by GaryG

From Hong Kong to New York to Geneva, eager bidders generally have the opportunity to bid to their hearts’ content on a large variety of contemporary and vintage timepieces; sellers will collect cash they can put into other watches or invest elsewhere; and auction houses will generate tidy commissions to finance their operations and, I suspect, pay for a few nice holiday gifts.

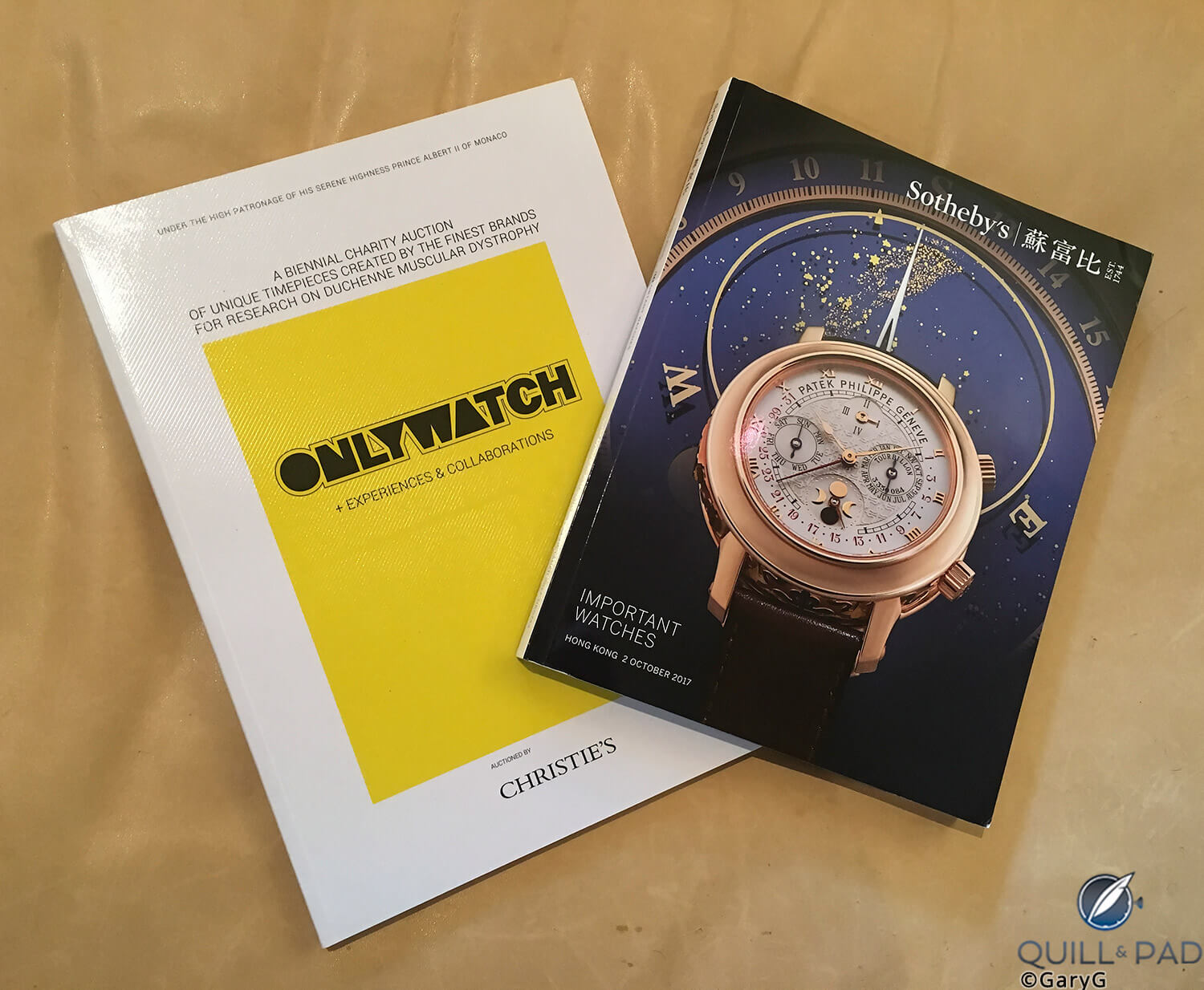

Homework assignment: catalogs from upcoming auctions

And there’s no shortage of tasty pieces on offer at all price points at the big auction houses during this 2017 season, from Paul Newman’s Paul Newman Rolex Daytona at Phillips to the wealth of unique Only Watches at Christie’s to a variety of MB&F specialties at Sotheby’s.

Like many collectors, I’ve bought and sold a number of watches at auction over the years. Since I’m a systematic type of guy, I’ve taken the time to analyze my philosophy of auction bidding and capture some of the tactics I use to achieve my goals; and I hope that at least some of my realizations will be useful to you in your own bidding.

Establishing your bidding philosophy

As with a great many human pursuits, the appropriate methods for bidding at auction depend on what one is trying to achieve. It stands to reason the approach taken by a win-at-any-cost buyer with deep pockets who calls out “One hundred!” when the next bidding level is fifty is, and should be, different from that of the bargain seeker who keeps as low a profile as possible and enters the fray with a single bid just as the initial wave of enthusiasm in the room has ebbed.

Pre-philosophy days: Audemars Piguet pocket watch, an early auction purchase by the author

While my early auction buying may have been somewhat indiscriminate, my underlying philosophy of auction buying these days looks something like this:

- I come into an auction setting with very specific ideas of the few pieces that I am interested in buying; as a rule, these are watches that I’ve been on the hunt for over some period of time rather than watches that “everyone” wants.

- I’m willing to pay the premium needed for a watch in exceptional condition and generally pass on pieces that are “honest daily wearers.”

- I would rather miss out on the occasional opportunity than overpay for a given watch.

Missed opportunity? Record-setting Jaeger-LeCoultre Geophysic sold at Phillips, Geneva in 2017

While some of my resulting tactics are specific to this philosophy, others probably apply just as well to the buyer looking for a few “fun” pieces or the hyper-focused bidder aiming for a single grail. That said, if let-҆er-rip spontaneity is your underlying model, you and I are probably going to use quite different methods!

Prior planning prevents poor progress

It’s always a happy day when an auction catalogue arrives in the mail, as each assortment inevitably contains one or more pieces I’d love to own. At the same time, as I’m now in the “selling to buy” mode (see Selling Watches To Buy Watches: One Collector’s Story) each auction requires some soul searching: are any of those shiny watches so tempting that I’d be willing to part with something already in my collection to own it?

With that tough screen in mind, I’ll now often read through entire catalogs and dog-ear a few pages but ultimately decide that none of the watches are for me. From time to time, however, an excellent example of a longtime object of desire simply jumps off the page at me, at which point there are only two questions: is it attainable and if so how important is the watch to me?

Object of desire: Breguet Type XX ‘Big Eye’

Even at this stage I make a point of reviewing the online condition reports and scanning the photos of each potential target closely: having bought a watch at auction years ago that required substantial servicing, I hope I’ve learned my lesson.

Seeing is believing

If you can, see and handle the watches in person at the previews! The first reason to do this is that as a registered bidder you will have the opportunity to touch, wear, and photograph a rich assortment of notable watches that puts the new releases at a given year’s SIHH or Baselworld to shame.

When I mark up my catalogue, in addition to the pages marked “B” for buy and “C” for consider, there are always a bunch labeled “L” for look.

Lookee here: steel Patek Philippe Reference 1518 on the wrist at Phillips’ Geneva Auction, November 2016

For the “buy” and “consider” pieces, though, careful inspection (including opening the back of solid-cased watches) and detailed discussions with the helpful members of the auction house team give you an advantage in understanding just how good a particular example is.

There’s also a bit of a hazard, of course: the risk of falling in love with a watch on the “look” list!

I had this experience with my Patek Philippe Reference 1526 perpetual calendar: once I had it in hand, on the wrist, and under the loupe I took a crash course with my friends at Phillips and Patek Philippe and ended up buying a watch that is now one of my favorites (see A Contemporary Watch Collector Goes Vintage).

Loved it, researched it, bought it: the author’s Patek Philippe Reference 1526 in pink gold

I wouldn’t go so far as to say that I would not bid on a piece I haven’t seen in person, but I’m a big believer in the value of in-person inspection and questioning.

Work your network

If you are interested in a particular watch, do your best to make it known to a member of the auction house staff. Contrary to what I believed when I first started bidding at auction, there are generally only a small number of bidders for a given watch, and as part of the detailed preparation that the auctioneer goes through he or she will want to understand who the likely bidders are.

To the extent that you are in the room and the auctioneer is aware of your interest, you might just edge out another bidder whose hand goes up as your does but just out of the auctioneer’s peripheral vision. At least in Switzerland, there are hussiers present to ensure fair dealing, but in my experience ties go to the prepared.

And don’t be bashful: clear signals matter!

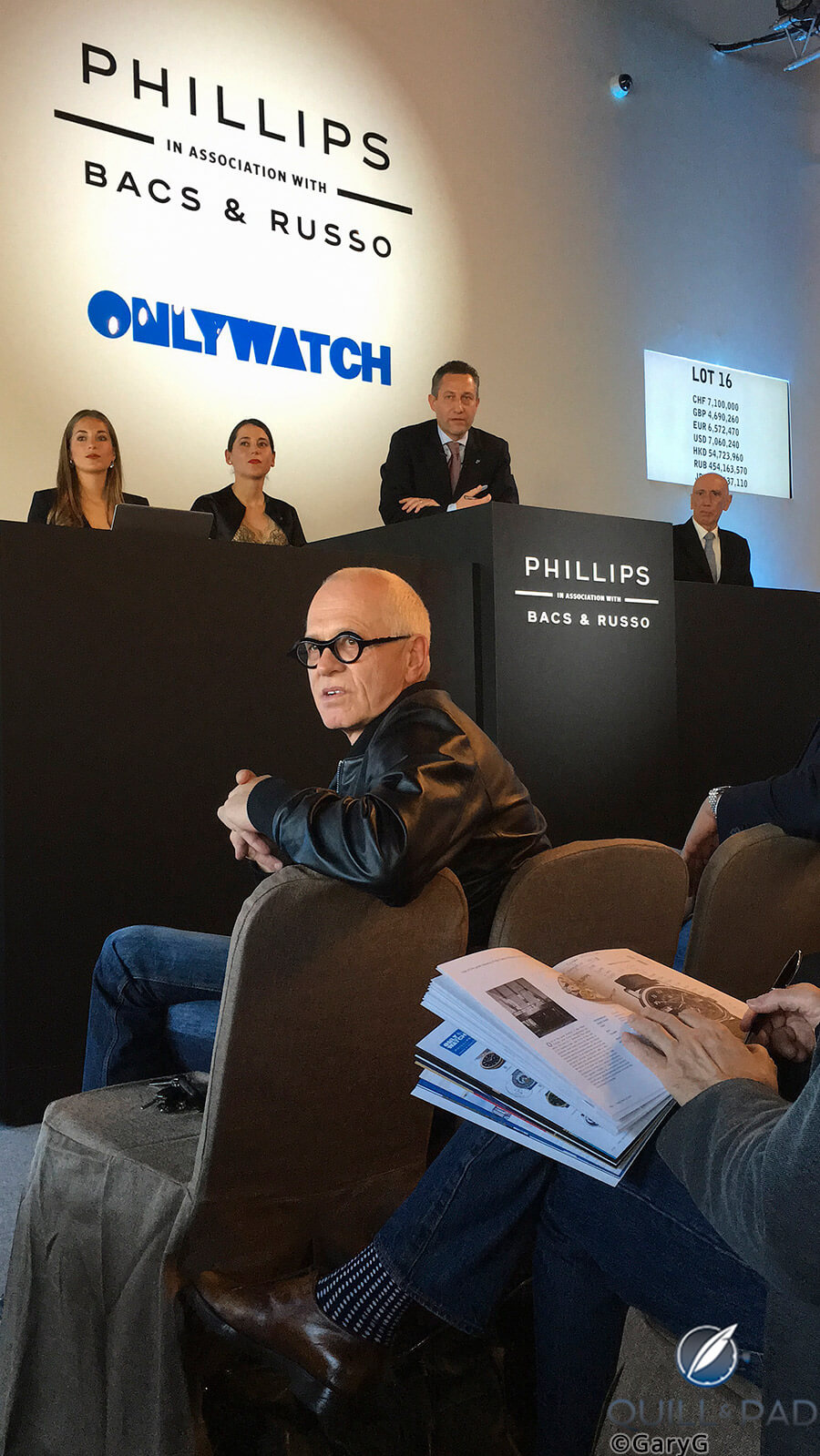

Fair warning, fair dealing: auctioning the Patek Philippe Only Watch, 2015 with Aurel Bacs at the rostrum and the hussier seated to his left

If you can’t be in the room, arrange to bid by phone; your auction house representative on the other end of the line can help you read the mood in the room, answer questions, and even buy a bit of time with the auctioneer that the “bid now” button on the internet app doesn’t provide.

Be aware, though: what can seem a glacial pace of bidding in the room seems mysteriously to shift into hyper drive when you are on the far end of a phone line, so having a clear bidding strategy is critically important.

Time to bid!

Given my bidding philosophy and somewhat poor impulse control, I try to go into every bidding session with a clear game plan for each watch I’ll bid on that includes:

- The maximum price I am willing to bid, expressed in dollars including buyer’s premium

- The bid increment in local currency that corresponds to that price

- A list of the few bid increments leading up to my top bid level

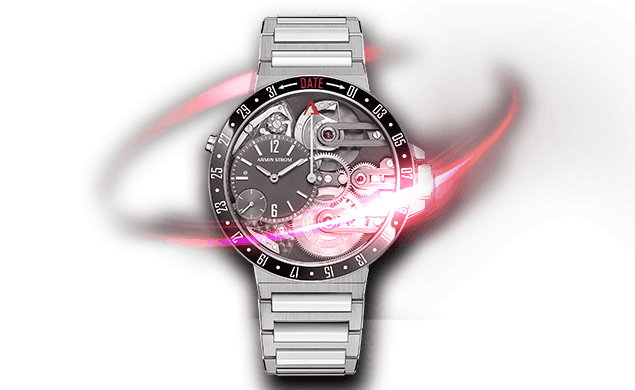

You can see a mocked-up example of this approach in the photo below for a watch that I don’t plan to bid on at Sotheby’s upcoming Hong Kong auction. In this hypothetical example, I’d be pleased to go home with the watch at an all-in auction price of $64,000, which corresponds to a bid of HKD 400,000 – within the estimated price range for the watch.

Homework, continued: bidding tactics in black and white

I’ve also studied the bid increments leading up to my top number and know that those are 300,000, 320,000, 350,000, and 380,000 HKD.

If I’m in the room or on the phone and I have the opportunity, I try to get into the cadence at an even number of bids below what I am willing to pay, or if the bidding that evening has been a bit soft overall perhaps one slot lower.

In our hypothetical example, if the prior lots have sold low in their estimate ranges, I might try to raise my hand at 320,000; if another bidder came back at 350,000, I would then be on track to bid 380,000.

That would leave me vulnerable to someone else raising the ante to my top number of 400,000, but then again there are a lot of Reference 5070Rs out there so the loss wouldn’t be so hard to take.

In this made-up case, 320,000 could also be a good number as the reserve is sometimes one bid below the low estimate. At last year’s Phillips auction in Geneva, bids “one below” were good enough to win me both the Patek Philippe Reference 1526 and the A. Lange & Söhne Pour le Mérite Tourbillon.

Bought below estimate: the author’s A. Lange & Söhne Pour le Mérite Tourbillon

Of course, this strategy doesn’t always work. Auctioneers have latitude to take bids that are not on the published increments, and there have been many occasions on which I’ve been wrong-footed and seen someone else go home with “my” watch, having been at the correct spot in the cadence to bid my targeted top price.

If you must absentee bid

If you can’t be there in person and can’t bid on the phone or Internet, there’s always the absentee bid process that allows you to place a maximum bid amount in advance.

One advantage of the absentee process is that it eliminates the possibility that you’ll be caught up in the excitement of the moment, but at the same time you’ll lose any chance of influencing the flow of bids and you’ll give up the chance to make “one more” bid at the margin.

I try to use absentee bidding only on those rare occasions when there’s a “nice-to-have” watch being auctioned in the middle of the night my time. My guiding rule in these instances is to think very hard about the following question: what’s the price at which, if I won, I’d be delighted to wake up to the news?

Parting shot: the author’s A. Lange & Söhne Double Split, bought at auction in 2012

A few closing thoughts

Before you go, just few more things:

- While I have lots of friends at the auction houses and believe each and every one to be of high integrity, remember that the auction house makes money by facilitating transactions. It’s your job to ensure that the piece you buy is in the condition you want it to be and to dig hard to learn all that you can about any concerns.

- Bid with conviction. Once you have decided in advance on your willingness to pay, don’t get cold feet at a lower price point during the action as you will likely regret it later.

- Auctions should be fun! It’s fun for me to take the highly structured approach I’ve described, but your preferences may vary; and I’ve missed out on a piece or two over the years using my relatively conservative approach that I’m still kicking myself about.

Good luck and happy hunting! As always, please feel free to share your own experiences and bidding strategies in the comments section below.

* This article was first published on September 30, 2017 at How I Bid: One Collector’s Approach To Buying At Watch Auctions.

You may also enjoy:

False Scarcity And Steel Sports Watches: A Collector’s View

Hammer Time: Expert Advice For Selling Your Watch At Auction

Leave a Reply

Want to join the discussion?Feel free to contribute!

Great advice Gary, I’ve never been to a watch auction but can surely relate. In fact I just lost a bid to a F348 Speciali – one of a hundred, and going after this article thinking what went wrong. Off course, after many weeks of thinking did I take the decision to remotely bid on an item. I think you being there at Genève in person is always different, feeling and wearing an item. Does your research on a product Pre auction include asking your awesome collector circle for advice, or do you follow your impulses on what you love and just bid ?

Thanks for sharing your thoughts and experience! Sorry to hear that you did not get that 348, though…

I absolutely do ask my friends for thoughts on various lots as their knowledge is both deep and diverse, and they often see things (or know things about a particular reference or watch) that I do not. This has saved me more than once!

At the end, though, I do depend on my own judgment — I’ve bought more than one piece that others weren’t so wild about at the time and now covet, and others that bring me great satisfaction even if no one else favors them!

Thanks again, Gary