’t my first F car, either — I’d bought a 328GTB and a Testarossa prior to that. The 550/575 series was not to my taste, so I held off while awaiting what became the gorgeous 599GTB — but in the meantime the US Ferrari dealers had begun to mistake flippers for truly loyal customers.

Sorry to hear about your experiences with some of the brands. On Patek’s Geneva Salon, I have been with some friends there over the past year or two who have also been advised that they will have a better chance of getting complicated watch allocations in their home countries; this may be a policy change, or more likely I was just fortunate to have friends who were already significant customers in Geneva.

If you’d like to drop me a note, you can reach me at [email protected].

Best, Gary

I agree with Howard. There’s a freedom (that seems to be fleeting these days) in just purchasing/enjoying anything, whether it’s “luxury” or not. Nothing wrong with loving brand/model A, movement B, craftmanship C or execution D. But progressively, there appears to be a ramping up of what might be described as an ‘old boys country club’ mentality of chasing/aspiring/satisfying the exclusive and elusive. I realize anyone (in any social demographic) can be susceptible to this. If attaining a product that should only be reserved for “the few who know” can make me a “made man,” then my concern is not so much with the producers or the marketplace, but with me: what does it say about me if that’s were I somehow find my value?

Scarcity at what level? at the highest levels the complications themselves take a long turnaround time to make and deliver so this dog-and-pony-show to ‘prove one’s worth’ is cosmetic. this is certainly the case for Patek. working through a good authorized dealer makes live easier too. but come on. what was once 3 years for a Patek minute repeater is now 3 months.

for the cheaper Rolexes and APs and Nautiluses- which market are they scarce in? in Hong Kong, where most are dumped, there are APLENTY – only marked high with premium because of FLIPPERS.

in poor distribution territories like Europe and USA, ADs are given the pieces but can’t cough them out because they can flip them most by exporting to the far east marked up sky high.

that’s the truth. don’t believe it? go see for yourself: http://www.hkwgs.com/home2.html

big europe and american dealers plant themselves in these fairs too.

I think we actually agree — and I definitely see your point that in addition to using popular entry steel watches to tie to other sales, Western ADs may well be flipping to markets like Hong Kong.

Of course, all markets clear at a given price, so there is no absolute “scarcity” per se for these watches as long as one is willing to pay the going price — they are, however, scarce relative to the demand for them at the MSRP, which is where the problems begin.

Best, Gary

No, not ‘all markets clear at a given price’ — that is why there are plenty of stock in Asia for these horrendously marked up pieces.

The watch industry has over supplied to nose bleed levels. That is never talked about by bloggers who wish to be in the good books of brands. There are no watch journalists anymore – there are only watch publicists.

99% of what Watch brands manufacture are less than desirable, dilutes their the innate luxury quality in such products, and have prices that fall off the cliff at the gray market.

This leaves the 1% desirables that are shipped off overseas away from the prying eyes of mystery shoppers, flipped to sky high premium levels, and gets stuck in shops in the naive belief that someone will buy them soon. At a shopping mall in Tokyo there are 7 omega snoopys of the recent issue all sitting pretty for several years at 60% above retail.

All the dog-and-pony-shows of ‘exclusivity’ is a joke. A richemont flagship boutique insists on a waiting list for their decimal repeater while 300m away the exact reference sits in a gray shop.

This circus is created by the luxury watch groups who have oversupplied and now are at death’s door – they can no longer con the ‘great unwashed’ masses with sparky advertisements, so their authorized dealers have no choice but to make the best out of the situation – by squeezing whoever wants the 1% of desirables.

And yet people still say ‘there is crazy demand for Rolex, AP, PP which cannot be met by supply’. 80% of the market has been in Asia or Asians buying in the west in the last 15 years, and stock flood towards there every month, BUT the great white people watch industry continue to be (a) two faced to insist demand is great to make brands continue to love them and give them cheap freebies and economy class tickets to attend showcases (b) prejudiced to admit the west simply has no buying power anymore with your broken governments, tax regimes and trade philosophy.

wake up won’t you all.

Well that got heated quickly, didn’t it!

First of all, you did see that the article was entitled “False” Scarcity, right?

I’m not sure where you studied economics, but all markets do by definition clear at a given price — in the cases you mention, just not at the prices asked.

The whole blogger/watch journalist topic regarding brand largesse and influence is for another time — happily for me I’m an enthusiast collector who pays his own way, and I have editors here who grant me pretty much complete freedom to express my views, so I am free to speak my mind — as I have in this article.

I don’t sit outside of watch stores and count so I don’t know what percentage of the substantial majority of luxury watch sales that were made outside of China including Hong Kong were to Asians — but I suspect that your claim of 80 percent Asian buyer share in aggregate is exaggerated.

Finally, I’m not even going to start with the “white people are the problem” and “the West is failed” topics other than to note my best wishes for your future role as a minor CCP provincial functionary.

Best, Gary

Ariel Adams gave me the same vague answers as a last resort to last year. Suffice to say,

– reality & practicality rings true- hence your muted response

– regardless u are a masquerading journalist – collector of some repute – ultimately trying to be famous in your senior years, ‘watch publicists is watch publists’.

– white people don’t spend enough time in the biggest consuming markets in the world. don’t pretend u know any. i doubt u even go to asia once a year! and yes, that means u have as big if not bigger ‘too white’ problems in your home country too

“…but I suspect that your claim of 80% Asian buyer in aggregate is exaggerated.”

Surely not!

“ohplease”, why are you so angry?

They’re just watches.

One of the first lessons we are taught in school is that sentences begin with a capital letter. Not doing so is lazy & shows a lack of attention to detail that I personally find highly irritating. You may well have a valid point in your comment, however, it is so badly written that I can’t take anything written within it seriously.

on the contrary, i think u find the logic overwhelmingly compelling but hate my guts for being right, and in the only means you are left with you choose to denigrate in a prejudiced way by being a grade school english teacher.

go teach grade school somewhere else please.

A few things to blame……Daytona in steel demand which the grey market saw as an excuse to over charge on every steel watch made by Rolex…..people daft enough to pay those prices…..these idiots on Instagram with their photo with the wool sleeve and the stupid pointy shoes…..good article thanks enjoyed reading it.

Thanks for commenting! And I’m feeling better that I never really got into the pointy shoe thing 🙂

When everyone is trying to be unique by acting in exactly the same way as others, there are some predictable side effects!

Thanks again, Gary

I still can’t get my head around lack of a clear waitlist, for the “non VIP customers”. Which brand director would be insane enough not to offer this as a very transparent way (an online central one for example, that gives you your rank in the queue and.estimated delay) to satisfy any customer and plan your production ahead. The longer the list the easier the brand job it is. When you know which backlog you have, your forecasts are easy,

Would I wait a year if I knew that I would get the model i really desire. For sure. I would even make a significant deposit, which again would help the brand manage cash flow.

Good point! It may be that we’d learn that some of the “in demand” pieces actually have shorter waiting lists than the brands would like us to see, but it would be a great step toward transparency.

To their credit, Lange has provided those on the waiting list for the steel Odysseus with timing estimates for delivery — these have been disrupted by the recent shutdown, but I believe Lange will be issuing updates soon.

Best, Gary

Thank you for your thoughts Gary. I’ve caught myself a lot wanting a certain status as a collector. I think I’ll always have this weird aspirational trait, but the recent nuttiness has really made me question how I value brand equity and hopefully I can move in a different (not necessarily better) direction.

You are not alone! I’ve been tempted many times to buy something because “everyone else” wanted it, and may even have succumbed a time or two — best wishes to you as you continue the journey to finding the pieces that truly speak to you!

Best, Gary

Hi GaryG, a very nice opinion piece, and thought provoking.

I myself am a year into an estimated 2 year waiting list for the refreshed GMT BLNR, and when my turn comes I’ll pay retail, strap it on and wear it to death.

Indeed, as I type this I’m wearing a blue dial DJ41 that is apparently ’hot’ but which is nicely scratched up from 18 months almost daily wear. I’ll probably sell it to fund the ‘batgirl’, but won’t for one second regret that I’ll get less than I could have got if I’d kept it minty in the safe.

Life is for living and watches are for wearing!

All the best,

Steve.

‘Nicely scratched up’…I can literally feel my blood pressure rise in exceedingly unhealthy increments! I am glad that you enjoy wearing what you collect though!

Wear them all! If I may be forgiven one more Ferrari anecdote, I’m frequently reminded of the politically incorrect but nonetheless accurate comment by legendary F-car collector Jim Glickenhaus: “Not driving your Ferrari is like not having sex with your girlfriend so she’ll be more desirable for her next boyfriend.”

All the best, Gary

Thanks for the article, good read.

I would like to point out that if demand outweighs supply, why are there so many sports model displayed by retailers in the grey market ?

They have so much stock that I am sure its not Rolex or PP not producing sufficiently that tilt the market.

The problem is Rolex & PP relies on distributors/dealers that created this so-called shortage of supply so they can start alternate strategies like tying products. The grey market retailers will just walk in and snap all the products and resell at a flipping price in their own store. They sell the not so hot pieces at a discount to create an illusion you get better deal. I know because I seen it with my eyes here in Hong Kong and Macau market. And if they can’t find it here, they will call up Rolex/PP boutiques from various countries to pick them up.

The challenge for Rolex/PP is really their massive distributors/dealers and how to control them to ensure their watches really end up in the hands of a real customer, rather than a grey market retailer.

I don’t see supply the main problem to this debacle we’re facing now.

Good points, Jit — I think you and I agree that much of the issue here is with retailer practices, leading to real challenges for the manufacturers. Of course, when the manufacturers are their own dealers, things do get a bit murkier.

I do still think that there is a supply-demand imbalance at the stated retail prices — otherwise the grey market folks would not be able to generate the flipping prices they do.

Food for thought!

Best, Gary

Gary, Very good article and very exhaustive. I guess life is imperfect in general 🙂

What always struck me is this group-thinking effect and I am more speaking about the “entry-level” watches here. I call it the social media effect, and it went to the point where not only the steel Daytona is scarce, but the entire range of sports models in steel is, and it isn’t even Rolex’s fault! They just can’t produce enough watches to cope with the demand, and this is opening the door to the worst grey market ever seen. This is insane.

The idea of wearing what everyone wants drives me mad. In an ideal world, I would simply love watch buyers to get a life and show some character in choosing a watch that they love and cherish, not the watch their watch friends would love to see on their wrist. And don’t speak about value, as this bubble cannot be sustained at this level forever. That would help a lot.

As for the tying practice, I also believe it is suicidal for the retailers/boutiques to do this on the long-term. Only driving well-meaning buyers away and destroying the brand equity. Not sure though, knowing the distribution agreements, that a retailer’s premium would even be possible, but in this crisis we have seen quite a few things move drastically, so why not 🙂

Thank you so much for your thoughtful comment, Pascal.

Thanks for these thoughtful remarks, Pascal! I fully agree with your observations and sentiments and hope that the manufacturers and retailers will find ways to navigate the current mess — and that buyers will expand their perspectives beyond the small set of “hot” pieces sold at bubble pricing.

Best, Gary

Hi Gary,

I don’t necessarily doubt the general point of your analysis, but I couldn’t get past the callousness of the delivery. Your article was so insensitive to those without your wealth, it was only just an inch short of providing a list of your famous friends and all the girls you dated at school. Pictures of Ferrari’s and details of you friend with too many Patek Phillipes detracted from the analysis and made it seem as if the conclusion was either get richer and pay over the top prices or accept you’ll never have the cool watch (helpfully punctuated by the picture of that watch which you own). I also feel that you simultaneously celebrate Rolex /PP but then also suggest that it is beyond them to ramp up production. I call b***s**t on that, and it’s about time the watch media did too. The most complicated elements of the watch – the movement – are being churned out on datejusts by the bucket load – which are always readily available in any dealer. If Rolex cannot recalibrate their production line to increase production (without throwing their entire operation into long term chaos) then perhaps they need to get some new engineers in. No, the real reason is that Rolex wants to artificially create this hype and demand. And what Rolex fails to realise is that they are losing connection with the essence of what Rolex was – a practical (albeit high end) watch. All of Rolex’s early advancements were about improving the use of a watch, not simply adorning it with precious metals and multicoloured gems. The Pearlmaster is a perfect example of the rot that has set in. And I am sure that I will get rebukes for my views and told that Rolex doesn’t care for my criticism because they are so in demand. It is true, but great brands are at their most powerful only a decade before the demise.

Will

Hi Will,

First of all, apologies for any offense caused! If you’re saying it, my guess is that some others are thinking it, and while it is never my intention to come off as an entitled jerk I do appreciate a warning call or two when I get close to the line. For better or worse, many folks read my stuff because I am willing to reveal my own experiences and lessons learned — and not surprisingly the “Ferrari through Turn 9 at Laguna” experience can be more useful to draw on when writing about luxury goods than the “room service sandwich at the Hilton Garden Inn in Akron after a red-eye in coach and all-day client meeting” ones, which (sadly for me) are much, much more numerous.

I’m not suggesting that PP and Rolex are incapable of ramping up production — rather, that it might be a bad business decision for them to do so, especially when seen within the long view of demand for today’s hot references. I don’t sit in their internal meetings, so I don’t know exactly what their private intentions are — but I do think that my reasoning is entirely plausible. We do, by the way, see both Rolex and PP continuing their traditions of continuous functional improvement, for instance in the changes in movement design in the Rolex Cal. 3285 in the recent “Batgirl” or the subtle improvements in the rattrapante alignment mechanism in Patek’s Ref. 5370.

If it’s any comfort, by the way, I don’t know many famous people (at least outside of the extremely narrow world of “fame” as it exists within the watch world), and I didn’t date many girls as a young guy as I was rushed through my primary and secondary education before heading off to Princeton at age 16 (gotcha!). 🙂

Joking aside, I do truly appreciate your openness and comments — please keep reading and chiming in!

Best, Gary

Complete watch nerd question here, what are the functional improvements Patek has made to the 5370P prior to retiring the reference? I’ve never been able to see one in person but am fascinated by the mechanics of haute horology.

Thanks!

the WATCH reference 5370P may seem to be apparently discontinued but not the MOVEMENT Caliber CHR 29-535. improvements are made to movements all the time – especially for the split movement and this instance was some hands alignment when you reset it blah blah blah. what else would one expect from paying a quarter of a million USD for it?

By the same token, ‘discontinued’ can mean nothing – at these sums of money you can add another 20% and Patek will be happy to do a one-off, say like they did for a salmon dial for 5970G for a certain owner of an almost bankrupt watch publicist magazine which fully encapsulates the doctrine “be the loudest voice, and people will believe what you say, especially when it is BS”.

There are a bunch of write-ups you can check out, including my earlier piece here: https://quillandpad.com/2017/02/18/bought-patek-philippe-reference-5370p/ — for me the most significant tweaks to earlier calibers are in the rattrapante mechanism, including improved centering (so that the two chrono seconds hands sit directly atop each other).

A complete description of all of the technical changes is in the Patek press release from the 2015 introduction of the reference: https://static.patek.com/pdf/pressreleases/en/2015_PatekPhilippe_Split-Seconds_Chronograph_5370P.pdf

Hope that helps! To be clear, all of these changes were made at the time of the introduction of the reference, not as running improvements during the production run.

Best, Gary

it is gary G’s secret ambition in his senior years to be oh-oh-OH (dream hot double D cup rambunctious in bed tanned hottie blonde) famous FAMOUS FAMOUS!!!! so, he will do what needs to be done.

as mentioned before – there are no such thing as watch journalists, only watch publicists. no matter how much u plead ‘oh I AM A COLLECTOR A COLLECTOR’ !!!!!

Oh, please.

Somehow I don’t get that impression about GaryG.

I’ve read a lot of watch journalism (as I’m sure have you) and I’ve even had a few pieces published. You are absolutely correct in stating that most of it is completely uncritical, just rehashing information retrieved from press releases. I also remember the desperate tone with which the publisher of a leading watch enthusiast website tried to shut down adverse commentary on a particularly ludicrous release by a well-known mid-tier brand. It was obvious that their bottom line was at risk – but there was never any disclosure, anywhere on the site, as to what that bottom line actually was. On the contrary, they repeatedly and disingenuously stressed how independent they were of the industry.

Far from the above, when I read Gary’s pieces, what comes across to me (but apparently, not to you) is the sincerity of his opinions. If he puffs a watch or a brand, it’s pretty clear that he does so out of genuine enthusiasm and respect for the product/s in question.

There’s another paradox inherent in your critique. Yes, GaryG is clearly well-off financially. And just as clearly, he didn’t make his pile from watch journalism on Quill & Pad. So it seems to me that he really has no particular incentive to become more “famous” than he already is. Why would he bother?

In fact I find it much easier to draw conclusions about your own craving for notoriety than about Gary’s.

[ p.s. thanks Gary, I’ll send my bank details under separate cover 😉 ]

Still blushing over the kind words, Tony! Haven’t seen your detailed wire transfer information in my emails, but will keep looking 🙂

Many thanks, Gary

Happy with my 20 stainless Classic Vostok Amphibias I got before COVID 19 slowed the mail and manufacture.

Very cool! There are great watches at every price point, and it’s good to hear that you have received your new piece and are enjoying it.

Best, Gary

Sweet 599 GTB there GaryG!

Oh, yeah. Nice watches too.

Thanks! The 599GTB is to me one of the great Ferrari models ever — well worth waiting through the 550/575 years for.

Thanks for reading and commenting!

Best, Gary

I see the flippers as a big part of the problem. I would have no problem with the market softening and them taking a relative hit. They will still make good money.

For the most part I have waited for my wishlist to come to the auction market. I am learning PATIENCE ugh! And have sadly written off the notion of getting certain references (double ugh).

T

I”m with you on all counts! Patience is not a trait that I have in abundance, and the flippers (and the retail practices that allow them to thrive) are in my view a big part of the issue here.

Thanks for commenting!

Best, Gary

Great article, delightful read. I already commented, but reading the comments and tactful replies I thought I’d ask this: I know in cases like PP’s 5131 world time enamel over the years list price did increase and maybe substantially, maybe an extreme example but a very sought after item will low production figures, as advertised. Would revising retail prices upwards potentially reduce demand and close the gap between retail and grey market ? For me, I know for sure if a simple aquanaut goes up in retail price as little as 1% I firmly believe it’s not worth the price, for the same functions I get, I would rather spend a little more on a “complication”. Just some thoughts, but again we must acknowledge the current situation seems abnormal, or something I have seen in the past 20 years…I know Gary has been collecting since high school so I am just a novice here thinking out loud : )

Intriguing questions! I suspect that especially with high end items with very limited production, price-setting is an inexact art. There’s always the risk of going too high, and either not selling out the stock of intended “halo” items or having to retreat — and at the highest end, cross-category competition comes very much into play, as the battle isn’t over which watch to buy, but whether to buy a watch, a car, a painting, or a gem.

If there’s a move to take up the prices of pieces like the Aquanaut and GMT-Master to dampen demand, the issue of what represents and entry piece for the brand comes back into play — and as you say, the question of whether this will drive buyers to other items within the line (which could be a good thing, but by the same token could lead to questions about the relative value of the other pieces).

Lots to mull here — wish I knew all of the answers, but your and others’ interesting comments are certainly making me think!

Best, Gary

1. price increase can be done annually when times are good. when they aren’t, it’s hard – they are blanket increments, not specific to a reference. when one increases, all increases

2. yes u can increase price to ‘keep up’ with market times BUT note that AD contracts locks in price when u acquire the timepieces, i.e. authorized dealers have the cheaper price before increment so have the latitude to discount if they wish. in other words, the brand can’t keep up with the price increases when fever pitch reigns.

3. Authorized dealers can’t easily sell in their own markets for fear of the wrath & fury of mystery shoppers (they are a true reality in europe. less so in the states. unheard of in Asia which is the key market so why throw a spanner in the works?). so they ship out. once shipped out – the fearful ones offering ‘no papers’ the premium is ‘free for all’…. hike it up as much as u want!!!

5131 ran into severe production problems because of the hand painting on the enamel dial, presumably only one person could do it and that person wasn’t feeling up to it (go F yourself PP were her choice words I heard). hence delivery was delayed and production suppressed.

watch sellers are just capitalizing on the veblen quality in SOME of these luxury goods – before u scream ‘rolex daytona super high in demand’, please take note first and foremost of all the junk datejusts in many precious metals available

– before u scream ‘Nautilus! Aquanaut!’ please take note of 5270 and the like where plenty are around and discounts available widely.

in this depressed luxury industry market, authorized dealers are capitalizing on flipping without getting caught these hot items at levels marked up as high as possible, in order to compensate for the other junk they are also forced to sell. (note for clarity: 5270 is not junk, just too many made).

it’s all very simple. how do I know ? just go and ask the authorized dealer as well as the flipper who tells u the truth, as opposed to the BS that watch bloggers spout.

Well written, GaryG. It’s nice to see a well-balanced view of a touchy subject that is most often discussed with a lot of conjecture and unnecessary guessing masked as facts.

I’m waiting on a GMT Master II, and am only able to get it with a relatively small wait of 5 months due to a purchase history, which I am fine with. In at least one way I do understand that from the AD’s perspective they want to keep their loyal customers happy with the more in-demand pieces, but it’s also a decent check that they aren’t just selling to flippers. My AD knows the only Rolex I sold was after 5 years of ownership and I only sold it because after losing 40 lbs the 42mm Explorer II looked a bit too big on my wrist.

Though I don’t believe that AD’s forcing the sale of slow moving inventory as a qualification to get what you want is something most people should accept, unless they really want the “lesser” watch they are buying.

Thanks for the kind words and for sharing your experiences (congrats on the incoming!) and thoughts.

I completely agree with you that it’s fair game (and a way to reduce flipping) for dealers to steer certain popular pieces to their loyal clients, but much less savory to tie more desirable pieces to less popular ones.

While I’ve suggested a few thoughts on the way out of this maze, it’s certainly not 100 percent obvious how the industry can navigate the current situation. Thanks for adding your own perspectives to the conversation — and I hope you’ll continue to chime in on future topics.

All the best, Gary

I visited ALS in NY a few months ago to inquire about an Odysseus. I was in holiday rags so brought my 2 existing ALS watches with me so they’d take me seriously and I left them in the counter while trying in the Odysseus. I went towards to door to see the dial in natural light and the sales girl said to the doorman in a loud voIce ‘don’t let him out’. This was odd as I’d left $100,000 in ALS on the counter. She then encouraged me to buy yet another ALS to help get me in the waiting list which was a new trick to me at the time…..I’ll buy an Odysseus alright but it certainly won’t be from ALS NY!

why bother? it’s a dumb-ass watch hyped up only by restrictions and initial spiel, which the brand has abrogated all this year with even dumber decisions. examine closely – the Ody is made up of different component case dial and movement parts from other references consistent with the copy and paste strategy mandated by Richemont and pervading all their other brands (except cartier which commands just over 50% of total richemont sales).

crap sales staff are rampant in the watch industry in the era of cost cutting and panicked recruiting amidst fleeing, high attrition. to this new class of talentless talent there is no difference selling watches or meat cleavers – and with budget thrown down the toilet and so many references vomited out annually that brands give up keeping track of (and don’t expect retail staff to know any longer), this is the only class of ‘talent’ who will join the luxury watch retail sales floor. the good retail sales staff have gone off to the office or to other industries – where stomaching the shameless degeneration of the concept of ‘luxury’ caused by overproduction, overpricing & dumping to the gary market, is easier.

Oh dear! Sorry to hear you had this experience, David — seems that the sales rep in question lacked common sense, not to mention good manners.

I’m generally at pains to announce loudly (in a joking tone) that I’m not going to run away with retailers’ watches when I go over toward the door with them, but that shouldn’t be a requirement for civil treatment…

Best, Gary

c’mon GG. surely u can do better than that at a critique? do u really need the brands to love you THAT much ? be honest, or i have to troll you to bring it out of you! history has shown I almost always succeed!

FYI and also my friend in ALS NY there was none of that rubbish from Wempe Berlin who, although they couldn’t guarantee a delivery date were happy to order one for me. My only previous custom there was a ALS clasp and strap last Summer…..

Wempe in NYC are also quite friendly and helpful, I’ve had good experiences there. Unfortunately, I’ve heard the same thing about ALS in NYC. May have to go and check it out just to see how bad they are. Quite disappointing!

Very nice write-up.

Here’s my take on it. I remember the times when a steel Patek 5712 could be ordered and three weeks later collected at your AD (2011 in Zürich, that was), and allocation was not considered a favour by the sales staff. Most likely, these times will come again, and perhaps sooner than we think possible.

Anyway, if ever an AD were to show me a watch, tell me its MSRP, but insisted on a bundle deal for me to acquire it, I’d write down the proposed deal, get the names of the staff present, and notify the police. Under Swiss law, if a shop quotes a price, this is a binding offer for purchase (unless it’s obviously wrong), and that’s an end of it. Now, I am under no illusions that I’d not get the watch this way. A life-time ban with this AD, and most likely at the rest of Bahnhofstrasse in Zürich, is the best I could hope for in such a situation. But then again, who wants to sell what to whom?

I have also seen the forms ADs have you signed where you commit to not selling a watch that you’ve just bought, and where they ask for your current pieces, whether you collect other things and whether there’s a family to which you could inherit the watch. The former is an unenforceable contract, the latter is quite frankly none of their business. If my money and my word as a gentleman is not enough, well, then, sadly, no deal is going to happen. Again, who wants to sell what to whom?

Perhaps I do not see the finer points of the finer things in life. And I certainly don’t want to be rude to salespeople, or bullying them – they’re just doing what they’ve been told to do. But as far as I am concerned, this is a simple business transaction, where someone wants to sell me something, and not me applying for the privilege to buy that something with strings attached and all. The latter may be their sort of illusion of how things work, but come a recession they’ll be desperate to sell to you. Like in 2011.

Thanks for your personal view on the situation — the demand swings you describe are of course very real and one of the things that manufacturers need to consider rather than flooding the market with today’s hot models.

I’m also not a fan of the intrusive retailer methods you mention — when the tables turn, I’m sure that collectors will remember who treated them as gentlemen!

Best, Gary

Easily the best missive I’ve come across on this subject. I could not agree more with your statement that “there’s a big difference between rewarding loyal customers and forcing a quid pro quo on buyers, whether established or new.” I, in fact, encountered this (mal)practice when inquiring about the Odysseus, which I did not expect from Lange – an expectation that had previously endeared me to the brand. The boutique rep informed me that they would add me to “the list” if I bought a (non-entry level) piece from the existing collection. I would have much more respect if I was told it was – at least for the time being – on reserve for existing clients – instead of being presented this bundling tactic. This simple nuance makes a big difference as a matter of principle. I’m not sure if things have changed since launch, but the sour taste in my mouth has not. Either way, I’m happy with my 15202 for now – which admittedly seems to be another culprit. Thanks for the great read Gary – you are a bonafide authority on this great hobby of ours and I’m proud we share a few pieces in common i.e. Batman, Reverso 1931, and Ming 17.06… although I went for the Copper 😉

The Copper is a great variant — after all, it did win a prize at the GPHG! Thank you so much for the kind words, and for sharing your disappointing personal experience — not much I can add other than to commiserate and share your hope that things will change.

I’m proud to be a member of this small community of watch fanatics with you, and hope that you will continue to read and share your thoughts!

All the best, Gary

Gary, Excellent article as always. I like the analogy with Ferrari; perhaps because I have never personally known a Ferrari collector before ! 🙂

A couple of points I would like to share based on what I have learnt in my part of the world (India).

– One of the largest Indian AD’s is notorious for the practise of ‘tying’ or ‘bundling’ when it comes to select Rolex models. Rolex is very popular in India and many want the usual – Pepsi, Batman / Batgirl, Daytona, Hulk – and these are usually ‘tied’ to a select few of their other brands. Problem I have here is that in my book, this shows Huge Disrespect from the AD to the Brand/s being ‘Tied’. Yes, because demand for Rolex is so strong that ‘tying; ensures these other brands get sold as well, and also the resale value of these select few Rolex might far outweigh the drop in value of these other brands; but it is happening for the Wrong Reasons and being Disrespectful to those brands. Whether those brands CEO’s and Executives know this, is anyone’s best guess.

This same AD is also know to ‘Profile’ potential Rolex clients. So if I am new to them and I want a certain Rolex, they may ask for my visiting card to ‘ascertain’ who I am. I have heard of this from close friends.

Also, I have read interviews of the CEO of a Hallowed Genevan brand, who openly said that he encourages his ADs worldwide to keep certain watches only for select local clients. And a friend of mine visited the AD of this brand in Bangkok, and was told he has to be a Thai National to buy from them !!! This brand is not represented in my country, and as such we have buy overseas. So if we come across an AD who ‘cannot’ or ‘will not’ sell to us because of citizenship / residency requirements, I do not know what to say?

I have intentionally not shared the names of the AD and Brand names above. I am happy to engage with you and Beth privately if required.

Thanks for the thoughtful comments, Kunal. Lots of topics in your post! In particular the residency requirement is a complex issue in my view as there are some legitimate reasons for wanting to ensure that products are available to residents of different countries and regions, but some of the other practices you cite are not acceptable in my book.

A good discussion sometime over a drink!

Best, Gary

As somebody who would love to get into watches I find the prices are just too much. And now on top of that you got to be on a special relationship? They have plenty of replica timepieces for a $130 that you can buy online 100 times over for the asking price of some of these models. And that’s before you get on their preferred waiting list.

Hi, Frank —

I’m no fan of replica timepieces as I really don’t like the theft of others’ intellectual property, but I do understand your views on today’s watch prices and I share your frustration with some brands’ (and in particular retailers’) practices when it comes to allocating pieces.

Best,

Gary