The last time this threat appeared on the horizon of the modern watch industry (around 15 years ago), it spurred an era of creativity, leading to many brands searching out alternatives to the ubiquitous ETA movements that had been powering the majority of mechanical watches since the late 1980s, the end of the quartz crisis.

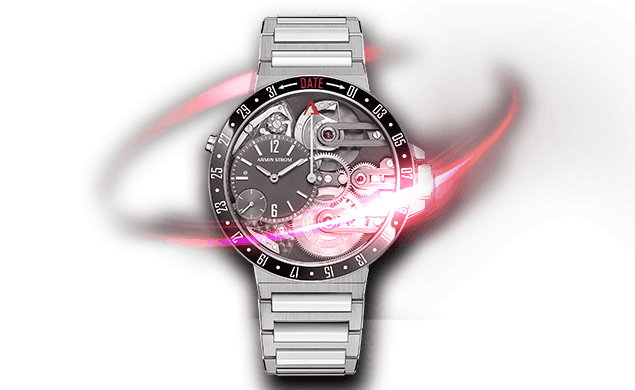

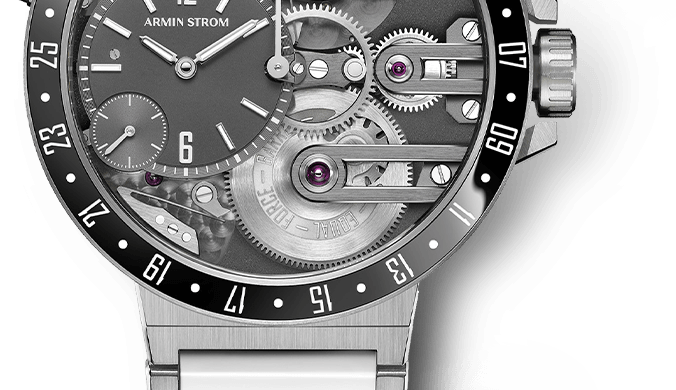

ETA Caliber 2892

In the early days of the so-called mechanical renaissance, less than a handful of brands manufactured their own movements. This meant that almost every watch brand bought movements either from a third-party supplier like ETA or from the few brands that manufactured movements and were willing to share for economies of scale.

Then came the moment in a booming period of recent watch history between 2002 and 2008 in which ETA attempted to stop delivery to brands outside the Swatch Group. Comco (Switzerland’s Competition Commission) stepped in to resolve that, decreeing the Swatch Group must continue delivering to ensure competition.

There ensued years of back and forth between the institutions and the powerful watch group, and finally, in 2013, an amicable settlement was reached between Comco and Swatch Group (the owner of ETA), which ensured further delivery until 2019.

Today, December 15, 2019, the Swiss press is reporting that the tug of war between Swatch Group and Comco is now back on the table – and could result in dire consequences for the entire industry as soon as 2020.

What’s going on?

Funny enough, this is not coming from the side of the Swatch Group’s ETA, which has meanwhile settled back into its profitable role as a provider of tried-and-tested movements to a grand percentage of existing watch brands producing mechanical watches.

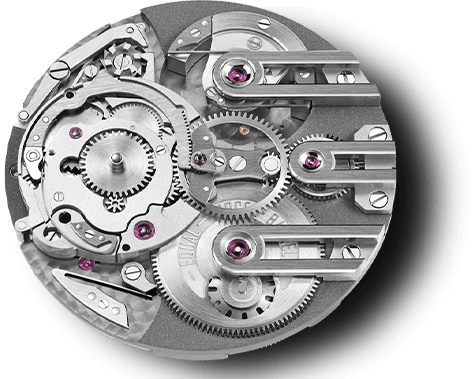

ETA Valgranges movements

The 2013 deal between the two called for ETA to deliver a little less to the market every year until the end of 2019, when Nick Hayek, CEO of Swatch Group AG, would once again be free to make his own decisions.

The basic idea was for ETA not to be the overwhelming market leader by that time (now), allowing ETA’s clients to be free to choose where it purchases ébauches.

The Comco commission is now petitioning to stop supply of ETA movements, with a decision to finalize set for the upcoming week. The reason behind all this is a poll Comco has been conducting with ETA’s clients over the last 18 months. Apparently, the results have only just come in – days before the end of 2019 and therefore days before the 2013 contract expires.

According to Grenchner Tagblatt, the local newspaper in Grenchen, where the majority of ETA’s factories are located, ETA sold 500,000 movements to Swatch Group competitors in 2019; in 2020 there may be no calibers leaving the Swatch Group’s workshops except in the group’s own watches – a situation that would mean certain doom to smaller brands depending on these deliveries for survival.

“The commission does not have the task of organizing the marketplace,” Hayek said to Grenchner Tagblatt. “If ETA is not allowed to deliver, that will not lead to more competition, but rather less.”

Hayek is correct. That could lead to absolute ruin for smaller brands and independent watchmakers depending on ETA movements as the basis for their work.

Larger brands, who have meanwhile adjusted to the whims of both Swatch Group/ETA and Comco, usually no longer depend solely upon ETA movements to power their watches, preferring to purchase ébauches from a variety of sources these days. While for them this will be an inconvenience leading to lower 2020 turnover and perhaps fewer individual watch models, it will not put them out of business.

Smaller brands, however, may not be able to weather this storm.

You may also enjoy:

Exceptional Movements In History: Zenith El Primero

Trackbacks & Pingbacks

-

[…] to find an ETA 2824 movement in microbrand watches of this price range, it is worth noting that come 2020, ETA will likely no longer deliver to non-Swatch group brands. The Merveileux may be one of the last non-Swatch group watches to use the ETA 2824 movement, so […]

Leave a Reply

Want to join the discussion?Feel free to contribute!

Right, Comco are now petitioning to stop the supply of ETA movements altogether, where before they were reportedly enforcing a minimum production level on ETA, as it was Swatch who were keen on cutting the supply off. Because of a ‘poll’. What to believe, eh?

Richemont and Swatch reportedly have a contract for Richemont to receive ETA calibres commencing in 2020. Is there any comment on that?

Anxious shareholders.

No word on the Richemont/Swatch contract at all, but I expect a lot of information to rolling in over the next few weeks. Also differing viewpoints. This is definitely a story worth following. I am only trying to present facts as they become available.

Yes, sorry Elizabeth, wasn’t having a go at you – just bemused by what the latest story is. Many thanks for posting the info, hadn’t seen it anywhere else.

Oh, I know! I was just clarifying.

Thank you for a grear article and important news. Any info which brands that can be most affected? Br C

I wonder what this means for Sellita? Are they capable of ramping up production to fill the increased demand?

As of right now that answer is no. Sellita has filled in a lot of gaps for the last decade or so, but they don’t have the capacity to take over all of it.

Will Seiko step in to fill the gap for the smaller players?

Seiko has been selling movements to other manufacturers for decades now and is already a mainstay source of power for a variety of brands. Joshua wrote something about the already a couple of years ago: https://quillandpad.com/2017/02/15/seiko-sii-ne88-automatic-chronograph-movement-change-wind-archive/

The late Nicolas Hayek wanted to stop delivery of ETA movements outside of the Swatch Group when he was alive (he’s been deceased since 2010). He repeatedly told the watch industry to “start making your own movements!”. The industry has had time to do this, the smaller brands should be doing this very thing and a few have. IMO, like Brexit, it’s time for Swatch Group to ‘cut the cord’ with the rest of the watch industry and go their own way.

(at this point I take cover to avoid incoming fire, LoL!)

This is stupid. You don’t improve competition by removing one competitor. Now Ronda is pretty much alone in cheap quartz, and Sellita in cheap mechanical.

Hundreds of jobs are now at risk, and COMCO is responsible. Well done…

There is another, potentially even uglier long-term result that could come of this. If there are not sufficient swiss-made movements available, then more small manufacturers may turn to some of the extremely reliable Japanese mechanical movements that are out there, and many people buying watches will not miss a beat. A long-term depreciation of the value of Swiss made movements is a potential that the Swatch company may well wish to avert.

If I were Fossil, I would be ramping up capacity to provide STP movements ASAP. Give their size, they are more likely than Sellita or Soprod to be able to fill a meaningful part of the gap if it comes to that.

I’m currently in Tokyo and went to the IWC store in Ginza to have a look at a Portugieser. The sales person told me they had just gotten the new version in and showed it to me – it had a sapphire caseback and she told me it now was a completely in-house movement. The previous version had didn’t have a sapphire case back and was a 50% in-house 50% ETA movement. Don’t know if this is “new” information but I was a bit surprised…

Maybe the larger watchhouses have been preparing for this move for some time…

If the industry is using this as a means of keeping premium pricing on watches I’ll just stick with watches with Japanese movements going forward. Grand Seikos and everyday beaters with Miyota 821a and 9015s in them. Sorted.

As one of these smaller brands that used to spec ETA, we have made a conscious shift away from anything ETA for this very reason. Not only are ETA calibers harder to come by, even through official channels, but the lead-time on any caliber is so long that it’s inefficient anyway to spec an ETA movement. The grey market is too sketchy for reliable sourcing of ETA.

Japanese mechanicals in Miyota and Seiko are the answer, but with two large caveats – there isn’t the myriad of dial layout choice vs Swiss movements, especially in terms of conventional dial layouts i.e. small seconds. But perhaps more crucial, the Japanese equivalents are more often than not a significant amount thicker than the Swiss counterparts, which can be troublesome if trying to be competitive in the design/specification/dimension dept. Where the calibers are thin, there aren’t the dial layouts, so it’s a constant trade-off.

Miyota have also made a shift away from offering hand-crank movements, which has been a disappointment for us, with our original USP being a hand-crank brand, and with manual winders being somewhat in-vogue again.You make your bed, as they say.

Hi there, I would like to subscribe for this webpage to get most up-to-date updates, so where can i do it please help.