Morgan Stanley-WatchCharts 1st Quarter 2025: Price Contraction Continues but at the Lowest Quarterly Rate since 2Q22

by Ian Skellern

From the Morgan Stanley-WatchCharts State of the Secondary Watch Market Report for the 1st Quarter 2025.

Morgan Stanley would like to thank WatchCharts for their contribution of secondary watch price data to our analysis in this report. WatchCharts is a research platform for pre-owned watches, and not part of Morgan Stanley’s Research Department.

Investment implications. Overall, prices of watches on the secondary market have continued to decrease in 1Q (for the twelfth quarter in a row), albeit at the lowest rate since 2Q22, with private players performing better than the listed names: 1Q25 prices are down -0.4% QoQ (vs. -1.6% in 4Q24).

As a group, LVMH was the worst performer in 1Q25, with prices down -3.2% QoQ / -8.5% YoY. The better relative performance from Zenith and Bulgari was offset by poorer trends from TAG Heuer and Hublot. Cartier (-1.1% QoQ) fared better than the other Richemont brands, improving from 4Q24 and maintaining its resilient position among mid-level brands.

Swatch Group’s performance was largely dependent on the outperformance of Omega within its portfolio (-1.0% QoQ), while many other brands performed poorly. Looking ahead, with volatility around tariffs (see note here) and a weak start to the year, with exports down -2.4% in the first two months in 2025 (see our note here), we expect the primary market sales to contract further – at least -HSD in the year (decline was -2.8% in 2024), with the three listed groups (LVMH, Richemont, and Swatch) likely continuing to underperform the market (see also our takes from Watches & Wonders here).

What’s new? We break down the latest trends in the secondary watch market in 1Q25 in this note, using data from secondary watch market research platform WatchCharts. Tracking the price evolution of secondhand watches is interesting for equity investors, as in general, it provides a good barometer of a brand’s desirability and thus future pricing power/growth trajectory.

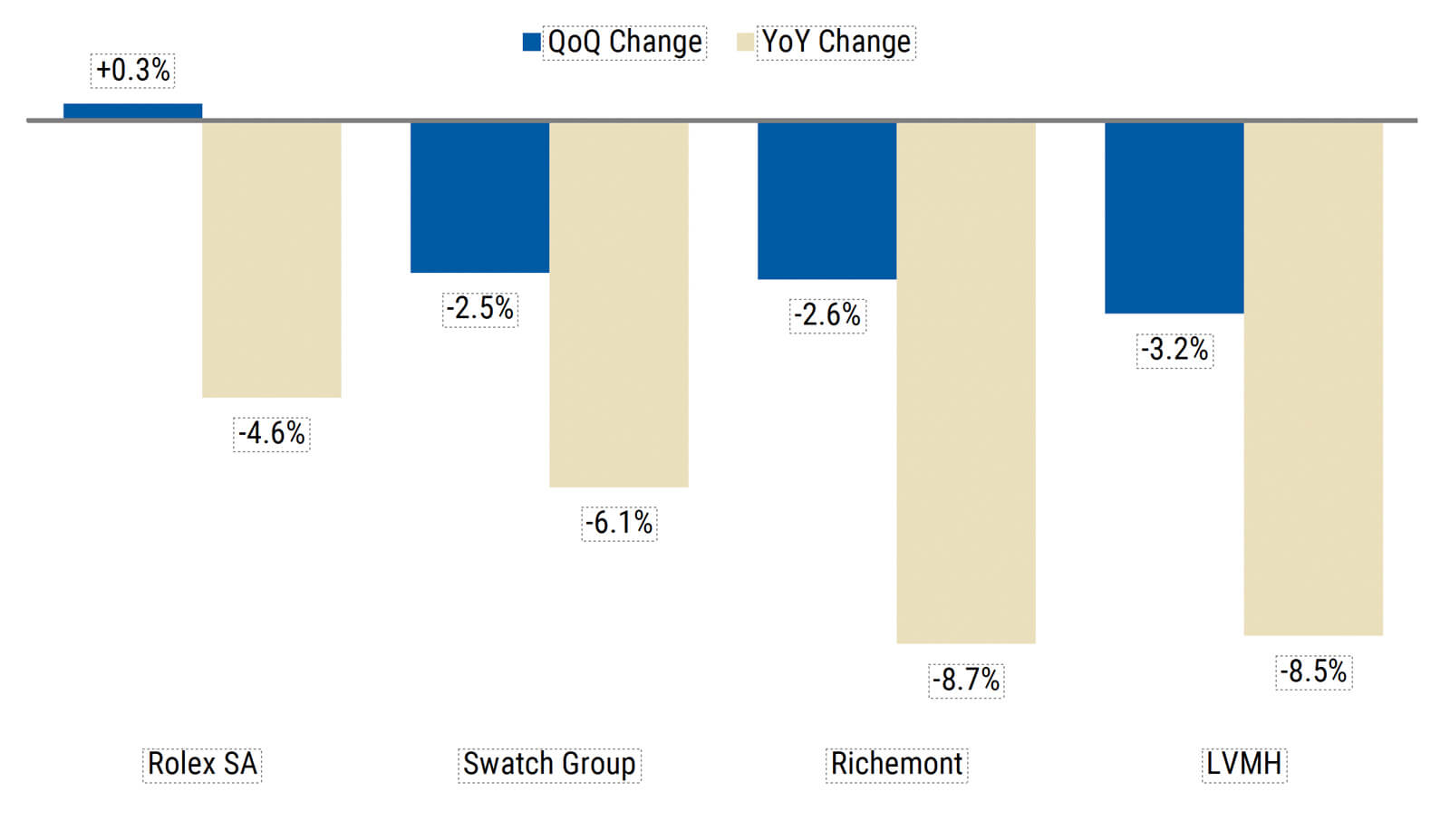

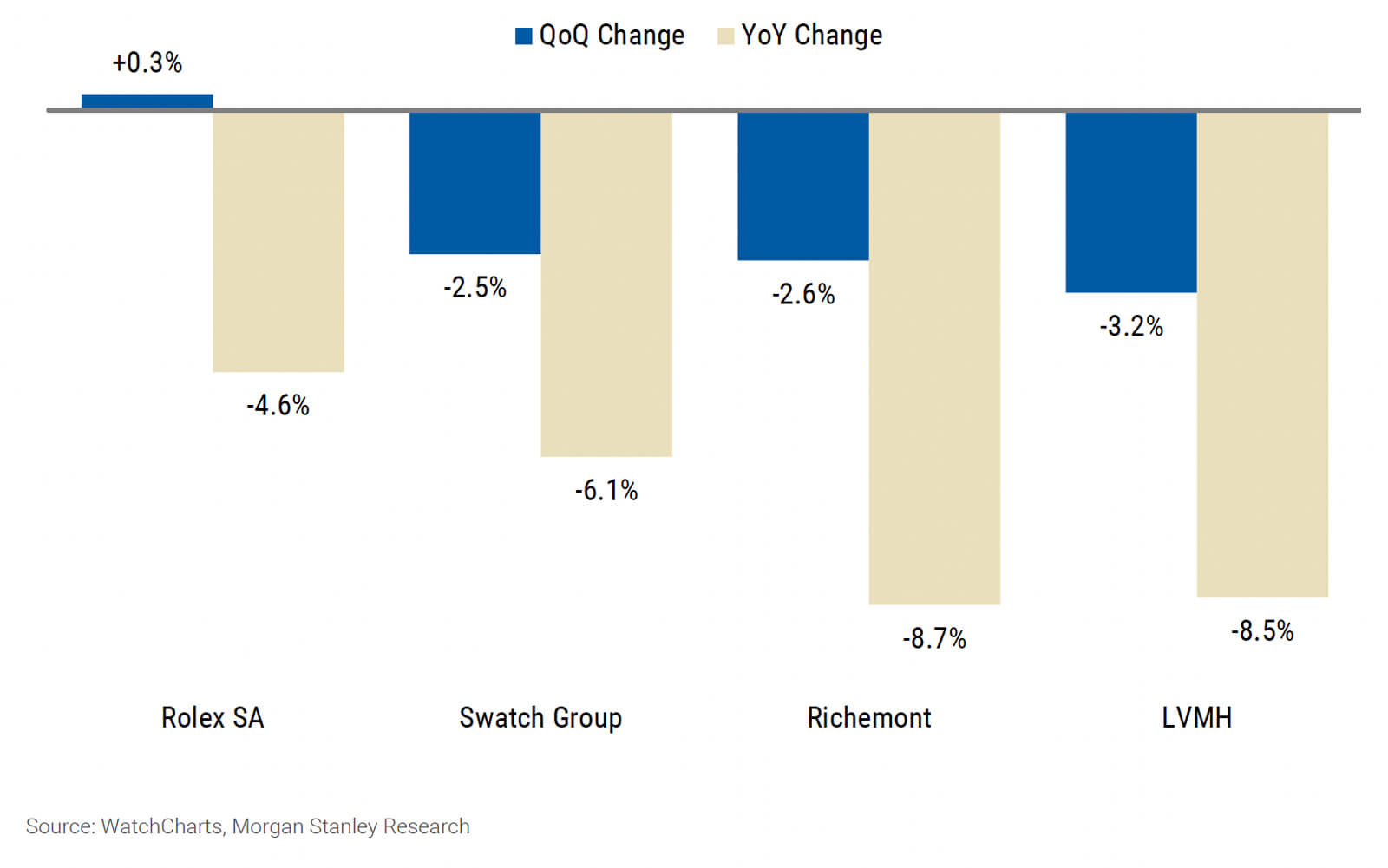

QoQ and YoY trend of WatchCharts price tracker for Swiss groups in 1Q25

What the data says:

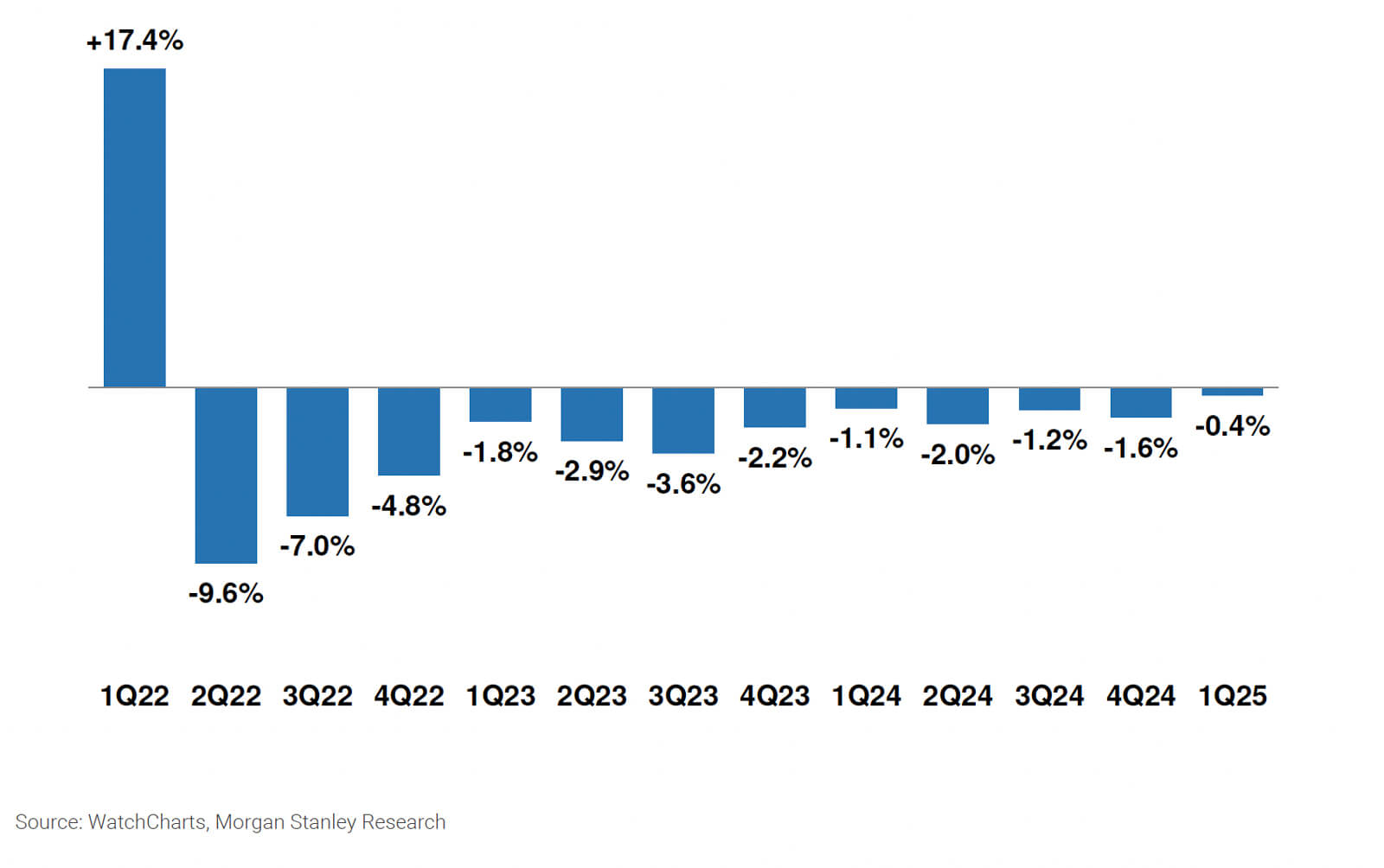

Secondary prices continued to fall in Q1, though the WatchCharts Overall Market price tracker fell only -0.4% QoQ in 1Q25, representing the lowest quarterly rate of decline since 2Q22 (marking 12 consecutive quarters of declining prices).

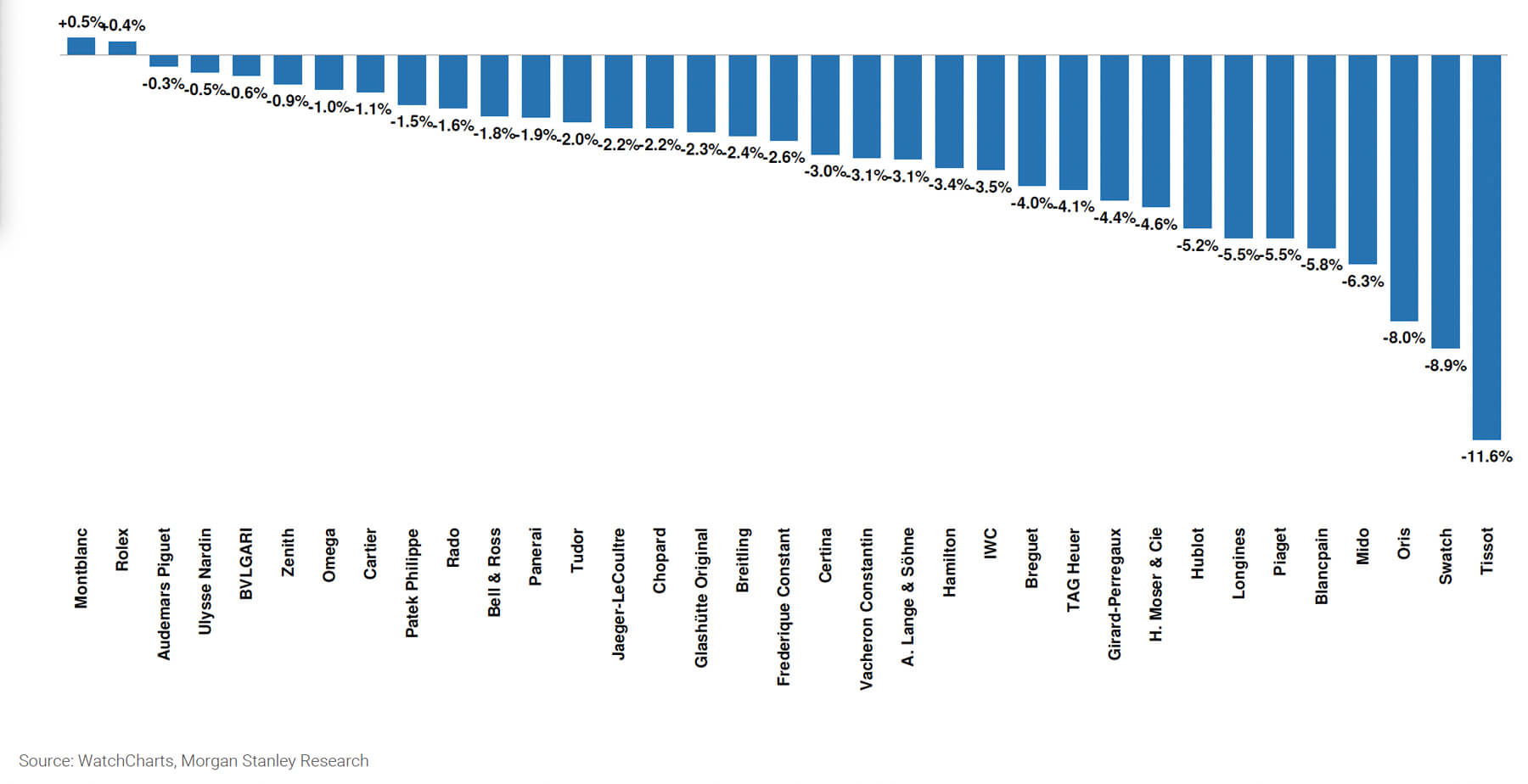

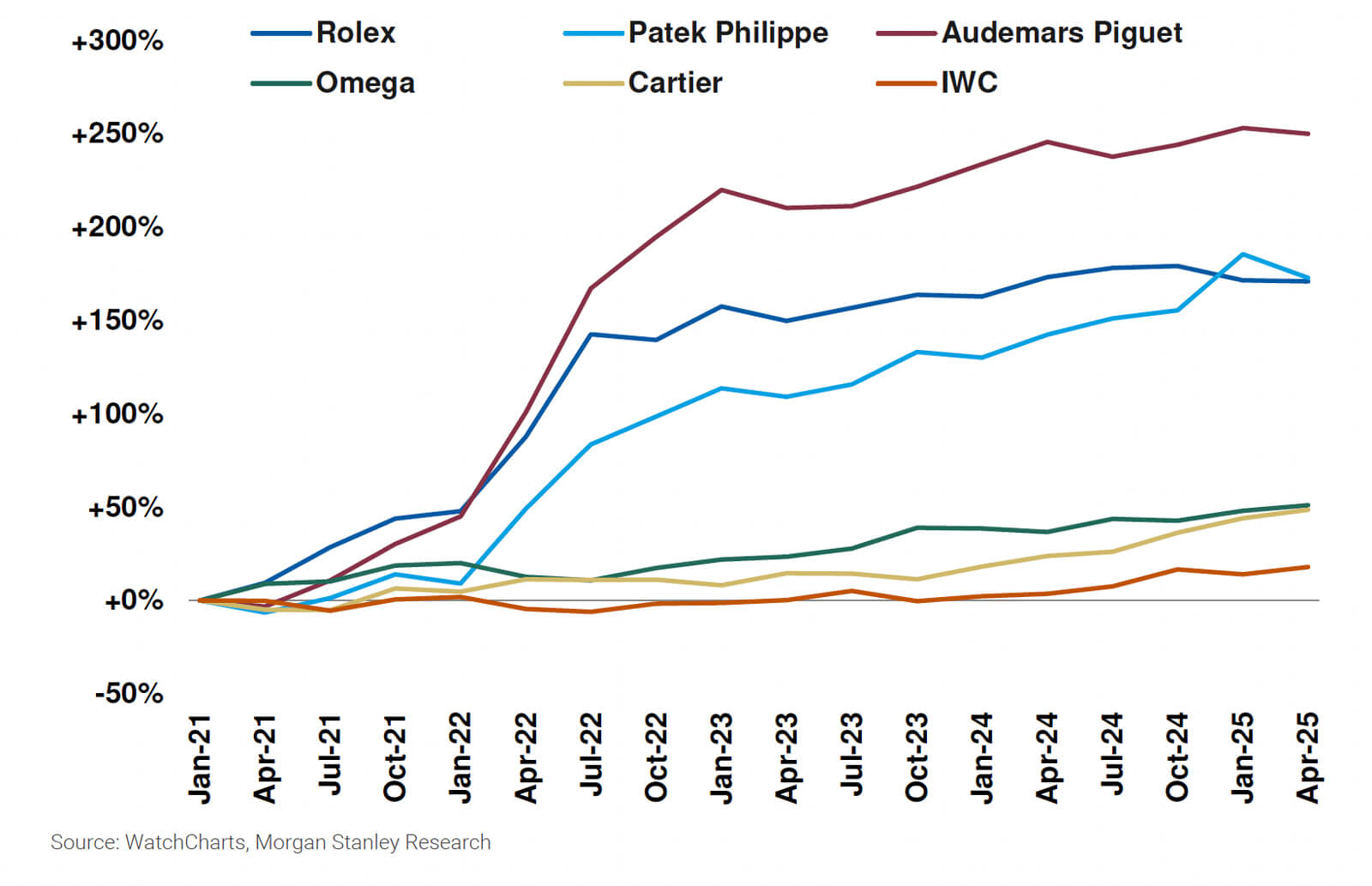

However, we note that this performance is now shaped more by the Big Three (Rolex, Patek Philippe, and Audemars Piguet), which were among the strongest brands in the quarter, while the listed players underperformed. Nevertheless, among the 35 Swiss watch brands we track, only two (Rolex and Montblanc) saw a positive QoQ performance.

Private players continue to outperform, while the listed names struggle… Rolex (+0.4% QoQ), Audemars Piguet (-0.3% QoQ), and Patek Philippe (-1.5% QoQ) were among the best performing brands in 1Q25 (ranked #2, #3, #9 respectively) in secondary watch prices.

This trend has inflected from 2024, when together they placed more in the middle of the pack (and even more so from 2023, when the Big 3 were really leading the decline), and is more reflective of trends in the primary market, where they continue to take market share (see our eighth annual Swiss Watcher here).

…with the exception of Cartier (which we estimated accounted for ~45% of Richemont’s primary watch sales in FY24), which fared better, ranking above Patek Philippe in #8 position, seeing prices drop QoQ by only -1.1%, rebounding from -2.2% in 4Q24. This relative outperformance is again reflective of the brand’s performance in the primary market – we estimate Cartier expanded its market share by +65 bps in 2024 to 8%, solidifying its no. 2 ranking.

Nevertheless, demand for watches on the secondary market remains for many brands. Despite falling secondary prices, supply has risen, whilst the rate of inventory turnover has remained consistent (as is the case for the likes of Cartier, Omega, and IWC, to name a few).

Looking ahead: 1. Flight to quality during volatile times could result in consumers choosing the ‘safer’ investments, favouring brands such as Rolex, Cartier, Audemars Piguet, and Patek Philippe, which are more like to hold their value (to the detriment of the listed players).

But at the same time, 2. as awareness around residual value grows, mid-size players (such as A Langes & Sohne and IWC, etc.) that resell at discounts of -30% to -40% to the retail market could have the potential to perform better on the secondary market. As consumers are increasingly educated around the price differentials, they may prefer the secondary channel, to the detriment of the primary market – we note that whereas some of the brands might be down -DD in the primary market, sales in the secondary market are up +SD in some cases.

Performance by group:

- LVMH (-) saw the largest sequential drop in Q1 as prices overall fell -3.2%QoQ, but performance varied by brand. While Bulgari (-0.6% QoQ), likely benefitting from the year of the Snake, and Zenith (-0.9% QoQ ) prices fell less than -1% QoQ, TAG Heuer (-4.1% QoQ) and Hublot (-5.2% QoQ), with most models retailing at a high price point of the low-five-figures, performed worse. LVMH will report 1Q25 results on Monday April 14th post close (VA cons. currently expecting the Watches & Jewellery division up +2.1% yoy at cons. FX, sequentially down from+3% in Q4).

- Richemont (=) brands continue to steadily decline as the prices of its watch brands (aside from Cartier) fell -LSD QoQ, with the likes of Vacheron Constantin down -3.1% QoQ, Jaeger LeCoultre down -2.2% QoQ, and IWC down -3.5% QoQ. Richemont will report 4Q/FY25 results on Friday May 16th. We currently expect the Specialist Watchmakers division to post a CER decline of -6% in the quarter ending March (see our preview here), and we see the consensus figure for the fiscal year March-26 of +4% as too high (MSe -1%, with further potential for downside risk).

- Swatch Group (-) saw prices decline -2.5% QoQ in 1Q25 with top brand Omega (we estimate made up ~75% of the group’s profits in 2024) prices declining ‘only’ -1% QoQ and failing to offset the poorer performance of other brands. Swatch and Tissot were notably the 2 poorest performing brands in the quarter, with prices declining -8.9% QoQ and -11.6% QoQ respectively. The Swatch Group is expected to report 1H25 results at the end of July (MSe currently forecasting a topline contraction of -5% CER, below css of +1%).

What’s new in 1Q25

Below we provide some of the key trends for the secondary watch market in 1Q25.

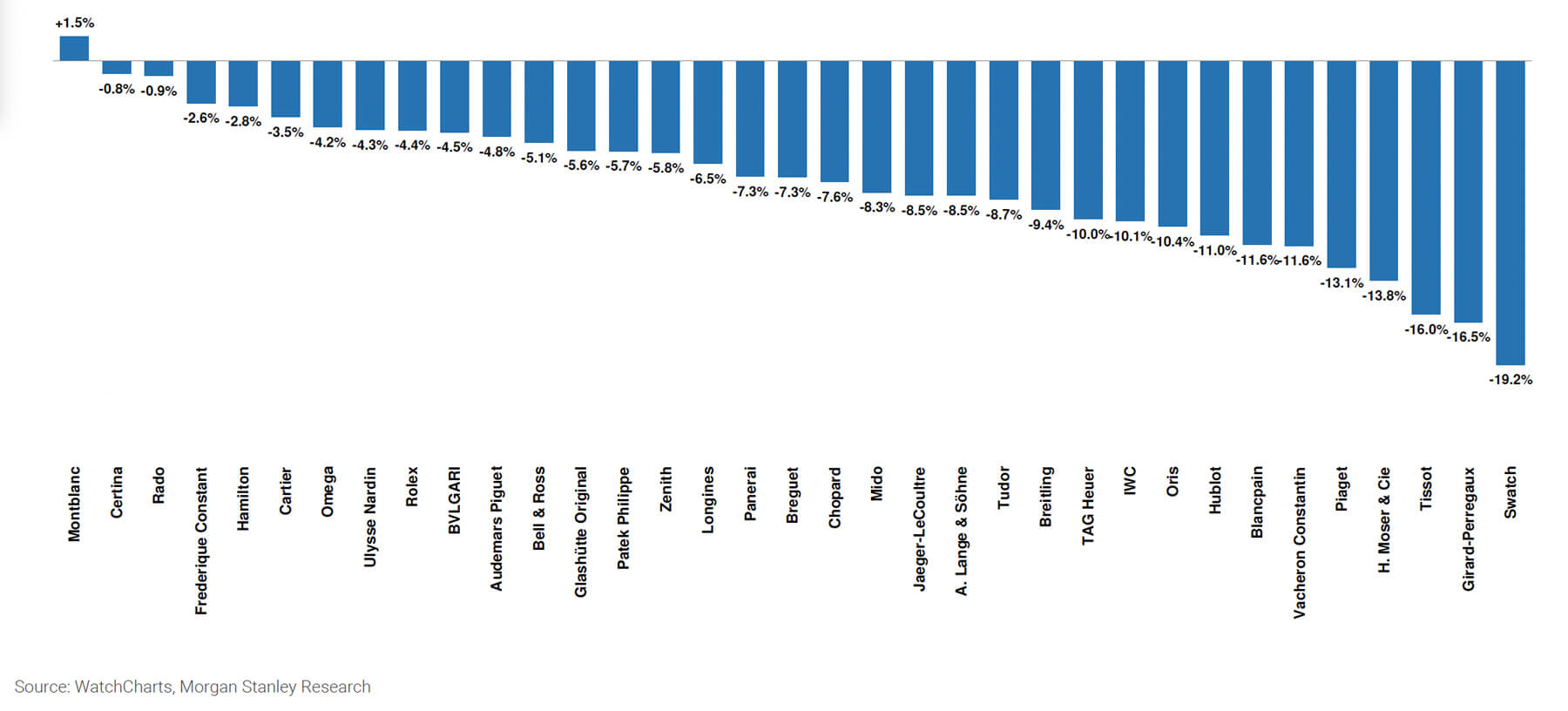

Secondary prices fell -0.4% in 1Q25, representing the lowest quarterly rate of decline since 2Q22 (marking 12 consecutive quarters of declining prices). However, we note that while this represents the lowest quarterly rate of decline 2Q22, performance is now heavily biased towards the Big Three (Rolex, Patek Philippe, and Audemars Piguet), which were among the strongest brands in the quarter while the listed players underperformed. Additionally, among the 35 Swiss watch brands we track, only two (Rolex and Montblanc) saw a positive QoQ performance.

Private players continue to outperform while the listed names struggle overall… Among the four major Swiss watch players, Rolex SA prices rose +0.3% QoQ, while Swatch Group, Richemont, and LVMH all fell around -3%. QoQ (see Exhibit 1 ). The top 10 brands included Rolex (+0.4% QoQ), the second best performing brand in the quarter, Omega (-1.0% QoQ), #7 and Cartier (-1.1% QoQ).

However, most other brands from the listed groups struggled. Vacheron Constantin (-3.1%), A. Lange & Sohne (-3.1%), and IWC (-3.5%) from Richemont all lost more than 3%, while TAG Heuer (-4.1%) and Hublot (-5.2%) from LVMH fared even worse.

Overall secondary demand remains resilient, but pricing power of the listed groups may be eroding. We saw an improvement in market health indicators for the Big Three, with a correction in Rolex supply levels being particularly encouraging. Among the key brands from listed groups, secondary demand remains generally strong despite falling prices.

We believe that some of this demand may be coming at the expense of retail sales, particularly when taking into account increasing secondary market discounts and significant YoY declines in retail sales for many brands (based on FY24 LuxeConsult, the leading Swiss watch consulting firm, estimates – see our note here).

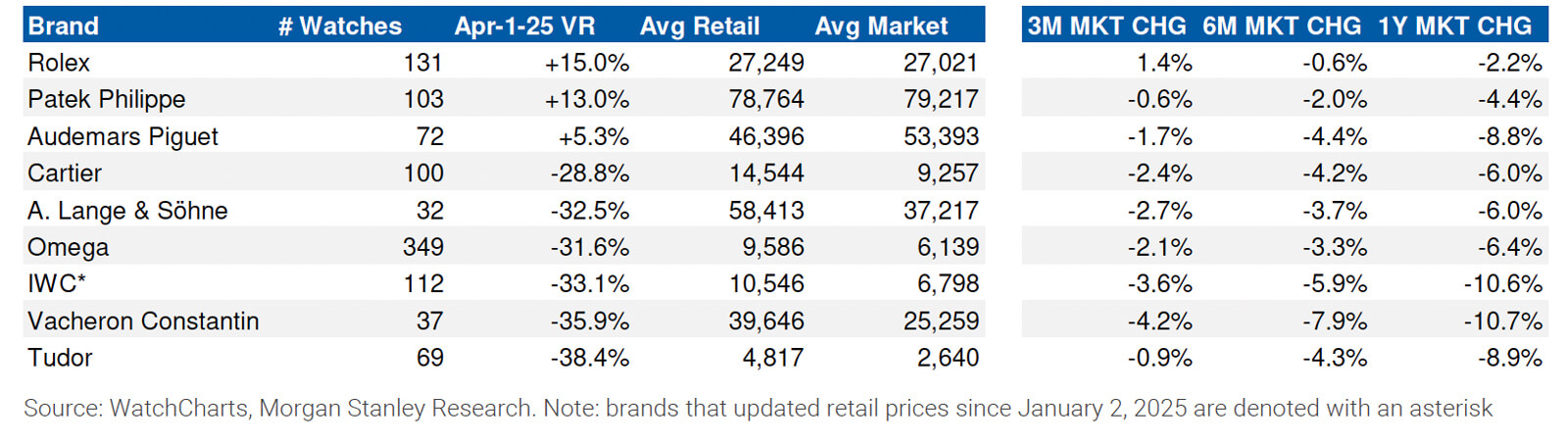

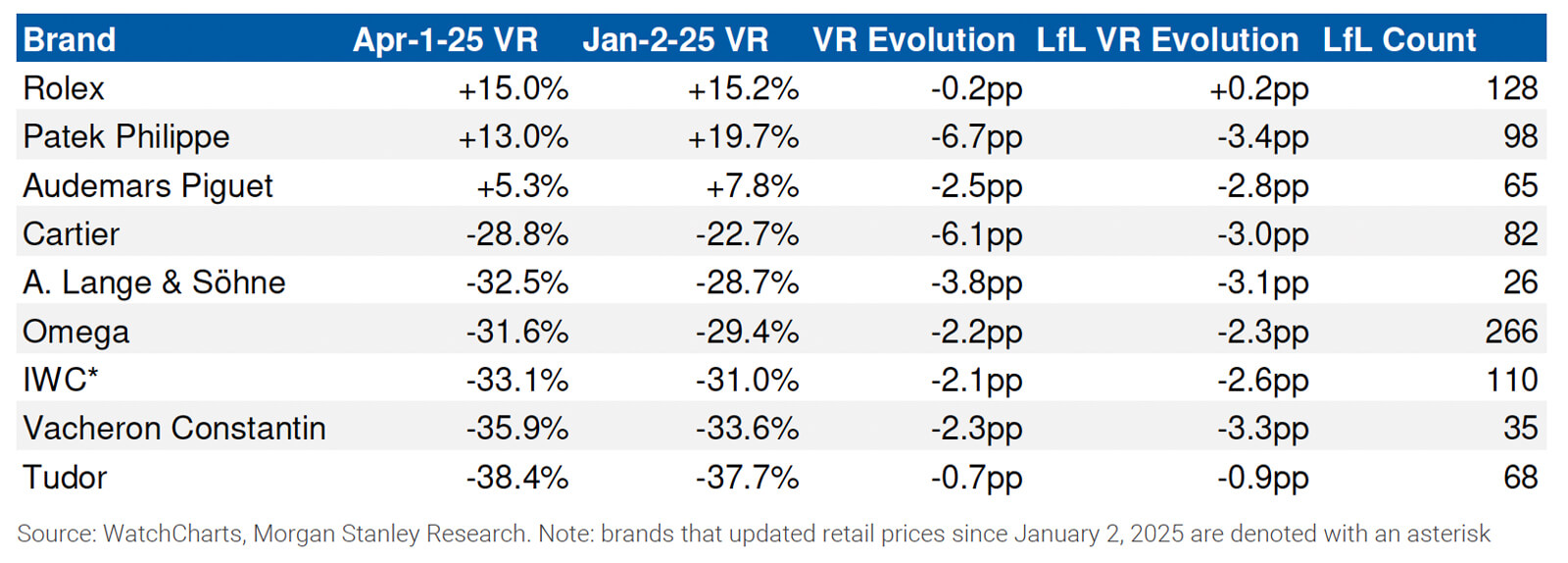

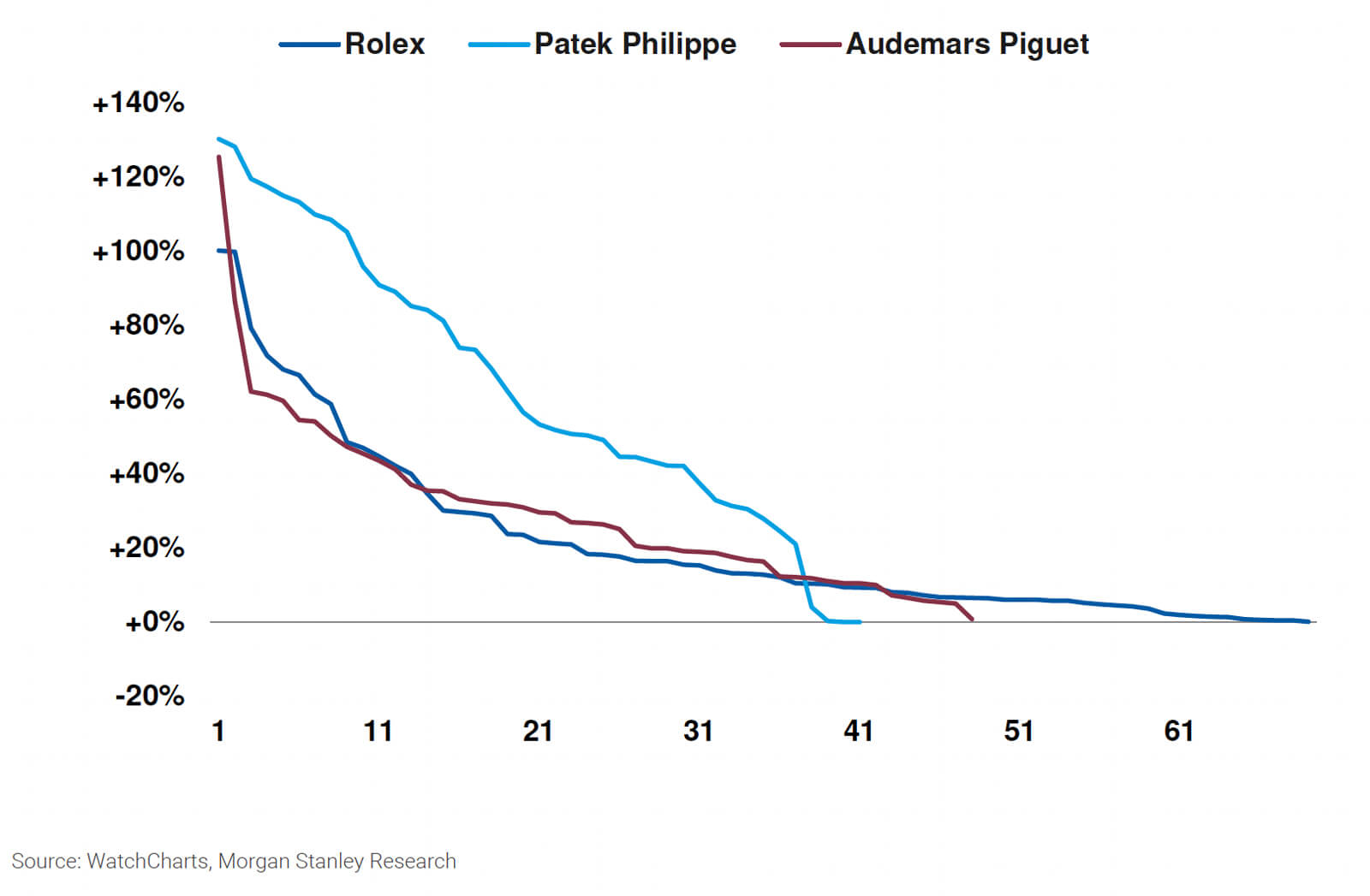

Value retention worsened for all brands except for Rolex, while IWC rolled out more retail price decreases. Rolex’s value retention improved by +0.2pp on a like-for-like (LfL) basis, though it was down -0.2pp across all in-production models. The brand has also replaced Patek Philippe as the top performer by value retention among those we track.

The Big Three continue to trade above retail, while every other brand has an average secondary market discount of at least -28%. After lowering retail prices by an average of 3% in 4Q24, IWC continued to roll out more retail price changes in 1Q25, with retail prices decreasing by an additional 1% on average.

The Rolex CPO program, which had a trajectory of steady growth throughout 2024, has stalled in 1Q25. Global CPO inventory levels and CPO premiums remained relatively consistent QoQ, with 1Q25 sales reaching the $100 million mark by our estimate. The majority of CPO inventory continues to be held by a few key retailers, with more than half of all inventory coming from Rolex (through Bucherer and Tourneau) and Watches of Switzerland.

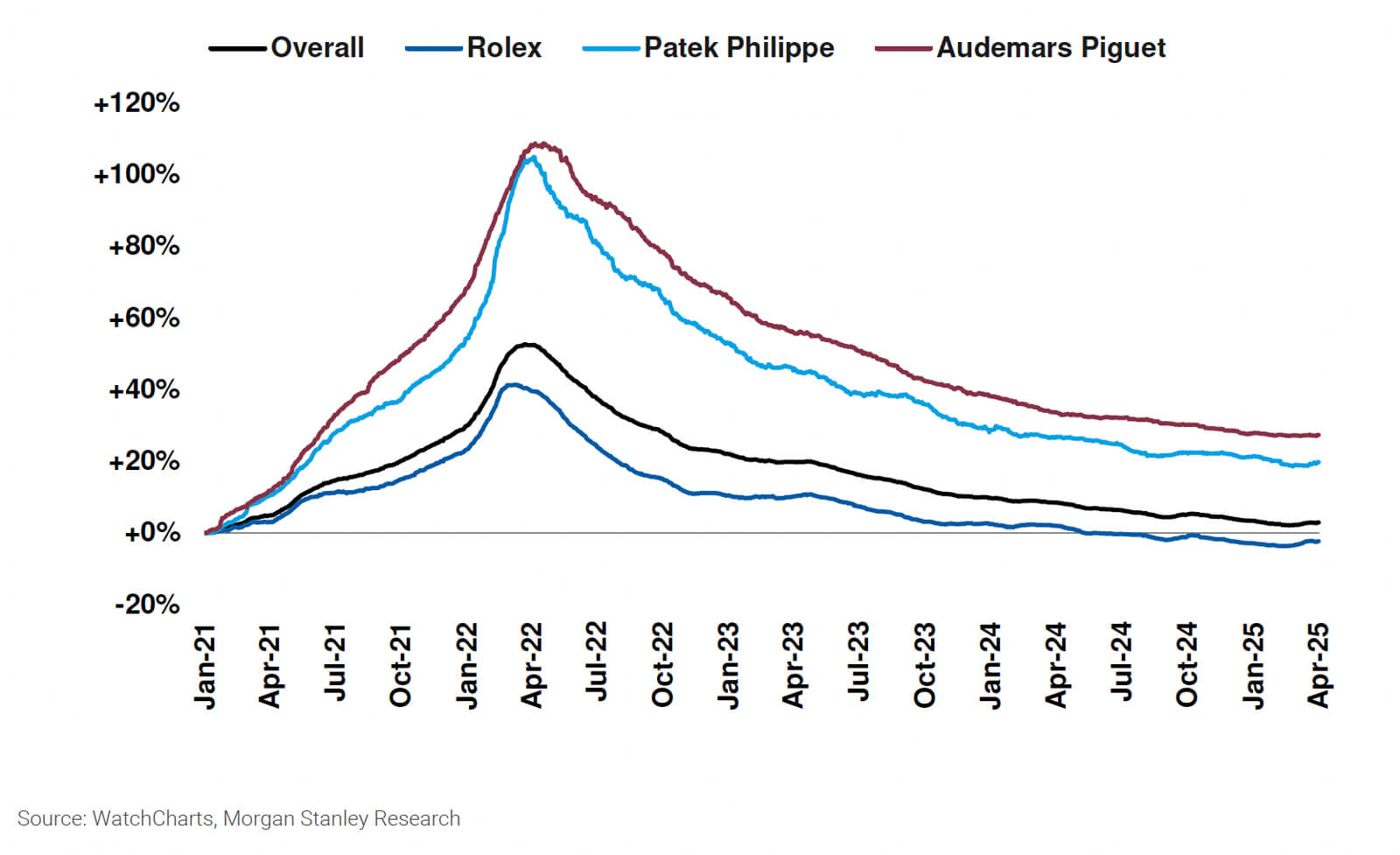

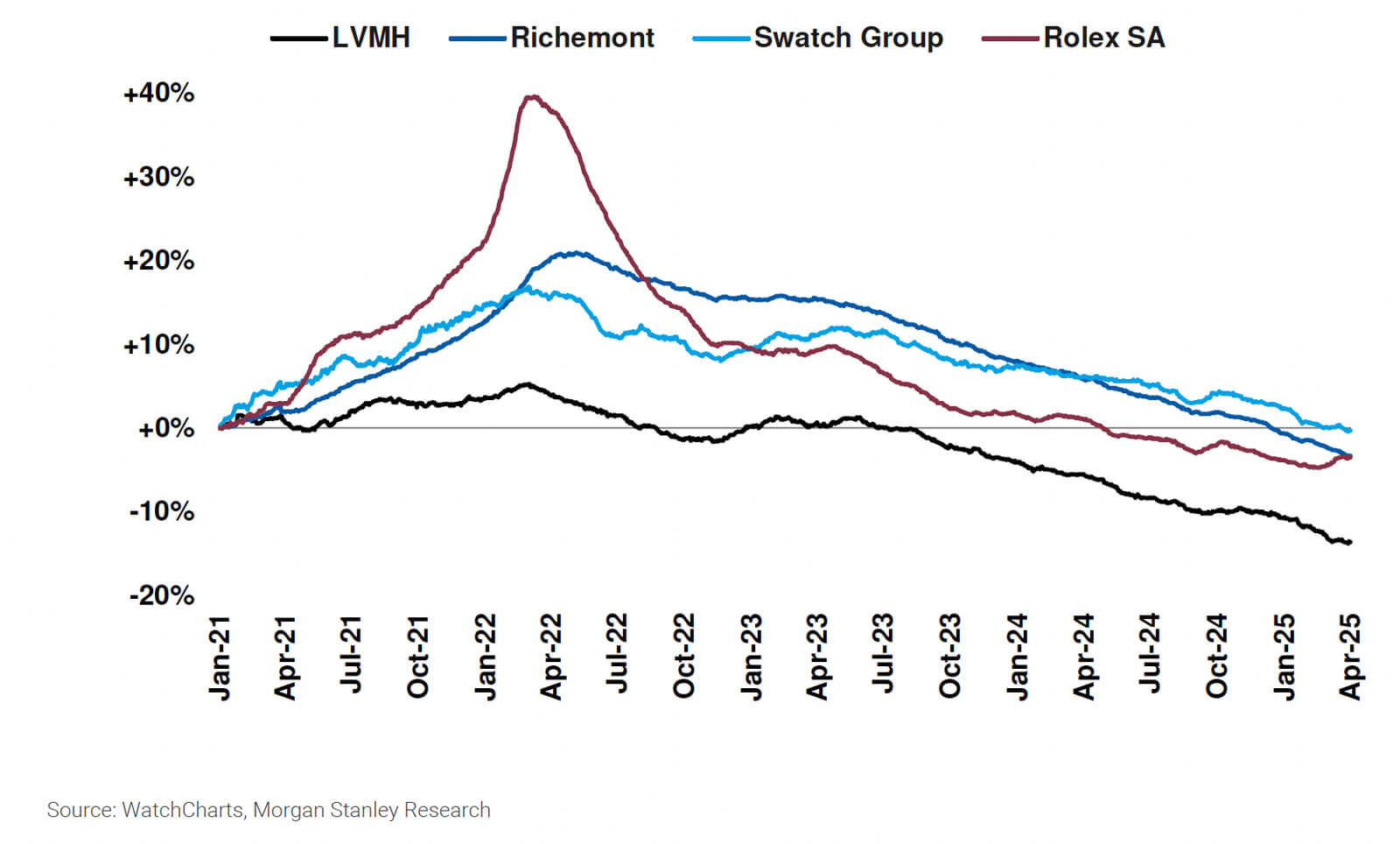

Performance of the WatchCharts Overall Market price tracker and brand prices for the Big Three since 2021

Quarterly sequential performance of the WatchCharts Overall Market price tracker since 2022

Unless otherwise stated, the analysis of the overall watch market in this report is based on WatchCharts Overall Market price tracker, which aggregates the secondary market performance of 300 watches from 10 major brands, weighted by annual transaction value. Brand or collection performance is analyzed using its respective WatchCharts price tracker derived from the top 30 watches within the brand or collection.

Group performance is based on the top 30 watches for each brand within the group, all weighted by annual transaction value. WatchCharts price tracker can be subsequently revised or adjusted. The most recent publications prevail.

The Big Three outperformed after being in the middle of the pack in 2024. Rolex (+0.4% QoQ), Audemars Piguet (-0.3% QoQ), and Patek Philippe (-1.5% QoQ) were among the best performing brands in 1Q25. Of the 35 Swiss brands we track, Rolex and AP held the second and third spots in terms of QoQ performance, while Patek Philippe was in the top 10.

This is a significant contrast from the trend in 2024 (where the Big Three found themselves more in the middle of the pack), and 2022/2023 (the beginning of the market downturn, when they led the decline). Given that the most desirable models from these brands continue to trade above retail, the Big Three have continued to retain strong brand equity despite the tumultuous nature of their secondary markets over the past few years.

Performance summary of Swiss watch brands on the secondary market in 1Q25 (QoQ change)

Performance summary of Swiss watch brands on the secondary market in 1Q25 (YoY change)

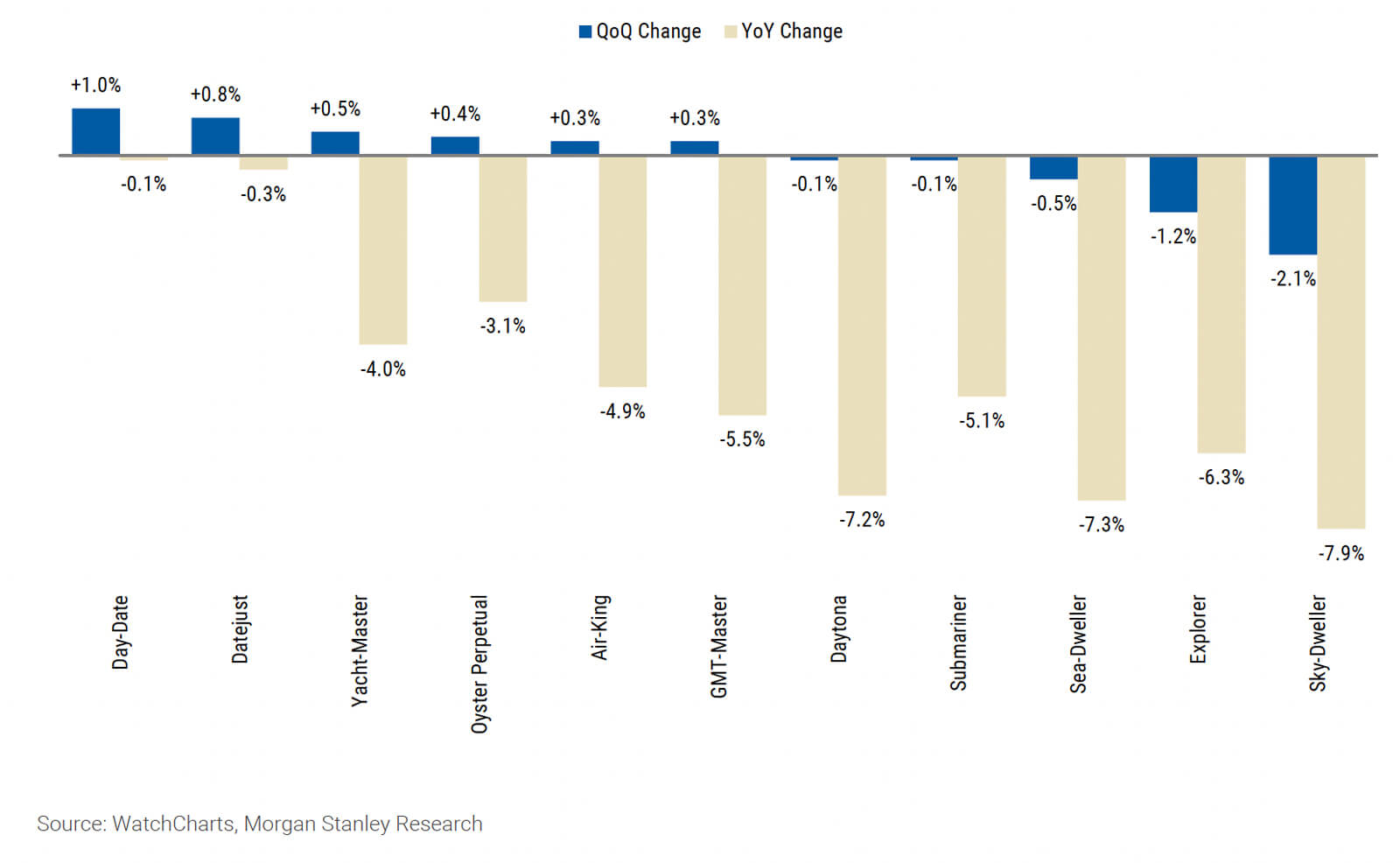

Rolex SA gained +0.3% QoQ as strong performance from Rolex (+0.4%) was slightly offset by Tudor (-2.0%). Rolex continues to benefit from strong demand for its Datejust and Day-Date collections, which saw secondary prices rise +0.8% and +1.0% QoQ respectively. Many other Rolex collections, including Yacht-Master, Oyster Perpetual, and GMT-Master, also saw prices rise by less than 1%. While some of this positive trend is likely seasonal (for example, as a result of anticipation for Watches & Wonders), the strength of Rolex’s performance across both its Classic and Professional collections remains unique within the Swiss watch industry. Tudor also made a slight comeback in 1Q25, placing in the middle of the pack after being one of the worst performers of 2024.

1Q25 performance of Rolex collections, QoQ and YoY

Swatch Group (-2.5% QoQ) was the top performer among the listed groups. Swatch Group’s performance continues to be boosted by Omega (-1.0% QoQ), which has one of the strongest secondary markets among mid-level brands due to the iconicity of its Speedmaster and Seamaster collections. However, many other Swatch Group brands underperformed. Breguet (-4.0%), Longines (-5.5%) and Blancpain (-5.8%) all lost at least 4% QoQ, while Swatch (-8.9%) and Tissot (-11.6%) were the two worst performing brands in 1Q25 among those tracked.

The performance of Swatch and Tissot can primarily be attributed to the MoonSwatch and PRX collections, which dominate their respective secondary markets. While these collections have been very popular and well-received by consumers, the initial excitement for them has faded by now, several years after their release.

Most Richemont (-2.6% QoQ) brands continue to steadily decline. The performance of Richemont brands remains generally in-line with previous quarters. Panerai (-1.9%), Jaeger-LeCoultre (-2.2%), Vacheron Constantin (-3.1%), A. Lange & Sohne (-3.1%), and IWC (-3.5%) prices all fell by low single digits QoQ. Cartier (-1.1%) fared a bit better, rebounding from its 4Q24 underperformance and maintaining its resilient position among mid-level brands. Montblanc (+0.5%) had the strongest QoQ performance among those tracked, although the brand has an extremely limited secondary market presence and thus equally little impact on Richemont’s broader performance.

LVMH (-3.2% QoQ) brands are a mixed bag. BVLGARI (-0.6%) and Zenith (-0.9%) prices both fell less than 1% QoQ, but TAG Heuer (-4.1%) and Hublot (-5.2%) fared worse. In particular, we are concerned about the performance of Hublot, which ranks among the brands that saw the largest secondary price declines over the past quarter, year, and two years. In combination with the brand’s high price point (with most models retailing in the low-five-figures), poor value retention (around -60% for popular models), and controversial reputation, we believe that Hublot may be facing an uphill battle in sustaining long-term demand.

Performance of WatchCharts price tracker for Swiss groups since 2021

Performance of WatchCharts price tracker for Swiss groups in 1Q25, QoQ and YoY

Analysis of market health and fundamentals

Market health evaluation:

We propose four key indicators for evaluating the health of the secondary watch market or one of its segments: total supply (the amount of inventory on the market), absorption rate (the rate at which the inventory is turning over), age of inventory (how old the available inventory is), and days on market (how fast sold inventory is selling).

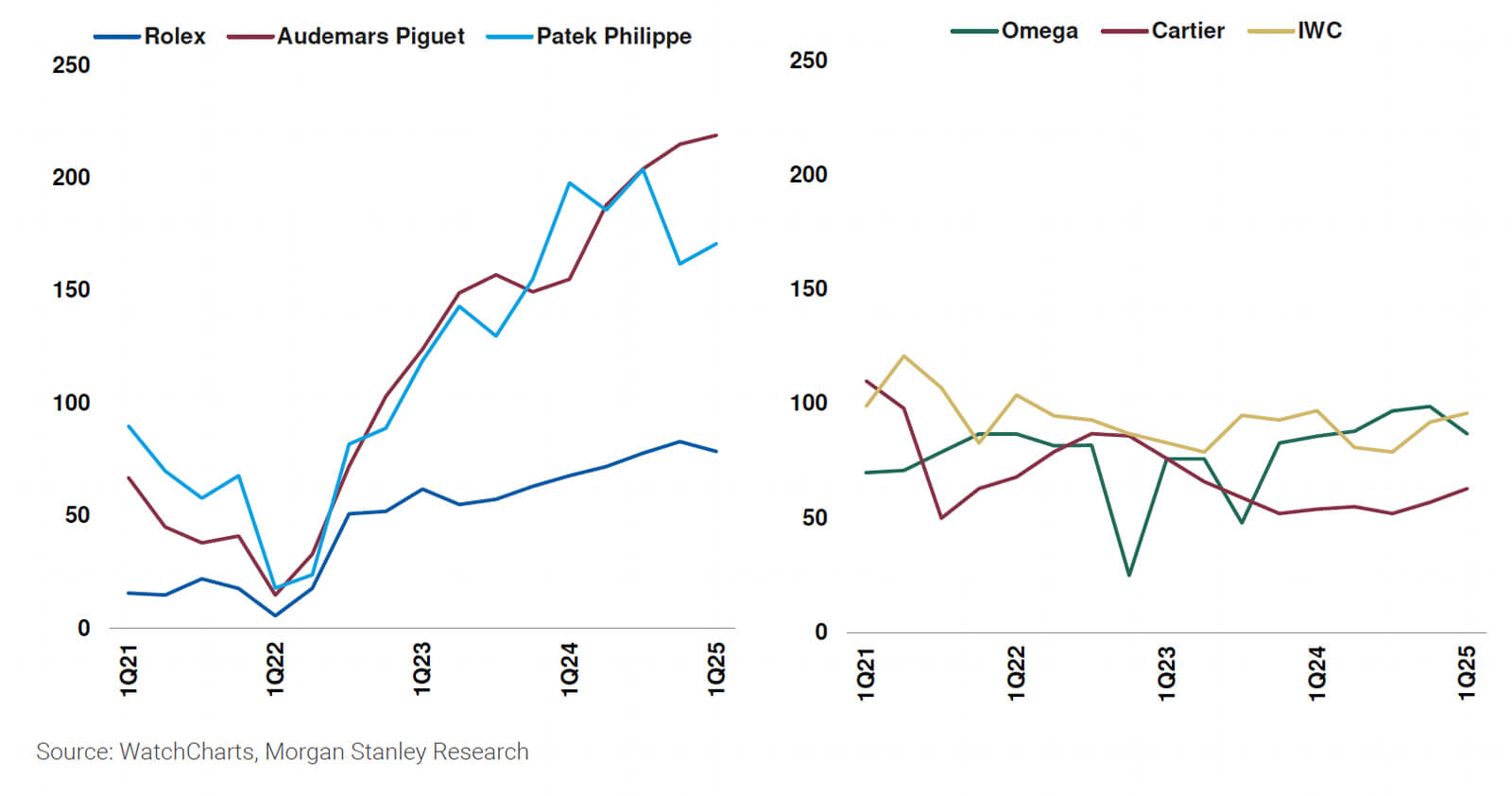

Total value of available inventory on the secondary market for the Big Three and mid-level brands since 2021

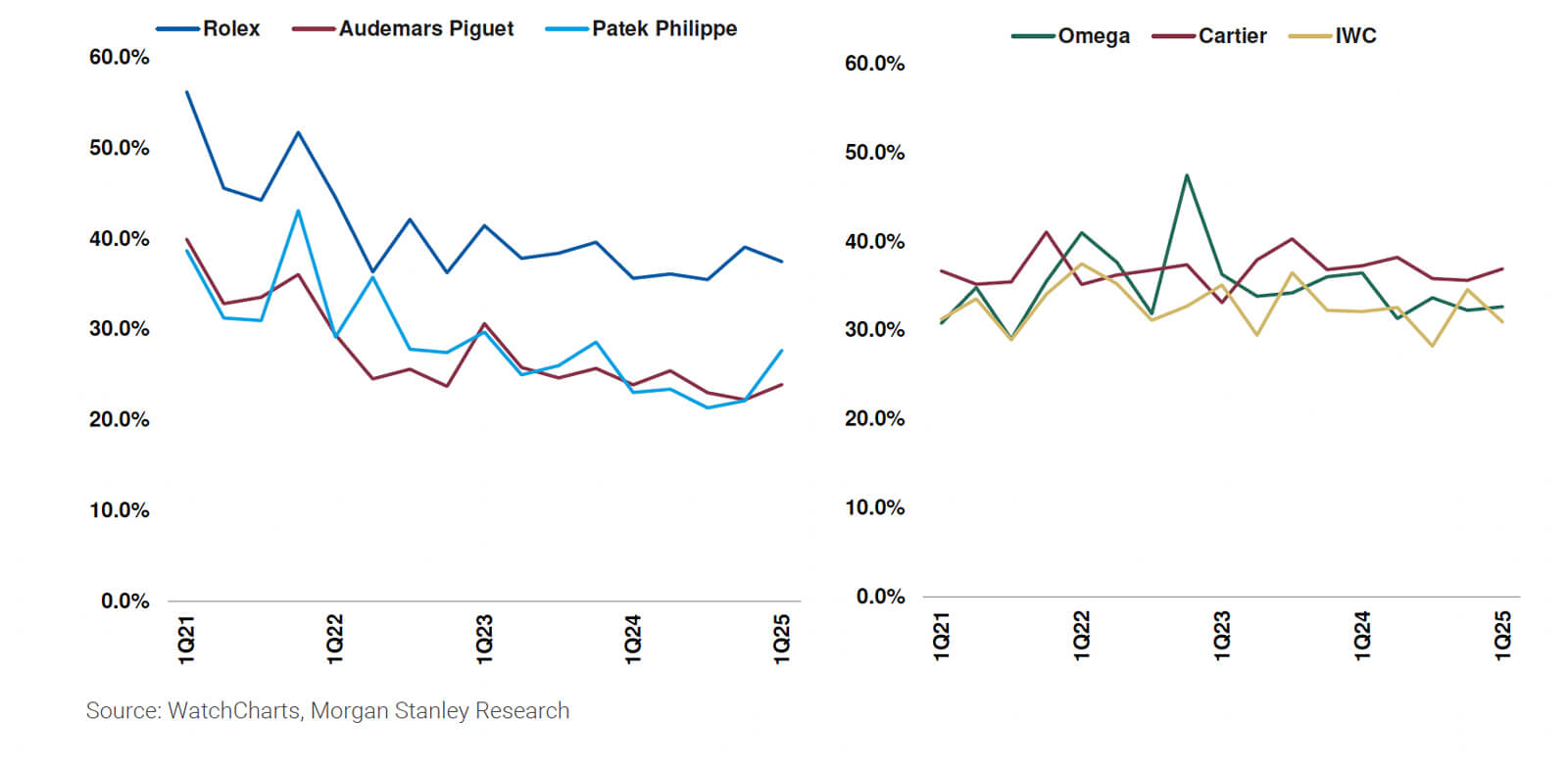

Average quarterly absorption rate (measure of inventory turnover, defined as

sold inventory value divided by total inventory value over a given period) for the Big Three and mid-level brands since 2021

Price-adjusted median age of inventory (number of days for which

purchased inventory is held by sellers) evolution for the Big Three and mid-level brands since 2021

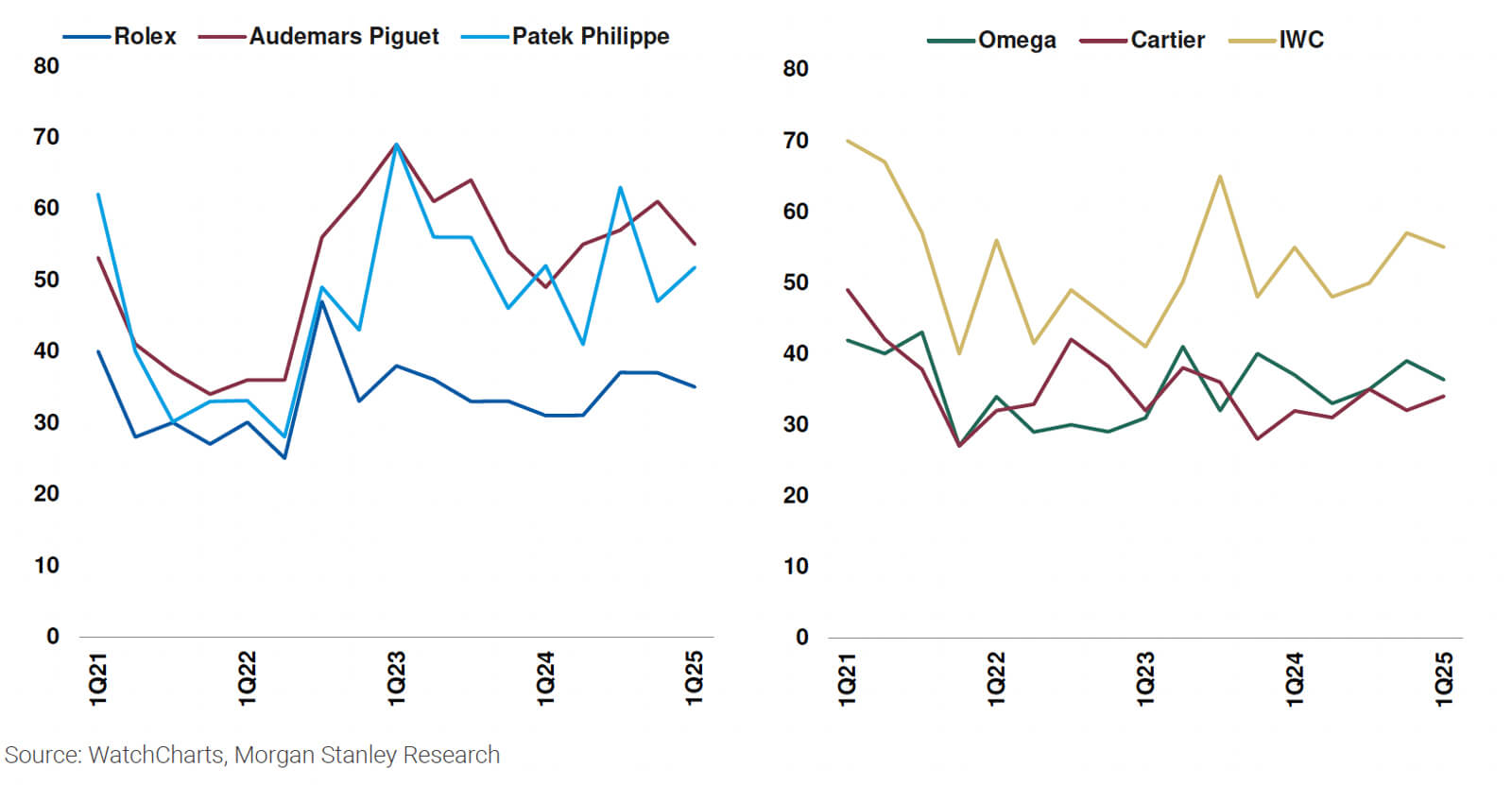

Average quarterly days on market (median number of days for which sold

inventory was available on the market) evolution for the Big Three and mid-level brands since 2021

Supply and absorption rate improve for the Big Three… Absorption rate improved or stayed the same for Rolex (+1.8pp), Patek Philippe (+4.7pp), and Audemars Piguet

(+0.0pp) in 1Q25 compared to the year-ago quarter. At the same time, all three brands also saw a QoQ decline in total supply, a positive sign given that the secondary watch market today is still feeling the effects of a mass sell-off beginning in 2Q22.

Supply levels for Patek Philippe and Audemars Piguet decreased by -4.4% and -0.9% respectively (after supply for both brands reached all-time highs in 4Q24), while Rolex supply levels fell -0.2%. Encouragingly, the supply level for Rolex has declined two quarters in a row, and is now the lowest since January 2024.

…though age of inventory remains historically elevated and days on market remains in-line. This indicates that there is still good liquidity for watches that are priced appropriately in the market, consistent with our general observation that brand equity remains strong for the Big Three.

However, stale or optimistically priced listings continue to accumulate, contributing to the elevated age of inventory, as many sellers remain hesitant to realize losses. While the supply correction in 1Q25 is a positive sign, sustained recovery will likely depend on broader seller capitulation and continued buyer confidence.

Secondary demand remains strong for many brands from the listed groups, though potentially at the expense of retail sales. Despite falling secondary prices, we have seen slight growth in the secondary markets of many key brands from the listed groups. In the cases of the key mid-level brands (Omega, Cartier, and IWC), inventory levels have risen consistently while absorption rates remain relatively stable, indicating that consumer demand remains strong (at the right price).

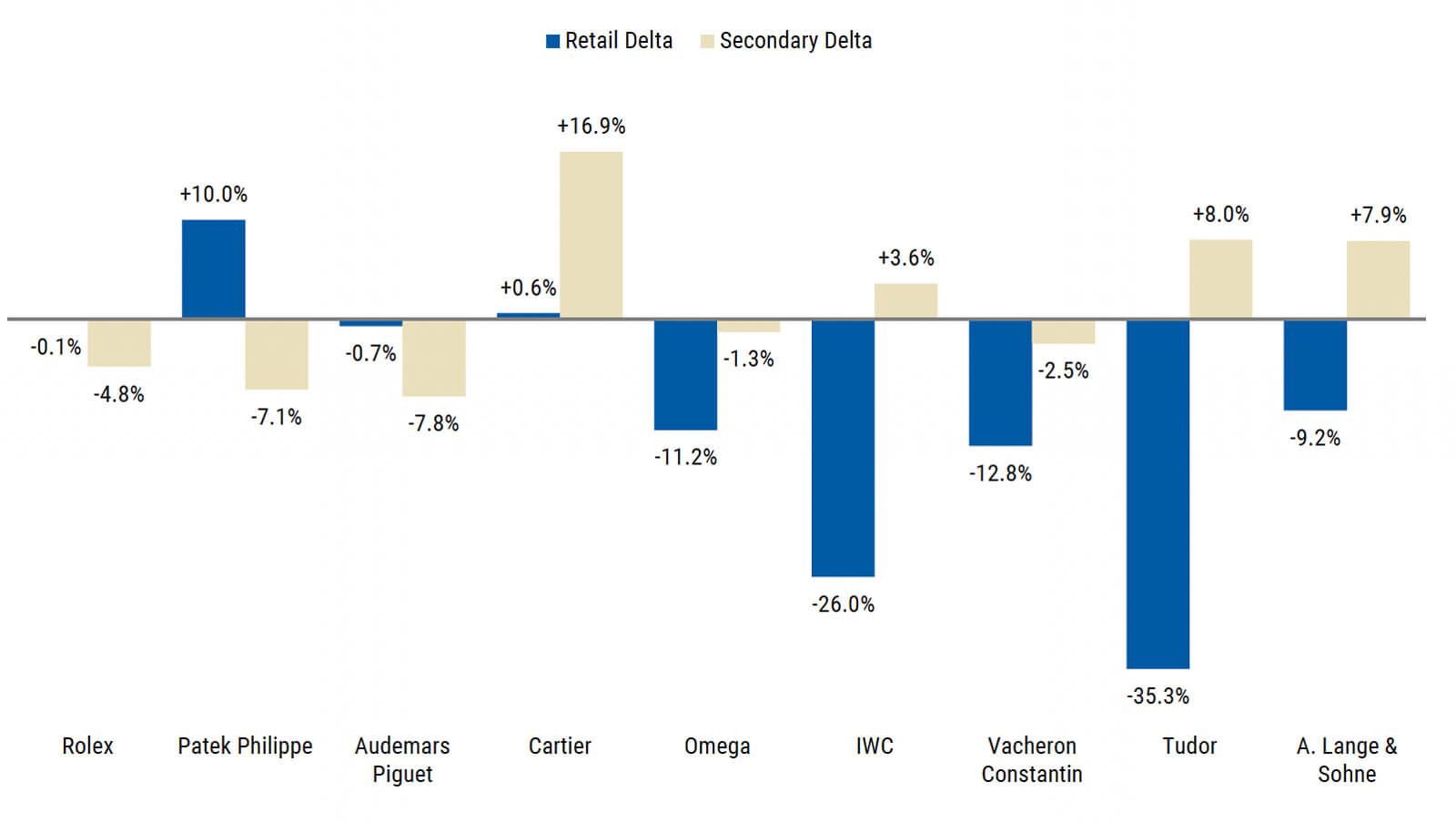

However, as discussed in our key questions for 2025 in our last report, we are concerned about the displacement of retail demand by the secondary market – and see some evidence of this when comparing primary and secondary sales estimates (see Exhibit 12). Given worsening value retention (which we discuss more in the next section) for in-production models, and (generally) even more significant discounts in the discontinued/vintage markets for most brands, the secondary market today represents historically strong value-for-money for consumers who are willing to cross-shop.

Comparison of YoY transaction value in FY24 between the retail market

(based on LuxeConsult, leading Swiss watch consulting firm, estimates in USD) and secondary market (based on WatchCharts estimates)

Analysis of value retention and market performance by brand

We define value retention (VR) as the premium/discount that an in-production watch trades for on the secondary market relative to its retail price (in USD), a key metric to gauge brand desirability.

Value retention by brand (prices as of April 1, 2025)

Value retention evolution since January 2, 2025 based on all in-production

models and LfL models only

With the exception of Rolex, value retention for all tracked brands continues to decline. Rolex’s value retention was relatively unchanged compared to our January 2025 analysis, with an evolution of -0.2pp (+0.2pp LfL). Tudor also performed relatively strongly (-0.7pp, -0.9pp LfL) despite having the lowest absolute value retention level among tracked brands. All other brands saw a sequential decrease in value retention of at least -2pp, across all in-production models and LfL models only.

Rolex also replaced Patek Philippe as the brand with the highest value retention. Since we first introduced comprehensive value retention analysis in February 2023, Patek Philippe has consistently held the top spot in terms of the absolute value retention level. However, the gap between Patek Philippe and Rolex (which has ranked second since mid-2023) has been steadily shrinking over the past two years.

In 1Q25, Patek Philippe saw the biggest sequential decline in value retention among tracked brands, both across all in-production models (-6.7pp) and LfL models only (-3.4pp). Rolex now holds the top spot in terms of absolute value retention level, although the models from Patek Philippe that do trade above retail continue to command by far the highest premiums (see Exhibit 16 for this breakdown).

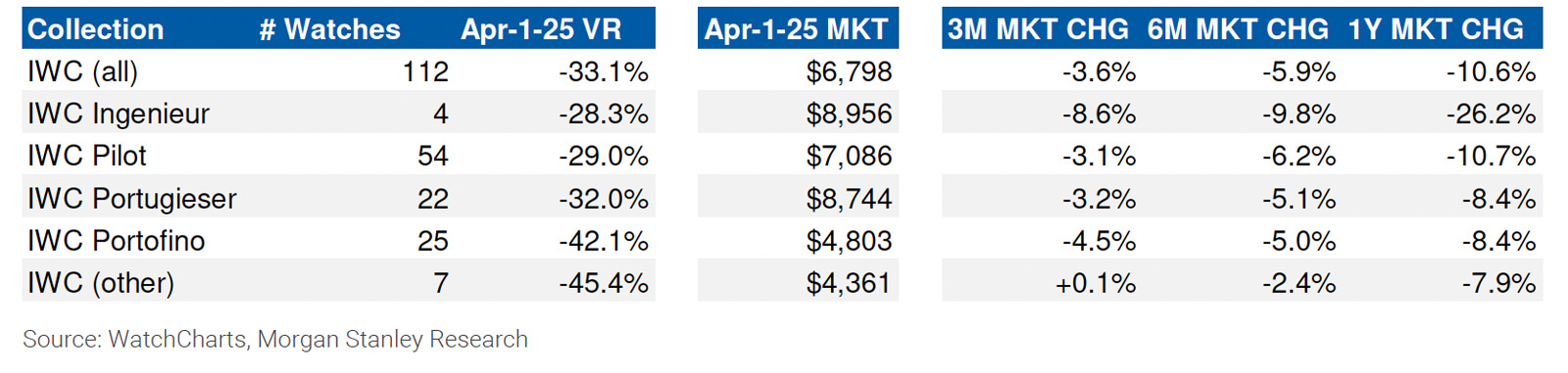

IWC rolls out more retail price changes. In our January 2025 report, we discussed how IWC had lowered retail prices for a significant portion of its catalog. Since then, we have tracked even more changes to IWC’s retail prices, with price decreases rolling out to more models, as well as a small number of price increases.

Among affected models, the average retail price change was -3%, resulting in a -1% decrease in retail prices overall. See the section on IWC below for more details. We did not observe retail price changes for any other brand.

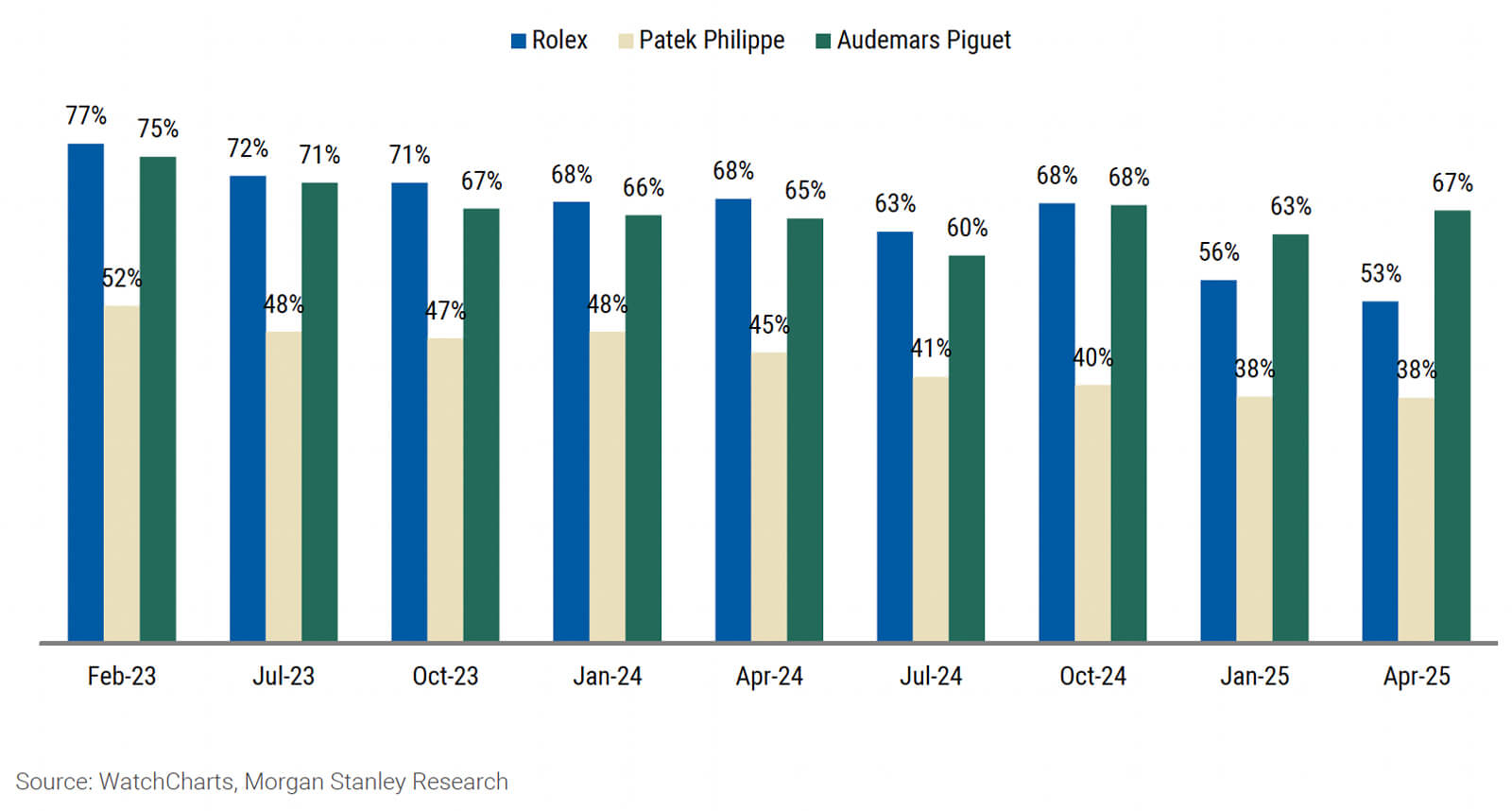

The Big Three continue to trade above retail… Rolex, Patek Philippe, and Audemars Piguet have value retention levels ranging from +5% to +15% above retail. However, the nature of their value retention performances differs quite significantly. Rolex has the most number of watches which trade above retail (69/131 models tracked), coming from a wide variety of model lines. Meanwhile, Patek Philippe has the fewest models that trade above retail, but they command the highest secondary market premiums. Finally, Audemars Piguet has the greatest percentage of models that trade above retail (67%), but they come almost exclusively from the Royal Oak collection.

…while every other brand has a secondary market discount of at least -28%. Outside of the Big Three, Cartier saw the biggest decrease in value retention (-6.1pp, though only -3.0pp LfL). A. Lange & Sohne and Vacheron Constantin also lost more than 3pp on a LfL basis. With Cartier’s decline, the gap in value retention between the Big Three and other tracked brands has reached more than 34pp (+5.3% from third-ranked Audemars Piguet, versus -28.8% from fourth-ranked Cartier). While strong VR is not a requirement for driving brand desirability (particularly for brands positioned at entry or mid-level price points, where the absolute depreciation is lower), we believe that this disparity captures a continued consumer preference for the Big Three.

Evolution of the percentage of in-production Rolex, Patek Philippe, and Audemars Piguet models that trade above retail since February 2023

Comparison of the number of in-production models trading above retail from Rolex, Patek Philippe, and Audemars Piguet as of April 2025, and their value retention levels

Rolex

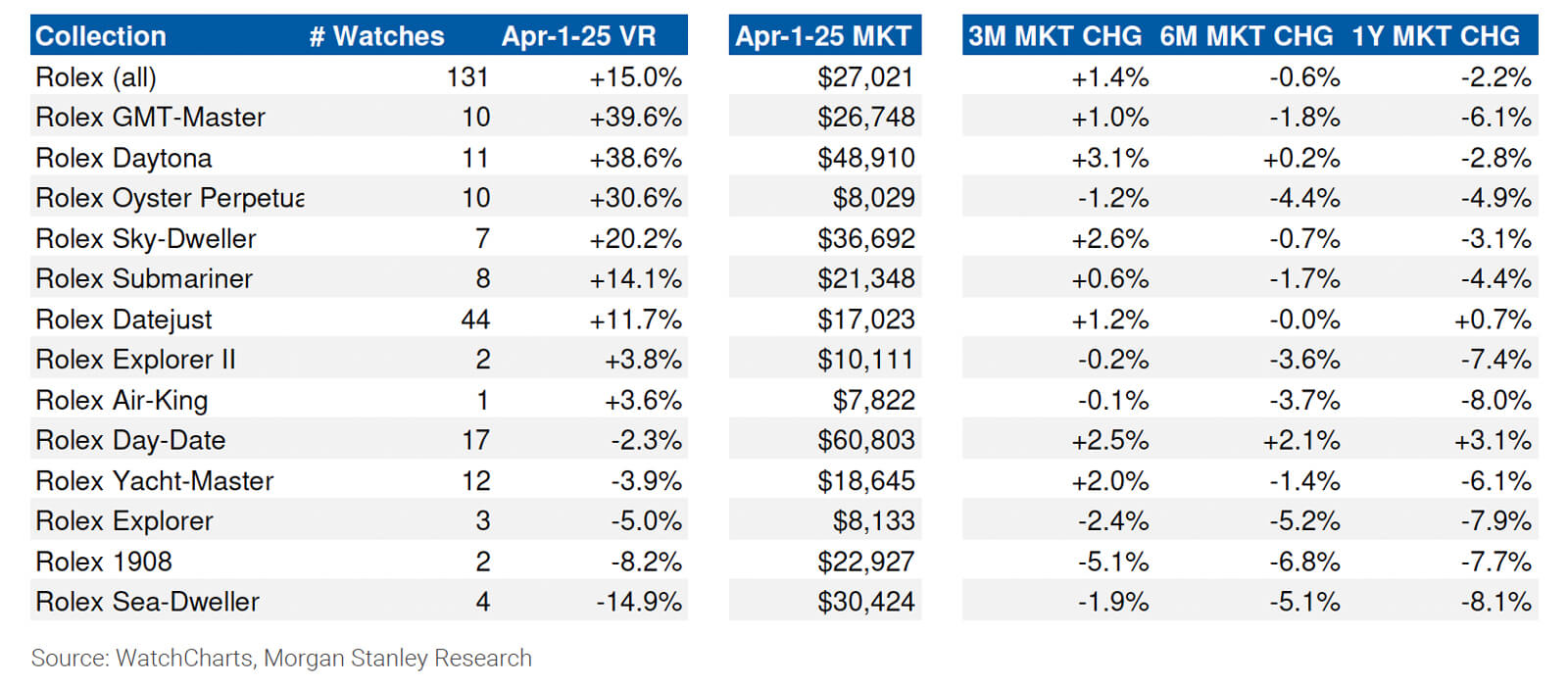

In production Rolex models trade for an average of +15.0% above retail, compared to +15.2% as of January 2025 (-0.2pp, +0.2pp LfL), based on our analysis of 131 models. We did not observe any changes to Rolex retail prices in the US since the brand increased prices by an average of 4.5% at the beginning of this year.

The state of our latest analysis reflects a set of product discontinuations, which took place at the beginning of April 2025, coinciding with the brand’s new releases at the Watches & Wonders trade show. As a result, the number of models included in our analysis decreased from 146 in January 2025 to 131 today.

All of the discontinued models which left our analysis were from the Oyster Perpetual collection, including the highly desirable “celebration dial” variants in 41mm, 36mm, and 31mm case sizes. Overall, these product discontinuations had a slightly negative effect on the brand’s overall value retention. Any newly announced models, including those from the new Land-Dweller collection, are not included in our analysis as they have yet to enter the secondary market as of the time of writing.

Aside from product discontinuations, the state of Rolex value retention remains relatively in-line with our previous report. We saw a slight increase in market prices for several desirable collections, including the GMT-Master and Daytona. However, prices continue to soften for collections which trade below retail, including the Explorer, 1908, and Sea-Dweller. Today, 53% of tracked Rolex models command secondary market premiums, compared to 56% a quarter ago and 68% a year ago.

Rolex value retention analysis by collection

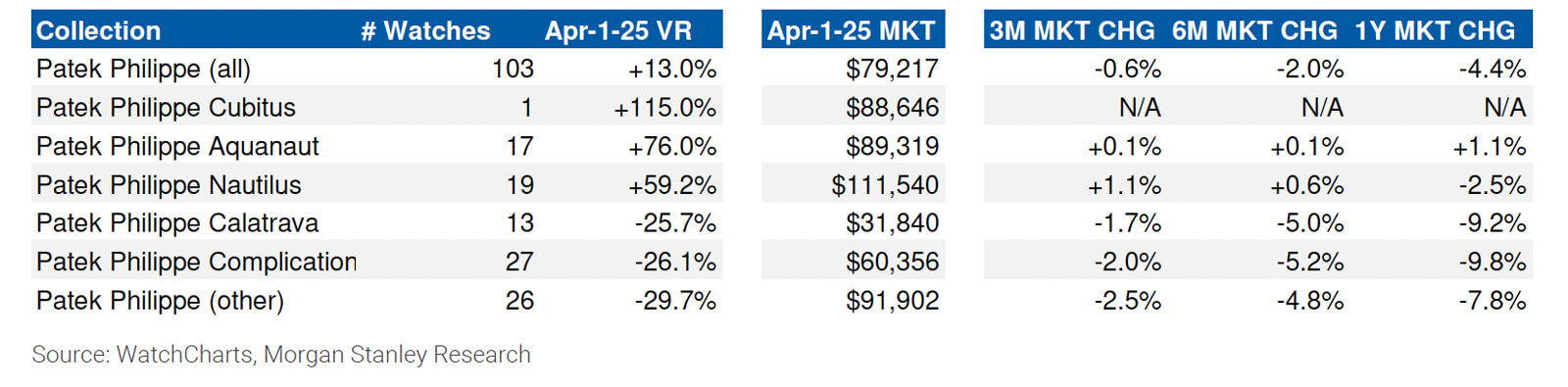

Patek Philippe

In-production Patek Philippe models trade for an average of +13.0% above retail, compared to +19.7% in January 2025 (-6.7pp, -3.4pp LfL). Five new Patek Philippe models have entered the secondary market since our previous report, while nine left our analysis as a result of product discontinuations in February. Interestingly, Patek Philippe did not increase US retail prices in 1Q25, as they did in the first quarter of 2024 and 2023.

Patek Philippe saw the largest sequential decrease in value retention among the nine brands we track. This is the result of three factors: a -0.6% decrease in secondary market prices, an increase in proportional sales from below-retail models, and the discontinuation of several particularly desirable models from the Nautilus and Aquanaut collections. Specifically, the discontinuation of the Nautilus 5712/1A and Aquanaut 5167/1A had the biggest impact on value retention, with both models previously trading at nearly double retail.

Today, every model from Patek Philippe’s sports watch collections (Nautilus, Aquanaut, and Cubitus) continues to trade above retail, while only a handful of models outside these collections command secondary market premiums. Notably, our VR analysis now includes the stainless steel Cubitus 5821/1A, which we estimate trades for more than double retail on the secondary market.

Patek Philippe value retention analysis by collection

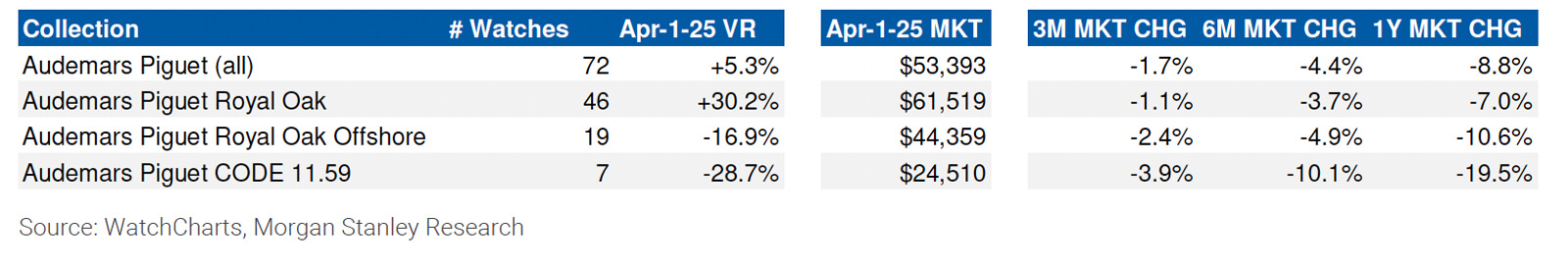

Audemars Piguet

In-production Audemars Piguet models trade for an average of +5.3% above retail, compared to +7.8% in January 2025 (-2.5pp, -2.8pp LfL). We did not observe any US retail price changes for the brand since our last report.

Similar to Rolex and Patek Philippe, Audemars Piguet also discontinued quite a few models in 1Q25, bringing down the number of models in our analysis from 79 to 72. Among the discontinuations were several desirable Royal Oak openworked models, as well as a half-dozen CODE 11.59 models which previously ranked as some of the brand’s worst performers by value retention. As a result, the CODE 11.59 collection’s value retention saw a sequential improvement from -33.5% in January to -28.7% today.

The Royal Oak collection continues to command a significant secondary market premium, trading for more than +30% above retail on average. Its price performance has also been the best among AP collections over the past year, at -7.0% compared to -10.6% for the Royal Oak Offshore and -19.5% for the CODE 11.59. However, the brand’s overall value retention is now approaching low single digits.

Audemars Piguet value retention analysis by collection

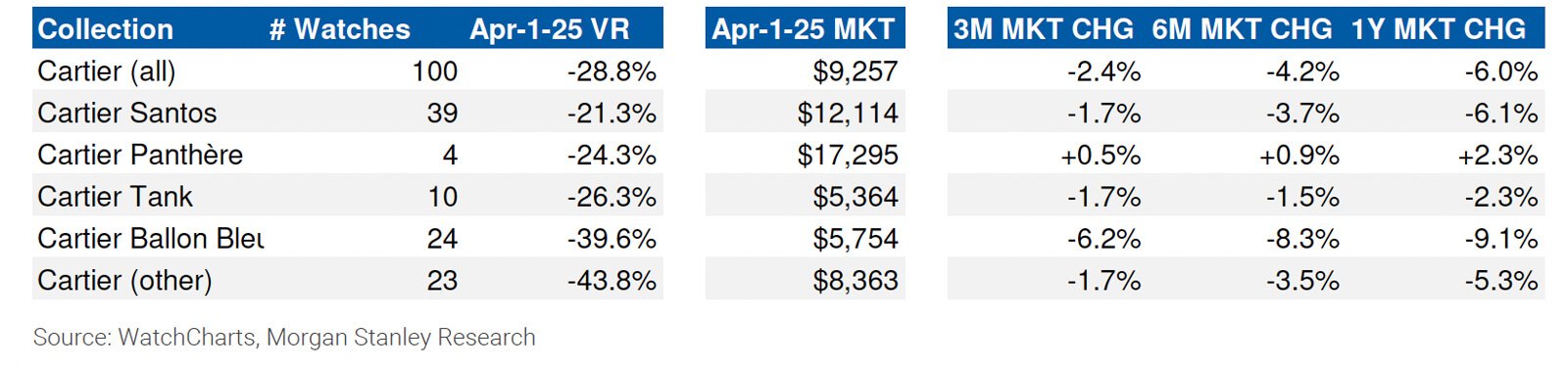

Cartier

In-production Cartier models trade for an average of -28.8% below retail, compared to -22.7% in January 2025 (-6.1pp, -3.0pp LfL). We did not observe any US retail price changes for the brand since our last report.

Cartier remains the brand with the strongest value retention outside of the Big Three, though its position has slipped a bit as a result of a 2.4% average decrease in prices of in-production models, and the discontinuation of many models from the brand’s top collections (Santos, Tank, and Panthere). We estimate that only one Cartier model currently trades above retail – the Santos-Dumont WSSA0046.

Cartier value retention analysis by collection

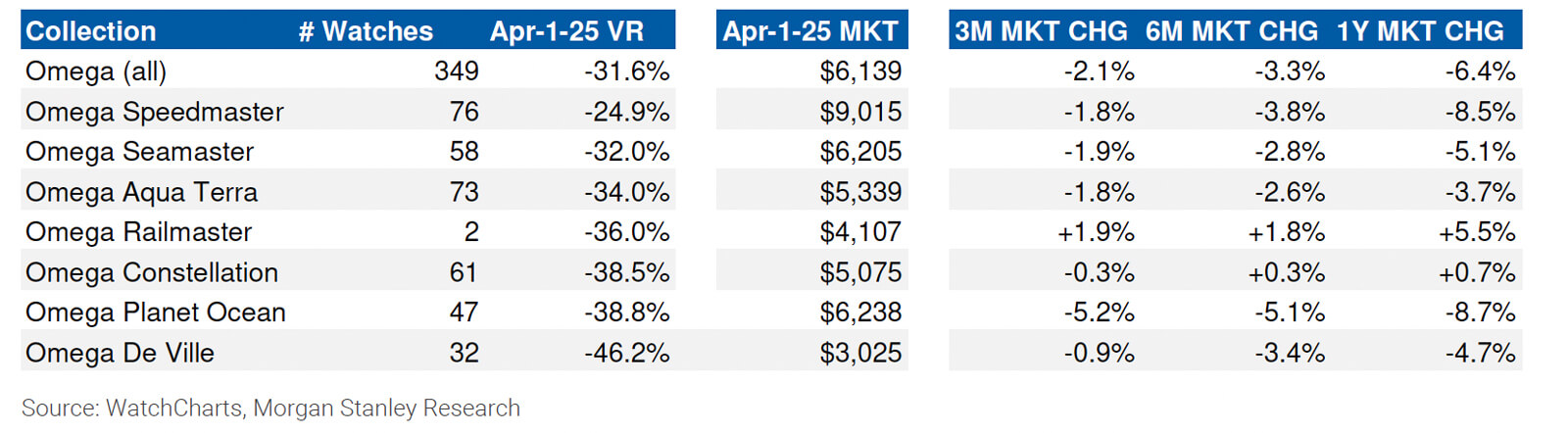

Omega

In-production Omega models trade for an average of -31.6% below retail, compared to -29.4% in January 2025 (-2.2pp, -2.3pp LfL). We did not observe any US retail price changes for the brand since our last report.

The number of Omega models included in our analysis has increased significantly since our last report, though this is primarily the result of inconsistencies surrounding the discontinuation status of certain models (which we determine from the brand’s website), rather than the result of many new models entering the secondary market. However, the top-line observations remain quite consistent with past reports. The Speedmaster remains Omega’s best performing and most popular collection, with two models continuing to trade above retail.

Omega value retention analysis by collection

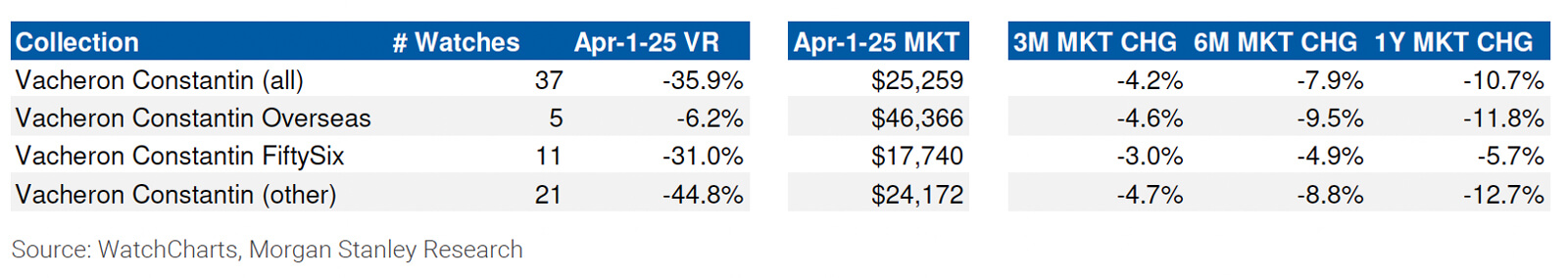

Vacheron Constantin

In-production Vacheron Constantin models trade for an average of -35.9% below retail, compared to -33.6% in January 2025 (-2.3pp, -3.3pp LfL). We did not observe any US retail price changes for the brand since our last report.

Vacheron Constantin continues to struggle, posting the worst secondary market performance of in-production models for the second quarter in a row (-4.2%). The Overseas continues to hold its value the best, with the only Vacheron Constantin model that trades above retail coming from the collection (ref. 4520V/210A-B128 with a blue dial). However, its uplifting effect on the brand overall remains limited due to low transaction volume; despite it now being more than a year since the collection was refreshed, the previous 4500V generation Overseas models are still traded much more frequently.

Vacheron Constantin value retention analysis by collection

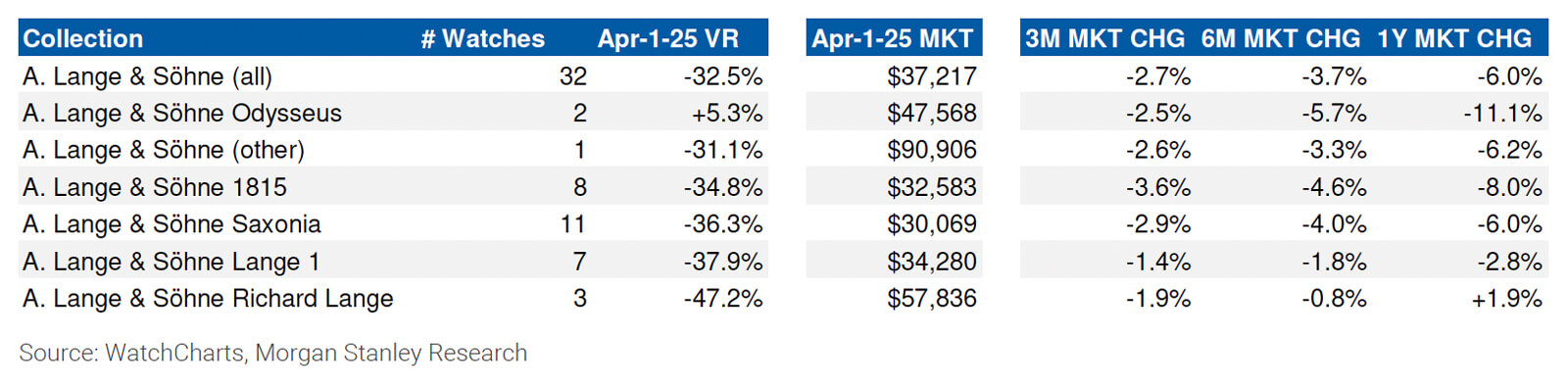

A. Lange & Sohne

In-production A. Lange & Sohne models trade for an average of -32.5% below retail, compared to -28.7% in January 2025 (-3.8pp, -3.1pp LfL). We did not observe any US retail price changes for the brand since our last report. Value retention dynamics for Lange remain in-line with historical trends, with the Odysseus continuing to trade above retail while all other collections trade at discounts of at least -30%.

A. Lange & Sohne value retention analysis by collection

IWC

In-production IWC models trade for an average of -33.1% below retail, compared to -31.0% in January 2025 (-2.1pp, -2.6pp LfL). After reducing retail prices for about a third of its catalog in 4Q24, IWC followed up in 1Q25 with more retail price changes. Among the 112 watches included in our analysis, 27 saw retail price decreases (by an average of -4%), while 6 saw retail price increases (by an average of +4%). On average across the entire catalog, retail prices were lowered by 1%.

However, this reduction in retail prices was not enough to offset a -3.6% decline in average secondary prices last quarter. The Ingenieur collection in particular, which traded at or slightly below retail a year ago, has seen prices fall 8.6% in the past quarter and 26.2% in the past year. While it still retains its value the best out of all IWC collections, it does so only marginally better than the Pilot collection, indicating that the hype from the Ingenieur relaunch in 2023 has now largely subsided.

IWC value retention analysis by collection

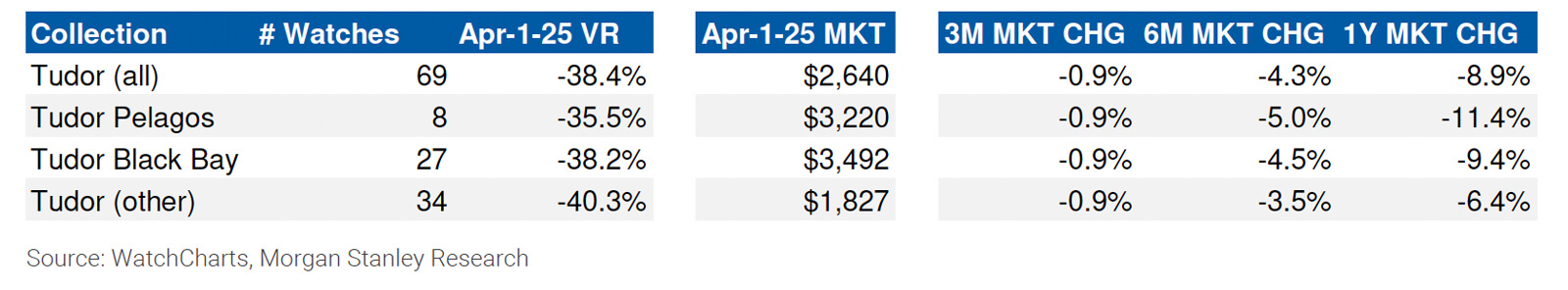

Tudor

In-production Tudor models trade for an average of -38.4% below retail, compared to -37.7% in January 2025 (-0.7pp, -0.9pp LfL). We did not observe any US retail price changes for the brand since our last report.

Tudor’s performance remains largely in-line with our previous analysis, with secondary prices falling by about -1% last quarter across all of its collections. The Pelagos collection continues to hold its value better than the Black Bay. The top performing Tudor model by value retention is the Black Bay Chrono 79360B at -14%.

Tudor value retention analysis by collection

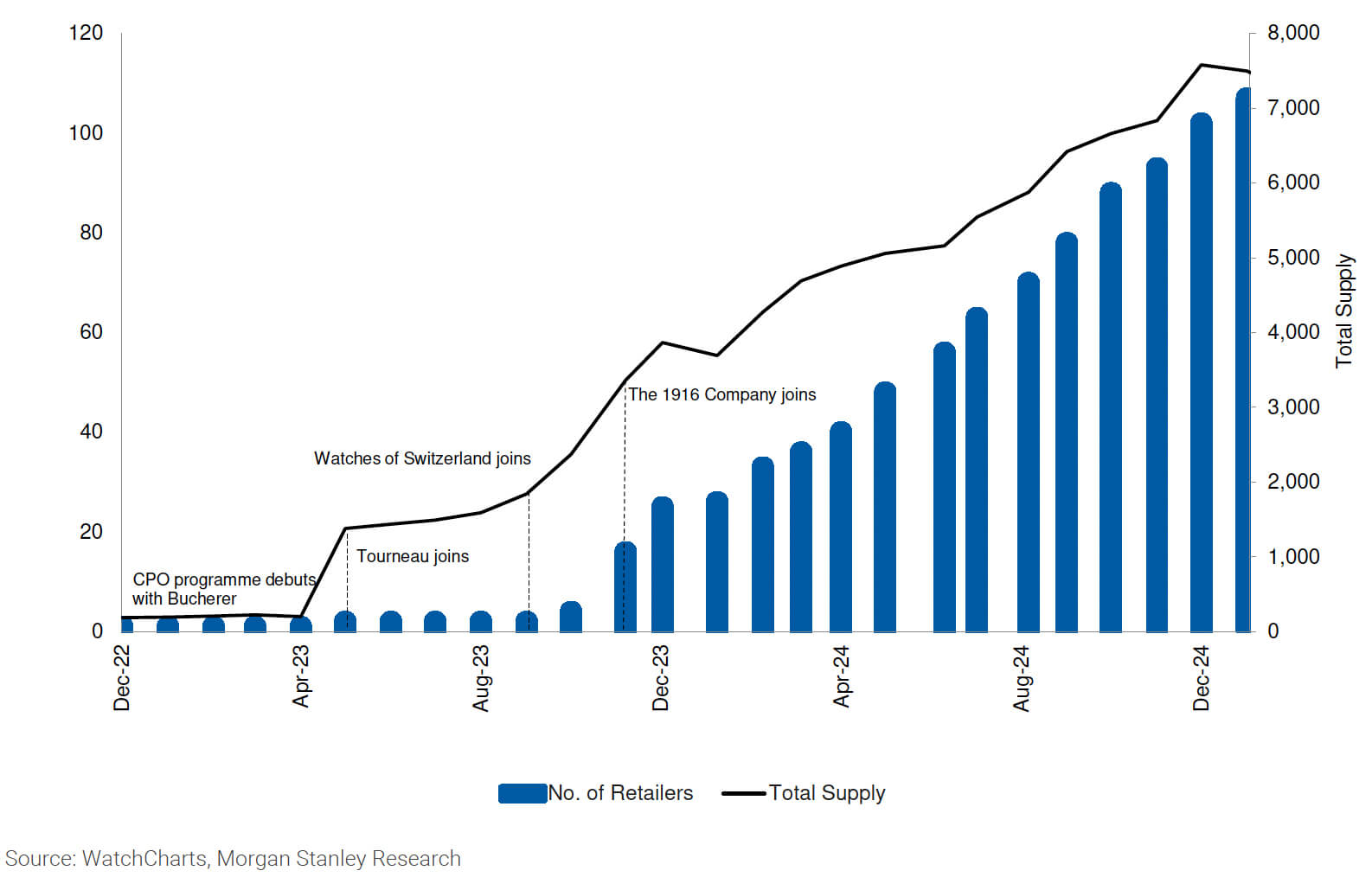

Update on Rolex Certified Pre-Owned Program

In December 2022, Rolex launched its Certified Pre-Owned (CPO) Program, the first large-scale CPO program by a luxury watch brand. By leveraging WatchCharts data, we track the global state of RCPO inventory and calculate a “CPO Premium” for each retailer which allows us to assess how disruptive the Rolex CPO program is to traditional secondhand watch trading platforms.

The CPO Premium is an estimate for how much more expensive a watch is when listed by a Rolex CPO retailer compared to a traditional secondary dealer.

The Rolex CPO program continues to expand at a steady rate. From January 2024 to January 2025, we estimate that the number of retailers enrolled in the program increased by more than 300% – from around 25 retailers a year ago to 107 today. Together, these retailers operate 217 doors worldwide that sell CPO watches.

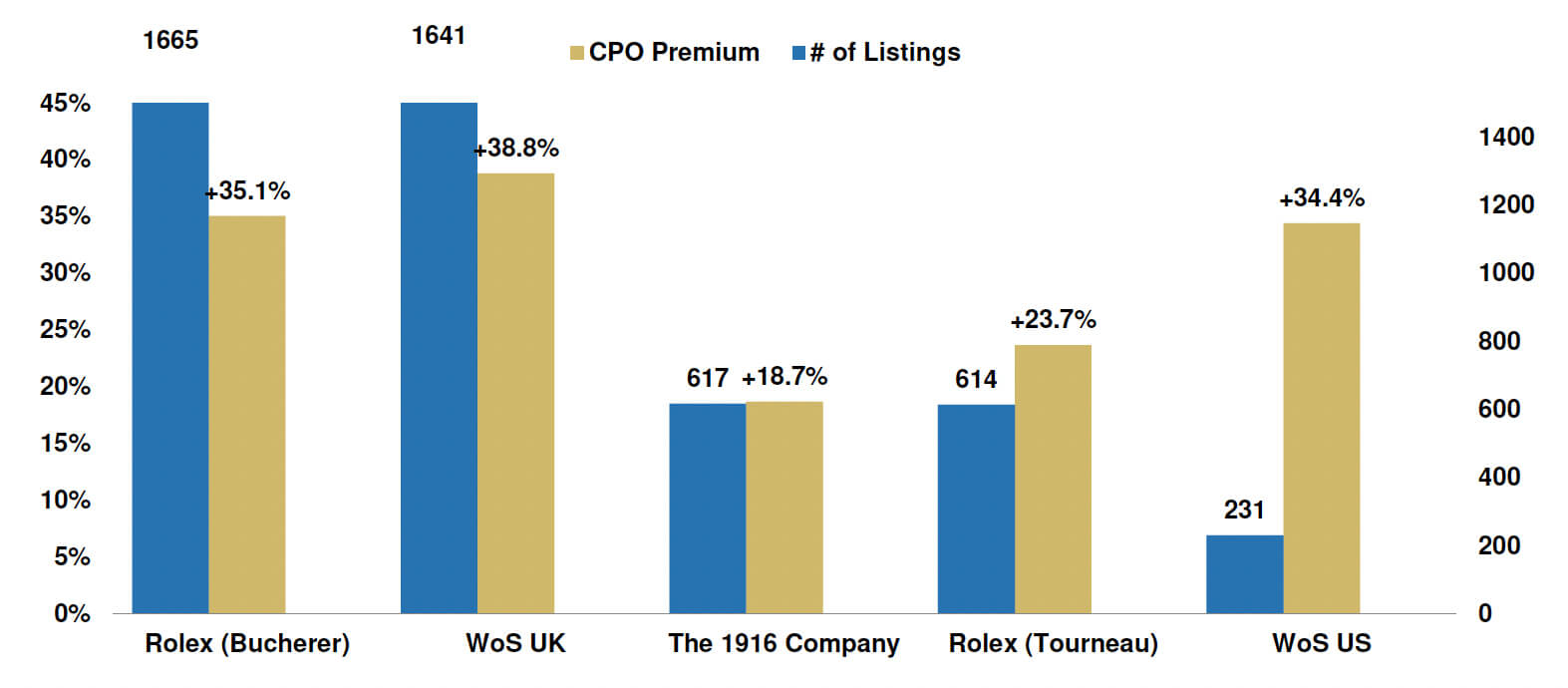

The expansion of the Rolex CPO program has stalled. In our last report, we estimated that the number of retailers enrolled in the Rolex CPO program increased from around 25 in January 2024 to 107 by January 2025, with steady quarter-by-quarter growth.

However, we are surprised to report that we have not seen any new retailers join the program since the start of this year. In fact, the total number of Rolex CPO retailers has decreased slightly as a result of several retailers leaving the program.

We estimate that there are 104 Rolex retailers operating RCPO programs today, with 214 doors worldwide selling RCPO watches. Together, these retailers hold around 7,500 watches in inventory, with a total value of around $170 million (relatively consistent with our estimates of 7,500 watches worth $160 million in January 2025). We estimate 1Q25 CPO sales to be around $100 million, up 15% compared to 4Q24.

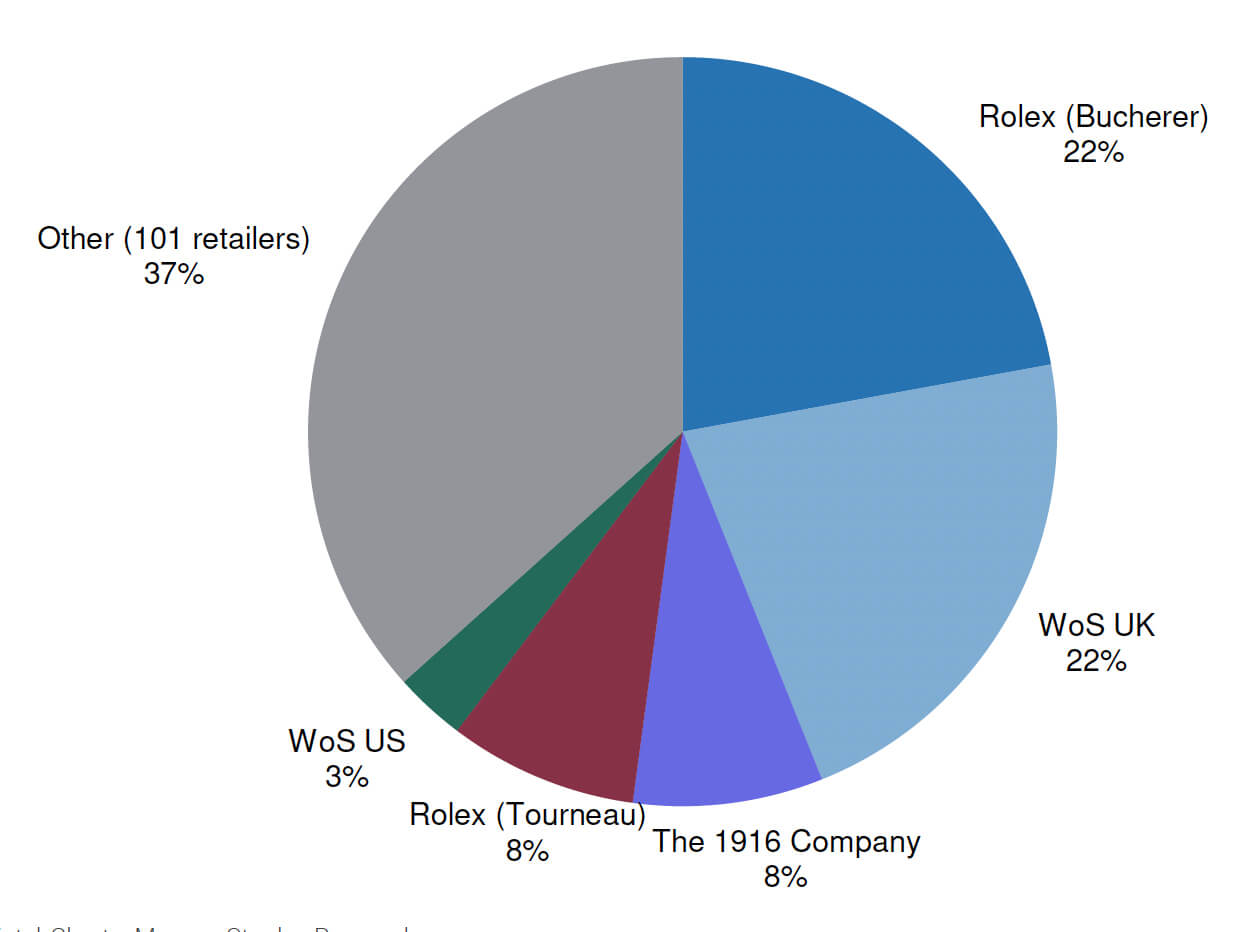

Evolution of total supply of Rolex CPO inventory and number CPO retailers

since the program’s inception in December 2022

The majority of inventory continues to be held by a few key retailers: Rolex (through Bucherer in Europe and Tourneau in the US) and Watches of Switzerland (in the US and UK) each carry around 2,000 Rolex CPO watches in inventory, while The 1916 Company in the US stocks more than 600 RCPO watches. Together, these three companies account for around 60% of all global Rolex CPO inventory, while no other retailer carries more than a few hundred pieces in inventory.

Inventory distribution by volume between Bucherer, Tourneau, Watches of

Switzerland US, Watches of Switzerland UK, The 1916 Company, and other retailers

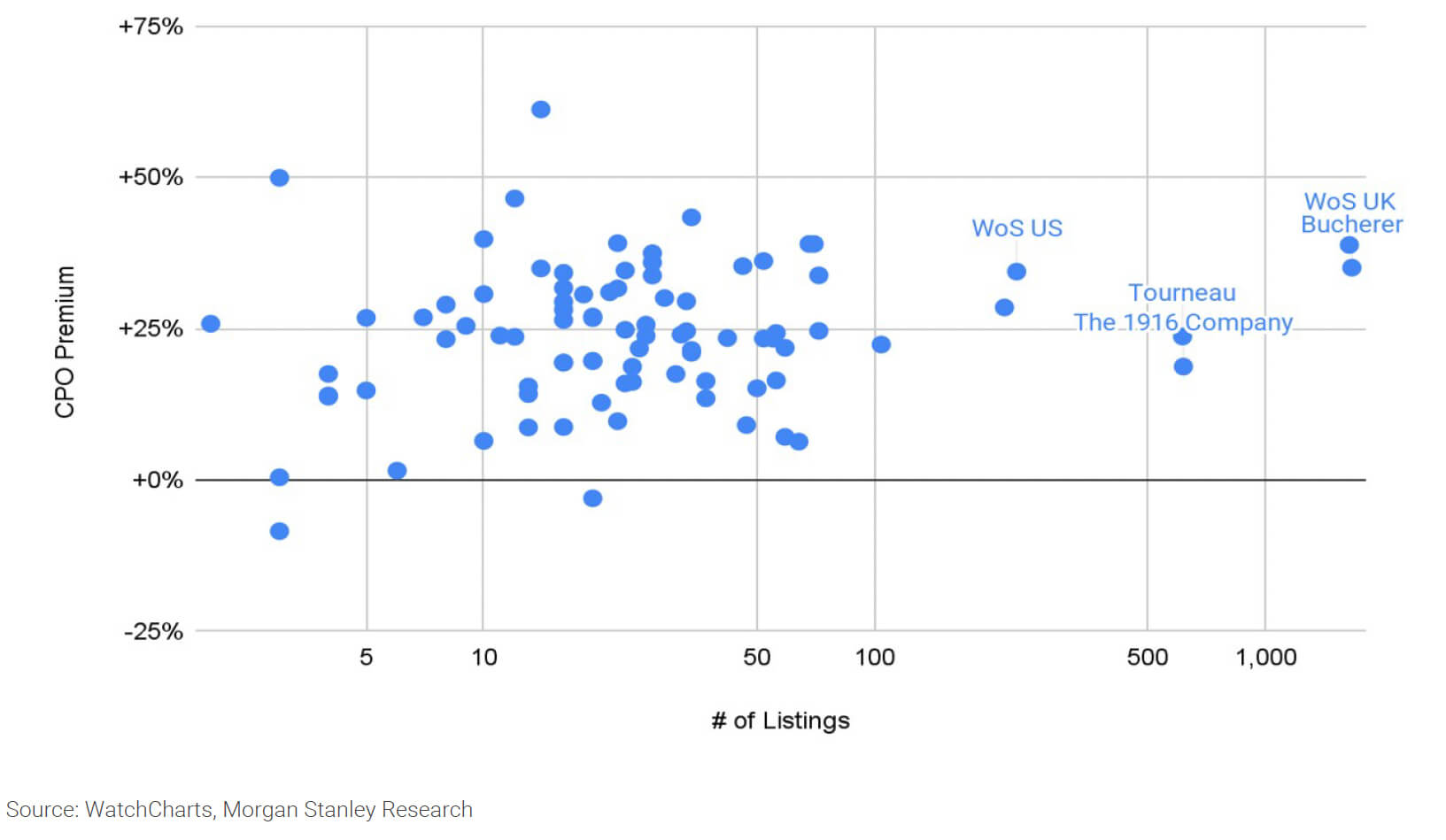

Analysis of listings and CPO premium for key Rolex CPO retailers

By leveraging WatchCharts data, we calculate a “CPO Premium” for each retailer which allows us to assess how disruptive the Rolex CPO program is to traditional secondhand watch trading platforms. The CPO Premium is an estimate for how much more expensive a watch is when listed by a Rolex CPO retailer compared to a non-Rolex CPO dealer. The methodology for determining the CPO Premium is outlined at the end in the Methodology section.

Rolex CPO watches continue to cost around 30% more than equivalent non-CPO watches. The median CPO premium across all Rolex CPO listings globally is +30.2%. 75% of listings have a CPO premium of +18.8% or more, while 25% of listings have a CPO premium of +41.6% or more.

Among the key retailers, The 1916 Company continues to price RCPO the most competitively (with a CPO premium of +18.7%) while Watches of Switzerland in the UK is the most expensive (with a CPO premium of +38.8%).

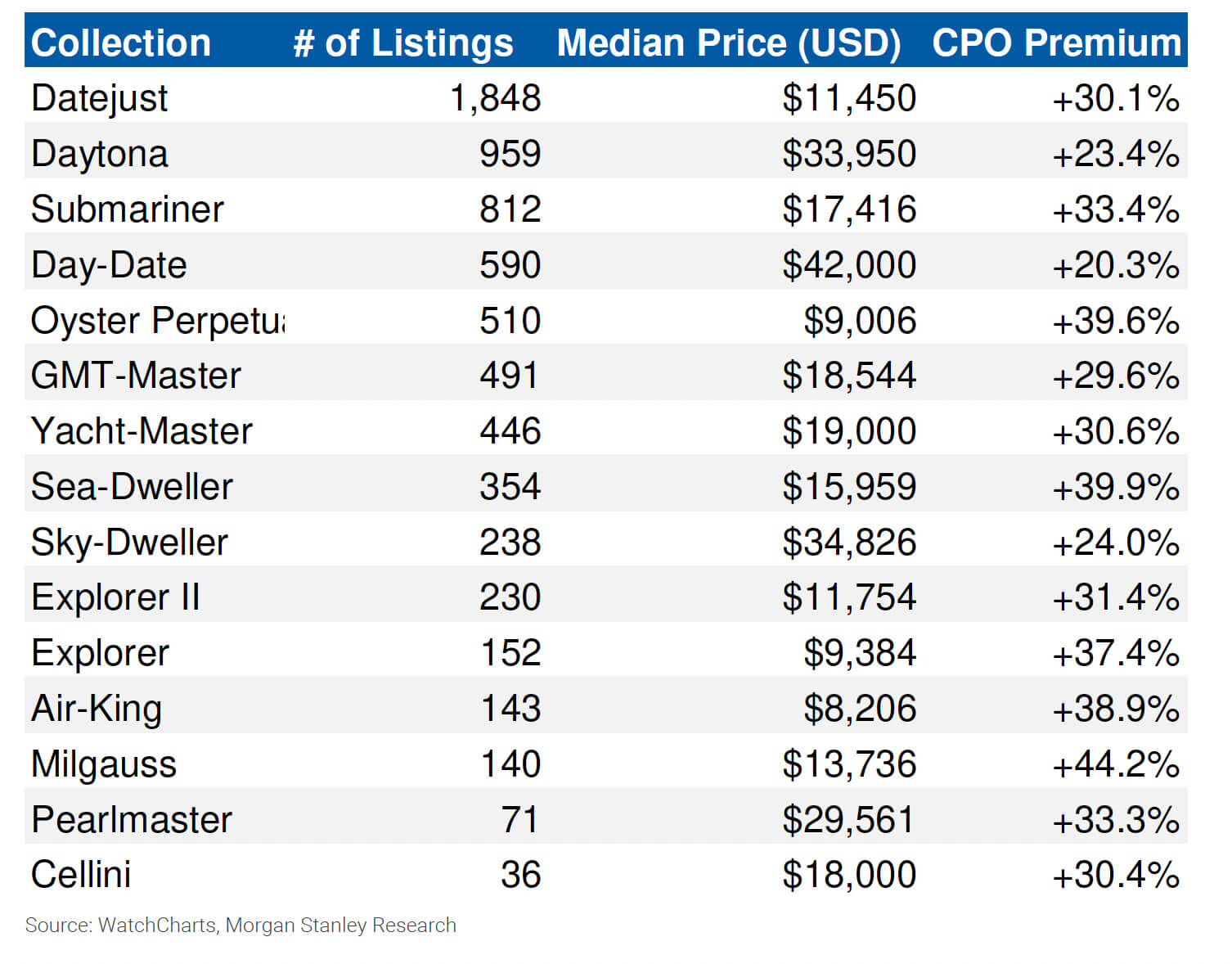

The Datejust, Daytona, and Submariner are the most popular Rolex CPO collections. The global state of Rolex CPO inventory represents a well-balanced mix of both Classic and Professional models. The Datejust is the most popular collection, accounting for around one-quarter of all RCPO watches.

CPO premiums remain relatively consistent across collections, though premiums are generally smaller for more expensive collections. For example, the three most expensive collections – Day-Date, Sky-Dweller, and Daytona – all feature below-average CPO premiums.

Summary of inventory level and CPO premium for key Rolex CPO retailers as

of April 6, 2025

CPO premium and inventory levels across all tracked retailers as of April 6,

2025

Breakdown of global RCPO inventory by collection as of April 6, 2025

Methodology

Value Retention:

The list of current-production models for the brand based on data from their official website is identified, along with the retail price of these watches in USD (watches for which the US retail price is not obtainable, is not considered for inclusion in the analysis). Then this list is cross-referenced with WatchCharts’ catalog of secondary market prices, filtering out any models that do not have sufficient secondary market data.

Value retention is then determined using a weighting factor based on WatchChart’s estimates of annual sales volume for each model (based off of sales volume).

For LFL analysis, common models between two different value retention data sets (two different points in time) are determined and delta of the value retention between these common models represents the LFL VR evolution.

Rolex CPO Premium:

The Rolex CPO premium is the comparison of two values: the price of CPO inventory (which is known by indexing the retailer’s website) and the price of comparable inventory sold by non-CPO dealers (which we need to estimate).

You can download the full report at https://quillandpad.com/wp-content/uploads/2025/04/WatchChartsMS-1Q25-Watch-Market-Report.pdf

You can check out WatchCharts Market Updates at https://watchcharts.com/articles/category/dispatch and there are more market insights and analysis on their YouTube channel at www.youtube.com/watchcharts

You might also enjoy:

WatchCharts December and Full Year 2024 Watch Market Update

So, You Want to Buy a Rolex? Well, Daddy-O, I’m here to Talk you Out of It!

Leave a Reply

Want to join the discussion?Feel free to contribute!

I’m not sure how comfortable I am estimating market trends for (any) brand with such a small (n) number of watches used as a sample size. Concluding Rolex sales did xxx when only 131 data points (Rolex watches sold) were used to come to a conclusion for a company sells over 1 million per year.

Having said that, I follow auction results and have seen prices soften over time.