WatchCharts March 2024 Watch Market Update

by Hamza Masood

Hamza Masood is the Business Development Manager at WatchCharts.com, which has kindly allowed us to share their monthly Market Updates.

___________________________

In our March 2024 watch market update, we discuss a potential stabilization in secondary market prices, the interesting dynamics of the Rolex Pepsi market that we’ve seen recently, and share some of the best and worst performing brands and collections of last month.

Relative Rolex Market Stability so far in 2024 – Will it Continue?

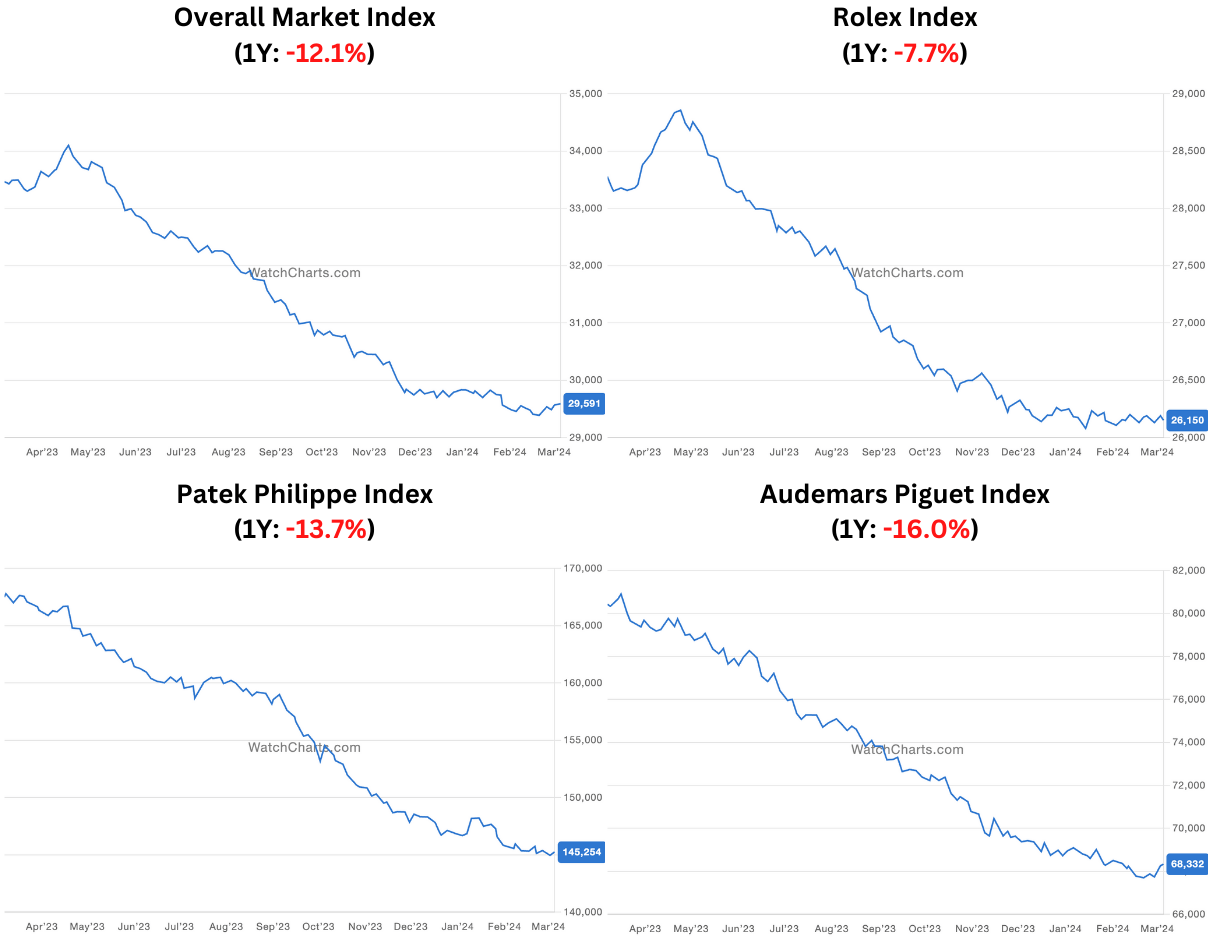

In February, we saw a -0.1% decline in the WatchCharts Overall Market Index, compared to a -1.0% loss in January. The slowing pace of decline is also evident from the brand indexes of the Big Three, where Rolex prices actually gained +0.2% and Patek Philippedropped half a percent and Audemars Piguet dropped -0.9%, the latter no longer in the 10 worst performing brands of the month.

Overall, Rolex, Patek Philippe, and Audemars Piguet Indexes Compared

While we have seen relative stability in the Rolex market over the past three months, we remain hesitant to make any claims about a sustained watch market recovery. The fundamental supply/demand dynamics of the market remain relatively unchanged in the past few months, remaining significantly elevated compared to 2022 (even when selecting only for discontinued models).

Furthermore, excitement around Watches & Wonders next month, speculation around product discontinuations (as we discuss below in regards to the Rolex Pepsi), and record-high equity and crypto markets may be transient factors fueling the secondary watch market stability.

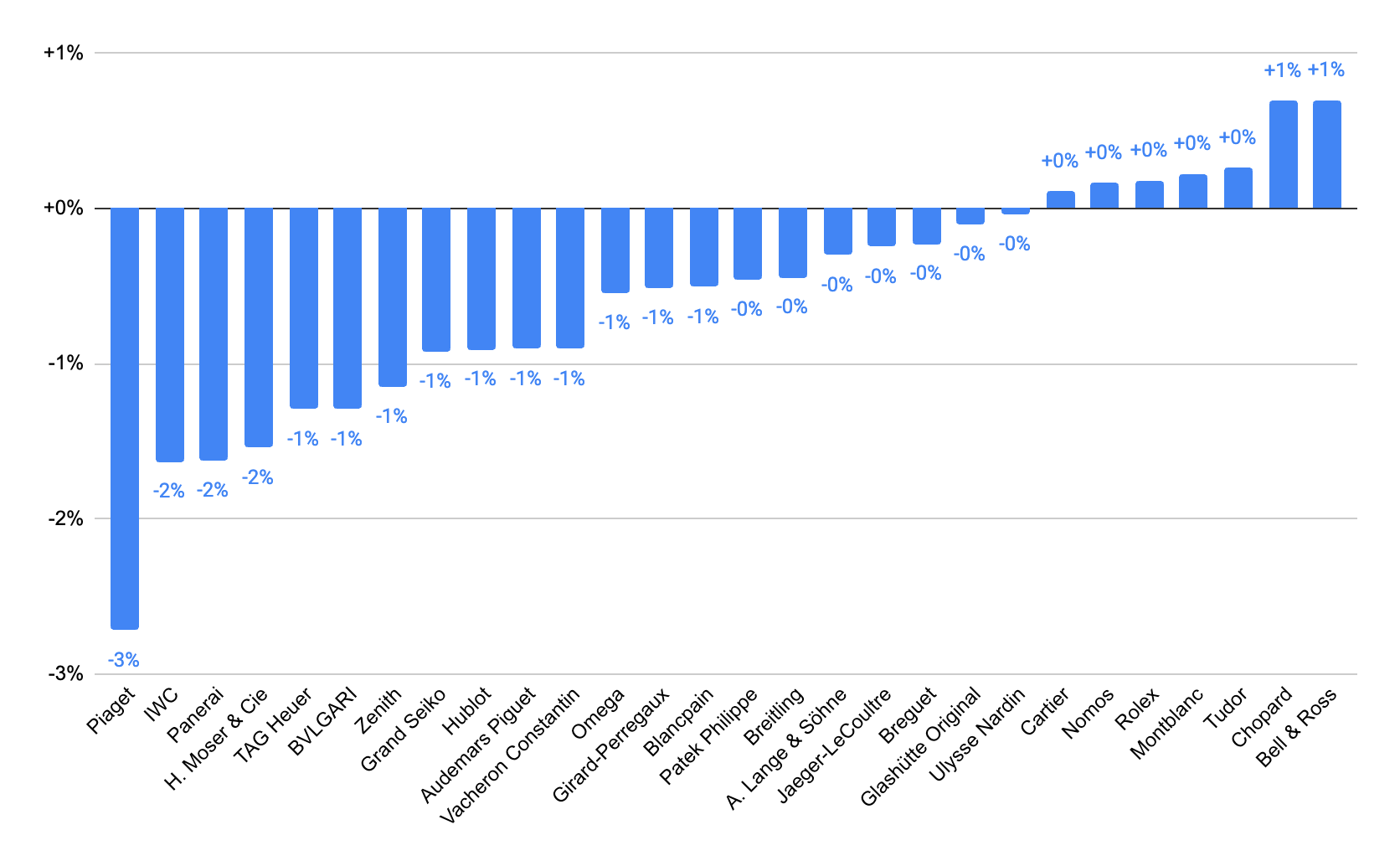

February 2024 Performance of Key Secondary Market Brands

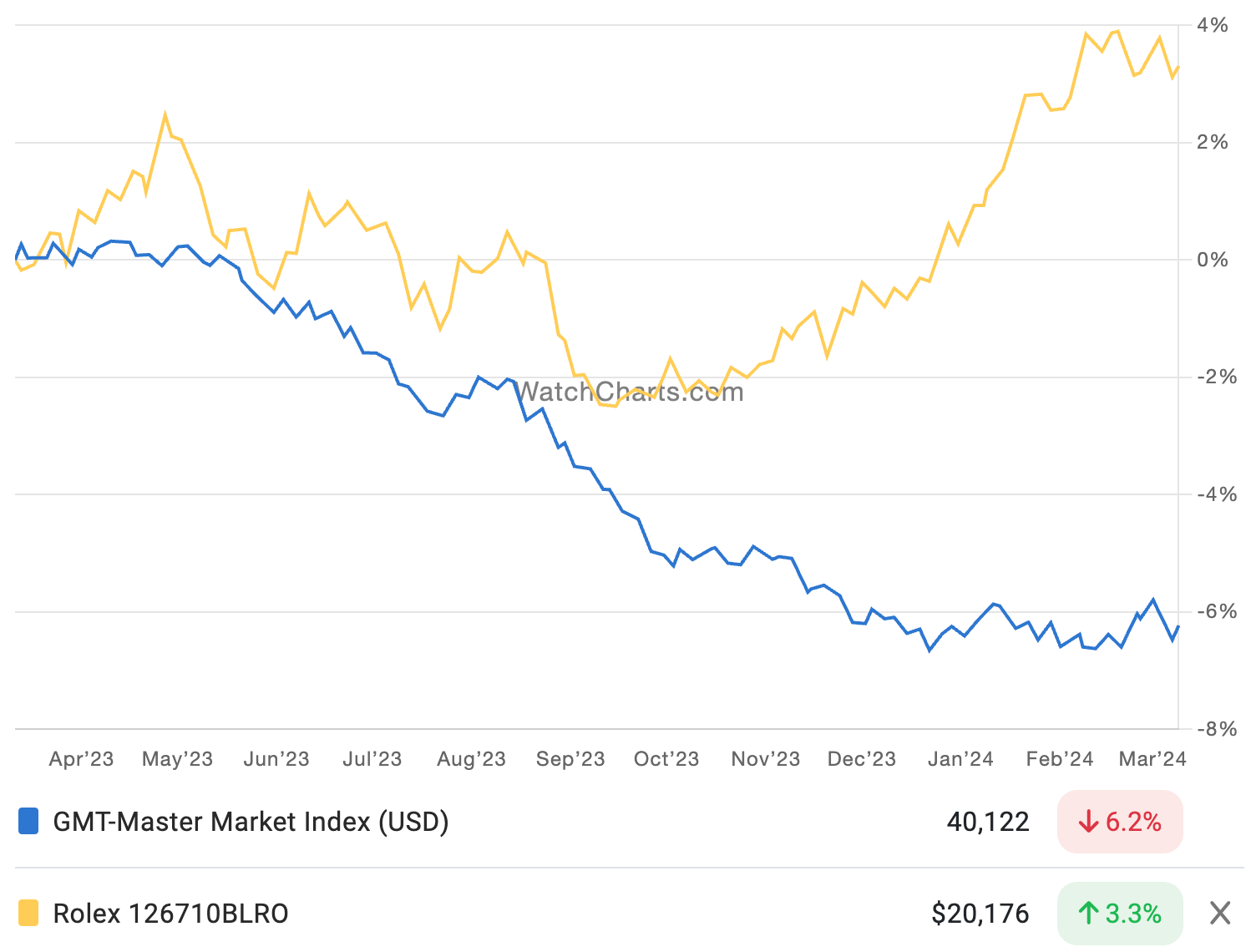

Rolex Pepsi Performance Deviates from the rest of the GMT-Master II Collection

While both the Rolex Market Index and the GMT-Master Market Index have been declining for over a year, the performance of the Pepsi GMT ref. 126710BLRO has diverged significantly from the rest of GMT-Master in the past six months. The Pepsi is up 5.9% in the past six months and 3.3% in the past year, while no other GMT-Master model (modern or vintage) has appreciated by more than 1%.

There has been speculation that Rolex might discontinue the Pepsi reference at Watches & Wonders next month. In fact, we estimate that total available secondary market inventory for the Pepsi has decreased 18% in the past 6 months as potential speculators buy up inventory, compared to -3% for the GMT-Master index as a whole.

The Best and Worst Performing Collections in February

Some of the best and worst performing collections for the month are included in the table below. This is the second month in a row that the Pasha collection has been featured (Cartier itself is up +1.2% over the past three months, but still below its 52-week high from last July).

| Brand | Collection | Feb Delta % |

| Cartier | Pasha | +3.2% |

| Rolex | Cellini | +2.8% |

| Oris | Aquis | +1.4% |

| Zenith | El Primero | -1.9% |

| TAG Heuer | Monaco | -2.1% |

| Audemars Piguet | CODE 11.59 | -2.4% |

* Hamza Masood is the Business Development Manager at WatchCharts.com. You can check out previous Market Updates at https://watchcharts.com/

You might also enjoy:

The Investment Market for Luxury Watches is Growing

So You Want to Invest in the Watch Industry . . .

Leave a Reply

Want to join the discussion?Feel free to contribute!

It looks as if watches have finally become a substitute for shares. Grotesque – and somehow also sad …