The Investment Market for Luxury Watches is Growing

The demand for luxury watches as alternative assets is fueling the growth of the pre-owned market. A growth that remains resilient, even though it slowed down in 2023. The pre-owned market is built today on transparency, information sharing, and accessible trading platforms that bring together knowledgeable buyers and established sellers.

In a 2023 Deloitte survey, 39% of the consumers surveyed stated that they were more likely than the year before to buy a pre-owned watch, in the next 12 months. Whereas 34% of those surveyed would buy a watch to diversify their investment portfolio, 28% of them would do so to hedge against inflation.

By 2030(1), the market is estimated to grow to CHF 35 billion and make up more than half of the primary market.

What is enabling the growth of the pre-owned market?

Greater price transparency and information sharing have increased investors’ trust in the pre-owned luxury watch market. Several online data providers have emerged capable of supporting the investment decisions of investors. These online platforms(2) collect the actual sales prices of hundreds of thousands of watch references across auction houses, dealers, and watch sales platforms.

The datasets that they put together enable investors to study past trends, to analyze real time prices, and to compare the performance of thousands of models. The use of artificial intelligence can then unlock further insights on price prediction.

The certification of pre-owned watches (i.e. CPOs) has made the trading of watches safer, compared to several years ago. Dealers and online platforms offering CPOs inspect the watches to confirm their authenticity, perform tests to verify their performance, and repair them if necessary. The sales of CPO watches are accompanied by a certificate confirming their authenticity.

Blockchain has also made the trading of watches safer. The technology enables the digitization and storage of the identity of a watch on the cloud, as a digital ID (e.g. a “digital passport”). A digital ID that cannot be tempered with.

The technology ensures the traceability of the watch and therefore its authenticity and ownership. Several important luxury brands have adopted blockchain in recent years (e.g. Vacheron Constantin, Breitling).

————————————————————————————————————–

—————————————————————————————————–

Why invest in luxury watches as alternative assets?

Alternative investments offer several advantages. First, they can help diversify an investment portfolio. Second, they can hedge a portfolio against market fluctuations, due to their relatively low correlation with traditional markets. Third, they provide return on investment performance.

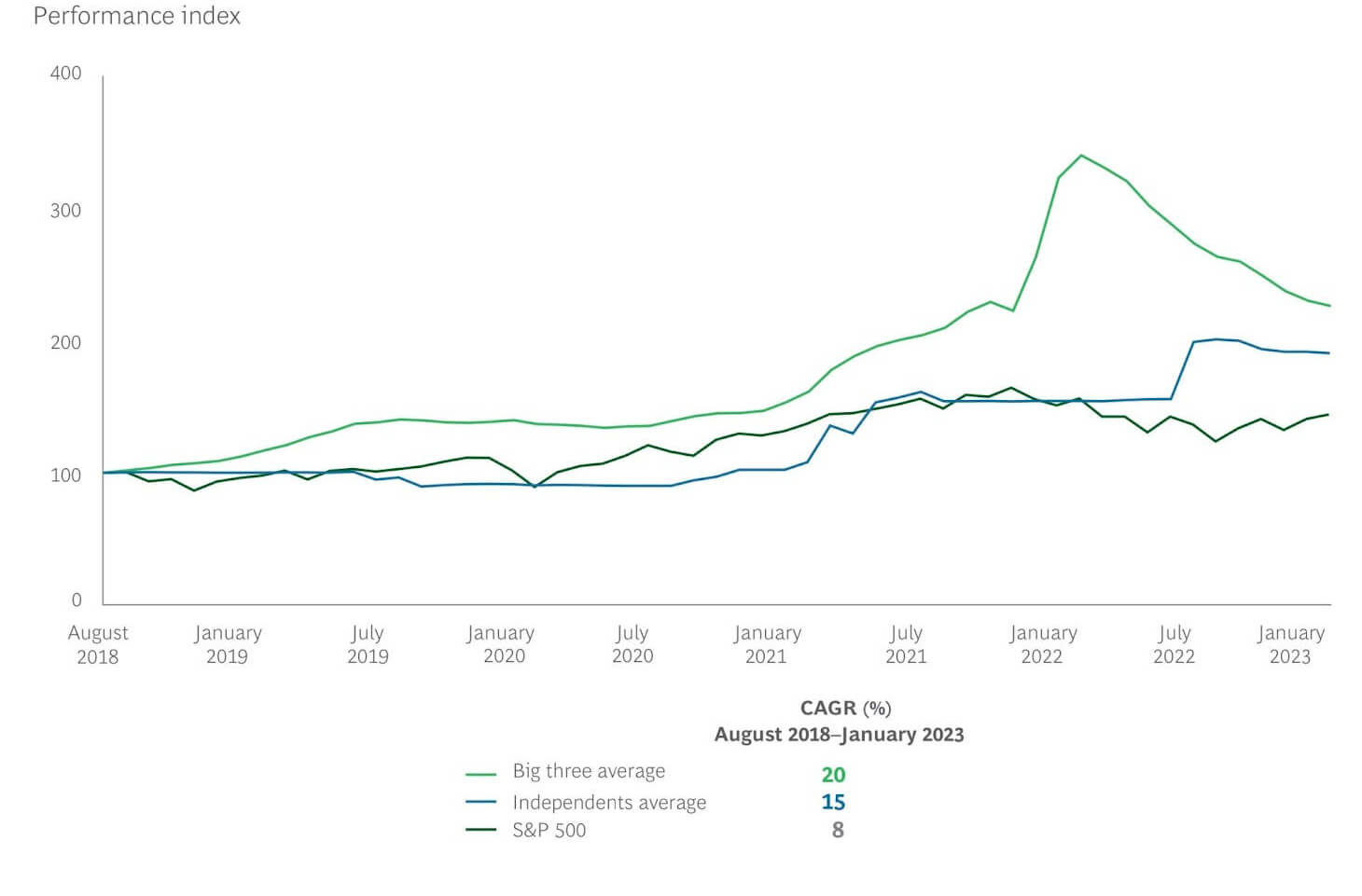

Average prices of luxury watches 2018–2023 (graph courtesy Boston Consulting Group, “Luxury Pre-Owned”)

For example, average prices for rare and exclusive pre-owned watches have been raising at an annual rate of 20%, from 2018 to 2023. This is much more than the 8% rise of the S&P 500 index, during the same period (see Fig. 1).

Luxury watches have also outperformed the S&P 500 index during the 2007–2009 recession. They have recovered from that recession faster than other investment classes.

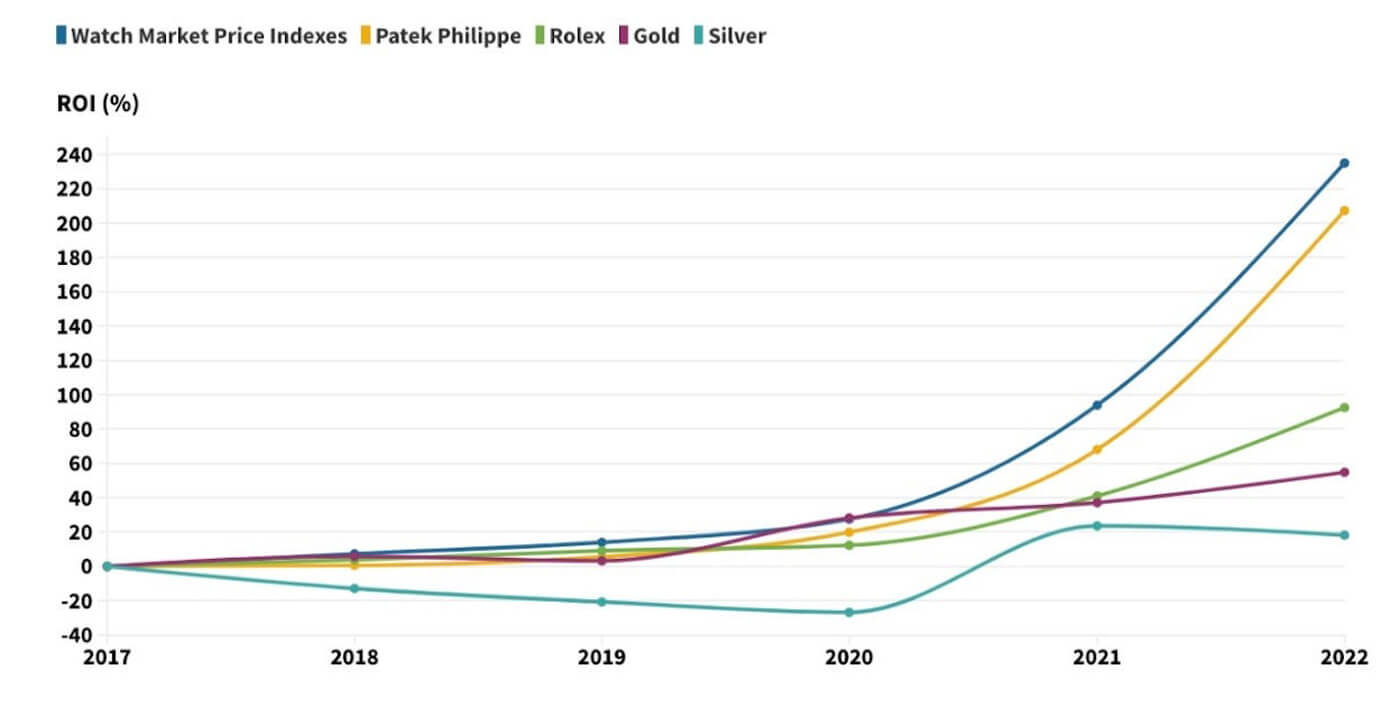

Luxury Watches versus Precious Metals (graph courtesy www.watchesworld.com)

Similarly, between 2017 and 2022, the return on investment (ROI) of the Watch Market Price Index was over 4 times better than the ROI of gold, and 13 times better than that of silver. Investing in a Patek Philippe timepiece in this period would have delivered a 207% ROI.

Luxury watches have the advantage of being tangible assets and offering direct ownership. They emotionally engage their owners when worn on the wrist or admired in a private showcase.

They are portable, thus guaranteeing money mobility. They can be easily stored and converted into cash.

An increasing number of financial services institutions offer credit lines using hard luxury investments as collateral. This is made possible by sufficient market liquidity and reliable appraisal methods.

These new financial products enable investors to leverage their collections to secure additional borrowing, to address cash-flow needs for their businesses, or to fund new acquisitions for their collections.

—————————————————————————————————–

—————————————————————————————————–

What to look for when investing in luxury watches?

Brands like Rolex, Patek Philippe, and Audemars Piguet have shown the potential for appreciation over time. Even other brands like Omega, Panerai, and Cartier have proven to be capable of storing value, based on limited editions or iconic models.

Given the right conditions and proof of authenticity, an investor needs to consider several factors before investing in a watch. Scarcity, uniqueness, craftsmanship, brand legacy and iconic status make a watch a desirable investment asset. It often takes time and a combination of these factors for a watch to rise in value.

Scarcity is at the top of the list of factors to consider. A mechanical watch produced in low amounts and for a short period of time may appreciate in value over time. This is especially so when the watch has a story to tell, it has iconic status, as well as brand legacy. Take the Jaeger LeCoultre Geophysic, for example.

Jaeger LeCoultre Geophysic 1958

Created in 1958 for the International Geophysical Year, only 1300 pieces were produced over the span of a single year. The Geophysic was designed to resist magnetic fields of up to 600 Gauss and featured a water resistance of 100 meters. It was indeed an innovative watch for its time. (see Fig. 3)

Watches with a high level of mechanical artisanship, a high quality in their finishing, decorations, and materials used are also in high demand as investment assets. Craftsmanship is a resume of the watchmaker’s know-how and exceptional craftsmanship will make a watch rare and exclusive.

The value of a watch is also inherent in the technical complexity of its movement. A watch that combines unique horological know-how, brand legacy, and scarcity will be highly rated by investors.

IWC “Il Destriero di Scafusia” (photo courtesy www.collectorsquare.com)

One such watch is the 1993 IWC “Il Destriero di Scafusia”. It features four highly complex complications: a split-second chronograph, a perpetual calendar, a flying tourbillon, and a minute repetition(8) (see Fig. 4). Its movement consists of more than 750 components.

Nevertheless, not all luxury watch models will appreciate in value over time. Some models in fact may even lose value in the long run. Investing in luxury watches requires careful selection of brands and models based on painstaking industry and market research.

—————————————————————————————————–

—————————————————————————————————–

The new breed of digital marketplaces

Digital marketplaces like Chrono24, Watchfinder, Watchbox, Chronext, as well as eBay dominate the pre-owned market. These market players may operate with different business models.

Whereas some are places of exchange between sellers and buyers, others buy watches and resell them after refurbishment. Yet others play consignment with manufacturers, retailers, and individual consumers.

New and innovative digital marketplaces have entered the market in recent years. Rather than facilitating the buying and selling of watches, these new platforms focus on democratizing alternative luxury investments (e.g. art, wine, watches, supercars) through fractionalization and exclusive portfolio management services.

Fractionalization lowers the entry barriers for potential investors. Platform users can invest in a percentage of a watch, rather than in the whole item. The watches offered for investment are subject to a meticulous evaluation which takes into account not only their intrinsic value, but also their long-term appreciation potential.

Supported by senior advisors from the watchmaking and financial services industries, these marketplaces deliver exclusive asset management services, which will include advisory and consignment, digitization, banking for collateral, storage and insurance.

In some cases, investors can purchase the watches using cryptocurrencies. They can digitize their collections and use them as collateral to borrow liquidity without selling them.

—————————————————————————————————–

—————————————————————————————————–

Passion Investing

Investing in luxury watches requires passion and a long-term investment view. Collectors who invest in rare and exclusive watches are what experts call passion investors. They invest in non-traditional, alternative assets such as classic cars, jewelry, rare wines and whiskeys, art and, of course, luxury watches.

The benefit of passion investing is direct ownership of the asset and the ability to enjoy it while holding it in the portfolio. Passion investing requires a long-term wealth management strategy.

The returns rely on capital appreciation, which may take many years to materialize and there is no guarantee that it will ever happen.

A mood for optimism is justified. The Knight Frank Luxury Investment Index(9) rose by 16% in 2022. A confirmation that passion investment is inflation and recession resistant and that it outperforms more traditional investment classes. Top performers were art with a 29% raise, followed by classic cars and luxury watches with raises of 25% and 18%, respectively.

* This article was first published in La Rivista magazine in December 2023.

You might also enjoy:

So You Want to Invest in the Watch Industry . . .

Watch Investment Funds: Show Me The Money!

Notes

- Karine Szegedi, Kristi Egerth. “The Deloitte Swiss Watch Industry Study 2023 — A caliber of its own”. Deloitte, August-September 2023

- WatchCharts, WatchAnalytics, Bloomberg, EveryWatch are some examples

- Pierre Dupreelle, Sarah Willersdorf. “Luxury Pre-owned, Your Time has Come”. Boston Consulting Group + Watchbox, March 2023.

- The “Big three average” (Fig. 1) tracks the second-hand market price for Audemars Piguet (selected Royal Oak models), Patek Philippe (Nautilus, Aquanaut, Chronograph complications, and Annual Calendar models), and Rolex (Daytona, Submariner, and GMT Master models), indexed to their value in August 2018. The “Independent average” tracks the second-hand market price of selected models from F.P. Journe, H. Moser & Cie., and De Bethune, indexed to their value in August 2018

- The WatchCharts Market Index is an indicator of financial trends in the second hand watch market. It comprises 30 popular watch models with high trade activity. The index shows the average market price of these 30 watches over time (www.watchcharts.com)

- Alex Douglas. “Rolex trails Patek Philippe and Audemars Piguet for a 5-year return on investment”. WATCHPRO, May 11, 2022.

- For each asset class, the ROI was calculated year on year from March 2017 to March 2022. The data for individual watches and watch brand indices is from WatchCharts (https://watchcharts.com/)

- Stefan Muser, Legendary Wristwatches: from Audemars Piguet to Zenith (Atglen, PA USA: Schiffer Publishing, Ltd.) 189.

- The index tracks the value of 10 investments of passions: cars, art, handbags, wine, whiskey, colored diamonds, watches, coins, jewelry, furniture. Each investment is weighted based on its collectibility.

Leave a Reply

Want to join the discussion?Feel free to contribute!