WatchCharts September 2025 Watch Market Update: Some Brands Up, Some Down (Including Rolex)

by Mark Xu

Mark Xu is the Head of Growth & Marketing at WatchCharts.com, which has kindly allowed us to share their monthly Market Updates.

————————————————

What happened in August 2025?

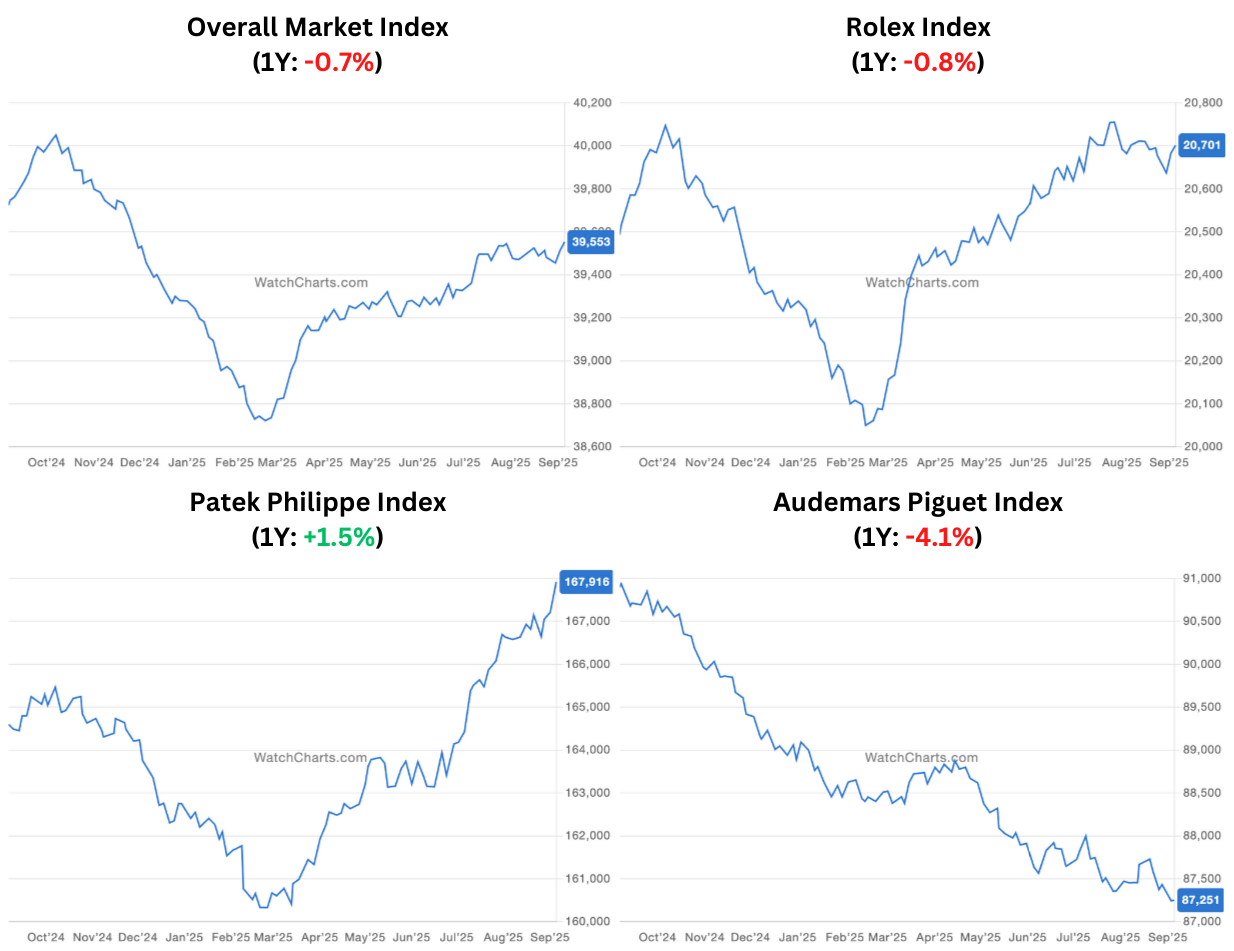

The WatchCharts Overall Market Index dipped slightly in August, down -0.1%. For the sixth consecutive month, Patek Philippe prices rose (+0.3%). Meanwhile, Rolex and Audemars Piguet slid by -0.3% and -0.1% respectively.

WatcxhCharts Overall Market Indexes Ausust 2025

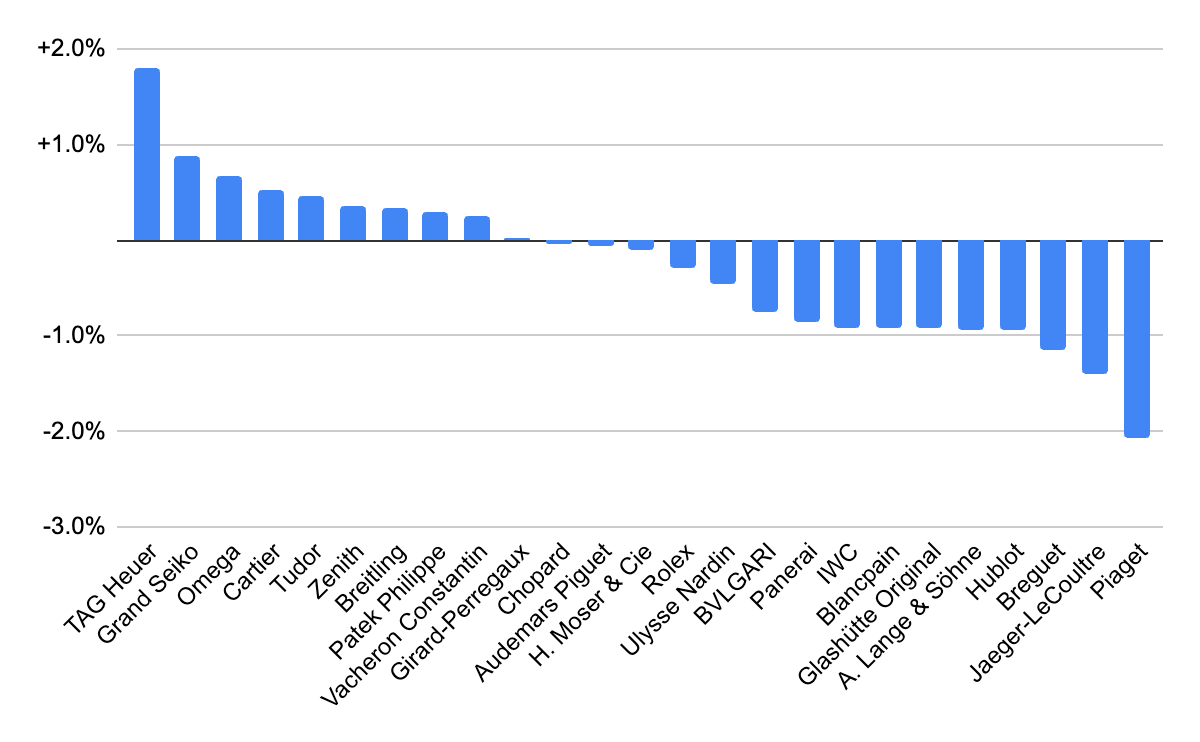

Performance by Brand in August 2025

WatchCharts Performance of Key Brands August 2025

In August, about half of the major brands gained ground. Patek Philippe, the best performer so far in 2025, continued its recovery, although the growth isn’t as strong as that of the previous months.

For the first time since February 2025, Rolex prices fell in a calendar month (-0.3%), driven by losses in the Daytona (-0.9%) and the Datejust (-0.7%).

The best performers in August are five mid-tier brands: TAG Heuer (+1.8%), Grand Seiko (+0.9%), Omega (+0.7%), Cartier (+0.5%), and Tudor (+0.5%).

Performance of Key Brands in August 2025

Some of the best and worst performing collections of August from major brands are listed below.

| Brand | Collection | Delta % |

| Breitling | Chronomat | +2.0% |

| Rolex | Day-Date | +1.1% |

| Cartier | Tank | +1.0% |

| IWC | Portofino | -1.6% |

| IWC | Aquatimer | -2.6% |

| Vacheron Constantin | Traditionnelle | -2.9% |

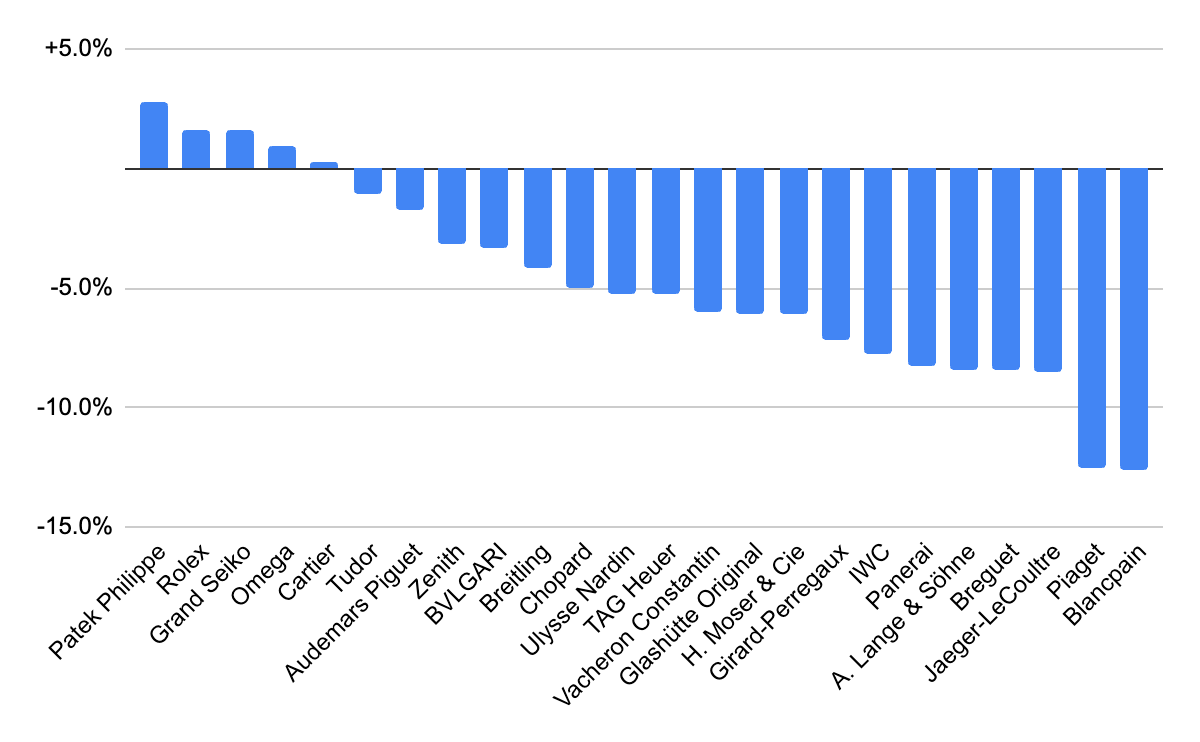

Best and Worst Performers of 2025 So Far

With four months left in 2025, it feels appropriate to check how the brands have fared so far this year. Of the 25 most notable brands, only five have gained year-to-date: Patek Philippe (+2.8%), Rolex (+1.6%), Grand Seiko (+1.6%), Omega (+0.9%), and Cartier (+0.3%).

We delved into these brands recently in our mid-year watch market update.

Most brands, however, have depreciated this year. The worst performing brands are Blancpain (-12.6%), Piaget (-12.5%), and Jaeger-LeCoultre (-8.5%). Blancpain’s two largest collections—Fifty Fathoms and Villeret—declined by -10.7% and -16.9% respectively.

For Piaget, the Polo collection is down -10% while the Altiplano is down -16.2%. The Reverso (-5%) and the Polaris (-6.2%) of Jaeger-LeCoultre have also fared better than its dress watch collections like the Master (-9.7%) and the Rendez-Vous (-14.2%).

Performance of Key Brands Year-to-Date

WatchCharts Performance of Key Brands Year to Date 2025

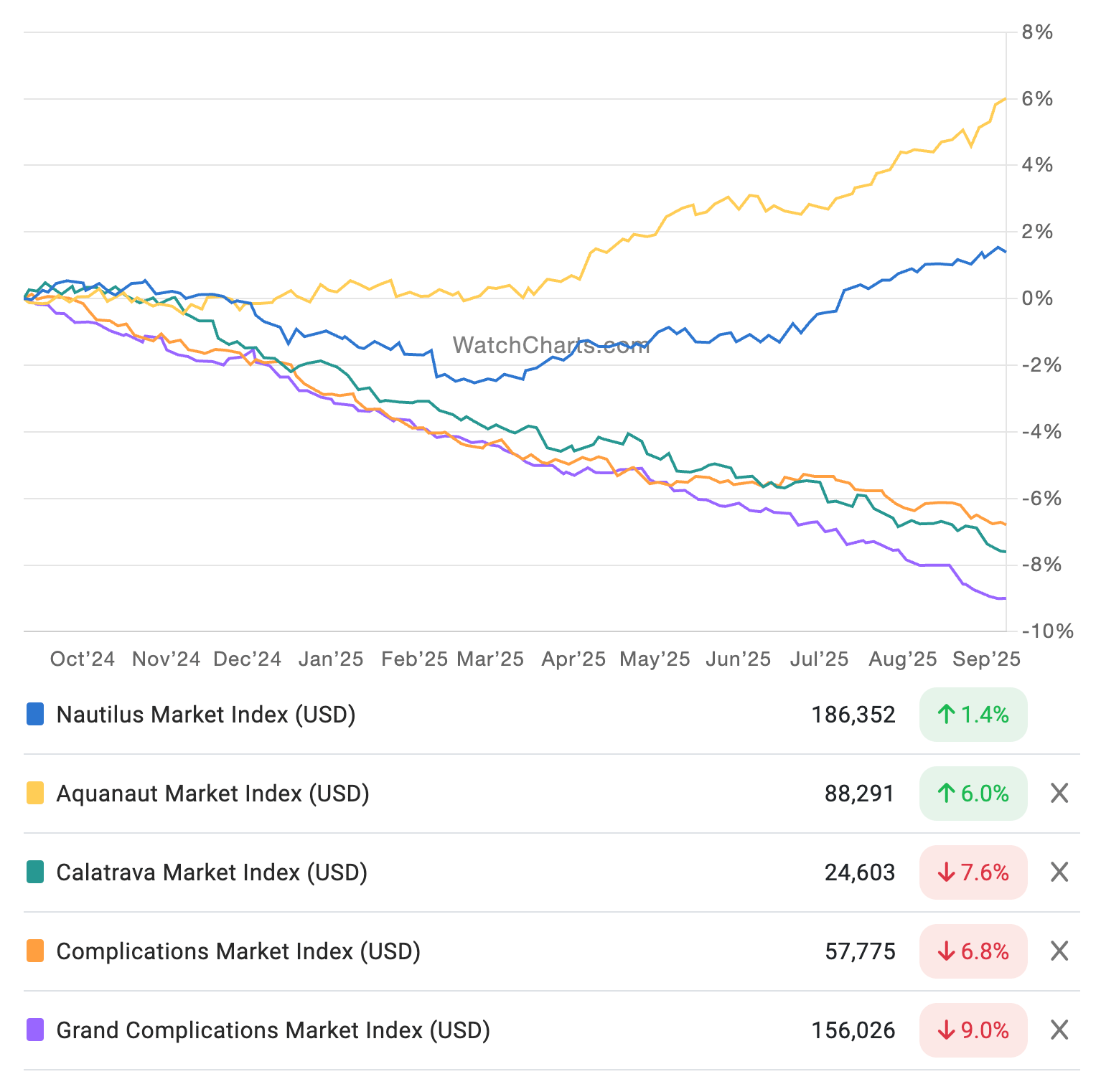

In Focus: The Patek Philippe Market Is Heating Up (Again)

Patek Philippe remains the standout performer of 2025. While prices for most brands continue to fall, Patek Philippe has gained +2.8% year-to-date thanks to the performance of two sports collections, the Aquanaut (+5.0%) and the Nautilus (+2.2%).

Watches from these collections are by far the most popular from the brand, occupying 28 of the 30 most frequently traded watches that make up our Patek Philippe Market Index.

Back in our February 2025 update, we noted that the discontinuations of key references such as the Nautilus 5712/1A and Aquanaut 5167/1A would likely push their prices higher. That prediction has borne out: over the past six months, the 5712/1A climbed +10.4%, while the 5167/1A rose +7.8%.

Performance of Patek Philippe Collections, Past 1 Year

Performance of Patek Philippe Collections, Past 1 Year

However, it is perhaps more accurate to say that the Aquanaut and Nautilus markets are heating up again, rather than Patek generally. In fact, pre-owned prices of dress models from from the Grand Complications (-6.1%), Calatrava (-5.3%), and Complications (-3.8%) have continued to fall steadily this year. Interestingly, the brand’s retail price increase in May of this year (by an average of +6.9% in the US) did not serve to slow these trajectories, although they may have accelerated the rising prices of sports collections.

While the rise of secondary prices coincides with a retail price increase, there is some evidence to suggest that this is not the only cause. Market fundamentals also point to increasing demand, with Patek sports models selling faster this year than they did in 2023 and 2024. Supply trends are also tightening.

Nautilus availability has declined steadily, while Aquanaut supply looks stable on the surface but is skewed by relatively new models (e.g., the 5261R and 5968R, both launched in 2023) entering the secondary market in larger numbers. Core references like the 5167A, 5164A, 5167R, and 5164R are actually becoming scarcer.

One key question remains: is the recent growth in Patek Philippe demand organic, or is the market headed towards another bubble? While it is way too early to say conclusively, for now we are cautiously optimistic. Patek prices are still down around 10% over the past two years, with most models trading for many tens of thousands of dollars less than market peak.

After the volatility of the past five years, the general market climate is still quite cautious – making an eminent repeat of the explosive 2021/early-2022 surge unlikely. However, if we continue to see exponential growth over the coming months, this may be some indication of renewed speculation.

* Mark Xu is the Head of Growth & Marketing at WatchCharts.com. You can check out previous Market Updates at https://watchcharts.com/articles/category/dispatch and there are more market insights and analysis on their YouTube channel at www.youtube.com/watchcharts

You might also enjoy

Morgan Stanley Swiss Watches 2Q2025: Secondary Market Stabilizes, but Listed Players Underperform

WatchCharts July 2025 Watch Market Update: Performance of Top Brands Remains Mixed

WatchCharts June 2025 Market Update: Light at the End of the Tunnel?

So, You Want to Buy a Rolex? Well, Daddy-O, I’m here to Talk you Out of It!

Leave a Reply

Want to join the discussion?Feel free to contribute!