By now the coronavirus is no longer novel and nearly everything has been canceled, postponed, or just put away.

The same is true for the world of fine watches, the first and only significant event in the first four months of 2020 was LVMH Watch Week in Dubai – and watch journalists are very lucky and thankful that it existed as it provided at least a handful of new watches to look at, talk about, photograph, and write about.

We are also very thankful for all the human interaction so vital to our industry. It seems strange not to be talking to, traveling with, and exchanging views with others about watches. Never mind my neighbors.

There is no doubt that the future of the main fairs – Baselworld and Watches & Wonders (formerly SIHH) – was already in jeopardy; 2020 was certainly going to be a make-it-or-break-it year for both of these global watch gatherings.

The good old days? Quill & Pad team at SIHH 2019

While Watches & Wonders has made no announcement regarding 2021 since canceling 2020 in early March, Baselworld announced it will return in January 28-February 2, 2021 and has also garnered criticism for how it is handling the transfer of exhibitors’ payments. As have Basel’s premier hotels. If they don’t find a way to satisfy their customers – whose very existence in many cases is also hanging by a thread – they might not have any customers to satisfy in future.

On April 3, 2020, Baselworld sent out a press release explaining that it was initiating “exceptional measures in support of exhibitors.” Here is the verbatim description of the measures: “In this challenging environment, Baselworld is very conscious of the stakes for all exhibitors and is absorbing a significant portion of costs due to postponing the show by offering to carry forward 85% of the fees for Baselworld 2020 to Baselworld 2021 (the remaining 15% will serve to partially offset out-of-pocket costs already accrued). If needed, exhibitors can alternatively request a cash refund which will be of up to 30% of the fees, with 40% carried forward to Baselworld 2021.”

News leaked on April 7, 2020 that the Swiss Exhibitors’ Committee headed up by Rolex employee Hubert J. du Plessix had written a polite but strong letter to the fair organizers on April 6 asking for a full refund for exhibitors. The quick response by Michel Loris-Melikoff, Baselworld’s director general, did not sound acquiescent.

The central square at Baselworld in 2019

An interview published by Switzerland’s Le Temps states that Watches & Wonders, which would have run back-to-back with Baselworld in April 2020 had the two fairs not been canceled, will likely take place in April in 2021. I’ve heard that Watches & Wonders will release an official announcement sometime in April. If true, that adds yet another wrinkle to this ever-evolving situation, essentially flipping the traditional slots of the two global fairs.

The two big Swiss fairs’ existences hang in the precipice, with no inkling of a clear way forward. And nothing is exactly clear about the world’s path ahead once our scientists have figured out how to tame COVID-19.

Distraction through watches: but what’s the future?

In this time of lockdown and quarantine for most of the world’s general population, many have turned to Internet-based entertainment for help in passing the time without going crazy. Which includes the digital watch media. As our own Ian Skellern explained, we will not stop reporting on the expensive luxury watches that make up the niche of Quill & Pad for this and other reasons. Right now, we all need to make the best of our situation and keep on keeping on.

But it is difficult to do without seeing watches in the metal.

However, imagine if some of these original, fanciful, and at times ingenious brands went under because of the slowdown? And is that even a possibility?

I asked some experts what they thought is and could be happening right now and in the future; in other words, I asked for some “inside” thoughts.

Maximilian Büsser, the MB in MB&F

“We can probably anticipate a drop of 50 percent revenue for all watch brands,” said Maximilian Büsser, founder of MB&F, about two weeks ago. “Those less exposed to Chinese clients may have less of a drop. COVID-19 will impact the watch industry in the same way it impacts humans: the more fragile immune systems are at very high risk. The others will have a rough time and then get back on their feet.”

“We were on track for a spectacular 2020,” Büsser continued. “With three totally new calibers released in less than 12 months (FlyingT, Thunderdome, and the HM10 Bulldog), we had organized it so our fifteenth anniversary year would be stellar. Notwithstanding COVID-19, the first quarter will have been the best in our history in sell-in and sell-out. Second quarter will be put on hold – especially because our team needs to stay at home now and we cannot deliver any product. Interestingly, the Asian market sell-out is what has been powering our last couple of weeks. They have rebounded much faster than we anticipated just when the USA and Europe are coming to a standstill.”

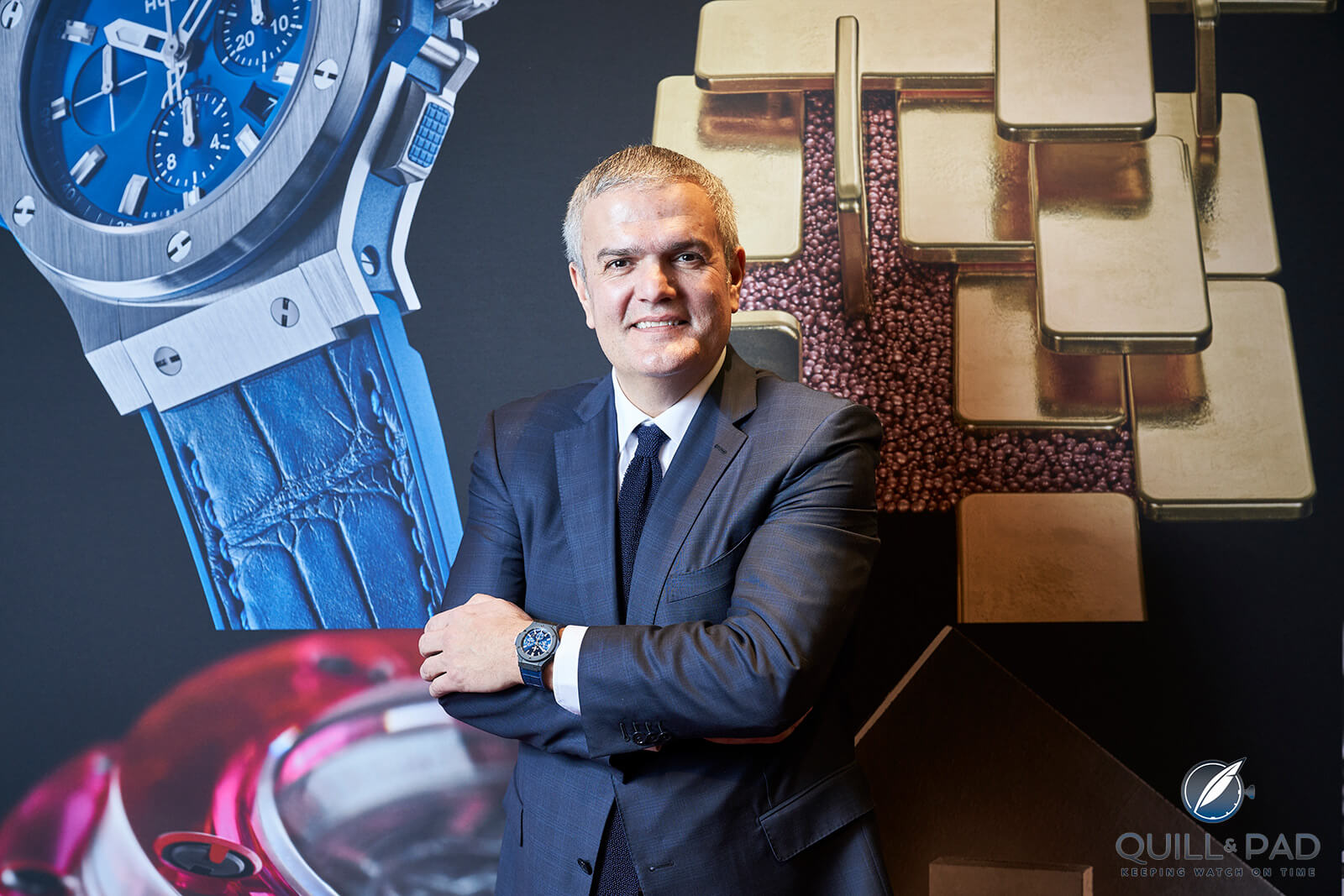

Hublot CEO Ricardo Guadalupe

In late February, one day before Baselworld postponed the fair to 2021, I spoke to Ricardo Guadalupe, CEO of Hublot. “In China it’s a disaster,” he said, before referring to the unrest and demonstrations that had already been taking place in Hong Kong before the coronavirus was declared a pandemic. “In Macau we had to close our boutiques for three weeks, and there is no traffic . . . [we’ve experienced] a drop of 70-80% of sales in China.

“China is important but our not biggest market, so globally we’re still doing well in the U.S. and we’re doing okay in Europe, the Middle East, and different countries, so we’re fine I would say. Of course, we see a slight drop in sales [there].”

Bulgari CEO Jean-Christophe Babin

“Since February with the COVID-19 expansion and subsequent store closures and consumer confinement, business has plummeted in many geographies as well as channels such as airports, for instance, where traffic tends to zero,” Bulgari CEO Jean-Christophe Babin added.

“We are now at the end March at the worst of the impact with Europe and the USA becoming further infected and closed, with an encouragingly steady China recovery, but insufficient to compensate losses in other geographies, also because Chinese aren’t traveling – and won’t for months until they are authorized and inbound/outbound restrictions lifted. With the COVID-19 due to recede by the early summer and thanks to Geneva Watch Days we are organizing at the end August, we remain confident that we’ll score a solid H2 and position ourselves as one of the most desirable watch brands for 2021 thanks to our irresistible 2020 news including a new world record in thinness [the Octo Finissimo Minute Repeater in pink gold] and a new masculine Octo variation designed to attract different client profiles.”

Richard Mille (and Audemars Piguet and Greubel Forsey) withdrew from SIHH/Watches & Wonders at the end of the 2019 edition, and just a couple of weeks ago Tim Malachard, Richard Mille global marketing director, talked to me a little about what he thinks the effects of the virus might be on the independent brand’s business in the short term.

“Our withdrawal of the SIHH was taken as the fair no longer corresponded with our strategy and business model. We ceased selling with retail partners since the end of last year, and our business is now all focused only through dedicated Richard Mille boutiques all over the world and in most key cities. To date we have 42 boutiques and plan to increase to between 45 and 50 over the next few years. The virus outbreak has actually created more logistical issues than a loss of business simply due to the reduced possibilities for our clients to travel and collect their watches in our boutiques. However, the next two months will see a larger impact with the global spread of the virus and governments installing a lockdown in many countries.

“Of course, the virus outbreak will have an impact on the industry as a whole and especially with the closing of retail outlets in many parts of the globe. Many brands have had to also temporarily close their product facilities, which will affect their budgets, revenue, etc. in 2020. What will be important is how the industry reacts once the peak of this crisis passes, and that normal business can resume, but this will be very dependent on each brand and the means they have to bounce back.”

According to numbers released by Morgan Stanley and reported in Le Point, Richard Mille achieved Switzerland’s eighth highest turnover by value in 2019 at 900 million Swiss francs representing 4,900 units sold. The implied average retail price per watch for this brand was €208,915!

Pascal Ravessoud, secretary general of the FHH

Pascal Ravessoud, secretary general of the FHH (Watches & Wonders’ governing and organizing body) agreed to give me a few comments about a week ago, words I found very human and logical. “What happened in the second part of 2019 in Hong Kong did already affect the region and the worldwide sales result of a majority of brands, HK being the main export market for our industry. So I guess brands were seeing the February 2020 Chinese New Year as a good way to make up for that, and instead experienced an even bigger drop in sales from January onward.

“I heard through the grapevine numbers in the range of minus 50-60 percent and more for certain brands in Asia, but we are already seeing signs of recovery in China, Hong Kong, and other markets, and this is very positive as Europe and the US are taking the plunge and experiencing the same.

“How long will it take to get back to a normal life again? A few months for sure. Ultimately, I firmly believe that we will globally get back to ‘some normality.’ Everyone retaining their money for fear of worse times will at least partly compensate in the second part of the year for what has been lost in the first part. How, when, and how much is anyone’s guess.

“What will not come back is a number of companies that don’t have the cash flow to endure these troubled times: brands, suppliers, retailers. Governments have taken tough measures and we have to be thankful to them for that, but a zero-casualty scenario is not realistic unfortunately. We see the first partial unemployment measures taken in Switzerland, and reduction in staff almost everywhere and re-organization of the operations will be the price to pay. But I have no crystal ball, hence making prognostics at this point is highly hypothetical.”

No fairs: no way or okay?

“For a few years, there have been many signs that the status quo was threatened,” Ravessoud admitted of the traditional fairs. “Expectations from exhibitors have evolved in all the retail salons and fairs worldwide, many different, cacophonous, even competing initiatives in our industry . . . that has been booming for a couple of decades and has now a very good opportunity to re-think itself. Everything happens for a reason. And crisis brings opportunities. I am also of the opinion that desperate times call for desperate measures. When you identify a threat and the possible consequences, can you ethically really play with peoples’ lives?”

In this section, I’d like to take the temperature of some exhibitors’ feeling for the future of the traditional fairs: what might the absence of them mean to the brands?

“A month ago I would have said a headache,” MB&F’s Büsser said. “Now it is just one little part in the 2020 odyssey. When half the world is in lockdown, there is not much space to talk about watchmaking, so we will postpone the presentation of our second semester novelties to our retail partners to September. At the time of this interview, most Swiss companies are forced into ‘hibernation’ by the government. The outcome depends on how long this ‘ice age’ will last.”

Other brands are also moving big launches to 2021, as in the case of Patek Philippe and quite possibly Rolex/Tudor (the latter at least to the second half of the year) in the hopes that some things resolve a bit and to give retailers a much-needed break from having to purchase unneeded stock. Hublot, currently celebrating its fortieth anniversary in 2020, is one of those brands postponing until later this year. At Baselworld, the brand would have launched celebratory commemorative timepieces in honor of its milestone anniversary.

LVMH Watch Week Dubai 2020’s opening conference

“We had the chance to do our LVMH Watch Week in January, a good move from our side because we already presented some novelties [new products] in Dubai,” Hublot’s Guadalupe explained. “And we saw some press, key retailers, and customers in Dubai so I would say the impact would be less important. And, of course, if Baselworld does not happen [indeed, it was postponed the following day –ed], then we would find other solutions probably to present the rest of our novelties during the year.”

“For Bulgari it was fruitful since we already secured commercially 60 percent of our yearly business plan,” Bulgari’s Babin agreed on the effectiveness of LVMH’s Watch Week.

“We can manage, you know, because the fairs today have evolved, so of course digital has transformed our world and also our way of making business,” Guadalupe, whose brand normally exhibits at Baselworld, continued.

“When I do a launch of a new watch, I can do it in a digital way and I can receive many orders without really showing my watch to every retailer at the fair like it used to be. But today it’s just that it’s different. The fairs really have to evolve also in the experience that they can give to the consumer. So that’s the big challenge that both Baselworld and Watches & Wonders are facing. For 2021, everything is on the table; we really want a new evolution in the fair to participate and of course the date is an issue as well.”

“Change has already happened since many years and especially with the digital age we all live in,” Richard Mille’s Malachard agreed. “Social media has created direct contact between brands and their customers with instant access to novelties, news, events, etc. For many years already we have concentrated activations with customers via our own events whether it be dinners in boutiques, sporting events, or invitations to major events we organize around watch launches, etc. If anything, customers relish this proximity we create with them as we get to know and understand their needs, wishes, and interests.”

It is interesting to hear a fair organizer on this subject, and I have very much appreciated Ravessoud’s logical approach to the dramatic events of 2020. “As you can imagine the cancellation of a salon like this has huge repercussions on the whole industry and all our partners – our brands and our suppliers – but today it is impossible to know what exactly these repercussions will be financially and operationally because we are centered on maintaining business continuity and adapting to a constant change, and this requires agility. All our energy now is geared toward exiting this crisis as well as building the future. Will the watch fairs remain as they were? What will evolve? A lot of things can evolve, and there are a lot of options.

“The moment when the decision was made was rather surprising – as we were doing everything ‘as usual’ – but inevitable. We have been through SARS, swine flu, Gulf wars, a financial crisis and other things, but to be honest the moment you pull the plug things are just upside down from one minute to the next. I am quite lucky as the Buddhist concept of impermanence is very present to me, so after having done everything to go in one direction, I can then do everything in the opposite direction as I embrace the vanishing nature of all things. Of course, there is no visibility on what is coming next, and it is somehow unsettling, but my priority is to find the best way to go ahead and I don’t look back.”

“All the brands have needed to rethink their strategies these last two months – I would not be amazed if this forced survival mode will cause many brands to reconsider the way they will be doing business in the years to come. Watch fairs being one of them,” Büsser summed up.

Babin countered, though: “I would not sketch a parallel between the COVID-19 pandemic and a new opportunity to ‘rethink’ in depth the trade fairs.”

“Crises are also great opportunities to reinvent ourselves. Status quo sometimes is the fear to make necessary changes,” Ravessoud wisely theorized. “Then comes a massive disruption and you are faced with the opportunity to apply those changes. We are convinced that a unity of place and time is what the majority of our brands want in the future. That’s a rather good starting point. We are now working full steam ahead on alternatives with our partners. More on this very soon!”

For more horological distraction, information, and possibly even entertainment, you may also enjoy:

Eric Freitas: Illustrator Turned Clockmaker Creates Mechanical Fantasies

3 New Watches For 2020 From Cartier, Montblanc, And Roger Dubuis

All 7 Of The Latest Rolex Models Of 2019, Plus Some Cool Variations (Rolex Photofest!)

Getting Through The Great Lockdown Of 2020: A Collector’s Guide To Solitude

Leave a Reply

Want to join the discussion?Feel free to contribute!

J.C. Babin looks as though he has been cutting his own hair during “the lockdown”!

Mr. Jean Christophe Babin shows the characteristics of a psychopath. His is not a morality of optimism (but I’m sure he’d say it was), his is a justification that shows no care for human life, only his own selfish regard. He is what gives the watch industry a bad name.