Yes, You Must Pay Duties and Taxes on Your Personal Watches When Traveling, But Here’s How to Avoid the Worst

The summer travel season is here, and many of us might leave home for vacations in Switzerland, Germany, Italy, Japan, the United States, or China.

Coincidentally each of these destinations happens to be among the world’s top watch producers. What to do about those pesky import duties and VAT as they relate to timepieces?

Being well-informed and educated is the best defense against avoiding fines, penalties, and embarrassment in these countries.

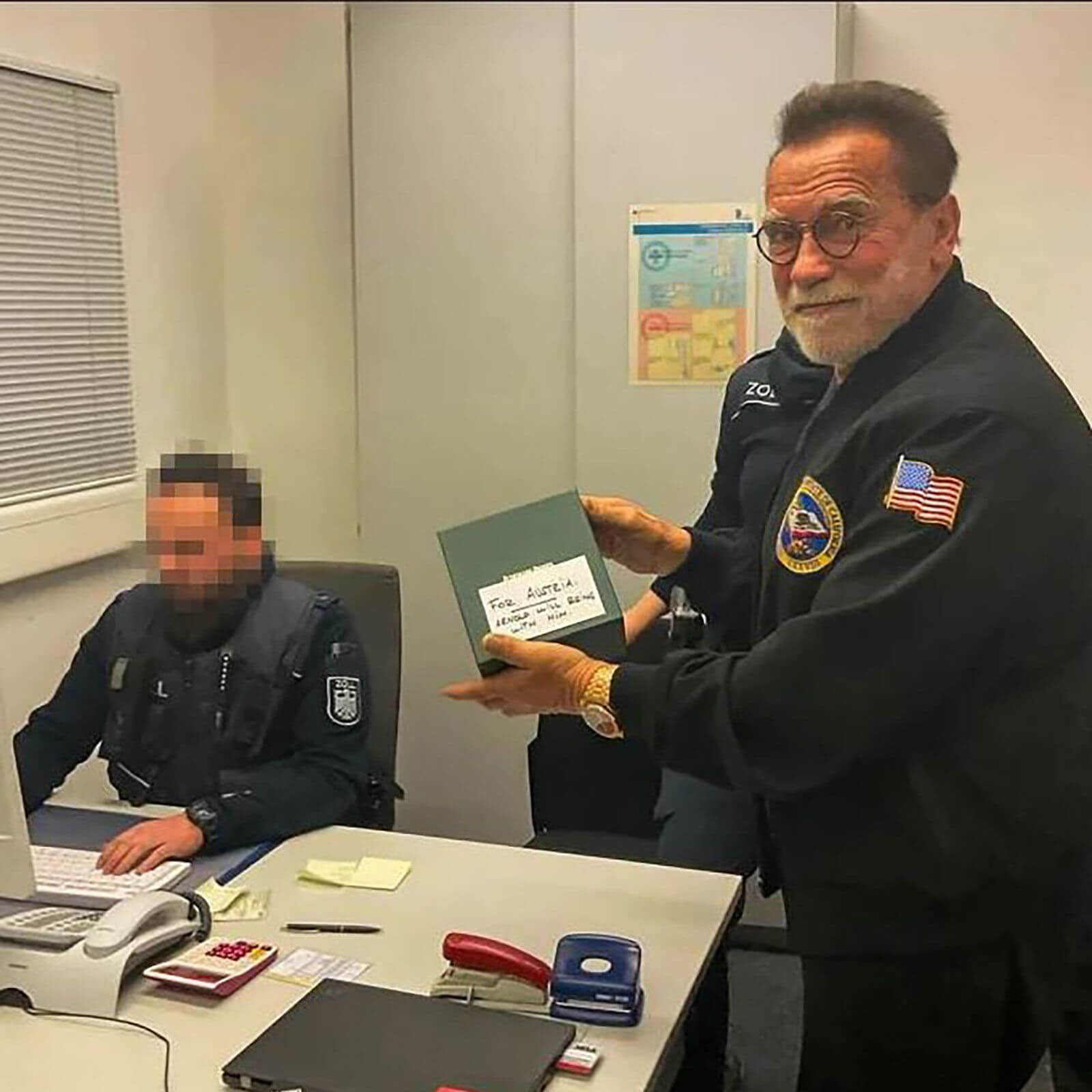

Arnold Schwarzenegger at Munich airport

You don’t want to end up like Arnold Schwarzenegger: Yes, You Must Declare Your Watches: Arnold Schwarzenegger held at Munich airport and Pays Taxes and Fine for Undeclared Audemars Piguet Watch for Charity or Swiss Customs Targeting Watch Show Attendees

Patek Philippe Aquanaut Chronograph Reference 5968A on an orange strap

General rules of the road

Dealing with customs officials of any country can be sticky, especially if they discover you to be less than forthcoming about exactly what you’re bringing into or taking out of their countries. The problem is further complicated if the country produces the very watch brands in which you’re “trafficking.”

The first rule is to declare your watches and jewelry. Most advise on declaring each piece before entering the country. You can even do this before you leave home or at the border before setting foot in the country.

Next, know what each country requires you to declare. When returning home to a non-EU country (the U.S., China, Japan, and Canada among many others), generally you must declare every single thing you purchased during your trip abroad.

———————————————————————————————–

———————————————————————————————–

Don’t forget whatever you purchased at the airport like a watch at an airport boutique or an authorized dealer. Gift items are on the list, too, even though you’re just the “mule” in that case.

Grand Seiko Spring Drive Manual Wind Elegance

Be sure to understand that duty free only eliminates local taxes from the place of purchase. It doesn’t mean there’s no customs duty payable on entry into your home country. There is.

Of course, items you purchased with the intention of selling or to use in your business must always be declared. In many countries, gold is on the list of declarable items. What’s that watch you bought made of? Declare it.

Another rule that may be hard to swallow, especially when disembarking a 14-hour flight at 1:00 am is to be honest and forthright when questioned. Just suck it up and be nice.

Customs officials have a job to do. The less you say, the better. Simple yes or no answers work best. Customs agents don’t care about your nervous jokes, they just want to do their jobs and get you on your way so they can serve the next customer in line.

You probably won’t have to even open your bag. But just in case, don’t put anything in there you would hesitate showing to customs officials. They are pros. They can spot the latest Patek Philippe model from across the concourse. Should they request your credit card you can bet they’re going to run it to see the list of recent purchases.

———————————————————————————————–

———————————————————————————————–

How embarrassing to see a new watch purchase on your wrist, but conspicuously missing from your declaration form. Not to mention the resulting fines and duties payable, along with the hours it will take to get this simple misunderstanding sorted out. All while your [furious] family awaits your release from custody.

Rolex Cosmograph Daytona ‘WildCat’

Know the countries by their brands

If you’re worried about paying duty and VAT when entering or leaving a country, the first step is to firmly fix in your mind which brands each country produces. Your case is stronger when bringing in a brand that’s not produced in the country you’re entering.

Watch-producing countries by top luxury brand are as follows:

Switzerland: Patek Phillipe, Vacheron Constantin, Audemars Piguet, Zenith, Rolex, TAG Heuer, IWC, Omega, Piaget, Jaeger-LeCoultre, Hermès, and many more

Germany: A. Lange & Söhne, Glashütte Original, Nomos, and more

Japan: Seiko, Citizen, Casio

United States: RGM Watch Co., Shinola, Oak & Oscar, Weiss Watch Company, and more

Switzerland

Baselworld 2019 brought forth horror stories – see what happened to one of our friends at Fratello in Beware: Swiss Customs Targeting Baselworld 2019 – of Swiss Customs officials pawing through bags and “discovering” undeclared watches, even though these had already been the property of the owners for years.

These were sometimes assessed both an import duty and VAT on entering and/or leaving the country. There were also vintage watches that border agents attempted to attach a value to in order to assess duty when they had no idea what the watch was worth.

A vintage Vacheron & Constantin Reference 4560 triple calendar

After such [probably few, but well publicized] unfortunate experiences at the hands of Swiss customs officials, the unwitting travelers heading from Switzerland into Germany were at risk of running into the same thing all over again.

Here is what you need to know about Swiss Customs and how to avoid such grief.

———————————————————————————————–

———————————————————————————————–

QuickZoll: the Swiss army knife of customs apps

QuickZoll is the official Swiss customs clearance app for tourist traffic. It is available for iOS and Android operating systems and is free. With QuickZoll individuals can register goods for importation that they purchased abroad for their own use or as a gift. They can pay any applicable taxes and duties directly through the app. QuickZoll also summarizes the important facts about entry into Switzerland.

Personal goods already declared and/or cleared using QuickZoll can be imported through all border crossings into Switzerland.

Import/export rules

For the rules Switzerland employs at its border, see www.ch.ch/en/swiss-customs.

The VAT-free allowance for purchases in a single trip is CHF 300. Exceed that limit and you will pay VAT on the total value of all goods, meaning you would forfeit the CHF 300 VAT-free allowance.

You may import items for your personal use while in Switzerland free of any duty. This would presumably include a single watch to tell the daily time.

Importing more than one watch might well be subject to customs duty on entry and VAT assessment on exit. After all, border officials might think, “who needs more than one watch if they don’t intend on selling it as a commercial good?”

Declaration of goods on entry into Switzerland

Declare all watches before entering and then again when leaving Switzerland. Even vintage watches that you’ve owned for years as well as the watch on your wrist for your personal use. Fail to make this declaration and you risk being subject to import duty.

Failure to declare a watch (or several watches) subjects them all to a fine of CHF 1,500 and 7.7 percent VAT, which you will pay if the customs official determines that you’re importing commercial goods for sale.

Vintage pieces are even trickier. If you don’t have the original sales slip then the Swiss customs police must somehow determine its fair value. Customs officials usually have little familiarity with valuing vintage watches. I’ve heard stories of quick internet searches and even pricing from eBay auctions.

It’s always best to bring the original sales receipt for all watches you’re bringing into Switzerland. The serial number on the receipt should match that on the watch case. If you no longer have the receipt, next best is the guarantee card showing the serial number that matches that on the watchcase.

———————————————————————————————–

———————————————————————————————–

Refunding VAT paid

If you were assessed VAT on importing watches into Switzerland or if you purchased goods in the country for which you paid VAT, then you might attempt to receive a refund. Swiss customs regulations don’t make this easy.

You must follow several steps to even have a chance of actually receiving your VAT refund. Here they are:

- If you brought in one or more watches that you own, chances are you computed their value in your home currency. You need to convert it to Swiss francs (CHF). To do this you must use the correct exchange rate when completing the appropriate forms and assigning value to your watches. The exchange rate should be the spot rate as of the last trading day before the import tax liability arose. You might wish to retain copies of the spot rate reports in your workpapers as proof of your computations. You just may be given the opportunity to prove your work.

- If you’ve already imported the watches and declared them as commercial goods you need to complete export forms for the purpose of getting a computer-generated export code that you’ll need later on in the process.

- When leaving, at the border Swiss officials will again inspect your watches to determine that they are indeed the exact ones that you brought in, paid import duty on (or declared), and for which you’re claiming a VAT refund. This may not be as easy as it seems. It is not in Switzerland’s best financial interests to accept that the watches you’re exporting are indeed those you imported and are requesting a VAT refund. It is best to have all receipts and that all serial numbers match.

- Assuming that customs officials accept your claim that you are exporting the same exact watches you imported, you will need to write a letter to the Swiss customs officials explaining that you owned the watches before ever entering Switzerland and that you paid the fine and the VAT and are now asking for a VAT refund.

- If you are extraordinarily lucky, you may one day receive some part of your VAT back. But don’t hold your breath.

When leaving Switzerland and moving on to another European country there is likely an importation tax on commercial goods; Germany’s, for example is 19 percent. You’ll need to do the whole declaration and proof thing again, so don’t put away your paperwork, receipts, and matching serial numbers.

Rolex Datejust 36 Reference 126234

Bottom line: declare everything with unassailable documentation and proof that you are the owner and not importing commercial goods for sale.

Better yet, just leave your valued watches at home except perhaps for one whose retail value is modest (less than 300 CHF, the maximum you’re allowed before taxes begin piling up). Be sure your prior ownership is readily provable with a sales slip and/or a quick internet search on your smartphone.

The Swiss are generally polite and as considerate as possible. Just don’t cross them. They have been burned all too often by travelers trying to beat the system. Return their civility, don’t lie, and follow their rules. You’ll be fine.

———————————————————————————————–

———————————————————————————————–

Germany

Navigating customs between European Union countries is quite easy as there are no limits on what individuals can buy and take with them for their personal use when traveling between EU countries. However, the products purchased must not be for resale.

Taxes (both VAT and excise tax) are included in the price in the EU member state of purchase. No further payment of taxes is due in any other EU member state. Still, be ready to prove that you purchased the items within the EU and paid the requisite taxes.

A. Lange & Söhne Lange 1 25th Anniversary Edition

Definition of personal use or consumption

Such goods must be exclusively for your personal use or consumption, for members of your household, or as a gift. You may not bring in goods for other people for a consideration. In other words you cannot buy multiple German watches for your friends for a fee – essentially acting as their mule – and hope to avoid a tax assessment.

Maximum value before assessing import duty

There are two maximum values of imported goods depending on how you enter Germany. If you’re traveling by sea or air, the imported value allowed is €430. If you enter Germany by another conveyance, the imported maximum value before duty assessment is €300. Both limitations are for a single journey.

Germany defines a single journey as ending when you return to your home in your own country or when you have arrived at your destination in Germany. This eliminates those attempting to use the travelers’ allowance by crossing the border multiple times in succession.

Glashütte Original Sixties Green Panorama Date

If the value of an item(s) exceeds the threshold, then duty is assessed on the total value without credit for the threshold amount.

Once you have exceeded the duty-free limit, you must pay VAT of 19 percent along with varying customs fees on the value of the item.

One more rule

As proof of non-commercial export, a completed form called Ausfuhr- und Abnehmerbescheinigung für Umsatzsteuerzwecke bei Ausfuhren im nicht kommerziellen Reiseverkehr, or some other documentary evidence, should be completed by the shop where you purchased your goods.

This alternate evidence can be an invoice showing the name and address of the shop, the commercial description(s), and quantity of the goods exported and endorsed with a valid stamp imprint by the customs point of export. You should print this form and keep several copies with you when shopping duty free in Germany. Some shops don’t have them.

———————————————————————————-

———————————————————————————————–

In Germany, as in all countries, keep your sales receipts handy when crossing borders. And be sure the serial numbers on the receipts match those on the items you purchased.

Japan

For a country with a reputation for precision, its customs system isn’t. Before you depart for Japan look up its customs procedures at www.customs.go.jp/english/index. This provides some indication of what must be declared, when, and how to declare watches you’re bringing into the country.

Generally, goods for personal use while in the country can be imported without any duty assessment. This includes one watch for telling daily time.

Calculating import duties

Japanese customs has prepared an online brochure you can see at www.customs.go.jp/zeikan/pamphlet. Here’s a summary of the rules:

- When entering the country, all visitors much complete a “Declaration of Personal Effects and Unaccompanied Articles” form. List all items being brought into the country that belong to you.

- Wristwatches whose value exceeds ¥150,000 are subject to both an excise tax and local excise tax. Foreign market value up to ¥150,000 is not taxable.

- Watches over that amount incur assessment on the full value without credit for the ¥150,000 nontaxable amount.

- The actual calculation follows:

- Take 60 percent of the watch’s market value in yen using the most recent spot price from the last trading day for foreign currency translation. Keep your workpapers.

- Federal excise tax computation: multiply the 60 percent discounted foreign market value by 6.3 percent. The result is the excise tax payable in yen on imported watches not for personal consumption.

- Local excise tax computation: multiply the federal excise tax (computed in “b” above) by 27 percent. Now you have the local excise tax payable in yen.

- Here’s an example:

- Foreign market watch value is ¥$350,000

- Excise tax computation:

¥350,000 X 60% = ¥210,000

¥210,000Y X 6.3% = ¥13,230 = excise tax payable

- Local excise tax:

¥13,230Y X 27% = ¥3,572 Local excise tax payable

Total tax payable on importing a ¥350,000 watch is 13,230 + 3,572 = ¥16,802

This is about 5 percent tax.

Be careful when completing the “Customs Declaration Form.” Question #2 on the form asks if you’re bringing in gold bullion or products of gold. Since many watches are considered products of gold, don’t be so quick to answer no.

Should you buy one or more watches in Japan, be sure to request a record of purchase and attach it to your passport. The record of purchase will be taken at airport customs when you leave.

Forms required when leaving the country

You’ll need to complete the “Registration for Carrying out Foreign-made Goods” form to declare any non-Japanese goods in your possession. Fill in the description and quantity of watches, bags, necklaces, and so on you purchased in the country and submit it to customs. Without this registration, these goods cannot be distinguished from articles purchased abroad and they may be dutiable in some cases.

Seiko Prospex 1970 Diver’s Re-Creation Limited Edition

The next form to complete is the “Declaration of Carrying of Means of Payment.” When departing or entering Japan, you will need to declare if you carry cash exceeding one million Japanese yen or its equivalent. This includes cash, checks, and gold of more than 90 percent purity.

———————————————————————————-

———————————————————————————————–

Many high-end Japanese watch shops are duty free. In Japan there is currently an 8 percent consumption tax on all goods sold. This rises to 10 percent in October 2019. Why pay it if you don’t have to? I recommend shopping at registered duty-free watch shops.

Should you shop at non-duty-free venues the consumption tax is refundable in full. The consumption tax refund procedure in Japan is somewhat easier than in other countries where you need to present your purchased goods in the airport.

Also, be aware that in Japan when shopping at duty-free venues be sure to bring your passport. Depending on the store you purchase your watch(es) from, they can either charge you the price of the watch minus the consumption tax or charge the full price and send you to a customer service counter to get an immediate cash refund.

Italy

Italy is a member of the EU, and traveling between its member nations is relatively easy. When traveling to or from non-EU member nations, you need to be aware of Italian customs rules.

In Italy, the VAT is called the IVA. Its current rate is 24.2 percent.

Importing goods from non-EU countries

Like all EU members, Italy levies a common tariff on imported products coming from non-EU countries such as the United States, Japan, China, and Canada. If you bring more than one watch into Italy it just may be subject to an import duty of 22 percent in Italy.

The value limit of imported goods is €175.50. Thereafter, you will be assessed the 22 percent import duty.

Goods purchased in Italy

Italy has many duty-free shops. Should you purchase items that are not duty free, you may wish to obtain a refund of the VAT paid (at a rate of 24.2 percent) when leaving the country.

The minimum purchase amount spent at one time at one store to submit a VAT refund in Italy is €154.94. So you’re better off finding one place where you can buy several things whose total accumulates to the VAT refund minimum.

Many shops will remove the VAT (IVA) from the price of the item before closing the sale. If not, then presumably you will be declaring your purchases at the border when leaving Italy. As always, you need to keep all sales slips.

Obtaining a VAT refund

Many people apply for their VAT refunds at the airport before leaving Italy. The first step is to go to the airport customs office and enter the IVA refund line.

The customs officer will review all of your purchases and compare them with your receipts. The officer will stamp all receipts. Major purchases, such as a watch, will need to match serial numbers on the receipt, the watch case, the warranty card, and anywhere else it might appear.

Panerai Radiomir 1940 Chronograph

If you dealt with some of the larger merchants, they are likely to have a branch at the airport. Premier Tax Free is one of the most common. Take your stamped receipts to the merchant branch and receive your cash IVA refund right there.

If your merchant has no airport branch mail your stamped receipt to them, requesting an IVA refund. Of course you may never see a refund or ever hear from the merchant. Even if they should send your refund it may come as a check in euros. You’ll likely lose a part of your refund in conversion fees and foreign currency translation.

———————————————————————————-

———————————————————————————————–

United States

If you want to bring some valuable foreign-made items back into the U.S. that you owned before leaving – like watches and jewelry – you can register them at a U.S. Customs and Border Protection (CBP) office or at the airport. You’ll need the items and their serial numbers to fill out the registration forms. Once they’re completed and filed you shouldn’t have any problems bringing your belongings back into the U.S. on your return.

The U.S. has a tax exemption of $800 per person on items bought abroad. Family members can combine their $800 tax exemptions in a joint declaration of value.

Items valued $1,000 over the exemption are taxed at three percent. Beyond that, the tax rate climbs to 6.5 percent.

RGM Caliber 801 Classic Enamel

You should declare watches and jewelry you purchased abroad. It doesn’t matter if they’re for your business, from duty-free shops, or gifts you received. Declare them.

The duty-free status of items purchased in duty-free shops only applies in the country where they were purchased. You just may have to pay an import duty on them when you enter the U.S.

Shipping from foreign countries into the U.S.

Someone with experience in shipping purchases from Europe to the U.S. in order to avoid U.S. Customs duty has told me that shipping by USPS rather than any other shipper (especially FedEx, I’m told) is less prone to discovery, levying a fine and the customs duty payable. Even so, the CBP is so sophisticated that it would surprise me if the loophole of shipping taxable goods into the U.S. has not already been discovered and slammed shut.

My advice? Don’t try it. The fine if discovered is far greater than just paying the tax.

Managing your VAT refund

There are apps available to assist in computing the VAT refund, locating its refund point should you want it paid in cash rather than credited to your credit card, and tracking its progress worldwide.

One of the apps I uncovered in my research for this article was Global Blue. There are others including WeVat Tax Refund, Stamp-Tax-Free, and Custom Cash—Tax Free Shopping.

Final words of advice

Don’t try skirting the customs system. Any amount you might save in duty and VAT payments would be more than swallowed up if you’re caught. And you’ll quite likely be caught.

Few casual travelers are professional smugglers. But every customs agent is a trained professional. The odds are so far against you.

Be honest when questioned by agents. Be courteous. Don’t be defensive. They’re just trying to do their jobs.

If you really don’t want to deal with the customs system, leave your valuables at home and don’t buy anything on your trip. But where’s the fun in that?

Safe travels.

* This article was first published on May 17, 2019 at Yes, You Must Pay Duties And Taxes On Your Personal Watches When Traveling, But Here’s How To Avoid The Worst.

You may also enjoy:

Shopping The Airports For A Luxury Watch: Customs, Duties, And Discounts Explained

Selling Watches To Buy Watches: One Collector’s Story

Leave a Reply

Want to join the discussion?Feel free to contribute!

This has got to be a joke. I’ll reread this when I’m not on the schi11er, but as best I know it if it’s a watch that’s yours you can go freely across borders. If you buy a watch overseas and try and bring it back without paying sales tax in your home country, beware; but that’s at your risk. Surely the presumption is you’ve paid taxes in your home country. I mean, seriously, the tenor of this article is that we are nothing but property of governments and they can decide at a whim what they want to do with us. As for Mr. Schwarzenegger, wasn’t his watch for sale in the destination country? That’s different than say, me, going on vacation to the South of France with a sport watch and a couple of dress watches, then maybe popping up to Zurich to see my cousins, before heading back to my home in the US? I’ve seen this article before. I call BS. I’ve never had a problem and I go to Europe (CH, GB, France, Italy, Germany) about once every 5 weeks.

Hi Will, a few points you made are worth refuting in case any readers think your advice is sound (it isn’t).

1. The presumption you have already paid taxes in your home country has nothing to do with having to declare your watches when entering another country. You are unlikely to get in trouble if traveling with just one watch on your wrist, but traveling with more than one elevates the risk. Countries don’t care that you already paid tax at home, they care if you are potentially bringing in wa watch (or watches) for sale in their country without paying them any potential taxes due.

2. Schwarzenegger did not get in trouble because he was selling his watch in another country, he got fined because he did not declare it to customs. If he had declared it he would not have had to pay anything. Europe exempts taxes on watches sold for charity but you still have to declare them.

3. If you are traveling to the South of France with a sport watch and a couple of dress watches, then maybe popping up to Zurich to see your cousins, before heading back to the US, you are breaking the law by not declaring your watches. The fact that you haven’t been caught only means you have been lucky, let’s hope your luck holds out.

Declaring watches you intend to take home doesn’t mean you have to pay taxes on them, not if you can convince the customs officer you do intend to take them all home. Not declaring them though is automatically a crime.

Regards, Ian

Hello Ian,

Interesting points, and certainly better articulated than my rant while having my morning constitutional. Still…

1) Based on what you’re saying, then everything is subject to declaration and potential tax (Heil, mein Führer!). I’m lucky enough to get my clothes made both in NYC and on Savile Row. My jackets, for example, have a value in excess of $4,000 or $5,000. I might travel with three of them. Surely, based on this logic, they must be subject to declaration, too?! Of course, they all have my name in them so they’re unlikely to be sold on. But what if I’m brining in a couple of Kitons at $6K a pop? Furthermore, sales tax is paid by the buyer, not the seller, at least, that’s how I understand it to be in the US. And what about, say, an Hermes bag? Some of them, as I’m sure you know, are tens of thousands of dollars. Should they be declared every time one crosses a border?

2) Really? Wasn’t it because it wasn’t part of his personal property?

3) Again, I travel to Europe from the US about once every 5 weeks. Switzerland, France, UK, Italy and then perhaps Germany, Spain… I’ve never been stopped or questioned. I’ve never seen an advisory telling me what I can or cannot bring in. Given the absurdity of what this article claims don’t you think it would be everywhere: Achtung traveler! If you are traveling with jewelry or watches or bags or any articles over the value of “X” you must declare them even if you are only in transit? Six weeks ago I went Tokyo. I wore a WorldTimer on one wrist and an Aquanaut on the other… Was I, again, lucky?

I’ll do some additional research. But, honestly, this sounds utterly absurd. While I’m also British and Swiss, I’m an American and that’s where I reside and pay taxes. I don’t own property outside of the US and I don’t earn anything outside of the US either. There has got to be the presumption that what I’m carrying on me is mine and while customs might understandably question someone with more than a few watches on them, I struggle to believe that the burden of the law is such that anyone with more than one watch, or one bag, or one pair of bespoke Gerling shoes is required to declare them? Could you imagine what would happen at airports if everyone with a Rolex declared it? Mad.

Hi Will,

1. Personal effects are usually not subject to paying any tax/duty if you are not planning to leave them in the country you are visiting, but in regards to items like watches, having more than one makes it more open to question whether you plan to export it again or plan to sell it. Watches are of particular concern to Swiss customs because they know there are lots of watch auctions held there. And Swiss customs are well aware when the big auctions and fairs are.

2. No, Schwarzenegger’s watch was his personal property and I’m sure all US taxes were paid on it. He got fined because he did not declare it and was not planning to re-export it himself https://www.theguardian.com/film/2024/jan/17/arnold-schwarzenegger-detained-munich-airport-over-luxury-watch

3. “Achtung traveler! If you are traveling with jewelry or watches or bags or any articles over the value of “X” you must declare them even if you are only in transit? Six weeks ago I went Tokyo. I wore a WorldTimer on one wrist and an Aquanaut on the other… Was I, again, lucky?”

Yes, you were lucky. And no, being in transit doesn’t count because you are not going through customs/entering the country.

This is the Japanese regulations: “Clothes, toiletries, and other personal effects for your personal use, as well as portable professional equipment that will be used during your stay in Japan, are all free of duty and/or tax, if they are considered quantitatively appropriate and are not for sale.” As long as your view on what is “quantitatively appropriate” AND you can convince customs you do not intend to sell then there’s no problem. The Swiss customs is harder to convince if you enter with multiple watches before big watch auctions.

It’s worth reading https://www.fratellowatches.com/beware-swiss-customs-targeting-watches/#gref

Regards, Ian

p.s. It’s worth highlighting that the article was not focusing on watches you have owned for years and are wearing while traveling, but watches that you might have bought overseas in Duty Free or at an auction etc., and are importing back to your own country.

Ian,

But that’s my point. Was it, or wasn’t it? Because really, it’s saying you should declare watches when you enter a country. Can we perhaps have some definitive clarity? I’m a watch fan; indeed, a minor collector. I’ve never sold a watch I own. And I generally travel with at least two watches worth north of $40K. These are MINE. My Patek WorldTime is white gold has a dark blue band and my Patek Calatrava is yellow gold and has a brown one. I wear them depending on what clothes I’m wearing. And I may, actually wear a sport watch (generally an aquanaut) to travel in. This article says I should declare them when crossing borders. Yet your now saying maybe not… What am I missing?

If you are traveling with one watch on your wrist that you don’t intend to sell then you do not have to declare it.

If you traveling with a watch you are not wearing it on your wrist, whether its your only watch and your put it in a case for protection, or if its a second (or third) watch to wear, then you should declare it. If you convince the customs officer that you are not planning on selling them and you just like to swap watches depending on what you are doing/wearing, they will thank you and let you go with nothing to pay.

If a customs officer finds a watch (especially a second watch) in your pocket or luggage and you have not declared it, then the suspicion is now on you and you have an uphill battle to fight.

This is especially a risk if you are traveling to Geneva for a big watch fair or auction weekend because Swiss customs are on high alert for taverlers with more than one watch.

Regards, Ian

p.s. the fact that they are your watches means absolutely nothing (except you didn’t steal them). What customs are worried about is that you intend to smuggle a watch or watches into their country to sell them without paying any duty due. Having proof of ownership, does not prove you do not intend to sell. And remember, by not declaring your watches on entry, you have already potentially broken the law, no matter what else happens. All the customs officer has to think is that 2 or more watches is not reasonable in their view. There’s no comeback to that.