WatchCharts June 2024 Watch Market Update: Decline in Secondary Market Continues, Plus Best Value Steel Rolex Daytonas

by Hamza Masood

Hamza Masood is the Business Development Manager at WatchCharts.com, which has kindly allowed us to share their monthly Market Updates.

________________________

The long-term decline in secondary market prices continued over the course of last month. In this update, we cover the Big Three in detail as well as the performance of all key secondary market brands.

We discuss why there are still worrying signs for the Rolex market and cover some of the best and worst performing collections of May.

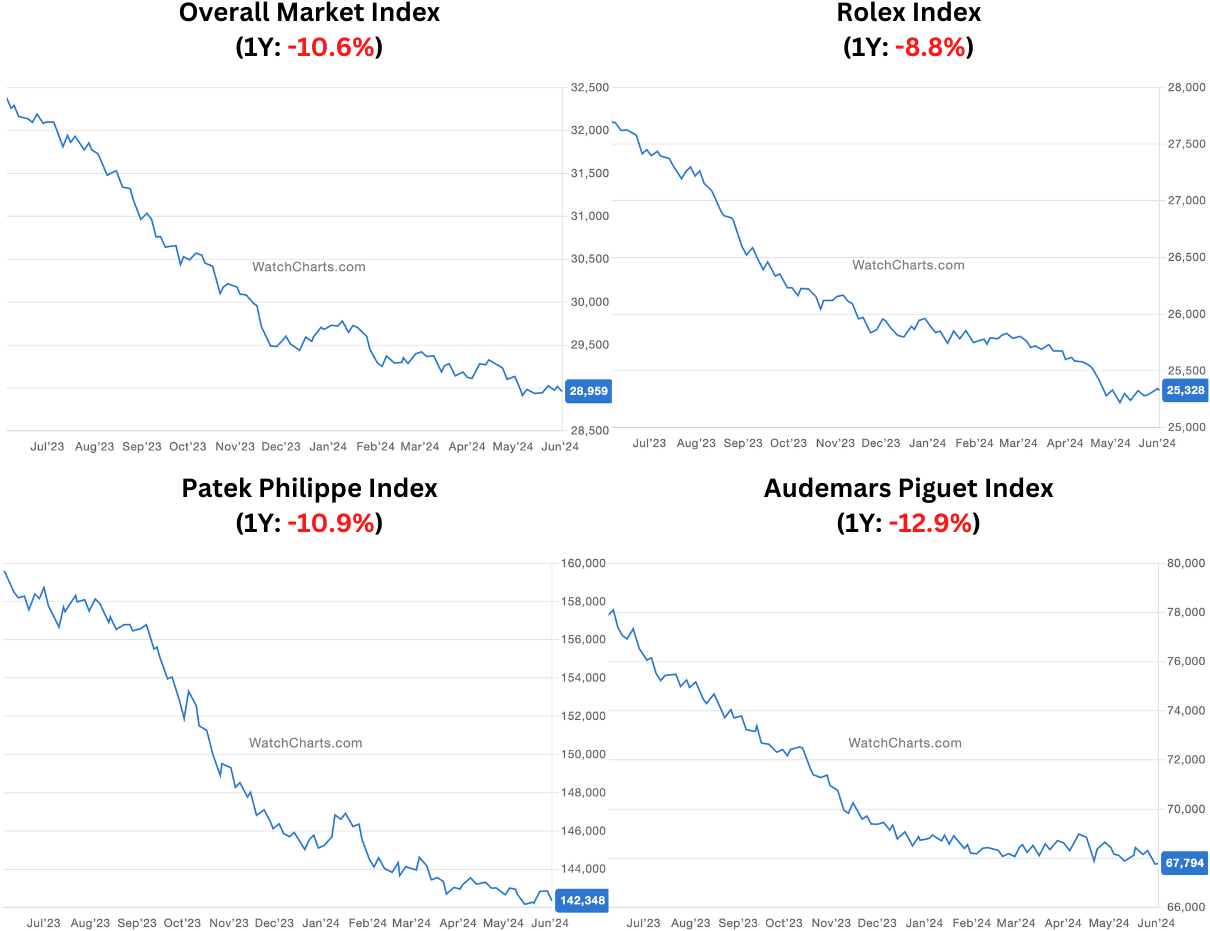

In May, we saw a -0.4% decline in the WatchCharts Overall Market Index, consistent with the performance in April we reported in our previous update.

Overall Watch Market Index to June 2024

Rolex prices rose +0.3% last month, though this was not enough to offset a particularly poor performance of -1.6% in April.

Audemars Piguet (-1.1%) and Patek Philippe (-0.2%) both saw further declines last month, with AP in particular ranking among the worst performing brands of the month.

Why Rolex’s Price Appreciation may be a False Dawn

May was the second month this year in which Rolex saw a positive performance, and the one-year view of Rolex’s index indicates a slowing rate of decline. However, these observations on their own are insufficient to understand where market prices may go from here.

Answering that question requires taking a deeper look at market fundamentals, which paint a grimmer picture.

Firstly, it is important to point out that market performance is affected by seasonal trends. Over the past few years, we have seen relatively stronger performance from around the start of the holiday season to the end of Watches & Wonders (November to April), compared to the summer and fall months (April to November).

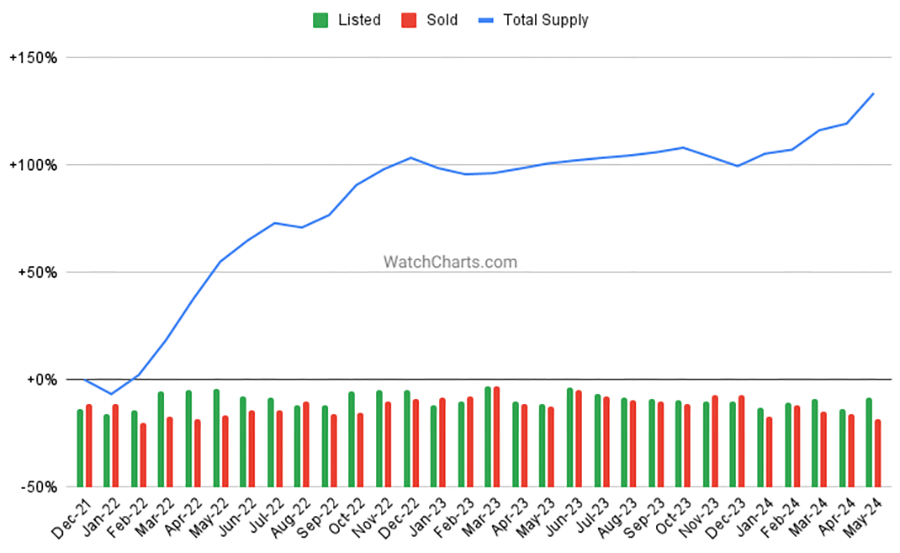

Secondly, we have seen a concerning slowdown in Rolex sales and uptick in total available inventory since the beginning of this year. While supply for watches in our Rolex Market Index roughly doubled in 2022, it remained relatively stable in 2023 before increasing 17% year-to-date.

Supply evolution for watches in the Rolex Market Index since December 2021

This increase in supply is primarily a result of weaker sales, as listed volume decreased only slightly year-over-year while sold volume has decreased much more significantly.

These factors suggest that at least for the short term, the market will continue to soften as competition between dealers and increasing selection of inventory available to consumers will continue to push prices down.

The Best and Worst Performing Collections in May

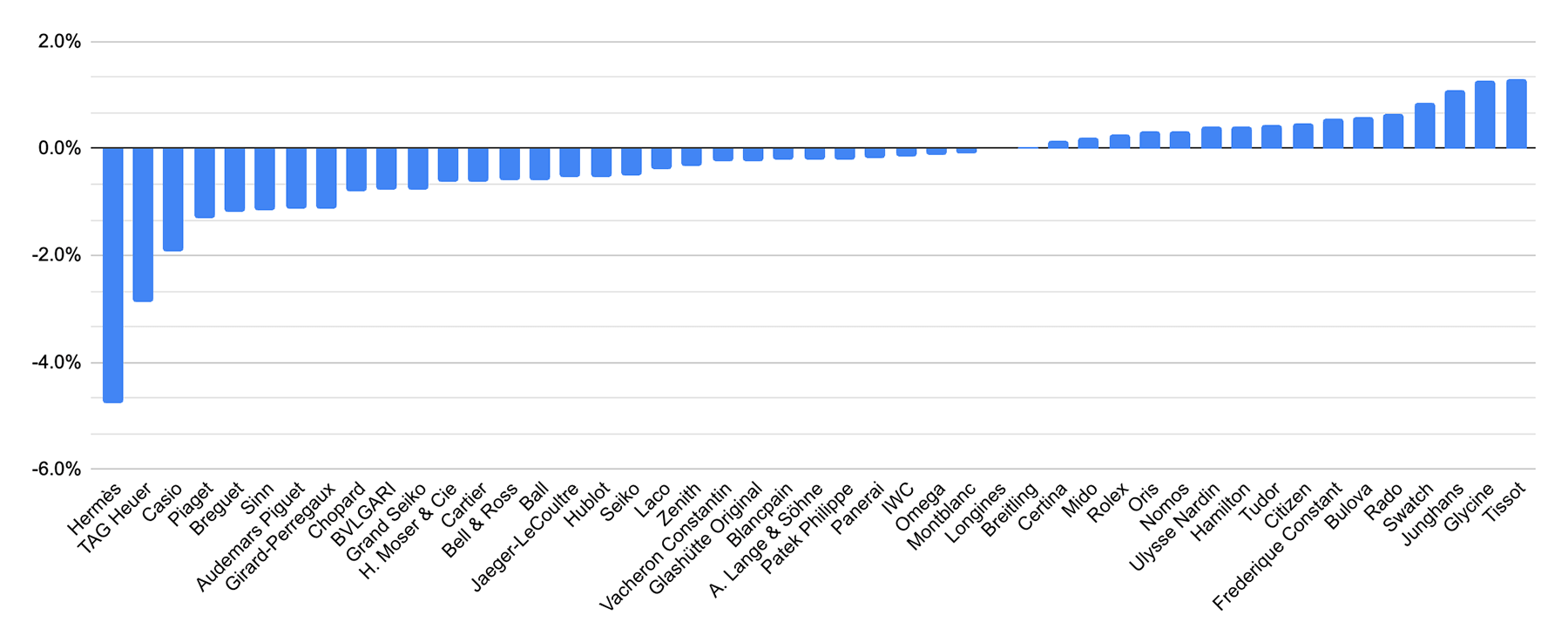

Supply evolution for watches in the Rolex Market Index December 2021 to May 2024

Some of the best and worst performing collections for the month are included in the table below. Most collections that have seen significant changes in value on a monthly basis are at three-digit price points and therefore do not significantly impact or represent the state of the market.

| Brand | Collection | May Delta % |

| Chopard | LUC | +1.4% |

| BVLGARI | Serpenti | +0.7% |

| Cartier | Tank | +0.7% |

| Cartier | Santos | -1.8% |

| Audemars Piguet | Royal Oak | -1.8% |

| Hublot | Classic Fusion | -2.2% |

The Best Value-for-Money Steel Daytona

There are now four modern generation Daytona references in steel to pick from: the current production ref. 126500, its ceramic bezel predecessor ref. 116500, the last steel bezel ref. 116520 and the Zenith movement ref. 16520.

* Hamza Masood is the Business Development Manager at WatchCharts.com. You can check out previous Market Updates at https://watchcharts.com/articles/category/dispatch and there’s more market insights and analysis on their YouTube channel at https://www.youtube.com/watchcharts

You might also enjoy:

WatchCharts May 2024 Watch Market Update: Rolex Secondary Prices Still Declining

WatchCharts April 2024 Watch Market Update: Will the Discontinued Rolex Milgauss go Up?

The Investment Market for Luxury Watches is Growing

So You Want to Invest in the Watch Industry . . .

Leave a Reply

Want to join the discussion?Feel free to contribute!

It is quite strange that there is now “stock market news” for wristwatches. We are not talking about shares or precious paintings here, but about utility items, some of which are even mass-produced.

Those who buy watches not to enjoy them but to make a profit take the fun out of this hobby for many. As a result, watches that are already overpriced often become completely unaffordable.