Everything I am about to say is likely to be called FUD by a few readers. Perhaps it will be below in the comments or perhaps when it gets shared to social media, but I guarantee that some of you will decry my points and say I am just spreading fear, uncertainty, and doubt (FUD).

But from time to time I need to share my entirely unoriginal (and hopefully growing in popularity) hot takes. So here it goes.

NFTs, as well as to a significant extent cryptocurrencies, are the latest grift by the unscrupulous and untrustworthy that have sadly caught a lot of normal people in the crossfire, and for a whole host of reasons should be almost universally avoided.

In the wake of the current crypto crash and NFT markets taking a nosedive, and with shared sentiments here at Quill & Pad, I wanted to go over some reasons why NFTs could be a looming crisis for the watch industry. I would like to assert that the industry as a whole needs to choose its next steps very carefully lest it become both latest victim AND criminal grifter in the NFT space.

But first a quick primer on what NFTs are, how they are made, and some basics about how they, and the market for them, function. NFT stands for “non-fungible token,” which means it is a unique item, not interchangeable with anything else (similar to a handmade sculpture by Michelangelo), only one exists and cannot be replaced with a duplicate. Unlike a mass-produced screwdriver, for example, which could be swapped for another of the same kind and there would be no tangible difference.

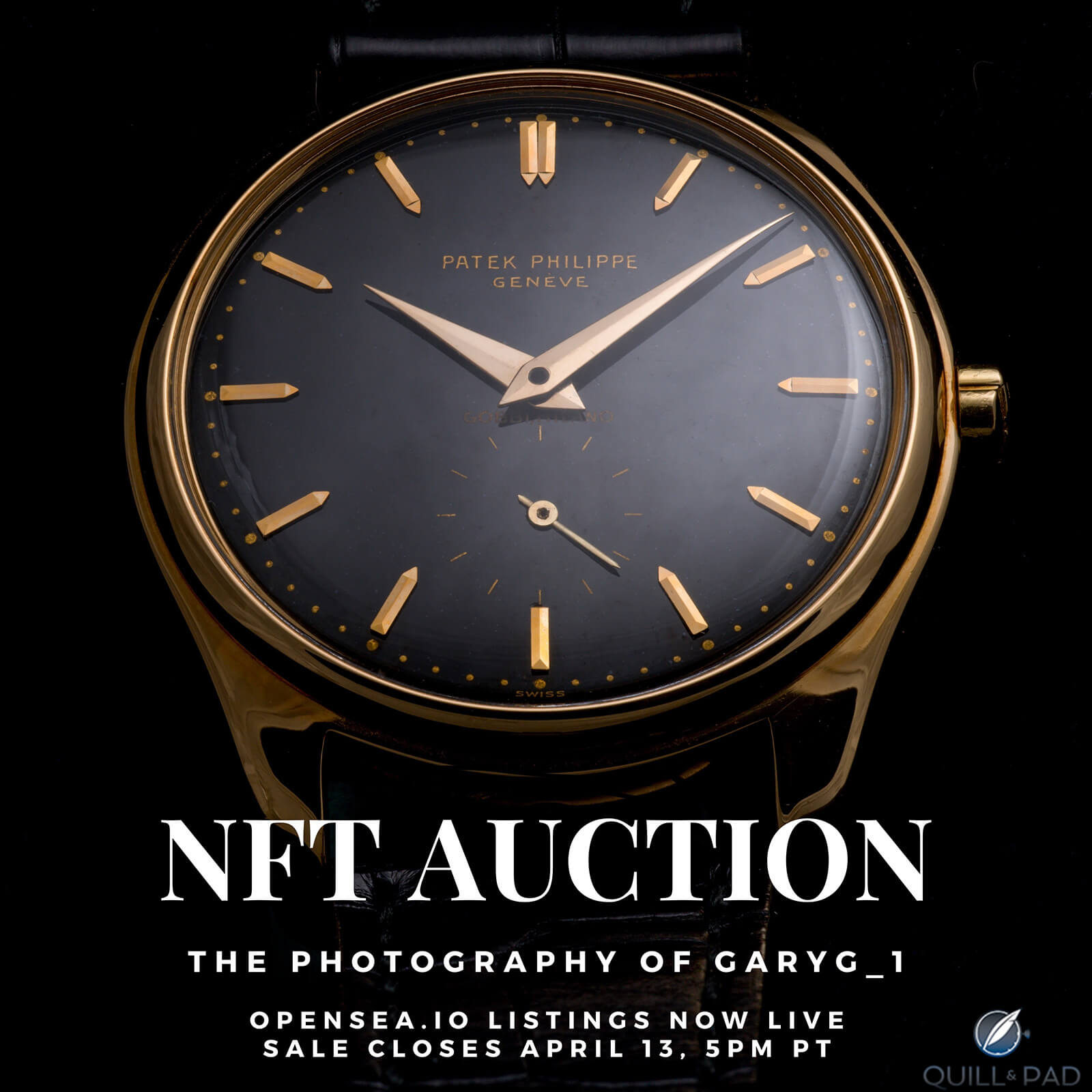

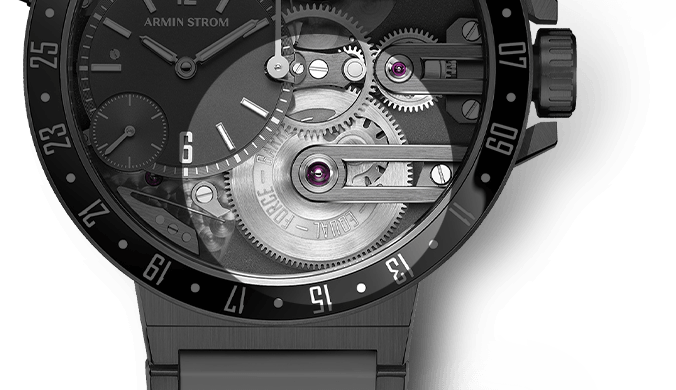

Advertising image used on Instagram, Twitter, and Facebook for GaryG’s NFTs

NFTs are usually made from a JPG, GIF, or other visual or audio file, but can be any digital file including text, music, animation, PDF, or even an Excel spreadsheet; really any digital file can become an NFT. This digital data is then converted into a digital asset that is recorded permanently on the cryptocurrency blockchain. I should also mention that NFTs can essentially have no content other than their record, and they essentially would be nearly identical in function.

This action is called “minting” and requires a fee to create – called a gas fee – which varies based on the demand of the market and can fluctuate from a few dozen dollars to a few thousand. Minting creates a unique identifier called a URI (Uniform Resource Identifier) that is similar to a URL (Uniform Resource Locator) but refers only to the identity of the resource. However, the URI does need to identify the location as well so there is typically an associated URL.

The NFT file is stored on a server connected to the internet and is pointed to by the URI so that it can be accessed and verified at any moment. The record of the minting and purchase are stored as an entry on the blockchain ledger, which is publicly managed and available for verification. So when someone buys an NFT what they are effectively getting is a record of their purchase, publicly available, and non-exclusive access to a file that is also publicly available.

And with that primer, here are my top 5 reasons why NFTs are a grift and brands should avoid them if they don’t want consumers to think they are taking advantage of their customers.

1. NFTs and watches have two very different methods for deriving value, and one is certainly (and logically) better than the other

Let’s face it: an NFT is usually just a copy of a digital image that someone paid to mint. That’s it, and that isn’t very special. In fact, the digital image isn’t even a unique entity that cannot be copied, which was supposedly the entire point of the “NF” (non-fungible) in NFT. The image is just a small digital file, one that probably already existed, or in the case of some infamous NFTs, was made automatically via an AI algorithm from a set of premade images stitched together in editing software.

Louis Moinet’s very recent NFT collection

What makes that asset non-fungible is that it is stored and “permanently” tied to a URI, which, when inspected, typically points to a URL as the location where the NFT can be accessed. Oh, and there is a reason I quoted the word “permanently,” which I’ll be coming back to later.

In terms of having intrinsic value, an NFT has very little in almost all cases to date. Because the minted NFTs are usually a JPG, GIF, or video 10,000 blogs and in 10,000 popup advertisements. The image itself isn’t the valuable thing; it is the position on the blockchain as a tradeable and speculative asset. So the value comes from the collective imagination that it has value, but not from anything actually related to the image or file itself.

The image or file is publicly available, able to be copied, shared, downloaded, and modified thanks to its URI and typically associated URL. If you dig into the blockchain or the records of the sale, you can navigate to where the file is stored and copy it for yourself. You don’t have the associated asset on the blockchain, but you do have the tangible (and visible) aspect of the NFT. In many of the most famous cases, the NFT image or file is shared on websites to show off how much it sold for, and people are simply saving the image and using it across the web (even the crypto-Übermensch Elon Musk has engaged in this to mock NFTs).

The only objective value an NFT truly has is the ability to trade it as a speculative asset like stocks, options, or commodities. Those have value because they are tied to the real-world functioning of a company, product, or industry producing goods and services, or the raw materials that the world uses to make things (or eat). NFTs are only valuable because of crypto “currencies,” which are speculative assets that investors and countries are pouring actual currency into. The NFT itself lacks a proven and widely demonstrated utility other than a gamble. The item tied to it isn’t non-fungible (it’s an easily replicated digital file), but the record on the blockchain is and that is what people are buying: a certificate of authenticity.

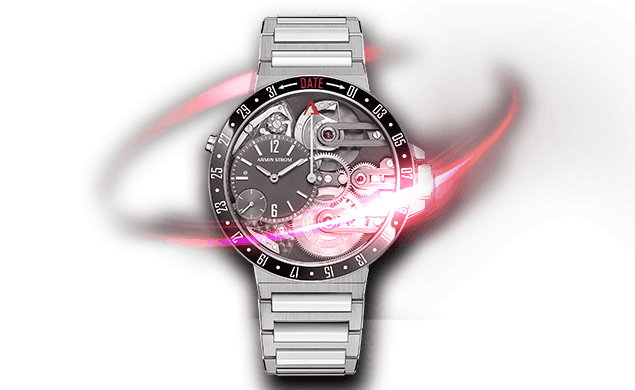

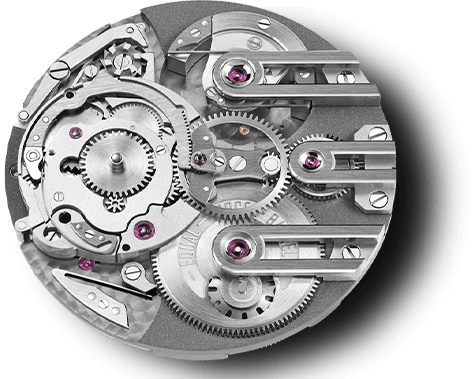

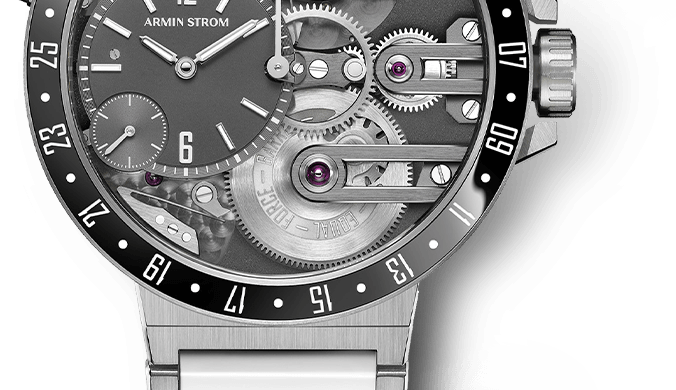

Watches are not like this and derive value from the engineering behind the piece, the manufacturing efforts, the human skill and time needed to create it, the materials the watch is made from, and the functional utility that the watch provides as both a tool and a tangible good. NFTs can and have been made with almost no effort and only compare to watches in that it costs money to produce them. The difference between the two objects is obvious and should be clearly understood to have no real connection to each other in terms of perceived value.

Bitcoin mining farm servers (photo courtesy Marko Ahtisaari/Wikipedia)

2. NFTs are not perpetual or secure and provide no assurance that they will be accessible or usable in the future

Remember when I said that the NFT was tied “permanently” to its URI? Well, that is only technically true if the people behind it are not crooks, and they are immune to hackers and human error. The NFT file is vulnerable to any regular data loss issue such as database corruption, user error, or deliberate malfeasance. The server owner of the place where the file is stored (such as a watch brand) could choose to replace or delete the image or file from its database or it could accidentally delete, modify, or simply move the file, breaking the link so that the file is lost to the NFT owner.

Beyond this, since the URI usually includes a URL to direct the owner (and the general public) to the file’s location on the internet, the NFT is also vulnerable to “link rot,” which occurs when a hyperlink becomes disconnected from a visitable location on the internet if a system is changed or the directory is reconfigured and the previous hyperlinks are replaced by new ones (there are a variety of other ways for link rot to occur as well). This issue is found all over the internet and is a serious problem not just for NFTs but for the internet’s entire structure.

In 1998 it was found that six percent of the links on the internet were dead, and a recent study of more than two million websites from 2013 until today found that 66.5 percent of links have rotted in some way, meaning that the problem is likely only waiting to happen. Actually, it already has happened – and with very, very expensive NFTs.

There is a way to guard against this with a system called IPFS (InterPlanetary File System). This allows the NFT file to be linked to anywhere it is currently being hosted, essentially a cloud-based solution for maintaining links for the NFT. Of course, this has also shown to lack dependability as multiple NFTs owned by wealthy and famous people have been inaccessible, if only temporarily

But IPFS and its failures inadvertently expose two truths about NFTs: the lack of being non-fungible and the lack of permanence. If the IPFS links to any instance of the file anywhere on the internet, then it demonstrates why the file has no intrinsic value for itself: there could be thousands of instances on servers across the world, and any individual file is literally a stand-in (fungible) for any other file.

Add to that the stark reality that there are entire systems being built to avoid the real problem of the NFT you buy effectively being “empty” if the file or link to it are damaged. This is technically a similar risk to buying a rare car, watch, or piece of art and knowing it could get destroyed someday, even though at no point can you just download a copy from a different server to replace a crashed Ferrari 250 GTO.

What’s worse, there is no current legal mechanism to provide recourse for the NFT owner if the link or file goes missing. So you may just be out of luck. Even if you sued there would be a need to prove legal liability for the perpetual maintenance of the file, which was never construed or agreed to when you purchased the NFT in the first place. And in addition to all of that it also seems like . . .

3. NFTs are a trend that has already passed, and the ability to make money from an investment in them may have already passed as well

NFTs were hot for a while, and that is when brands started to dip their toes into the waters and come out with digital NFT watches or NFTs linked to physical watches. But being in front of the trends is not a feature of the Swiss watch industry (or really any legacy industry) so it should come as no surprise that the NFT marketplace is flatlining and may already have been past its glory days before the watch industry got involved. From November 2017 through April 2021, NFT sales averaged between 1,000 and 5,000 in sales per day. Not bad for a niche within a niche.

On May 18, 2022, there were 24,452 sales of NFTs, which would represent a five to 25 times increase in sales.

So why would I say that the trend has already passed when there has been such an increase? Well, that figure also represents an almost 90 percent decrease in NFT sales from the peak in September 2021 when the average daily number was over 225,000. This number was also just days after a massive sale of 55,000 NFTs, half of which were resold within a week. If you follow markets and the economy, it’s pretty easy to see why this has happened: the “investment” has become too risky and NFTs and the necessary cryptocurrencies are a good way to lose lots of money really fast.

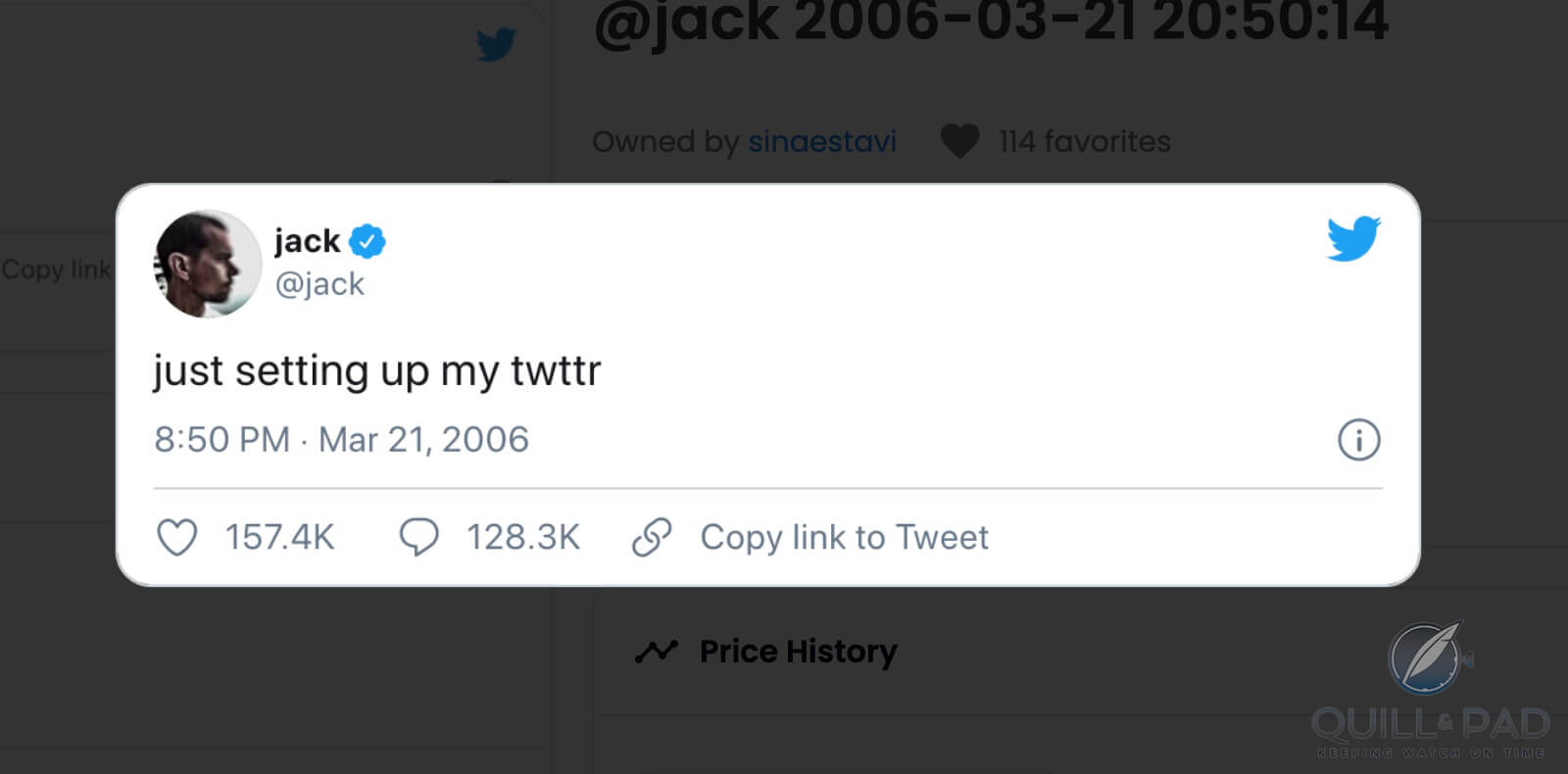

Jack Dorsey’s first Tweet sold as an NFT for $2.9 million

An example to put this into perspective is the first Tweet by Twitter co-founder Jack Dorsey, which was minted into an NFT in March 2021 and sold for $2.9 million, a princely sum. It was recently put up for sale with the hope of selling it for around $48 million, but the highest bid was a measly $12,600, which is approximately 0.4 percent of the original sale (or a price drop of 3,809x). While this is a shocking outlier to make a point, the underlying truth is that sales are way down and the market is not showing signs of steady or sustainable growth. But it was probably just a bubble to begin with.

This also doesn’t take into account that the market is rife with bogus activity that is helping to hide the lack of demand for NFTs overall. The concept of a “wash trade,” in which a person sells an NFT to a different account they also own, is used to either artificially inflate the price or create artificial activity in the marketplace to hide dwindling interest. One NFT marketplace has been shown to be almost completely wash trading with about 95 percent of its trades (accounting for $18 billion in trading volume) coming from such transactions.

A robust and growing market would not have these types of numbers anywhere near them. If I bought a typical house for $500,000 and just one year later I couldn’t sell it for anything more than $2,000, there is not a single investor who would want to buy into that market as a way to grow wealth. Especially if you couldn’t live in the house but could only look at it on your phone or computer.

Watch companies creating NFTs to hop on this trend will need a better sales pitch to collectors than “we minted an NFT” because that isn’t a way to attract buyers who understand investing. It can attract buyers who want to pretend they are savvy investors or who are looking for a way to flip something for a quick profit. Based on my experience in the watch industry, brands don’t look too favorably on that behavior anyway.

Konstantin_

Joker Chaykin NFTT (draft)

4. NFTs provide no security against theft or fraud, and in many cases are invitations for it

The entire cryptocurrency and NFT market is full to the brim with fraud and often resembles the classic confidence scheme, better known as the Ponzi scheme. The human tendency to experience FOMO (fear of missing out) has created a market in which people have heard about average crypto investors making millions (and sometimes billions) of dollars on small investments. Sometimes it was only a few hundred or a few thousand dollars, but there have been literal rags-to-riches stories and people use that to create visceral excitement that it could be you next. All you need to do is invest a few hundred dollars into Garlicoin and if it goes to the moon (aka skyrockets in value) you could be a millionaire!

Of course, in nearly all cases this has proven to be little more than a scam to separate people from their legitimate usable currency like U.S. dollars or Euros in the hopes that someday they might be able to sell their cryptocurrency to someone else for a massive profit. It’s not an investment, it’s a gamble. But in and of itself that does not make it a scam or a Ponzi scheme. And this is where “rug pulls,” “pump and dumps,” and our old friend “wash trades” come back into the picture.

With cryptocurrency, this is well documented and a major problem for investors.

Most currencies have relatively small market caps in the millions so that a large investment from a few individuals or a flurry of rapid investment can send the price of the coin soaring. When this happens, it attracts more and more people to buy into the coin thanks to FOMO, and the price rises even higher. But unless you were a very early investor or were able to secure a large position at a relatively low price, you are the one taking the risk.

The early major investors wait until the price is inflated and then sell off all their holdings, making a massive profit for themselves and leaving everyone else with a coin that seemed to be growing but now crashes, turning the late investments into smoke. This is the classic pump and dump scheme, and it is extremely illegal in securities trading. For a long time, cryptocurrencies weren’t considered or treated anything like securities, which allowed this type of behavior on an almost daily basis.

But then something changed: while the SEC and international regulatory commissions have not officially been able to change the designation of cryptocurrencies to speculative securities in many cases (though it’s coming), new lawsuits (and hefty legal judgements) started to come after offenders from the Commodities Futures Trading Commission (CFTC) for millions of dollars in fraud. To the worst offenders it signaled the end of the easy scamming with cryptocurrency. So the party was over, right?

This legal shift all began to coalesce around March 2021, and coincidentally NFT sales exploded in late April and early May. Why? Well, cryptocurrencies were now going to be subject to legal scrutiny and sanctions if one engaged in market manipulation, but the products one buys with crypto were not. So the grifters switched strategies. Now people stopped advertising, pumping the altcoins (crypto coins aside from the main players), and hawking the “next big thing in crypto and the new economy, bringing equity to creators and allowing you to profit from your support of your favorite artist.” At least that was the sales pitch.

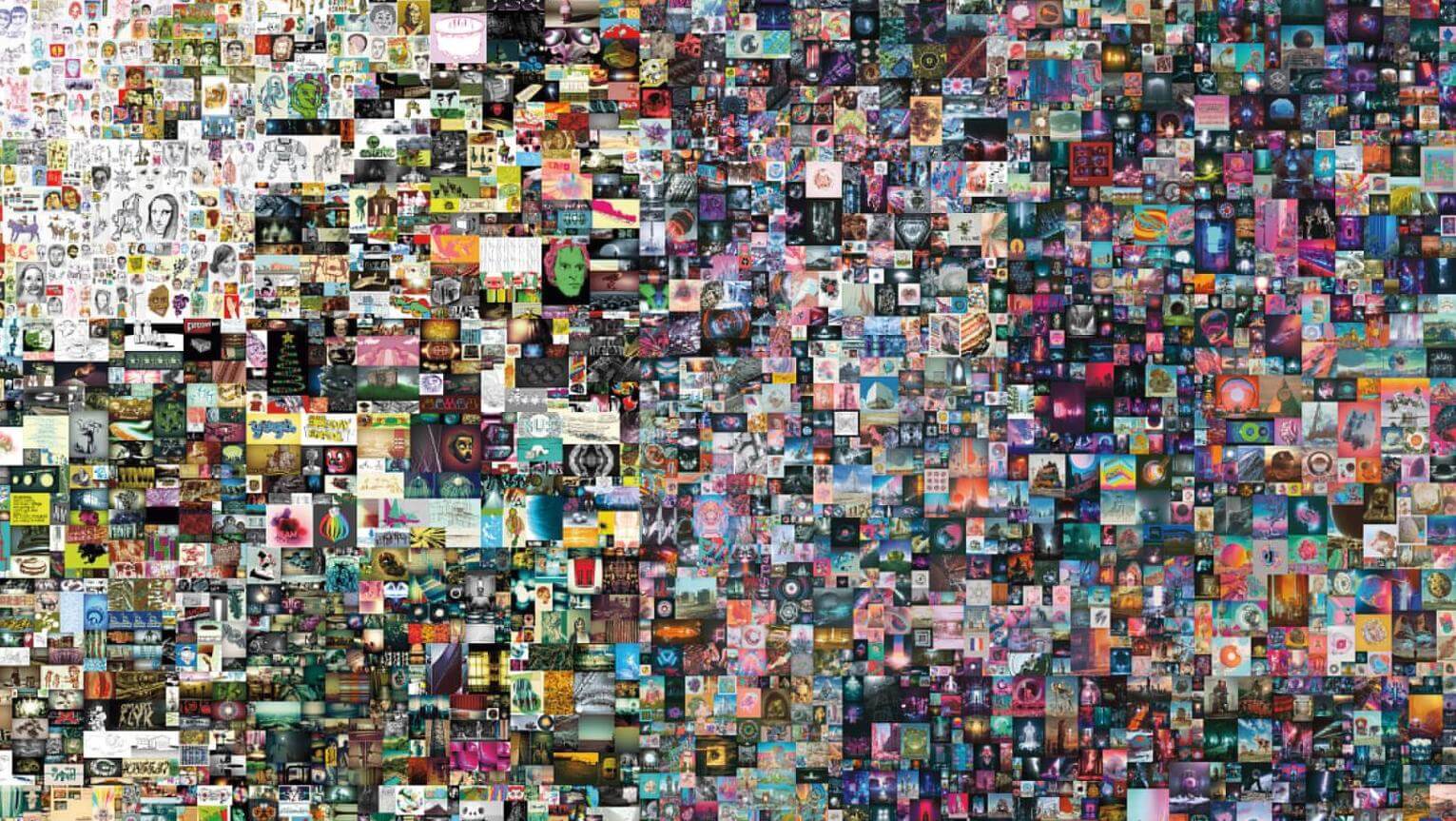

A few big sales early on, like a $69 million payday for digital artist Beeple in March 2021, which was preceded in December 2020 by a $3.5 million sale on a different platform, came together with that highly questionable NFT of the first Tweet, which also sold in March 2021 for $2.9 million, signaling the new market. For people who wanted a new way to pump and dump without the legal ramifications, NFTs were perfect.

This became the heyday of the “rug pull.” A tactic already in use with cryptocurrency and ICOs (Initial Coin Offerings), a rug pull is when a project is announced with a great amount of hype, promotion, and possibly celebrity endorsement, only to have the creators kill the project after a significant number of investors have paid their money, allowing the creators to sneak off with massive profits for nothing more than creating buzz.

In the NFT marketplace this takes the form of hyper optimistic projects that promise loads of benefits or real-world perks that are attached to the NFT, including concert tickets, access to private events, physical goods, and even meet and greets with celebrities. As Quill & Pad contributor Brendan Cunningham pointed out in his earlier opinion piece on this topic, there is a website with the sole purpose of tracking and archiving instances of rug pulls as well as those of fraud, lawsuits, and general malfeasance. Web3IsGoingGreat.com can further elucidate just how common this is in the NFT marketplace.

If the rug pull or pump and dump didn’t happen, there is still the chance that wash trades will artificially create the illusion of a valuable and tradable asset, keeping people interested in putting their own real currency into the market so that others have the ability to cash out, effectively making the market an ever-flowing Ponzi scheme. This leads me to my final consideration.

Beeple sold this NFT for $69 million

5. NFTs linked to physical watches or NFTs of digital watches or media related to existing products open the brands to being defrauded or having their images tarnished just as much as NFT buyers

Rolex is the largest single player in the watch industry with a valuation of about $8 billion in 2020 and with a reputation for being extremely careful with its image. Ferrari is a massive player in the exotic sports car world and has a current market cap of $34.3 billion, more than four times larger than Rolex, and is also known to be excruciatingly careful with its image and reputation, going so far as sending cease-and-desist orders to people who customize their personal Ferraris in ways that Ferrari doesn’t like (which is a whole other can of worms for a different day).

The difference between the two is that Ferrari announced a plan to mint NFTs with Swiss blockchain company Velas Network during the Q4 earnings call with Ferrari CEO Benedetto Vigna. Rolex, as of today, has made no intentions known of dabbling in the NFT marketplace.

When it was discovered that a Ferrari-owned domain was selling Ferrari-minted NFTs under the title “Mint Your Ferrari” and made the claim that Ferrari had introduced “a collection of 4,458 horsepower [sic] NFTs on the Ethereum network” it would seem that was the first look at the previously announced collaboration with Velas Network.

The only problem was that the page was fake, a hacked subdomain of Ferrari – specifically forms.ferrari.com – and the NFT sales were going to a wallet address unrelated to the company in any way. The scam only resulted in a little less than $900 in sales, but it demonstrates both the ability to find, exploit, and create something realistic enough to convince unsuspecting buyers. And if it can happen to Ferrari, a very large and wealthy luxury car firm, using a known Adobe Experience Manager exploit all it takes for an unscrupulous hacker to try it on a watch brand like Rolex (or any other) is the opportunity.

Most crypto and NFT fraud happens not in outright hacking or the direct theft of assets, but through social engineering and instilling false confidence in the mark. It is much easier to get people to buy into a project (that has no hope of turning a profit) if they have already purchased other similar assets or if they are simply less experienced in the market but thanks to FOMO will make rash decisions.

Now I am not saying that watch brands intend to do this but as Brendan Cunningham highlighted, most brands have no internal knowledge or expertise and must rely on outside partnerships, which makes them vulnerable to a rug pull just as much as the average consumer. Perhaps Patek Philippe won’t be the victim of a rug pull collaboration, but a small brand with few resources may try to hop on the bandwagon and get taken advantage of just like other companies have been.

In addition to that, the idea of linking a physical watch to an NFT both devalues the NFT (because the physical watch has a much more concrete level of value that is harder to manipulate) and adds little utility that cannot be gained elsewhere. NFTs have become almost synonymous with the concept of “smart contracts,” which are lines of code attached to the NFT on the blockchain that are supposed to automate the execution of an agreement without human interventions.

But just like any program and any contract written by humans, things can go wrong. And these smart contracts can be exploited by nefarious means or will simply fail to work as intended. On top of that, many smart contracts haven’t been shown to be secure or guarantee anything and may not even be legally enforceable or provide any of the benefits that the NFT was guaranteed to include. That is because code cannot create a meet and greet with a celebrity out of thin air or guarantee citizenship and a physical plot of land on a real island.

The possible utility of NFTs exists, as does its novelty factor, but it doesn’t seem to add much to the experience without the hype of the NFT market and the associated idea that NFTs could “make you rich as a sound investment.” This is where brands really need to be careful and understand exactly what they are trying to provide for the customer.

In conclusion

With everything I’ve covered, the idea of watch brands dabbling in NFTs seems, at best, an odd choice or, at worst, a recipe for disaster. And none of that even touches the environmental costs of cryptocurrencies (which NFTs cannot exist without).

NFTs are a fascinating digital experiment and they do show some creative thought in how computing and mathematics can be harnessed for new practical uses in the real world, but so far they have failed to demonstrate any real utility that cannot be achieved via other, already existing means that don’t rely on the extremely volatile and speculative nature of NFTs and cryptocurrency. A year after the crazy rise and fall of the NFT bubble (or heaven forbid the first NFT bubble), all of these things and more are becoming evident to the masses as those who looked closely at the beginning already suspected.

Articles and videos are coming out that showcase weeks or months of research into the topics, and websites like Web3IsGoingGreat.com is a great resource to see all the bad news about the topic. I would also recommend a phenomenal full-length documentary called Line Goes Up by YouTube creator Dan Olson on the channel Folding Ideas. It provides an incredible throughline showing how the entire crypto, NFT, and web3 space is a direct result of the housing bubble crisis of 2008, not to mention covers vastly why everyone should be very hesitant about getting involved.

People who are invested heavily in crypto usually will call pieces like I’ve just written FUD because any fear or doubt in the marketplace drives down speculative value, i.e., their investments. There is a bubble that crypto enthusiasts need to live in, and they try their hardest to get everyone else to live in that bubble so that they can make a lot of money – or perhaps simply get their money back out before there is no one left to sell to and the market crashes.

Watch brands are usually slow to react to trends, and in some ways it has really hurt their bottom line as smaller, more agile companies have adapted to the web much more seamlessly. But Web3 is not the same as Web2 and it hasn’t really been shown to be an improvement to anything, just a more complicated and expensive way to do what people were already doing. It has shown itself to be a way for some to extract wealth from those gullible or desperate enough to dump life savings into assets that have no regulatory mechanism.

So I will close by suggesting to watch brands to define their philosophies acccording to why they wish to get into the NFT space and how it actually matches with their products.

It is too easy for a brand to race into a new trend because it doesn’t want to seem like a luddite or it simply doesn’t want to miss out on being a part of something exciting. But FOMO combined with a lack of knowledge and no clear reason behind the creation has the huge risk of losing money, losing credibility, or chasing profit at the expense of everything it stands for.

If NFTs end up being an almost universally good thing, cryptocurrency finally makes a positive impact to the environment instead of destroying it, and brands can define a legitimate and useful utility or value added to their products (while being fully informed about the who, what, where, why, and how of the space), then I will be interested to see what they come up with.

But if brands continue to dump resources into NFTs in the ways we’ve seen so far and no true utility can ever be demonstrated, then I would urge the brands to reconsider what they are hoping to accomplish and use their creativity to achieve it in a way that avoids all the demonstratively terrible things about NFTs and cryptocurrencies.

I love watching technology progress, but I personally put legitimate value creation over speculative value creation any day. I value utility, function, the result of skill and effort, not luck or being “first” (which is the best way to win at the crypto and NFT game). I make things, I do work, I actually create tangible value in the world, and I appreciate others who do the same, which is one reason I love watches so much.

I also love software, mathematics, and the creation of unique digital tools, which really have revolutionized the world. I use digital tools every day. But I do denounce the creation of things for the sole purpose of taking money from people who don’t know what they are buying while selling promises that can’t be kept. The NFT market is built on this concept by a bunch of programmers who think they can singlehandedly change the world because they wrote some interesting code.

It takes a lot more than that to fundamentally shift how the world works, especially in a positive way that doesn’t hurt more people than it serves. NFTs may have potential, but so far they are siphoning wealth mostly from the “have-nots” and funneling to the “haves.” I would hope that watch brands realize that they have built brand equity from providing utility and value to their customers, not by selling promises and leaving their customers holding nothing but air.

You may also enjoy:

Real Or Illusory? A Watch Collector’s Foray Into The World Of Digital Collectibles And NFTs

Leave a Reply

Want to join the discussion?Feel free to contribute!

Strongly presented argument. Wise thinking that I hope folks pay attention to. Highly recommend watching the 30 min “the line goes up” video: it’s a walkthrough of these topics that’s entertaining, clear, and easy to comprehend.

Great article, in fact a community service.

Best Q&P article in months. And of course I agree completely with you on all of this.

An excellent article, thank you. Technologies becoming increasingly complex, fewer and fewer people have the patience to dig in and the courage to disagree with the hype.

Excellent article, Joshua. You have articulated the problems/concerns/fears very well, and I applaud your frankness. I feel the crypto/NFT world crossed into the horological spectrum in a heavy-handed way the last few years, and could very well represent the glut of money being used to drive up the prices on hype-pieces. Perhaps more of a leap in my thinking than the sound reasoning used in yours, but I digress. Chefs kiss to this piece you’ve crafted.

Joshua,

Thank for this excellent article. I’m so glad someone has taken the time to write this. Clearly laid out and explained to the non digital savvy person, who I suspect is the target of these dodgy new ways to extract wealth from uninformed folks, hoping to jump on the train and “not miss out”

I hope watch makers & companies read this and heed your wise words.

Consumer confidence and trust is very real and important, especially to brands who make many of the same item. To potentially ruin that, is extremely foolish and it is one of the reasons I believe Rolex has elevated itself to the lofty heights in the luxury world, by specifically maintaining trust and consumer confidence by making solidly built and well designed watches year and year out.

They deliver on their promise, and create valuable items that people can easily understand and have been willing to buy for many years.

The current market hype is another thing altogether and for a different discussion, but tied in with the economics of cash flush buyers looking for an “investment” opportunity!

Keep up the great work and thank you again,

Cheers,

Tim

Thanks for taking the time to read this opus, Tim. We all pretty much feel the same way about this emerging market here at Quill & Pad. Not everything that is new is the way to go by any stretch.

Nice, on-point explanation of the phenomena. I really enjoyed reading it and I agree.

I personally consider it a huge image mistake to announce NFT’s, possibility to buy with cryptocurrency at a time when that market is going vertiginously down. Once – for your “classic” buyers (seeding mistrust), second – for the future of your assets, now in an unregulated system.

Sounds like despair to get a new market. “But do you really wish to have that market?” – This is my question for the brands…

Cheers,

Andrei

Best article on the subject I have read and it clearly lays out what NFT really means. I would venture that most people know the terms NFT and blockchain but probably nothing deeper. Thanks for the great writing!

Thanks for the thoughtful and thorough essay. The NFT/cryptocurrency market seems to be an example of 21st century arbitrage, rather than the creation of durable value or tangible goods.

Thanks for sharing such an informative article. Hope this article is helpful for others.