Top 20 Watch Brands by Geography: What Your Region Says About You

by Raman Kalra

I enjoy exploring different trends within the watch market and finding ways to showcase them. In the past, I have written articles examining general trends in the market, such as case size and dial color, as well as my predictions for where the industry is headed.

Patek Philippe World Time

One topic I have not considered up to now is how geography plays a role in tastes. Factors such as growing up in a society that values subtlety or being surrounded by a particular style of architecture or art can all contribute to differences in the brands and watches we end up liking.

With that in mind, I have analyzed which brands are of most interest to people in various regions. For this, I have looked at six different countries, providing a broad range for us to consider.

How do you think 20 of the biggest brands in the world rank against one another in different regions? Do they line up with your expectations?

Before starting, as always there may be flaws in this methodology given the limited information available to the public. These limitations and considerations will be highlighted, but overall it ended up confirming what I imagined, with a few surprises along the way.

Please share your thoughts on whether the outcomes reflected are what you would expect.

————————————————————————————————————–

—————————————————————————————————–

Methodology

If you have read some of my previous articles, you would have seen the Morgan Stanley Top 20 Swiss Watch Brands table. If not, I have added it below for reference. Each year, Morgan Stanley produces a report looking at the top brands and ranking them based on total revenue and units. This is what sparked my interest in this topic.

Watch brands by country (table courtesy Morgan Stanley)

Ultimately, how many watches you sell, and the revenue generated is the goal, and Morgan Stanley covers that here. That is the way to create a successful business.

However, what about the intangible value a brand has?

What does the broader society feel about these brands, and how would they look ranked purely based on interest?

To produce the results, I have used Google search trends extensively and applied a pairwise method to compare 20 brands against each other. That entailed 2,400 comparisons! The brands considered are broader than just the big Swiss names, and I have included Nomos, Hermès and Grand Seiko, while ignoring other such as Van Cleef & Arpels from the Morgan Stanley report.

While sales and revenue tell us who the biggest brands are from a monetary point of view, what are people actually searching for whether they purchase a watch or not? That is what I aim to answer here. I have broken down the method in more depth for those that are interested, otherwise, feel free to skip ahead!

I compared each of the 20 brands against one another over a five-year horizon and gave them a score from 1 to 4 based on their relative popularity. Using search trends provides a direct comparison and a relative proportion of numbers of searches.

The scores for the pairwise were based on how the brands compared to each other, with a score of 4 indicating that a brand had over 75% of the search popularity, and a score of 1 indicating a brand received less than 25%.

A few countries were selected to capture the broadest variant in geography and demographics.

—————————————————————————————————–

—————————————————————————————————–

A couple of considerations were taken into account. Firstly, some brand names such as Omega and Tudor are commonly searched for outside of the watch industry. To account for this, I added the term “watch” after the brand name in all searches and to ensure accuracy, this was kept consistent for all other brands in these comparisons (e.g., Omega watch vs. Rolex watch).

This same thinking of adding “watch” applies to Cartier and Hermès, which would have some jewelry interests embedded into their search popularity.

Secondly, all results are for search terms specifically. There are other searches for these brands which are categorized into “Manufacturing Company” or similar, but these were avoided to capture the broadest audience.

Then we need to be aware of the limitations. The most obvious is that this analysis set search terms based on the brand’s name, and assumes no other searches are being done. This is not the reality, where a person interested in Rolex could search for “Rolex”, “Rolex watch”, “Submariner” and so on.

There are endless search terms possible, including spelling mistakes, but for this analysis, we are considering just the brand name.

Results

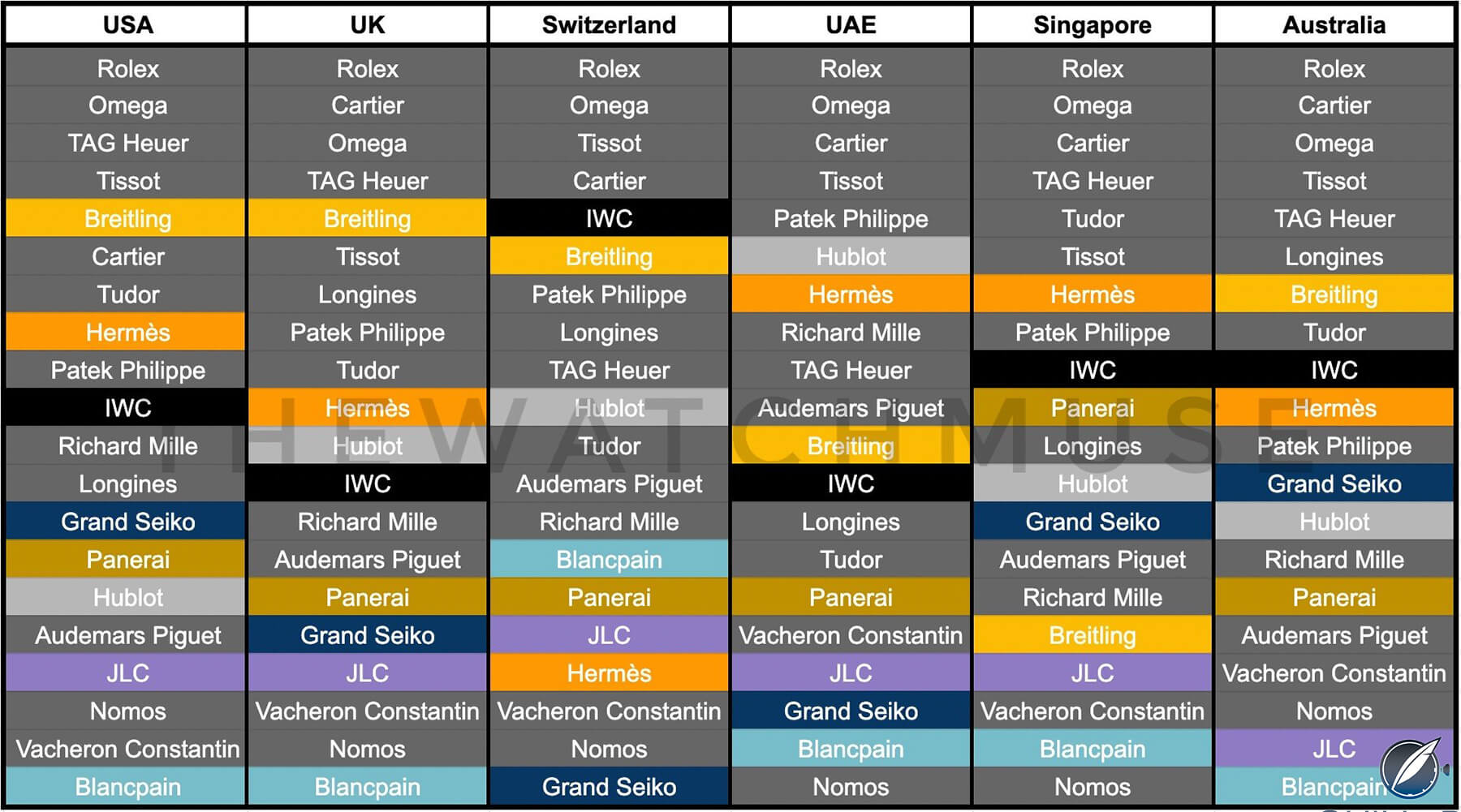

There is a lot of information to digest in the results and it becomes immediately clear that different countries prefer different brands. I want to highlight a few of my main takeaways before getting into discussion points about why this might be the case.

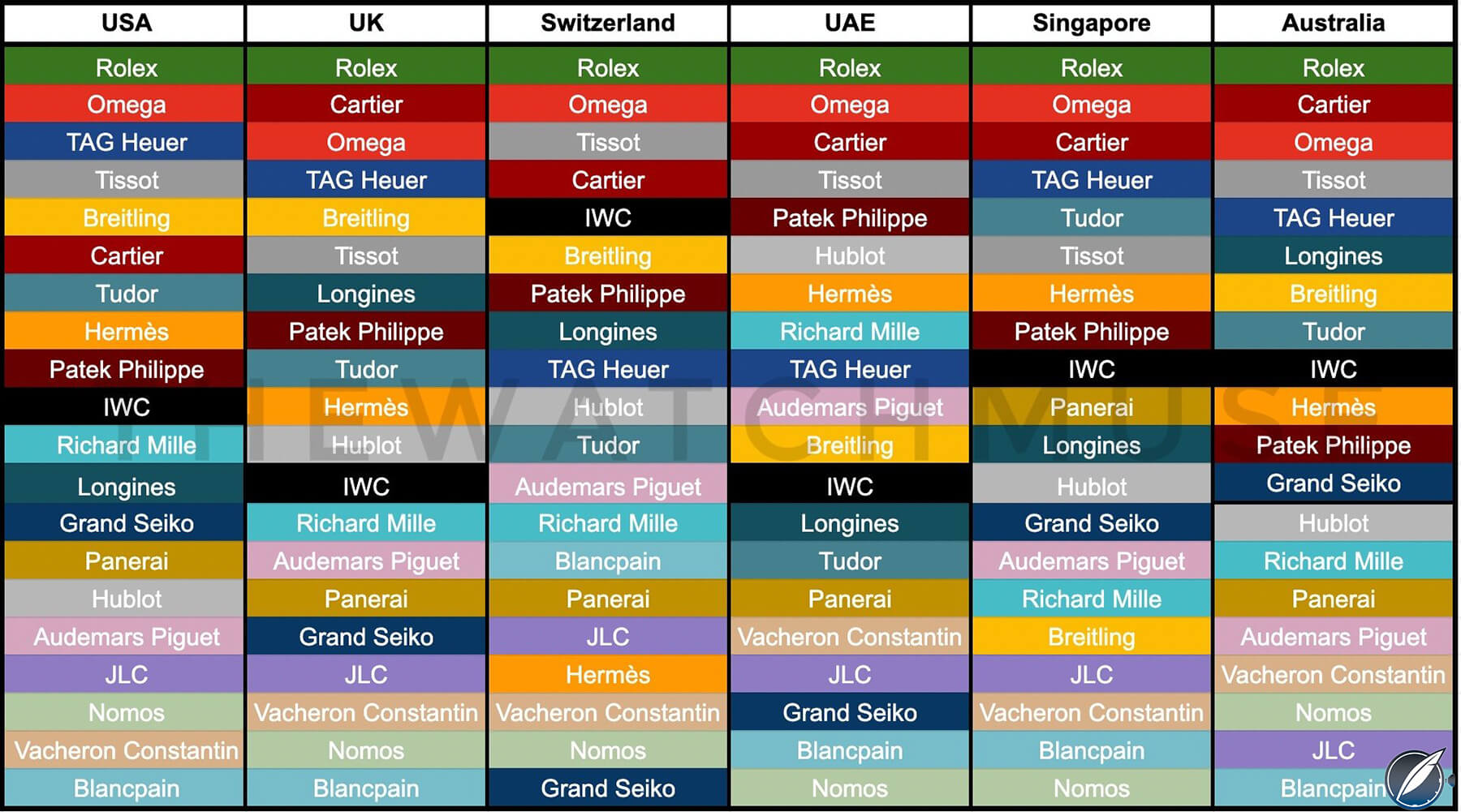

Watch brands by country

First, and without surprise, Rolex is the most popular brand, followed closely by Omega. These two names are synonymous with luxury watches for both enthusiasts and the broader population. These two behemoths being the most popular regardless of region and country makes sense and is a testament to the mass appeal they both have.

Moving down the table, you will notice several more affordable brands ranking highly such as Longines, Tissot, and, to some degree, TAG Heuer.

This was to be expected. By being relatively more attainable, they have the broadest consumer footprint meaning as more people can purchase one, so more are searching for them.

On the flip side, more expensive brands like Vacheron Constantin which feature in the middle of the pack according to Morgan Stanley, are towards the bottom. This demonstrates it is a more well-heeled enthusiast brand and so does not capture broader societal interest.

It is a similar situation with Blancpain even though there was a large spike of attention around the Swatch x Blancpain launch.

Rolex Milgauss

There are several factors to consider when trying to understand why the results turned out as they did. It essentially comes down to the taste and style that each country prefers.

This can be influenced by various aspects like the average size of the watch, the level of subtlety, or even the choice between wearing watches on leather straps or bracelets (for example, the USA tends to prefer bracelets over leather straps).

—————————————————————————————————–

—————————————————————————————————–

Additionally, disposable income plays a role in shaping preferences towards lower or higher-end watches such as Patek Philippe and Tissot. I am aware that the countries included in the analysis are all developed and some of the wealthiest in the world, but I find it no coincidence that Patek Philippe and Richard Mille are ranked the highest in the UAE.

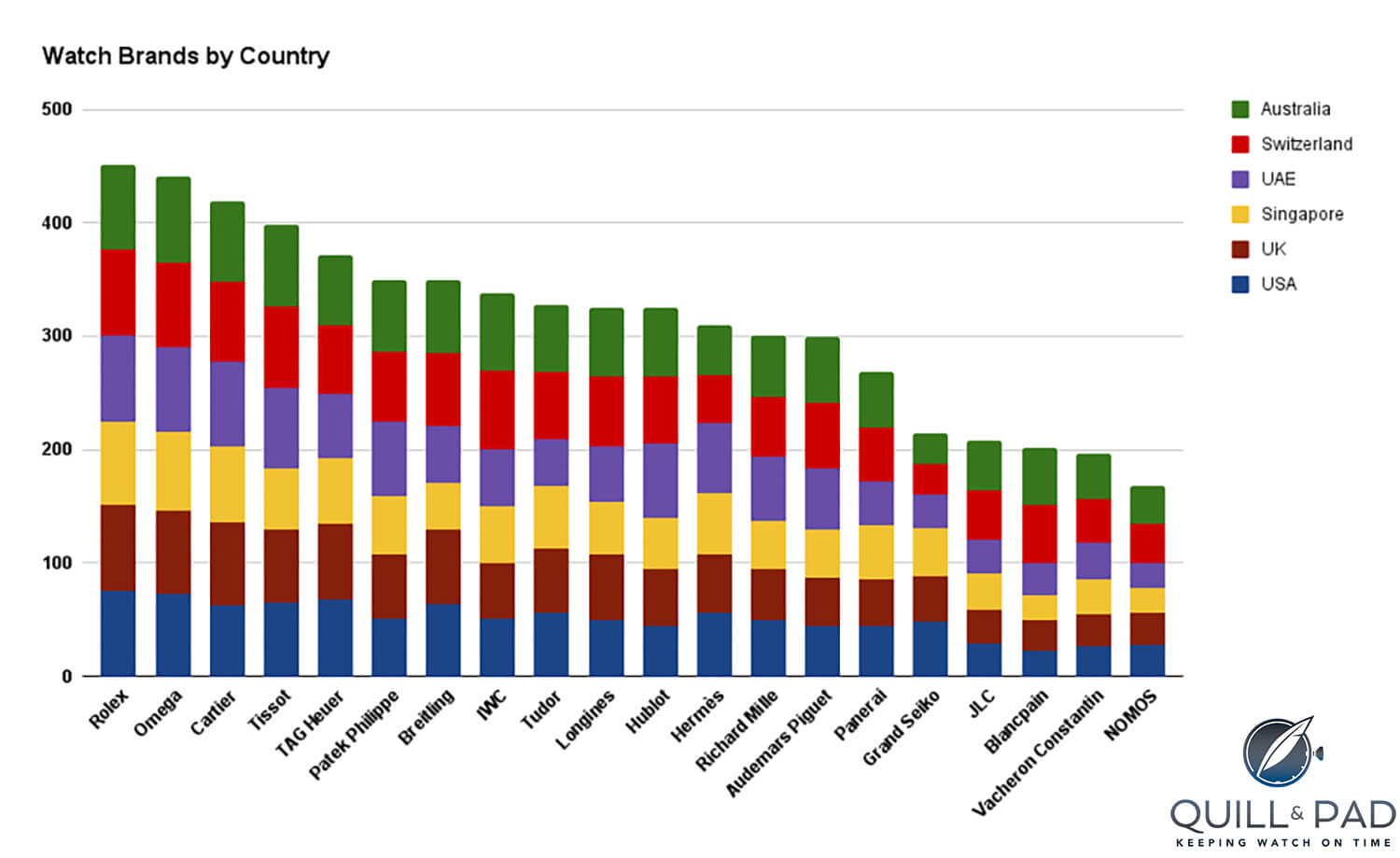

In addition to the ranks shared in the table, you can also see the overall scores each brand received by country. This provides a more detailed perspective, as it shows that even if two brands have the same ranking, their scores may differ greatly, indicating higher or lower levels of interest.

It’s important to note that scores were assigned on a scale of 1-4, depending on how well each brand performed in comparison to the others.

Watch brands by country

When analyzing these results, Switzerland receives the highest scores across brands. This suggests that the Swiss are most interested in a wider range of brands, rather than just the big names.

It is not surprising that this is the case since Switzerland is known as the home of watchmaking, and as a society, they are most aware and interested in the widest range of names.

Additionally, it is worth mentioning that many of the brands are based in Switzerland. Looking at the scores closer, the top 3 brands are all very close together and only lost points to one another, although Cartier did fare less well in the USA.

Discussion

Looking at the results is one thing but digesting them is another. I have found some notable highlights that are what I expected and line up with the narrative from the watch media, but others that surprised me.

The Big Three

Similar to the results section, I want to start with Rolex being at the top and receiving near-perfect scores across countries.

What is remarkable is that Rolex ranks so highly while producing watches starting at roughly $5,000, with the vast majority being more expensive.

Rolex Daytona

Even when you compare Rolex to more affordable brands that have more consumers, which should generate more search interest, Rolex dominates in popularity.

Omega Speedmaster

Omega is very close behind and is the closest competitor to Rolex. Omega has been applying pressure to Rolex in recent years, aware that they are best positioned to benefit from the demand fallout of those unable to get a Rolex Submariner.

Omega has stepped up its efforts on brand recognition and marketing through the Omega x Swatch MoonSwatch. There have been technical improvements including the Spirate System, as well as engineering marvels like the Chrono Chime.

Omega is very much flexing its abilities to try and lure more people over from the crown. There are still areas to improve, but the direction of travel has been in the right direction (see Omega vs. Rolex: How Omega is Reaching for the Crown).

—————————————————————————————————–

—————————————————————————————————–

Cartier Santos

Cartier is one name that consistently ranks highly, however, in the USA it does fall further down the ranks. Cartier tends to produce more delicate watches, as I am sure you know, and with that, they tend to have a more dressy aesthetic. This goes against what the fashion seems to be in the USA where (more casual) bracelets are favored, but also larger watches.

This is perfectly highlighted by the strength of Breitling, ranking 5th. It is the same case in the UK, even though Cartier is 2nd there, knocking Tissot out of the top 5. Cartier produces some of the most iconic designs available including the Tank, Santos, and Panthère.

It shouldn’t come as a surprise that it ranks so well, but to some degree, it does show the impact of appealing to the female audience as well.

So many brands focus on their men’s catalog, leaving the women’s market to models like the Rolex Datejust and Cartier Tank. I expect a good proportion of those searches into Cartier watches to come from the female audience.

I am sure brands do a lot of work behind the scenes on this angle, but as the watch market grows, the female consumer set is also growing.

What about the more affordable names?

TAG Heuer is another brand that performs well, especially in the US, UK and Singapore. It highlights the significant influence it has in terms of brand recognition.

TAG Heuer Carrera

I never fail to appreciate the name, but watch enthusiasts often criticize modern TAG Heuer for some of their more mass-market watches. Many consider a lot of their catalog as uninspired, given the name “TAG Heuer” and the prices for these watches.

Watch brands by country (table courtesy Morgan Stanley)

In the last few years, this has started to change with better designs and rebuilding a connection to their roots. Regardless, TAG Heuer is still the go-to entry point for luxury watches for many, and that is reflected here.

In a sense, no matter what your opinion is of the watches they offer, TAG Heuer should be commended and respected for getting more people interested in watches. However, they do drop down the list when looking at the affluent UAE and Switzerland.

—————————————————————————————————–

—————————————————————————————————–

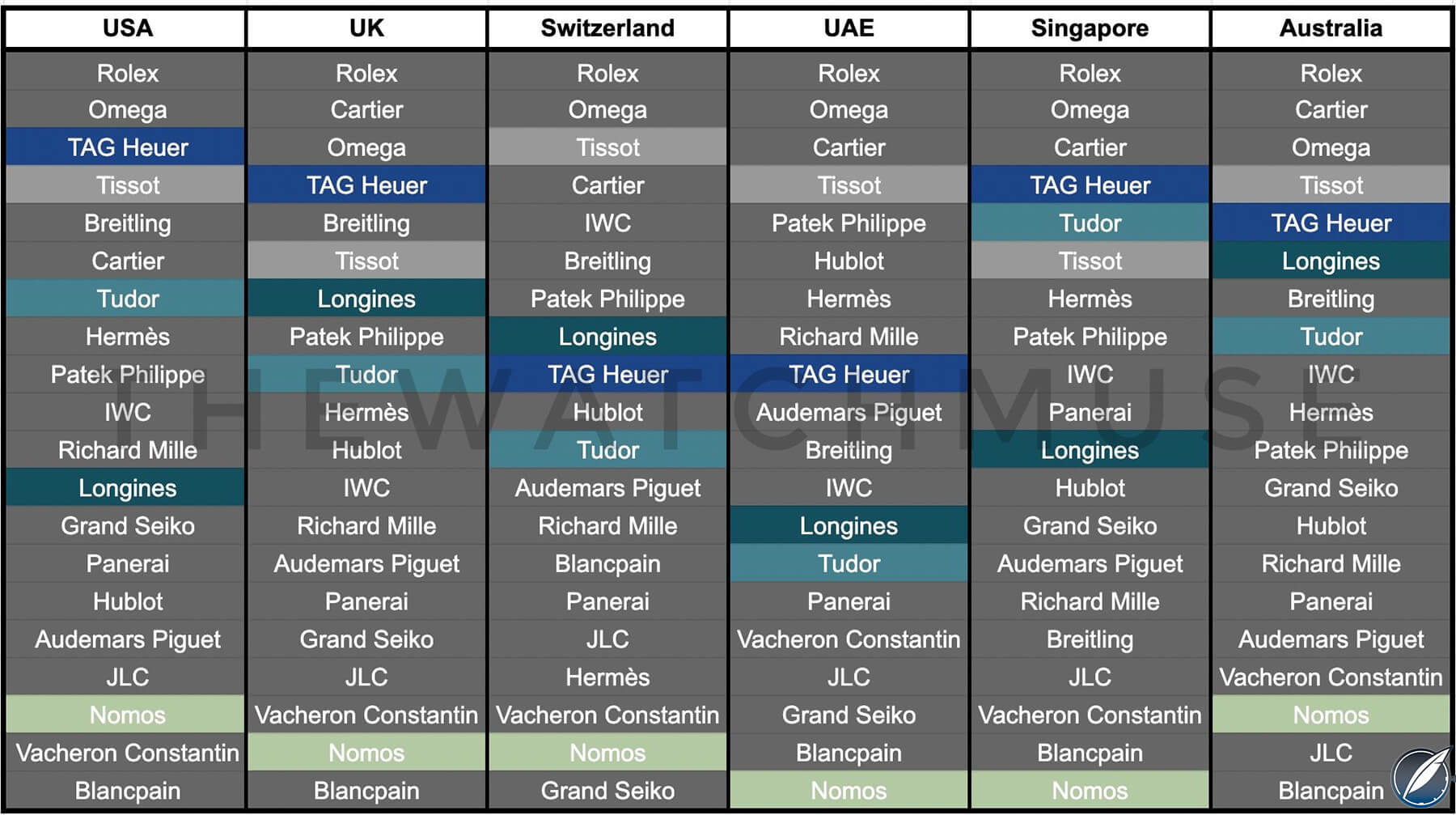

One of the most impressive performances comes from Tudor. I say this because even though Tudor is a brand with a rich heritage, it can be considered somewhat modern having a major brand relaunch in 2009.

The popularity of the Black Bay range contributed to the success of the brand, which has since expanded to other product lines.

Tudor Black Bay 32

Tudor’s impact is evident as it ranks in the top 10 in the USA, UK and Singapore. Having broken into these markets in such a short period and becoming one of the most searched brands is nothing short of impressive. It reflects the value on offer and they well deserve to be up there.

Nomos Club Neomatic

Comparatively, Nomos, a brand that produces excellent watches at reasonable prices, consistently ranks toward the bottom of the pack. On the one hand, this surprises me as the Club range is one of the best options around the $1,500 mark, bringing together Bauhaus designs and robust movements. I might be biased because I have a Nomos in the family.

However, this result is not unexpected. Nomos is relatively one-dimensional with its designs. They follow the same path of playful, dressier pieces that are more delicate on the wrist across their whole collection.

While they are undoubtedly fantastic, the aesthetic is not for everyone, and that is reflected here. As I mentioned in my full Nomos review, perhaps it is time for them to diversify their range and produce something new.

The Holy Trinity

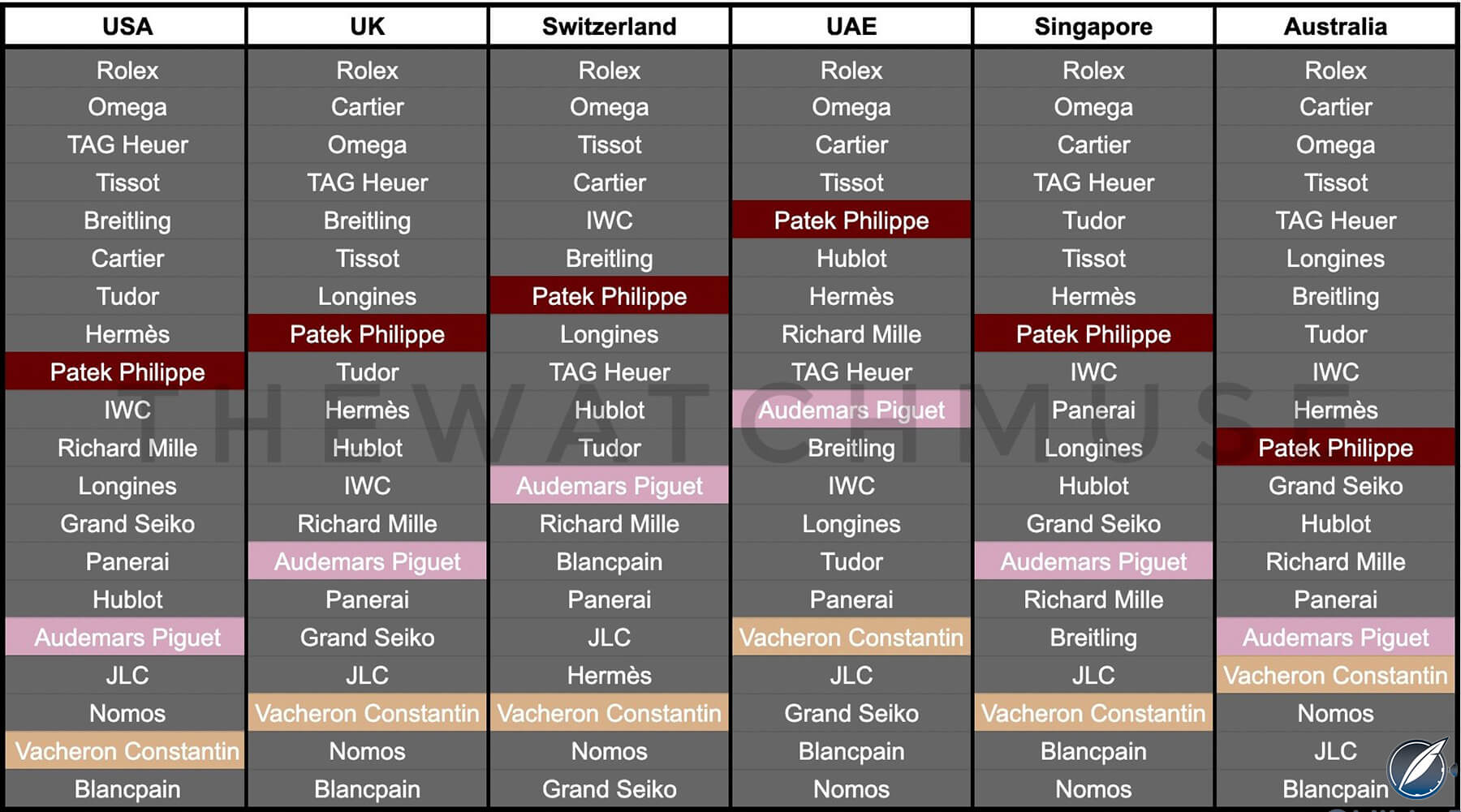

The ‘Holy Trinity’ – Patek Philippe, Audemars Piguet and Vacheron Constantin – is the next filter to think about. For enthusiasts, we all know of this term and group the three together. Looking at the results, the Holy Trinity has its own undeniable ranking within the group when societal interest is taken into account.

Watch brands by country

Patek Philippe ranks at the top in every country, followed by Audemars Piguet and then Vacheron Constantin. Patek Philippe, in a similar way to Rolex and Omega, is a name synonymous with luxury watches, albeit at an even higher tier.

Where Rolex and Omega could be thought of as the Porsche and Aston Martin of the watch world, Patek Philippe is the Rolls Royce.

Patek Philippe Ref 5711-1A Nautilus (photo courtesy Tim Mosso)

OK, perhaps you have other car brands in mind, but the equivalence for what these watch brands reflect non-enthusiasts sits around there in my opinion. Patek Philippe has an allure of being beyond the gold standard, and with that, it attracts more general interest.

—————————————————————————————————–

—————————————————————————————————–

Audemars Piguet is next and on average a few places below Patek Philippe. Arguably, the Royal Oak has been the focal point in watches for the past 5-10 years and brought a great deal to the brand.

Even though Audemars Piguet ranks lower, and below some other brands, if you take a step back to appreciate the level of interest a brand can generate off one great design, it is outstanding.

Audemars Piguet Royal Oak Chronograph

I understand AP produces the Code 11:59, but this is relatively new and the popularity of the model has only just started to improve.

Finally, Vacheron Constantin lags behind them both. Whenever you think of the integrated bracelet stainless steel watches that have become incredibly popular, you think of the Nautilus and Royal Oak.

Vacheron Constantin Overseas

The Overseas has been an extension to this and is the option that enthusiasts have looked towards to fill the integrated bracelet void. It is by no means a reflection of the Overseas and what a great watch it is, but it has not received the same popularity in pop culture.

The $5,000 – $15,000 Range

Thinking about the rest of the brands, in what I like to think as predominantly filling the $5,000 – $15,000 segment, you have a variety of names that might be considered as Rolex and Omega competition.

Watch brands popularity by country

One that stands out across the table is Hermès. I firmly believe that is a brand that needs to be taken more seriously when it comes to their watches (see Hermès Watches: Why they are Worth Seriously Considering).

Hermès produces some unique, interesting designs with good movements to back them up. It may be a luxury fashion house first, but its watches provide an intriguing proposition for those wanting something more individual. Regardless of my opinion, Hermès ranks a lot higher than I think anyone would expect.

Hermès H08 in blue titanium (photo courtesy Hermès/Joel Von Allmen)

How many people know about the Hermès H08? I would guess not too many. Clouding the results for Hermès is their collaboration with Apple on the Apple Watch.

Searching for a Hermès watch brings up the Apple page and Apple Watch options alongside their mechanical pieces. In my opinion, the ranking for other regions should look closer to where they rank in Switzerland.

—————————————————————————————————–

—————————————————————————————————–

Hublot is an interesting result as I find it (and Richard Mille to some extent) is the true indicator of how a country feels towards loud and extravagant designs. This is not to say a gold Rolex is not loud, but Hublot is built upon this foundation where their watches are more about design and materials rather than anything else. Their watches tend to be brighter in color and more ostentatious in materials and size.

Hublot Big Bang Unico White Ceramic 44mm

There are fans of Hublot everywhere, yet when considering the overall country’s tendency to be interested in a brand, you can see it proves most popular in the UAE. IWC is the opposite end of the spectrum. Even if they produce ceramic cases, their overall design is understated and reserved.

IWC Pilot’s Watch Chronograph

The interest in IWC is consistent across the board, with Switzerland being the best performer, coming ahead of Longines and TAG Heuer who do better in the other countries.

Grand Seiko Seasons Winter “Taisetsu” SBGA415

Grand Seiko deserves a mention as it only split from Seiko in 2017, becoming its own brand. This allowed the brand to have more control over its marketing and growth strategy, with a particular focus on Western economies like the USA.

What is reflected here in the results shows us that they have relative popularity in Singapore and Australia, closer to their home market, but also the push into the USA is working.

However, having “Seiko” on the dial can be a deterrent for the brand. It requires a true understanding that Grand Seiko is not just an expensive Seiko, but offers quality comparable to Swiss brands, if not better (see Grand Seiko: Looking at What Makes the Brand so Special – And Grand Seiko is Definitely Special!).

It is admirable that the brand has fought through the initial perception of what Grand Seiko is and has become more widely searched when compared to brands like Panerai, Audemars Piguet, and Hublot.

Grand Seiko lags slightly in the UK, although I am confident this will change going forward. What I did find amusing was Grand Seiko right at the bottom in Switzerland.

Even if everyone else knows that Grand Seiko offers exceptional quality and is worth considering, the Swiss are not interested!

—————————————————————————————————–

—————————————————————————————————–

Finally, I want to touch upon Blancpain and Jaeger-LeCoultre. Both brands I have covered in more depth in depth (see Jaeger-LeCoultre Watches: Why Are They Not More Popular? and Blancpain Fifty Fathoms Automatique: Time to Move on From the Rolex Submariner?) and in both cases, I concluded that the brands need to do more to gain popularity. Both are fantastic brands, although they remain firmly enthusiast’s brands.

Blancpain Fifty Fathoms Automatique Grande Date

Blancpain has a claim to producing the definition of a dive watch in the Fifty Fathoms. They created what a dive watch should have such as legibility, a rotating bezel, and luminescence, and many including Rolex looked towards the Fifty Fathoms when designing their own models.

The Fifty Fathoms has the heritage and aspects of finishing that make it one of the most compelling luxury dive watches on the market. The biggest issue, however, is the size.

The brand has retained the large case sizes of 45mm, and at a time when tastes are leaning towards smaller watches, Blancpain is suffering. It is a widely noted request in the community, but they could do wonders by having something more wearable on offer apart from the Bathyscaphe.

The Blancpain Swatch collaboration brought a spike of interest from the public, and this interest needs to be maintained. Having Blancpain on more wrists is the answer!

—————————————————————————————————–

—————————————————————————————————–

JLC is in a similar situation where they produce some technically fantastic watches, but don’t manage to capture the imagination of a lot more customers. There are a few reasons why I believe JLC is not more popular, including a lack of consistent design language and no clear, compelling entry point to the brand (where the Reverso might not be for everyone).

Jaeger-LeCoultre Polaris Date

This is a topic I have covered in more depth ((see Jaeger-LeCoultre Watches: Why Are They Not More Popular?), and I ultimately feel that JLC could benefit from a push in marketing and producing something similar to the Master Control Sector Dial of 2017 that is attainable, distinctive, and gets the brand on to more wrists.

Conclusion

The watch market is always very interesting to consider. No mechanical watch bought is a necessity and that purchase is driven by emotion. Horology is an industry that relies on selling a story. However, even if people are not interested in purchasing one, they are aware of the big brands.

At the same time, watch brands are slow-moving with all decisions and changes around the direction of a brand taking years to settle on. It is why we can look at how trends evolve over the years and draw conclusions.

Watches are also unique in that they are all very similar, yet small differences create a whole new personality and vibe. With that, geography can play a large role in why a particular brand or watch is liked or disliked.

Even though I began working on this story with an idea of what the rankings would look like between 20 brands across different countries, it has been exciting to see the results come to life. Using Google search trends, we can analyze the intangible value a brand has – how many people are searching for your brand regardless of sales. Yes, there may be a few limitations, but it confirms that geographical trends are real and make a noticeable difference.

What do you think? Let us know in the comments below.

* This article was first published 23 December 2023.

You might also enjoy:

Omega vs. Rolex: How Omega is Reaching for the Crown

Grand Seiko: Looking at What Makes the Brand so Special – And Grand Seiko is Definitely Special!

Jaeger-LeCoultre Watches: Why Are They Not More Popular?

Blancpain Fifty Fathoms Automatique: Time to Move on From the Rolex Submariner?)

Hermès Watches: Why they are Worth Seriously Considering

Leave a Reply

Want to join the discussion?Feel free to contribute!

What a farce – We’re you paid to leave out the two largest luxury watch markets in the world?

Pretty sure bankiers and venture capital focusing on this kind of commodities have a different set of sources and criteria for their investment picks.

Popularity, Market share and units/profitability is of no concern to me yet an annoyance most places where watches are discussed, as instakids and some “watchlovers” have become totally obsessed with these factors and status, as if it was a horological quality.