WatchCharts December and Full Year 2024 Watch Market Update

by Charles Tian

Charles Tain is the founder of WatchCharts.com, which has kindly allowed us to share their monthly, and here also yearly, Market Updates.

————————————————

Welcome to our last watch market update of 2024. After a slight uptick and some mixed signals in September and October, the secondary market decline continued in November and so far in December.

Over the past month, the WatchCharts Overall Market Index fell by 0.8%, with secondary prices for our Rolex, Patek Philippe, and Audemars Piguet indexes all dropping slightly less than 1%.

Over the past year, the overall market is down 5.1%, with Rolex, Patek, and AP down 4.9%, 6.5%, and 7.4% respectively.

Performance by Brand in November

Performance by watch brand in November 2024

The chart above shows the performance in November of the major brands that we track. Even more brands experienced price declines than the previous month.

Only Bell & Ross, Tudor, Cartier and Zenith saw any improvement, and that too of less than a third of a percent each. The three worst performing brands – Chopard, Breitling, and H. Moser & Cie – all lost over 1.5% of their index values in November.

Best and Worst Performing Collections in November

Some of the best and worst performing collections of November are listed below. The decline in MoonSwatch values continues to be driven in part by prices for the MoonSwatch Mission to Neptune reference declining and coming in line with market values for other references in the collection.

| Brand | Collection | Delta % |

| Tudor | Submariner | +2.4% |

| Omega | Constellation | +2.0% |

| Tudor | Pelagos | +1.3% |

| Chopard | Alpine Eagle | -2.3% |

| Rolex | Explorer | -2.6% |

| Swatch | MoonSwatch | -3.1% |

2024 – The Year In Review

This was a challenging year for the watch industry, both in terms of the primary and secondary markets. After a record year for Swiss watch exports in 2023, volume and revenue were down across the board for the major Swiss watch groups in 2024.

The data in the chart below comes from the Federation of the Swiss Watch Industry.

Revenue units (watches) 2020-2024

On the secondary market, many well-known dealers such as Chrono24, Crown and Caliber and CHRONEXT have been cut or cease operations as a result of falling demand and secondary prices.

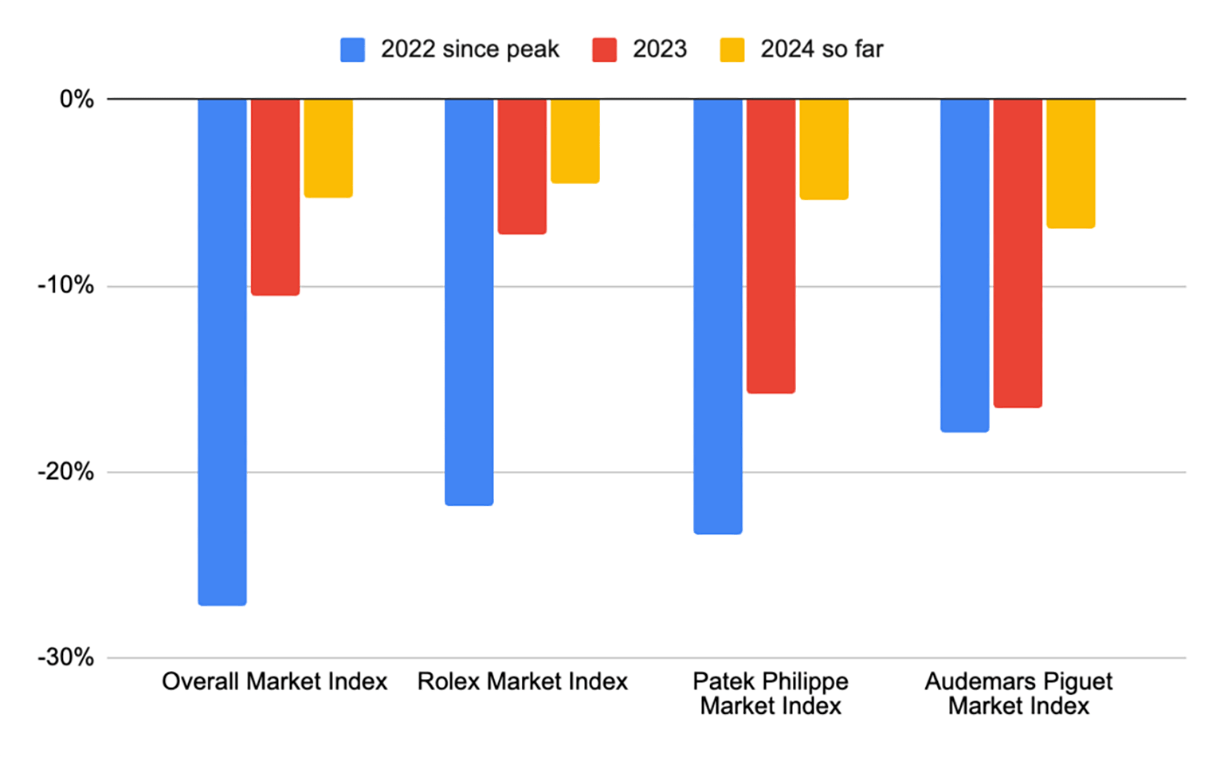

However, the good news is that prices have fallen less in 2024 than they did in 2023 or 2022, since the market downturn began.

Market index 2022-2023-2024

Performance by Brand in 2024

While prices for nearly all major brands fell in 2024, some performed much better than others. The chart below shows the performance over the past year for all brands with a minimum index value of $3,000.

Most notably, Cartier was the best performer among this list in 2024 (-0.6%), with the brand coming into somewhat of a resurgence over the past few years as a result of its strong heritage and broad appeal.

On the other hand, brands such as Vacheron Constantin (-11.8%), H. Moser & Cie (-12.7%), and Girard-Perregaux (-13.7%) struggled the most as a result of waning interest in their integrated bracelet sports watch collections.

Performance by Brand in 2024

Is Now a Good Time to Buy?

If you’ve been in the watch market at all for the past few years, you’ve probably heard a watch dealer say something like “prices are falling, now is a good time to buy”. We’ve refrained from making such statements in the past, as just because prices are falling doesn’t mean they won’t fall further.

However, we do think there exist many options in the watch market today that could represent compelling value for money. Rolex, Patek, and AP prices are all past three year lows, and Rolex prices are at more than 5-year lows when adjusted for inflation.

Coupled with frequent retail price increases from brands the past few years, we probably haven’t seen the secondary market represent this much value-for-money since before COVID.

Does this mean we can guarantee you won’t lose money on a watch that you buy today? Certainly not, particularly if you opt for a recently-released in-demand model.

However, we do feel that for the astute and knowledgeable buyer, there exist some opportunities right now to find better deals than much of what we’ve seen the past few years, while incurring relatively low future risk. Hopefully WatchCharts can help you with that. But most importantly, buy what you like.

* Charles Tain is the founder of WatchCharts.com. You can check out previous Market Updates at https://watchcharts.com/articles/category/dispatch and there are more market insights and analysis on their YouTube channel at www.youtube.com/watchcharts

You might also enjoy:

Watchcharts November 2023 Secondary Watch Market Update

So, You Want to Buy a Rolex? Well, Daddy-O, I’m here to Talk you Out of It!

Leave a Reply

Want to join the discussion?Feel free to contribute!

Moser is in the toilet because they hired the Govberg team to shore up secondary market prices a few years ago. That only works for so long and then the market gets smart.