The pre-owned market has been booming for years now. In fact, pre-owned is one of the fastest growing segments in the watch industry as reported by WatchBox, which two years ago had announced sales of second-hand watches growing on average by 40 percent every year for the previous five years.

At that time, WatchBox co-founder Danny Govberg predicted that it will only take another five years for the size of the secondary market to exceed that of the market for new watches. And it looks like even the COVID-19 situation shows no signs of hampering that prediction.

WatchBox boutique in Dubai

WatchBox reported strong revenue growth of 25 percent in the first half of 2020, completing more than 16,000 transactions (watches bought and sold) with an average selling price for pre-owned timepieces rising from $12,000 to $18,000 during this period.

According to WatchBox, growth drivers included unprecedented demand and rising secondary market values from top-tier brands as well as notable growth in both first-time buyers and watches sold in the sub-$10,000 category. In addition, WatchBox cited increased activity from returning customers and multiunit transactions, with the highest multiunit single transaction value exceeding $3 million during this period.

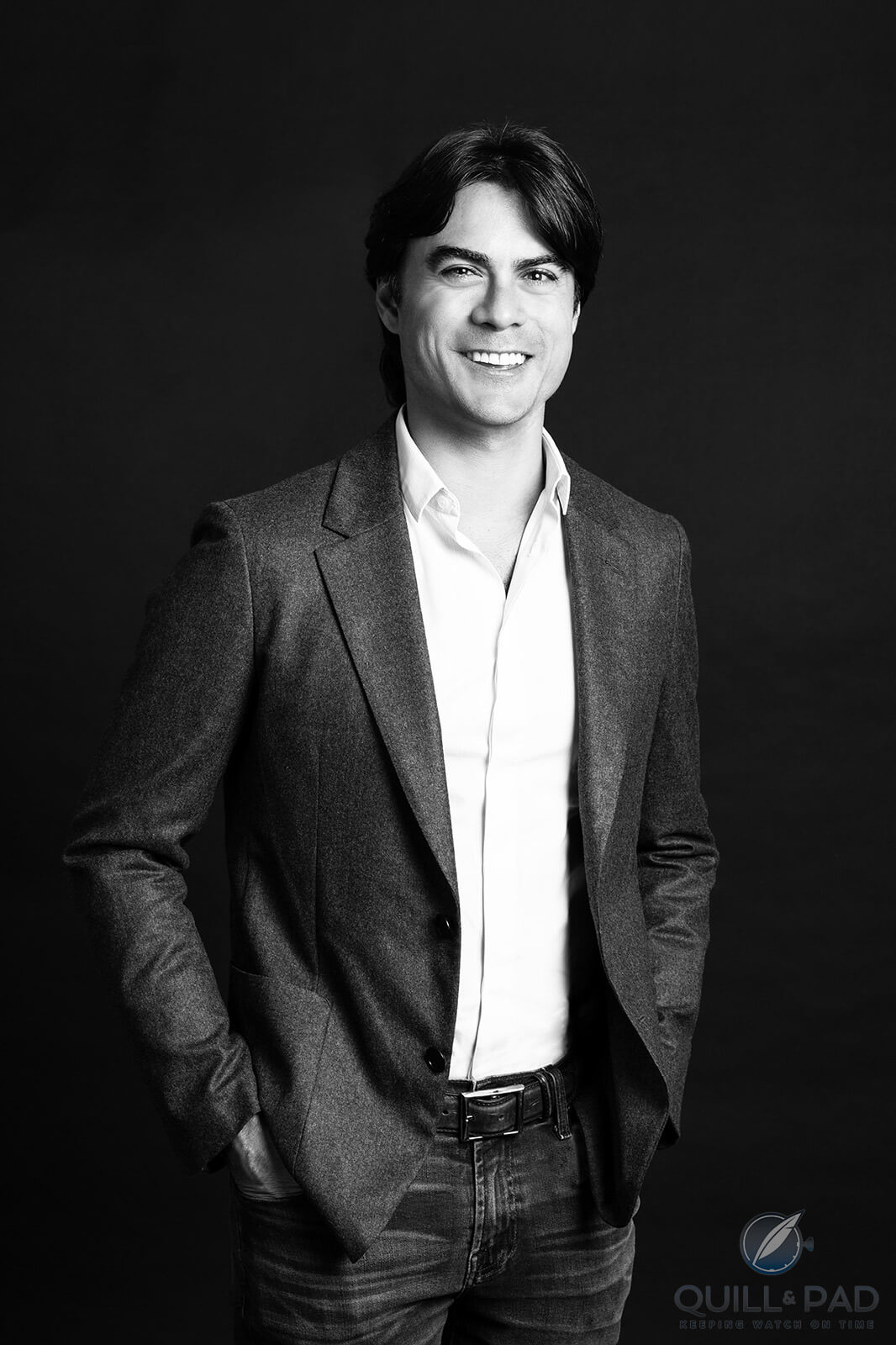

Justin Reis, WatchBox co-founder and CEO

“WatchBox’s annual revenue is comparable to the top two leading auction houses combined,” co-founder and global CEO Justin Reis said. “Our clientele and community have been incredibly active throughout the pandemic. As restaurants, stadiums, and cultural institutions were closed, and vacations and special experiences put on hold, many collectors turned to the watch community as an outlet for entertainment, enjoyment, and distraction. While people weren’t going out, they spent time researching, trading, and being more deliberate about the growth (and enjoyment) of their collections.”

Pre-owned watches are now big business. So much so that even the watch manufacturers joined in on the action: not only did the Richemont Group take over Watchfinder, but many watch brands have their own certified pre-owned services now, among them F.P. Journe, Urwerk, H. Moser & Cie, De Bethune, and MB&F.

“I have always thought that a strong brand is one with a strong pre-owned market and that it is the brand’s responsibility to help the secondary market as much in fluidity as in value,” said Maximilian Büsser, founder and owner of MB&F, which offers completely refurbished and serviced timepieces no longer available from retailers – even coming with a two-year factory warranty, thus reassuring buyers of their condition and aiding the sellers in finding new homes for their watches.

In 2020/2021, the pre-owned landscape experiences yet another seismic shift: consolidation, led by the acquisition of online vintage and pre-owned dealer Analog/Shift by Watches of Switzerland in late 2020 and more recently Hodinkee, which started out life as a personal blog in 2008 but has progressed to retailing watches, purchasing Crown & Caliber.

Hodinkee and Crown & Caliber

On February 18, 2021 Hodinkee founder Ben Clymer announced in a blog post that his company had taken over online pre-owned shop Crown & Caliber, which was founded in 2013 by Hamilton Powell. In it, Clymer defines what Crown & Caliber does: sell pre-owned watches, not vintage watches, which Hodinkee had been selling since pretty close to the beginning.

Clymer defines vintage as a watch made before 1990. Like with “vintage,” “classic,” and “antique” cars, there is no official definition, just a general sense.

Pre-owned, on the other hand, is fairly precise: it means modern, but not brand new.

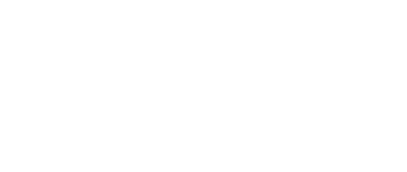

A pre-owned F.P. Journe Chronomètre à Résonance at WatchBox

“This is a transformative time for the watch industry,” WatchBox’s Reis commented. “Hodinkee’s acquisition of Crown & Caliber is great for the pre-owned market as it brings the category to the forefront of the global watch conversation. Over the last decade, Hodinkee has done a remarkable job of educating and developing a new generation of watch enthusiasts, and this illustrates another way to capture their attention.”

Hodinkee added a small pre-owned selection to its own shop in February 2021, which it plans to grow.

Coming back to the growth experienced by the pre-owned market, it seems that it was also relatively global: Fortune writes that Crown & Caliber has been growing at a rate of 60 percent annually.

Where does this leave WatchBox post pandemic?

“We are already seeing significant year-over-year growth in 2021 and project strong performance throughout the year,” Reis revealed. “This will be achieved through entrance in some new markets domestically and worldwide as well as concentrated growth within the independent brand and watchmaker segment.

“WatchBox’s high-touch approach has changed the way many collectors grow, modify, and ultimately enjoy their watch collections. Innumerable hours were spent ‘together’ over the last year (digitally, over the phone, on Zoom, etc.), and we are counting down the days until we can connect with our clients and community in person again! Our growth strategy includes entrance into new markets domestically and worldwide, and we believe that physical locations will bring us closer to our community, accelerating this next phase of growth.

“We have learned so much about our clients’ interest and appetite for high-quality content throughout this period and look forward to continuing to expand our voice and to working with leading journalists and publications like Quill & Pad to meet the needs of the WatchBox community.”

The WatchBox popup lounge at Dubai Watch Week 2019

Questions of authenticity

Perhaps the last remaining vestige of doubt in consumer minds regarding pre-owned is the question of authenticity. I know that that was my own inhibition threshold for many years having heard horror stories from the likes of eBay in the early years.

Like WatchBox (but unlike Chrono24, which is like eBay for watches, though that platform does offer verified dealers and escrow payment), Crown & Caliber buys the watch, inspects it, services it if needed using in-house watchmakers, and re-sells it online. Hodinkee/Crown & Caliber offer one-year guarantees on these watches. WatchBox offers a two-year guarantee.

“Both WatchBox and Crown & Caliber support customers who are looking to buy, sell, and trade timepieces from their personal collections,” Reis explained. “Our models primarily differ with respect to the type of inventory we carry. A significant percentage of WatchBox’s inventory is in the $20,000 and above segment, and I believe Crown & Caliber focuses on a lower price point, with the majority of inventory within the $3,000-$6,000 range. What we sell is directly related to the inventory that we are buying, and WatchBox specializes in the high-end and collectable timepiece category. Our customers are at the heart of everything we do, and we pride ourselves on the service and experience we offer.”

On a separate note, but one worth mentioning, eBay recently introduced its own Authenticity Guarantee. As WatchBox has had one for years, I asked Reis whether he sees this new element by such a large platform changing anything about the business of pre-owned, and his answer was very positive.

“eBay’s introduction of its Authenticity Guarantee brings greater awareness to quality standards and the need for trust across the pre-owned space. The more that the market develops its standard for quality and attention to mechanical and aesthetic excellence, the better it will be for all major players as more people get into collecting pre-owned watches.

“The last year has been challenging for so many, and we continue to be sensitive to what the world is going through,” Reis continued. “In many ways, 2020 was a tremendous test of our hypothesis for the category. COVID-19 accelerated the digital transformation of the industry, and WatchBox was in a unique position with an already strong digital foundation.”

For more information on WatchBox and its services, please visit www.thewatchbox.com.

Leave a Reply

Want to join the discussion?Feel free to contribute!